Part of an ongoing series on how the 3D printing hype bubble has affected the lives of the individuals involved. To read the first story in this series, head here.

January, 2014: 3D printing stocks are at all time highs and, for the first time, International CES has added a dedicated 3D printing zone to the world’s largest consumer electronics conference. While the newly Stratasys-acquired MakerBot hits the event with three new desktop 3D printers and a 3D scanner, competitor 3D Systems ups the ante with what may be the largest booth in the zone. There, the company overshadows most other 3D printing news at the event with, not only a completely 3D printed band, but a ceramics 3D printer; the first full-color, consumer-level 3D printer; and a full-color sugar 3D printer. Then, to top things off, 3D Systems CEO Avi Reichental announces that the company’s new Chief Creative Officer will be none other than Black Eyed Peas frontman will.i.am.

At the time, it seemed as though the 3D printing hype would never stop. For those unfamiliar with hype cycles, like I was, the technology itself was proof of the enduring success of the industry overall. So, when financial analysts warned that the P/E ratios of companies like 3D Systems and Stratasys were way out of line with their stock prices, it was difficult to take heed. After all, 3D Systems had just unveiled a printer capable of 3D printing technicolor sugar sculptures that tasted like sour apple.

But the stock market, human beings, and technological potential shouldn’t be conflated. As valuable as 3D printing is to technological progress, the stock market is a complicated apparatus that works off of investment dollars, the global economy, and sometimes hype. And all of that is tied to the psychologies of individual people. The personality at the center of 3D Systems, until October 29, 2015, was its CEO and President, Avi Reichental.

Back When Avi Was Called Abe

Though 3D Systems was established in 1986 by Chuck Hull, the inventor of stereolithography, it wasn’t until 2003 that Reichental took the reins of the company. Before that, he worked as vice president and general manager of the Shrink Packaging Division for Sealed Air Corporation, where he had been employed in various capacities for more than twenty years. According to a press release from the time, back when Avi was called Abe, “Abe was a key contributor to Sealed Air’s growth and development from a company even smaller than 3D Systems to a multibillion dollar global packaging company.”

3D Systems made some acquisitions before he began with the company, but under Reichental’s leadership, 3D Systems would become notorious for its numerous acquisitions, particularly in the second half of his tenure there. In total, between the years of 2010 and 2014, 3D Systems purchased 45 different companies, which averages out to nine a year. Some of this expansion was funded through the company’s move from the NASDAQ to the NYSE in 2011, their busiest acquisition year, in which they purchased 13 companies.

Many of these purchases have boosted the 3D Systems’ product portfolio quite substantially. In addition to the original acquisition of DTM in 2001, the subsequent purchases of Z Corp and Phenix Systems gave the company the biggest systems portfolio in the industry. Geomagic, Quickparts, and some service bureaus bought along the way boosted 3D Systems on the software and 3D printing services front. Bits from Bytes gave the company its Cube line of 3D printers for consumers. And the purchase of a couple of medical VR and 3D printing firms allowed them an entrance into the field of medicine. From a bird’s eye view, and, in many ways, an investor’s view, this would make 3D Systems look as though it were primed to take over the entire industry. But, despite the potential benefit they might bring the company, this large portfolio could be unwieldy and actually affect the company negatively. To understand how, we might look at an ongoing legal dispute between 3D Systems and the former founder of a startup called Print3D.

In 2011, 3D Systems acquired Print3D for its CAD software plug-in, designed to instantly generate production costs for the 3D printing of a given CAD design. As a part of the purchase, founder of Print3D Ronald Barranco says that he was meant to be brought into 3D Systems to head a division related to the software, as well as earn money generated from Print3D for three years afterwards. And, while Barranco worked at 3D Systems after his firm was acquired, he was let go twenty months in. In turn, Barranco filed a lawsuit against the company, in which he says that, on top of being fired, he did not receive any earn-out pay related to the purchase of his company.

Around the same time that they bought Print3D, 3D Systems also bought Quickparts, another instant quotation firm, now associated with their industrial 3D printing service bureau. The court documents from Barranco’s case (.pdf) paint a picture in which 3D Systems devoted more resources to Quickparts and neglected Barranco. The arbitrator on the lawsuit writes, “An overall assessment of the record indicates that Mr. Barranco was rarely, if ever, treated as a manager and poorly managed as an employee.” Barranco’s former co-founder, Deelip Menezes, tells him in an email that management’s plan was to ignore Print3D altogether, “They don’t want you anywhere close to them. They want you out of all this so that they can drive Print3D the way they want or just let it rot there, which is what they have been doing all this time.”

