Back in November, I reported on a company called Changing Technologies (CHGT) that was putting out very fluffy, bizarre press releases that aligned its so called plans to operate a “3D printing portal [insert pirate voice] the likes of which ye have never seen!” It had an absolutely ridiculous market cap of $80,000,000 dollars, last month, which is now down to under $20,000,000. It attempted today to pump up its stock value with another press release that talked about how great they were because they were sending a representative to a conference to talk about innovative technologies and new concepts. The dump part of this “pump and dump” scheme will probably happen soon because for once the announcement did very little for the stock. I wanted to explore the value of press releases when they are coming from a decent company, like Tinkerine.

“Canada’s leading manufacturer of desktop 3D printers and 3D printing educational content, today announced the engagement of Sophic Capital as its investor relations firm. Sophic Capital is a Toronto-based capital markets advisory firm for companies in the technology sector.

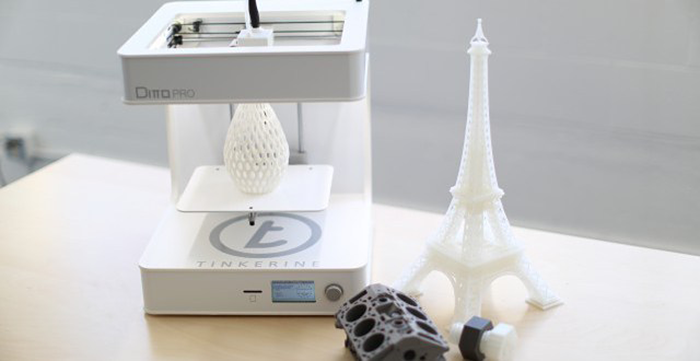

“Following the successful launch of the new DittoPro and our growing opportunity in the education market, I now feel it is time to increase the awareness of the Company in the public markets,” said Martin Burian CFO of Tinkerine. “Sophic Capital and its proven expertise in both financial and technology markets make it an ideal fit to introduce new investors to Tinkerine which will ensure we meet our shareholder communications and capital markets goals.”

Under the services agreement (the “Agreement”) Sophic Capital will receive monthly fees of $6,000 and reimbursement of disbursements. In addition, Sophic Capital has been granted options to purchase 190,000 common shares of the Company (the “Options“), exercisable at a price of $0.25 per share until December 2, 2017. The Options will vest in equal quarterly installments over the next 12 months. The appointment of Sophic Capital is subject to the approval of the TSX Venture Exchange. The Agreement has an initial term of six months, which can be renewed for a further six month period upon the written consent of both the Company and Sophic Capital.”

Ok, so when it comes to small- and mid-capitalization companies that typically are traded on the NASDAQ and OTC markets, according to Brian J. Bushee, a professor of accounting at Wharton and Gregory S. Miller, a professor of accounting at Harvard Business School, “We find that these companies have significant increases in their disclosures [of financial and other corporate events], press coverage, trading activity, institutional investor ownership, analyst following and market valuation after hiring the IR firm, both in absolute terms and relative to a control sample matched on exchange, industry, time listed and prior investor following.”

It seems to me that a relatively small company like Tinkerine would benefit from hiring an IR firm such as Sophic to attract investors, and perhaps understand where their profile and cash flow is headed. It seems as though small companies have lost the ability to speak to just a few big firm Wall Street analysts and now have to reach out directly to investors, which is why they hire middle men like Sophic Capital. This also indicates a long term commitment to current and potential investors.

So overall, the press release is an interesting tool, but it is clearly better from a marketing perspective if the news is substantial, factual, and indicative of a serious commitment to affordable innovation and change. Tinkerine’s stock barely fluctuated at all with this particular press release. Their market cap did not fluctuate wildly in a month. They have and make digital and physical products that are well reviewed by industry professionals and customers.

We will see a lot of smaller companies disappear over the next few years, some will be acquired by larger companies or grow independently (my guess for Tinkerine), and some will disappear because of their own parasitic design and missteps (CHGT).

Comparing Tinkerine to Changing Technologies may seem a little extreme, but remember, as of right now, even though CHGT is at an all-time low, it’s market cap is almost three times ($21million) that of Tinkerine ($7 million).

3D Printed Wolf of Wall Street. Unreal.