Three seems to be the magic number in the 3D printing industry and it’s not just because of the third dimension. For voxeljet, 3 – as in 30.6% or almost one third – is the rate the company grew in Q2 and is projecting to grow in FY 2014, closely matching (on a different scale) Stratasys’ Q2 growth of 35% and projected full year growth (+25%), as we reported on last week.

ExOne, producer of binder jetting sand, glass and metal industrial 3D printing is also reporting on healthy growth for Q2 and H1, respectively at +21.7% and +13.2%, while forecasting full year revenue growth as high as 50%. Where does the 3 come in? In the full year gross margin, projected at between 32% and 36%.

For Materialise, the Belgian 3D printing service and software company that just went pubic on the NASDAQ last June, growth in Q2, the first trimester the company is reporting on since the IPO, stands at 15.1% at €19.238 million (please note that the period here – and in this entire article – is used to separate the decimals, as per the US standard). This represents a growth in earnings close to €3 million (there is that “3” again).

Apart from the “number 3” curiosity, what all these publicly traded 3D printing companies truly share is healthy growth and positive outlook for the future, a future based on heavy investments on research and development, establishment of new branches and manufacturing facilities, as well as new personnel hiring. Paradoxically, these investments in future solidity are not reflected in the companies’ stock performance (Materialise has been stable since the IPO, while both voxeljet and ExOne are almost 50% off from the peak they touched at the end of 2013).

voxeljet , the German company led by CEO Ingo Ederer, is reporting revenues of €2.091 million for its Q2 which ended last June 30th. This growth is led by Systems sale revenues, which grew 46.2% to €1.234 million, while 3D printing Services revenues grew by 20%. Gross profit margins for the quarter stood at 31.5%, an improvement compared to last year’s 28.7%. For the first half of the fiscal year, voxeljet’s revenues increased by 22.1% to €5.469 million. Both Systems and Services revenues grew during the half.

Although the growth outlook is positive, with voxeljet reaffirming its previous full FY guidance of revenues exceeding €18 million and growth above 50%, this will not come cheap. Total loss in Q2 was €1.405 million (0.38 per share) and €2.116 for the six month period. voxeljet is attributing the losses, in part, to increased headcount in the pursuit of its growth strategy, as well as to the cost of being a publicly traded company.

“We continued to execute our key growth initiatives throughout the second quarter. Demand for both our 3D printing systems and on-demand printed parts remains robust, and we reaffirm our financial guidance for the year ending December 31, 2014,” commented Dr. Ederer. “In Systems, we delivered two printers, while increased levels of quoting and sales activity contributed to a solid backlog at the end of the quarter. Services performed well, benefiting from a favorable product mix and the recently completed capacity expansion at our European on-demand service center in Germany. We generated record sales in plastics and received record orders for sand parts in the quarter. This in our opinion illustrates the market’s growing acceptance of 3D printing for production, and validates our capabilities and strategic positioning within the industry.”

ExOne’s financial performance is, in many ways, comparable to voxeljet’s. In its Q2 (which also ended last June 30th) the US-based company has increased its global workforce by, close to, 10% to 251 employees, and has expanded is capacity with new planned factories in Japan, Italy and North Huntington (Pennsylvania). ExOne is also working on the development of a new Lab, a new M-Print (for metal 3D printing) a new S-Max (for sand 3D printing) and a new High Production machine.

Revenues for the second quarter stood at $11.2 million, with growth at 25%. For the first fiscal half the total reached $18.5 with growth at 7.5%. Like voxeljet, ExOne is forecasting a very strong second half of the year, with revenues expected to grow by 40% to 50%, resulting in approximately $55 to $60 million and gross margins, as said, between 32% and 36%. Also like voxeljet, ExOne is reporting a substantial operating loss of $4.7 million for Q2 and $10.1 million for the whole of H1, which is directly linked to investments in people and processes to support future growth.