In a recent decision, the Arbitrator issued Barranco an $11,281,681.46 award for damages, interest & fees, and expenses. 3D Systems is fighting the arbitrator’s decision, but the lawsuit itself raises concern about the 50 other acquisitions that the company has made, particularly the 45 more recent ones.

One former employee, brought onto 3D Systems as a part of such an acquisition, suggests that the management of those different businesses, among other things, played an important role in some of the issues the company faced leading up to Reichental’s departure. This individual chose to remain anonymous because, in addition to buying smaller firms, 3D Systems has a reputation for having a litigious legal team.

This person worked at their startup for a long period of time, saying that their tireless efforts eventually saw them become an executive-level employee. Introducing 3D printing to the firm early on, before their competition had done so, this person had actually turned to 3D Systems when it was still making the Actua 3D printer. The source describes the Actua as “the equivalent of a Commodore 64k by today’s standards, but it did the job.” Given the rapid production possible with even early 3D printers, the firm was able to outpace its competition. So, when the new Thermojet printer was released by 3D Systems, the business decided to upgrade to the new machine. The source explains, “The resolution was better than the Actua, but not perfect, which was OK for what we were using it for.” Overall, they say, “3D Systems was a true partner” to their firm.

“Then, the next big news from 3D Systems was the introduction of the InVision machine, which was supposed to be the next revolutionary step forward in 3D printing technology. It was not. It turned out to be a giant albatross.” The new machine, released in 2003 and after Reichental joined the company, soon caused the firm to miss deadlines on a regular basis, the source says, “We had purchased three of the InVisions to the tune of $85k per, and they were all feeble.” While the source wanted to do something about their InVision printers, they explain that the owner of the business “saw 3D Systems as a valuable partner and had some sentimentality attached to the relationship… and was reticent to confront 3D Systems.” The source then complained to anyone at 3D Systems they could about what the source saw as “hundreds of thousands of dollars going up in smoke due to delayed/lost projects.”

The source says that 3D Systems tried to address their concerns. but only after they threatened to end their business relationship with the printer manufacturer. “Now, enter Abe Reichental. Yes, he referred to himself as ‘Abe’, not ‘Avi’, at the time. After I threatened to end ties with 3D Systems, the various levels of management took my complaints to his doorstep. Somehow, they convinced him to visit to see what could be done to remedy the relationship…” the source says. “[I] politely listened to his proposal to replace all of our machines with ‘new’ InVision machines ‘at cost.’ My jaw dropped. Here we were with these worthless printers and he wanted to offer us a deal in which we would have to pay for more of the same lemons. It was a ludicrous proposal.”

They continue, “I basically informed him that, if this was the best he had to offer, he probably wasted a trip from headquarters. With the owner’s approval, I went ahead and severed all ties with 3D Systems. We immediately purchased an Eden 350v… It was completely reliable and the resolution was more than respectable. We got rid of all our 3D Systems printers and did not look back. I later found out that the InVision model was rushed to market prematurely, along with the orders from management to change the loading door from the side to the front at the last minute. Apparently, this was done in an effort to compete with a rival manufacturer. The decision was a fatal one indeed.”

The source explains that, later on, their firm entered dire financial straits. “Enter Abe… He wooed the owner into selling the company,” the source says. “I had no idea that this deal was transpiring. The owner called me the day after Christmas to let me know that they had sold the company to 3D Systems. I was in shock. Of all the companies out there, I was perplexed as to how he could sell to this one in particular, given our history, of course. But, hey, money speaks louder than words, correct? Although Avi and I would sometimes pass each other in the halls after the acquisition, he did not once acknowledge my existence. I was relieved of duty without ceremony several months later.”

During those four months at 3D Systems, the individual says they learned a lot about how the company was managing the vast number of startups it had acquired. “Obviously, ours was not the only small company to be consumed during Avi’s shopping spree,” the source says. “What ensued was a transitional chaos. No one at 3D Systems had a clue as to what should be done with these various companies and their corresponding cultures.”

While their small firm was unconventional, the individual describes their new owner by saying, “3D Systems was (is), at its core, a Dockers and polo shirt-wearing corporate machine.” They continue, “We were like oil and water. From what I could tell, many of the smaller companies that they absorbed were struggling under the same foreign, corporate climate, just as we were.”

In this person’s opinion, much of the blame rested with the CEO. In addition to the way in which Reichental treated their small firm, the source believes that the CEO also overestimated the ease with which ordinary consumers could use the company’s 3D printers. It was hard for them to believe that an average consumer could just pick up the technology easily. They explain, “From the moment they made their presence known, I could tell that Avi was highly desirous of making 3DS ‘cool”… When he started rambling on about how 3D printing was the ‘now’ and how every home in America will want one immediately, I just couldn’t believe my ears. Was he intoxicated?”

The source concludes, “The truth is, prior to Avi’s arrival, there was a very positive relationship between 3D Systems and [our firm].”

“The work environment is a place without joy or pride.”

Here it could be believed that this was the story of just two of the individuals that had suffered as a result of having their firms purchased by 3D Systems. And, because they are no longer with the company, there may be even more reason to issue complaints. However, another employee, currently with their facility in Andover, Massachusetts also reached out to me, as their facility prepares to be shut down.

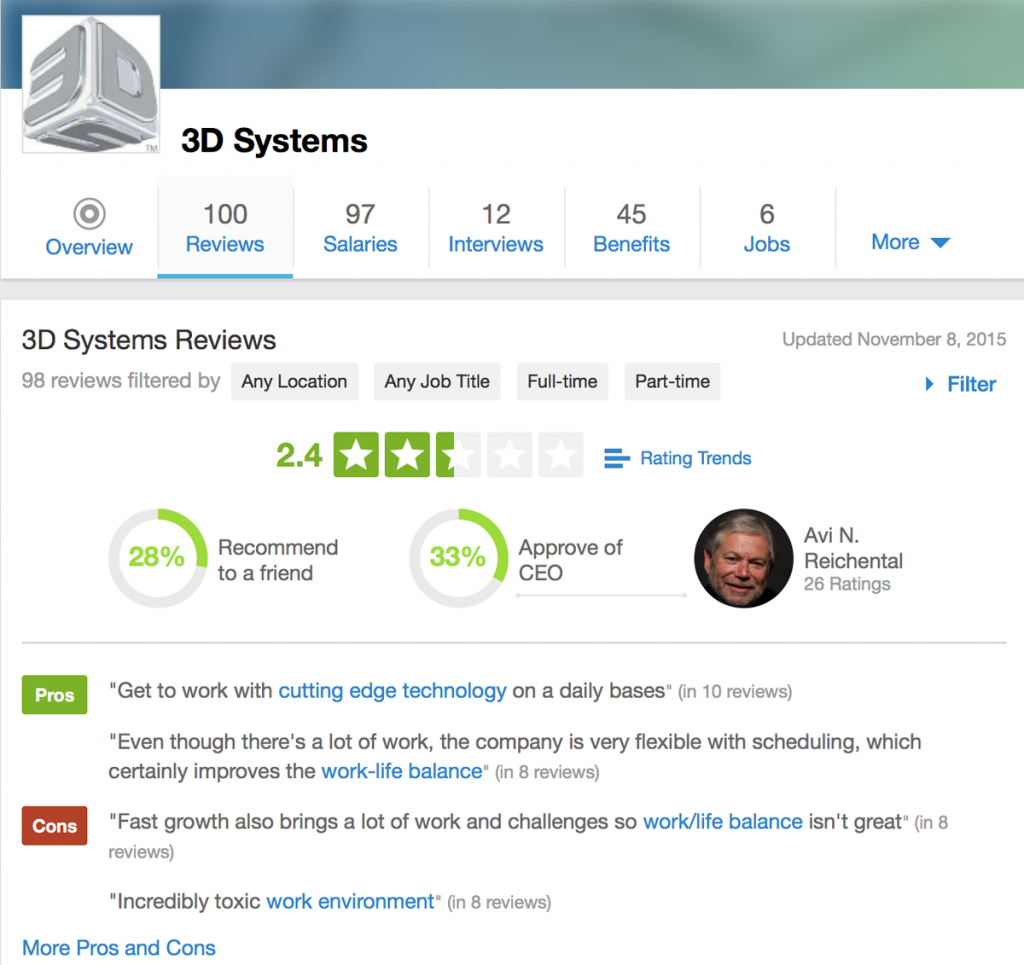

This individual believes that there were management issues, as well. “Avi and his leadership team (some of which is still in place) cut development resources in all areas. It was neglect in the worst way. Team leaders would go for MONTHS waiting for approval on a relatively inexpensive piece of equipment or to hire new or replacement personnel. Pretty much everything is dysfunctional.” They continue, “In all honesty, I can’t think of one internal corporate area that works well: not HR, not the travel desk, not benefits, not our internal network and IT systems, not accounts, nothing that I can think of. Avi provided little leadership, nothing to aspire to, no development of corporate culture, nothing. I know it seems crazy, but those super negative reviews on Glassdoor are all true. It really has been that bad.”

On Glassdoor, 3D Systems has 98 employee reviews that give the company an average rating of 2.5 stars out of 5. Based on the reviews, there are plenty of people that love working at the place, including an engineer who has worked for them for four years and is “loving every minute of it”; a Gandhi-quoting director who has been there for 10 years and believes that 3D Systems is flexible, innovative, and a privilege to work for; and a sales person that thoroughly enjoys the fast-paced environment and selling their products.