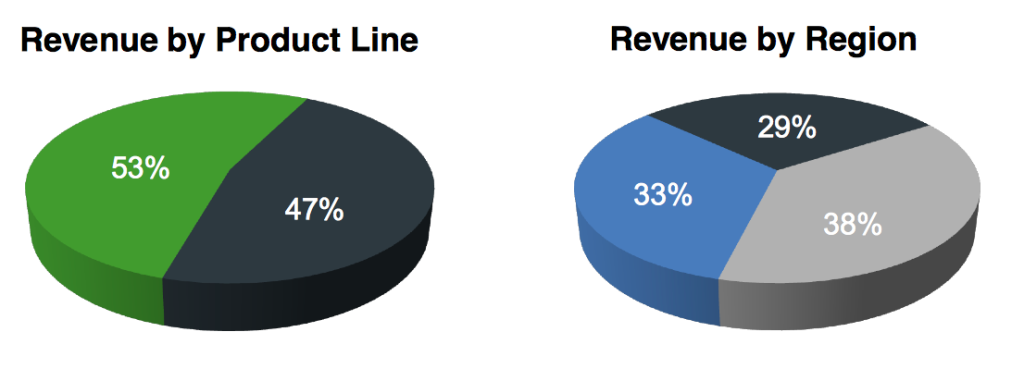

As per voxeljet, a slightly larger part of Q2 revenues came form Machine Sales, followed by Services, while ExOne stands out for a very homogeneously distributed territorial revenues mix, with 38% coming form the Americas, 33% from Asia and 29% from Europe. During the first half of the year, ExOne sold 9 machines (as many as during the first half of FY 2013). The difference is that, while last year’s line-up focuses on the S-Max, this year’s line up also included the sale of the more expensive M-Flex, of which it sold two systems, along with four S-Max’s, one S-15 and one X1-Lab.

“Given demand from our growing base of industrial customers, we expect that 2014 sales will meet our expectations, although timing of order flow continues to be unpredictable,” noted S. Kent Rockwell, ExOne Chairman and CEO. “We expect our development to result in more productive machines that our customers can apply in a variety of industrial applications. More significantly, there is improving clarity for the role and acceptance of our binder jetting technology within 3D printing. The market opportunities that we develop now should be the foundation for our success in 2015 and beyond.”

As said, Materialise’s revenue growth stood at €19.238 million for its Q2 (with an additional $89 million raised from the IPO), which means the company grew by 15%. Of this, 31% was represented by sales of its professional 3D printing software, including medical software products. Materialse’s results reflect its status as a more established company. While growth was slightly slower than that of 3D printer manufacturers, it reported a net quarterly loss of €223.000, also impacted by a significant €930.000 investment in R&D activities.

Materialise’s revenues for industrial production, that is its professional 3D printing services, increased by 26.5% to €7.986 million. This resulted form the company’s impressive – and unique – array of industrial 3D printing systems, which grew from 109 to 115 machines, This growth in revenues was largely driven by higher sales of end parts (which, by the way, means that Materialises’s machines are being used more and more for manufacturing, rather than prototyping). Perhaps equally impressive (although based on smaller revenue numbers), were the company’s “growth businesses”, their i.materialise consumer service and the RapidFit professional 3D printing service, which rose by 73%.

“We performed well in the second quarter, delivering a 20% increase in total software sales. As expected, R&D expenses were substantially higher, at 18.5% of total revenue, reflecting the heavy investments we are making this year to develop a new generation of innovative products in our medical segment,” Peter Leys, Executive Chairman, stated. “More generally, to capitalize on the vast opportunities in the 3D printing industry and our position as an industry pioneer, we are aggressively expanding our sales reach and developing new products across all our business segments, in order to drive top line growth and bolster long-term profitability.”

The bottom line is that these 3D companies, just like market leaders Stratasys and 3D Systems, are investing heavily in their future and in the future of 3D printing. This means coming up with losses now that will spawn higher revenues tomorrow. Another public company worth mentioning along these lines is Organovo, which also reported its Q2 results. The San Diego based company does not yet have a commercial product on the market (though its 3D printed human liver tissue is close) and is heavily investing in R&D. As per any other sectors these are big bets. But if there is one sector worth betting on today, it is definitely 3D printing, wether it be machine manufacturing, services or bioprinting.

Disclosure: the author of this article owns stock in all of the companies mentioned.