A few of the posters on Glassdoor, however, suggest that these positive reviewers are fake, with one writing under the “Advice to Management” section, “Fire whoever is posting the shill reviews on Glassdoor. It’s really obvious when the only positive reviews are posted on consecutive days.” Another states, “Any review stating positive regard for 3D Systems current state of affairs and its CEO is highly suspect. In a facility of dozens and dozens, not one person has ever voiced positive regard for the CEO. Quite the opposite. The poor attitudes, disrespect, and lack of trust start at the very top and force their way down.”

If you believe them, then you’re left with a lot of negative reviews, which are pretty bleak, if not occasionally scary for an office job. There are mentions of “political backstabbing”, and many that say that the morale at the company is low, with comments like “Very political – the ‘insiders’ get very generous stock options while the rank and file get dumped on. Morale so low that customers and resellers pick up on it.” Multiple mention the number of executives that benefit at the expense of employees below the management level. One review reads, “Toxic culture – morale is LOW Everyone is a manager – There are probably 30 VP’s.” A different reviewer ups the estimate to 40: “40 plus VP’s, dozens of ‘Chiefs of’ all making ridiculous salaries, bonuses, and crazy perks… For 2015 they didn’t give raises to average workers, drastically cut bonuses no matter how good your performance was, (except to VP’ s and up).”

And this carries over to every branch of the company, from San Francisco – where the division “once called ‘Cubify’, is poorly run by a dictatorial” leader and “[m]orale was highest when everyone was intoxicated not on what should be an exciting technology” – to the UK, where a 3D Systems Europe employee says, “[C]oworkers are rude and mean spirited, I was made to feel isolated and intimidated constantly.” This feeling is transported all the way over to 3D Systems India, where one reviewer writes, “Employees are treated like Slaves. No benefits to Employees, Indian Politician’s are better then Management in 3DSystem India. Management seek their own Profit’only’ and Employee can not Question them and if at all ask then you are blacklisted.”

When I say “scary”, I mean that there were actual references to “fear” and being “afraid” of Reichental whose “style and personality are legendary inside the company. What’s worse is that because he treats his executives and their underlings so poorly, it sets a precedence.” Another reviewer writes, “The weekly telephone conferences felt like episodes of Fear Factor. There were at least 30 people on the line and most were too terrified to join in for fear of reprisal.” Another describes what sounds like borderline verbal abuse, saying, “CEO and his children create a hostile work environment. Aggressive, belittling, chaotic and demeaning. If you can avoid them, do.”

Altogether, this energy results in what one reviewer even calls a class system:

The psychological environment is dismal. Class system enforced between blue collar and white collar workers. New hires are not introduced to coworkers or other teams. Seriously, eye contact is rarely made. People purposely look at the floor or away when passing in the hallways. Employees don’t smile, say hello, or crack jokes. There is no corporate culture. Little to no camaraderie. The work environment is a place without joy or pride.

Though there is a whole lot of blame focused on management, a few reviews emphasize how the negative work environment was only worsened by the “acquisition spree”, as one reviewer describes it. Another has a more colorful simile, in which “Avi consumed small companies like a man at a pie eating contest.”

Failing to fully capitalize

While all of this was happening behind the scenes, to investors who might not spend time on Glassdoor or hadn’t looked deeply into the quality of products like the InVision 3D printer, 3D Systems looked like a company that had taken on board a huge portfolio of highly capable startups and new technologies. There was a complete suite of machines displayed at CES that could apply the amazing geometrical freedom of 3D printing to such materials as ceramics, sugar, and metal, yielding an impressive range of applications, like custom cake toppers, ornate porcelain dishes, and a complete ensemble of 3D printed instruments.

After CES, Needham & Co. analyst James Ricchiuti gave 3D Systems a Buy rating and $100 price target, referencing all of these products and the verticals they would open up for the company. FBR Capital Markets analyst Ajay Kejriwa also increased the price target for the company to price target to $98, from $85. Forbes contributor Panos Mourdoukoutas writes, as CES approaches, “In this case, I would consider buying the shares of two market leaders: Stratasys and 3D Systems. I particularly like 3D Systems. It is still heavily shorted–a cushion in case the stock pulls back. These are the companies which have amassed both the scale and scope to continue their profitable growth. I would steer away from the other two smaller companies [voxeljet and ExOne], which lose money.” Multiple posts from The Motley Fool in early 2014 also hint at the strength of DDD stock, including the video from the site’s 3D printing analyst, Steve Heller:

However, not every analyst was so enthusiastic about DDD stock. Citron Research put out a report around the time of CES that “Avi spins word pictures of revolutionizing manufacturing, medical care, biotech, entertainment, nutrition, and even education (and ‘politics’ by ‘democratizing’ manufacturing … whatever that means…)” and that “The bull thesis on DDD is flawed beyond all measure. If you really want investment exposure to [the 3D printing] space, Citron suggests you consider Stratasys, or maybe even H-P.” Whitney Tilson tells ValueWalk in Feburary, 2014, “Mark my words: today’s blowup of 3D Systems Corporation (NYSE:DDD) is the beginning of the end for the 3D Systems Corporation (NYSE:DDD) bubble (I’m short five stocks across the sector, the largest of which is DDD)… 3D printing is real, but the stock valuations aren’t. For example, coming into today, DDD was trading at 17x revenues. So now it’s trading at 14x. So what? Even if DDD is accounting properly for its nearly three dozen acquisitions in the past three years – which I highly doubt – it’s maybe worth 3x. The story is the same for pretty much every company in the sector, which is in a completely obvious and STUUUUUUUUUPID bubble.”

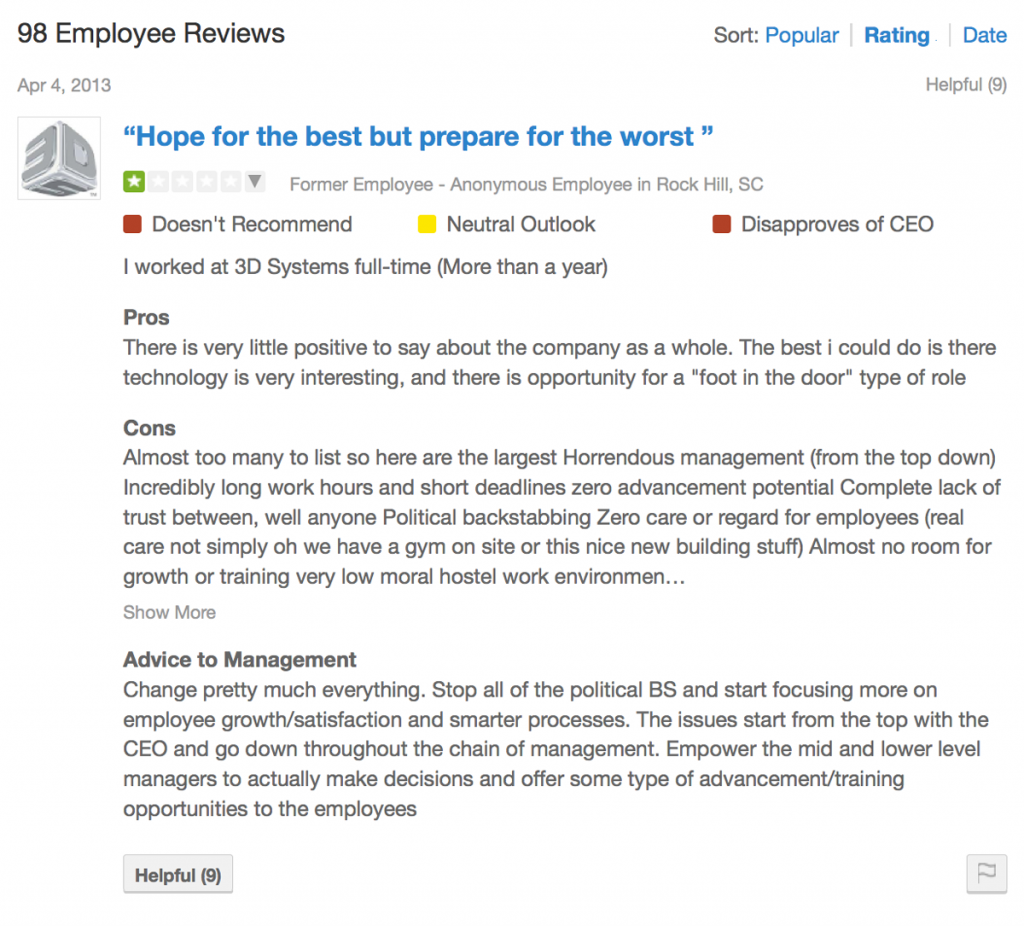

The shortsellers would eventually be proven right. Over the course of 2014, most of the systems announced at CES never made it to market. I was regularly asked by readers when the CubeJet and ChefJet machines were going to be released, but no information about those releases ever came. Despite the red flags, the company continued to chug along, from a marketing standpoint. That is, until July 31, 2014, when the company announced its Q2 results, which included a backlog of orders and revenues below analyst estimates. This led to a drop in stock price of about 11%. Things appeared even bleaker on October 22, 2014, when they published their Q3 2014 results, with 2014 estimated revenues cut by $50 – $90 million, about $17 to $57 million less than analyst estimates. At the time, CEO Reichental stated:

“We are disappointed that we failed to fully capitalize on the robust demand for our direct metal and consumer products during the quarter. While we worked very hard to deliver these products sooner, achieving manufacturing scale, quality and user experience targets took significantly longer than we had anticipated. Now that we have closed these availability gaps, we expect our revenue growth rate to increase.” He continued, “Our accelerated investments in new products and acquisitions contributed to a record order book in every period of this year, but disrupted revenue generation and pressured our gross profit margins. Now that we are shifting our attention to fine-tuning these investments, we expect to leverage them into a valuable and sustainable first-mover advantage.”

In other words, they had attempted to grow and release products too quickly and were unable to produce the metal, ceramic, sugar, and other 3D printers that they had promised at CES. At that point, 3D Systems stock dropped around 15% in a single day and has continued to drop since.

On June 12, 2015, Scott+Scott, Attorneys at Law, LLP filed a class action complaint on behalf of all who purchased (or otherwise acquired) 3D Systems stock between October 29, 2013 and October 22, 2014. The lawsuit claims that 3D Systems violated the Securities Exchange Act of 1934, specifically Rule §§10b-5 and 20(a). This act, which saw the creation of the SEC, is according to Cornell University Law School Legal Information Institute, “designed to force companies to make public information that investors would find pertinent to making investment decisions.” Scott+Scott’s complaint argues that 3D Systems drove up their stock through the use of false and misleading statements, specifically in relation to the company’s “(i) ability to increase the capacity of its metal printing business; (ii) demand for its consumer products; (iii) the value of multiple companies it was acquiring; and (iv) expected earnings.”

The complaint quotes what the plaintiffs consider “false and misleading” statements made by 3D Systems during the Class Period and brings Reichental and EVP of Mergers & Acquisitions Damon J. Gregoire into the suit as individual defendants, as well:

For example, on October 29, 2013, 3D’s CEO and President, Defendant Reichental, proclaimed that the Company had “decided to triple our manufacturing capacity over the next 12 months, as well as accelerate the development of additional direct metal 3D printer models.” Defendant Reichental also touted the strategic value of the Company’s recent acquisitions. In addition, on February 28, 2014, Reichental also represented that “our plan is [to] quadruple [direct metal printing] sales over the next 12 to 18 months.”

However, contrary to Defendants’ positive statements concerning the Company’s growth, Defendants had no basis to represent that the Company would be able to triple its metal printing capacity and/or quadruple direct metal printing sales.

Specifically, as was later disclosed, many of the Company’s acquisitions were not strategically acquired in an effort to boost revenue through acquisition and would require significant additional investment to integrate into 3D.

The suit also claims that the inflated stock prices allowed Reichental and Gregoire to make profits off of the sale of their own stocks, with the documents reading, “3D’s inflated share price allowed Defendants to receive over-sized profits from the sale of 3D stock. For example, on May 29, 2014, 3D offered 5,950,000 shares of its stock, netting approximately $300 million. Similarly, the Individual Defendants sold approximately $4.5 million in 3D stock during the Class Period.”

To just about everyone, $4.5 million is a lot of money. To the people in the workplace environment described in those Glassdoor reviews, it’s tragic.

Shutting Down Facilities

will.i.am discussing a 3D printer capable of 3D printing with recycled Coke bottles now seems like a fever dream, in retrospect. Even those outside of the industry, who read the Times or the Wall Street Journal on a regular basis, have heard of 3D Systems and could tell you just how bad their stock is doing. The employees, as much as they may hate it there, can feel the weight of the failing stocks even more.

On October 28th, the day before Reichtenal stepped down as CEO, an employee from the 3D Systems facility in Andover, Massachusetts contacted me to say that management had come in and told them the facility, employing between 80 and 120 people, was being shut down “as a cost savings measure”. This is the location that houses the Projet manufacturing division, Projet and CubeJet engineering division made up of the team from Z Corp, the Geomagics software group, as well as the Customer Service, Other Software Services, Ceramics, Print Services, and other divisions. The shutdown is set to occur by June 30, 2016, but the source thought that it would most likely happen by the first of next year.

While the source thought that the blue collar workers, who suffer the brunt of the class system described on Glassdoor, would likely be let go altogether, white collar workers were divided into roughly two categories, with some being asked to stay on with a 20% increase in bi-weekly salary until the place closes and their jobs are terminated. The irreplaceable employees, on the other hand, were offered a 15% bi-weekly salary bonus until the close of shop and a $20,000 relocation allowance to be transferred to another 3D Systems location.

It’s important to note that the entire Z Corp team is located at this facility. Not only would they build the next generation of full-color binder jetting printers, including the consumer-level CubeJet 3D printer, but their technology is now being used in various important 3D printing technologies around the world. This includes the sugar 3D printing used by the ChefJet, but binder jetting is also behind ExOne’s process for 3D printing metal parts and sand cores for casting. It’s also the technology licensed by voxeljet, with its massive sand 3D printing systems. And, it goes without saying that Z Corp’s technology brings us all of the full-color shelfies that have caught the public’s eye. After this facility’s closing, the source suggests that some folks will most likely not stay with 3D Systems, taking their valuable knowledge with them.

Since then, on Monday, November 16, 2015, the Cubify group at 3D Systems headquarters in Rock Hill, South Carolina, was also let go, the source tells me. According to this individual, these employees were unable to return to their desks and, were instead, escorted out of the building, while other employees packed up their desks and brought them to the Cubify group in boxes. The source believes that this signifies the closure of Cubify in San Francisco, as well. They also thought that, in an executive board meeting the following Tuesday, November 17th, the survival of the food printing program was also discussed. I’ve reached out to 3D Systems to verify this information, but have yet to hear back at the time of publication. Update 11/19/2015: I still have not heard back from 3D Systems on Cubify, but one anonymous commenter has said that the entire Cubify unit has not been let go, but that some were given until the end of the year and that none were escorted out in the manner described to me.

When people are let go, I tend to look at executive pay. My mom often tells me this story about her father, once a manager at Raytheon before he passed away. When the executives wanted to lay people off, he’d go into the boardroom and tell them that all of the higher-ups, himself included, should take a pay cut, instead of laying off employees. “They were furious,” my mom would say. “So, did they do it?” I always ask. “Of course not!” my mom exclaims.

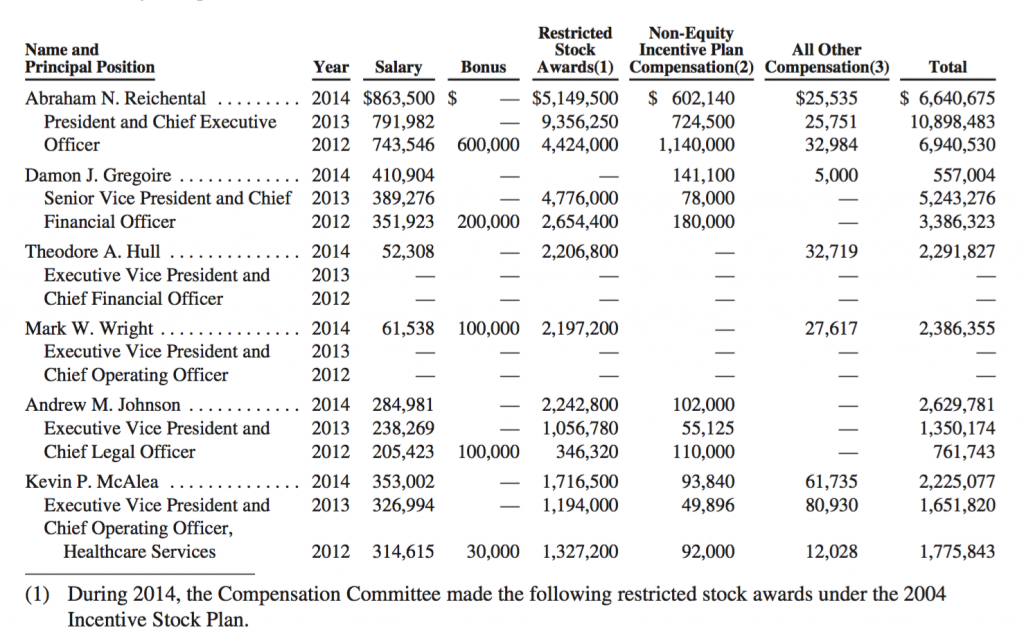

According to 3D Systems’ March, 2015 Proxy Statement, Reichental and Gregoire (the EVP mentioned as a defendant in the suit) took large pay cuts (“large” being a relative term) in 2014, but the company’s Chief Legal Officer and Chief Operating Officer of Healthcare Services increased their compensation about two-fold to roughly $2 million each. In 2013, Reichental took home $10,898,483 and Gregoire took home $5,243,276. The following year, however, both dropped their total compensation so that the CEO earned $6.6 million and the EVP earned only a tenth of the previous amount at $557,004. Additionally, two new EVPs earned about $2 million each in 2014.

Another feature on Glassdoor is the ability to see what some types of positions earn, based on self-reported salaries. Engineers at 3D Systems earn somewhere in the $60K – $80K range, production assemblers and other entry-level employees earn about $26k, and some customer service and sales employees earn around $48k. If Reichental and four of the EVPs cut their salaries by even just $1 million each, that would be $5 million that could be used to save some of those jobs. With that amount of money, 38 entry-level employees, 20 customer service and sales personnel, and 14 engineers could keep their jobs, half a million could be used to rent out the facility, and they’d still have $1.5 million leftover.

The same day that this 3D Systems employee emailed me about the Andover facility, the company also put out a press release announcing “the grand opening of the 3DS Culinary Lab, a groundbreaking new culinary innovation center in the epicenter of the Los Angeles culinary community.” In the photo attached to the release (above), there are, what look like, six ChefJet Pros on display. I say “look like” because, with 3D Systems, looks aren’t always what they seem.

Stepping Down

October 29, 2015: I wake up and look at my phone to check the 3D printing news, as one does in 2015. I turn to my wife, Danielle, and I mutter, “Whoa. Avi got fired.”

Technically, he actually “stepped down”, but I can imagine it going either way: the pressure of dropping stocks and public image finally getting to him and he screams, cheeks pink and voice accented, “I’m out of here!” or, more realistically, the 3D Systems Board of Directors finally had enough and sent him packing.

In a press release from that day, Reichtenal is quoted as saying, “I am deeply grateful to have had the opportunity to lead and build this fine company for the past 12 years, and I am excited about its future.” Next, an Executive Management Committee takes over, led by Charles Hull, inventor of SLA and founder of 3D Systems. In the interim, Chief Legal Officer Andrew Johnson will serve as Interim President and CEO.

We are a bunch of kindred spirits that are focused on growing and harvesting exponential-tech innovation and business model disruption. We are a magnet for top-notch global talent that is committed to making the world a better place by democratizing access to exponential technologies. We are the architects of new products, experiences, platforms and business models. We are both guides and students, the investors and entrepreneurs, the advisers and the clients and we are taking this journey together.

Though Reichental may be lost in the caves of the Internet, rejected by his company and speaking to himself in the royal “we”, I believe that, given the company’s status as the first company in the 3D printing industry and pioneers of the technology, people haven’t given up entirely on 3D Systems itself. It sounds like there have been issues for some time, but that there are those that remember with fondness the times that it was a small business. Or, at least, they believe in the foundation 3D Systems created. But, at this point, it’s hard to imagine what would bring them back around again.

One of my sources gives their input, “I don’t know what could save them at this point. I mean, kudos to Chuck Hull, he actually made the magic happen in the first place! His legacy will remain undaunted I’m sure. And that’s as it should be. However, when you have the likes of HP jumping on the bandwagon with their financial clout, well, small to mid size 3D printing companies won’t stand much of a chance. And with all the PR damage that 3D Systems has suffered these last couple of years, well, survival is going to take a miracle.”

A negative reviewer on Glassdoor comments in their “Advice to Management”, “3DS has a lot of potential to be a great company. The acquisition spree seems to be slowing down, and the dust is finally settling.” Another writes, “The board of directors are old and senile just what Abraham needs to keep his job. They are incapable of doing the right thing… If the board were not so old and senile they would replace the CEO now before the stock becomes penny stock. Don’t understand why the board does not act. Look at the company’s filing to see how much stock the board members have. They have lost so much money in stock value you have to wonder why they don’t do the fiduciary responsibilty and remove the CEO. Only answer look at their age.”

In that case, the Board of Directors seems to have heeded the warning, but it’s hard to say if it’s too late. Most of the other “Advice to Management” sections are also filled with demands to see Reichental fired, along with most managers and executives. As an employee knows, though, the most important thing any company can do is to listen the people that work there.

One reviewer tells 3D Systems, “Listen to your employees, perhaps listen to some that been terminated” and another says, “Invest in your people. You can buy someone’s time and labor, but if you want their passion and creativity, you’ve got to EARN it. Or just keep churning through employees which seems to have worked thus far,” later adding, “Empower employees and foster internal innovation instead of just gobbling up smaller companies.”

One suggestion seems to end by almost reaching into your heart in a plea for reform, “It’s people and relationships that matter. Let the managers of the 30+ companies acquired to date have responsibility, accountability, and appropriate resources to make products successful. The shareholders need to see that the CEO and his management have failed and need to leave the company before all is lost.”

So, we could wait around for a new CEO and management team. Or maybe another company to purchase 3D Systems at its lowest valuation. I don’t know: HP or Canon? Maybe even Stratasys and 3D Systems could try to merge to take on the large companies entering the field. But, if you really listen to the advice to management, there seems to be an alternative solution, too: just listen to your employees. Heck, I wonder if the best solution might not be to just let the employees run things themselves. And turning 3D Systems into a 3D printing co-op couldn’t be much worse than it sounds like things were when they had 40 VPs, too many managers, and a CEO scaring people with his two kids in the office. Could they?