PyroGenesis, a Montreal-based 3D printing metal powder producer and plasma torch specialist, has submitted a formal application to list its shares on the NASDAQ Stock Exchange. The move comes as the company aims to increase awareness and broaden its appeal to a larger shareholder base.

The firm will continue trading its shares on the Toronto Stock Exchange (TSX) and will trade on both TSX and the NASDAQ under the ticker symbol ‘PYR’.

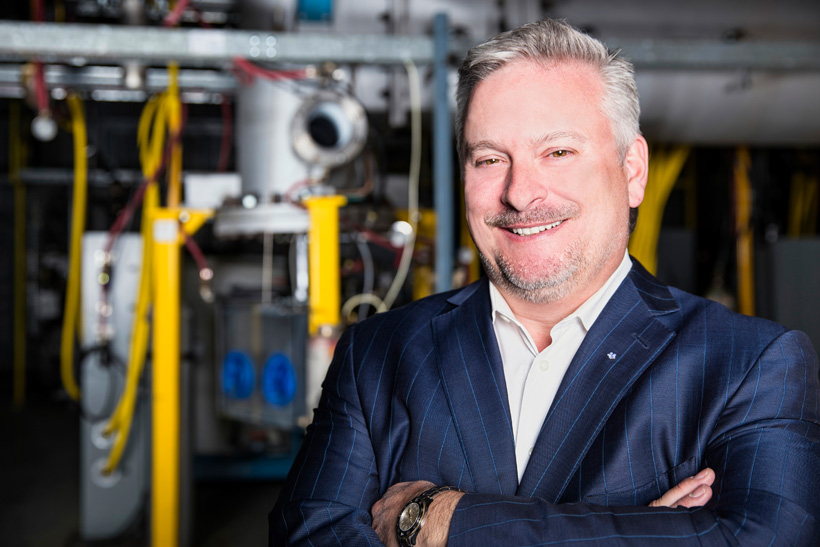

“We believe the company is entering a heightened growth phase and timing could not be better for uplisting our shares to NASDAQ,” said P. Peter Pascali, CEO and Chair of PyroGenesis. “We expect that the move to NASDAQ will increase awareness of PyroGenesis and its offerings, both within the financial community and amongst potential clients.”

PyroGenesis and 3D printing

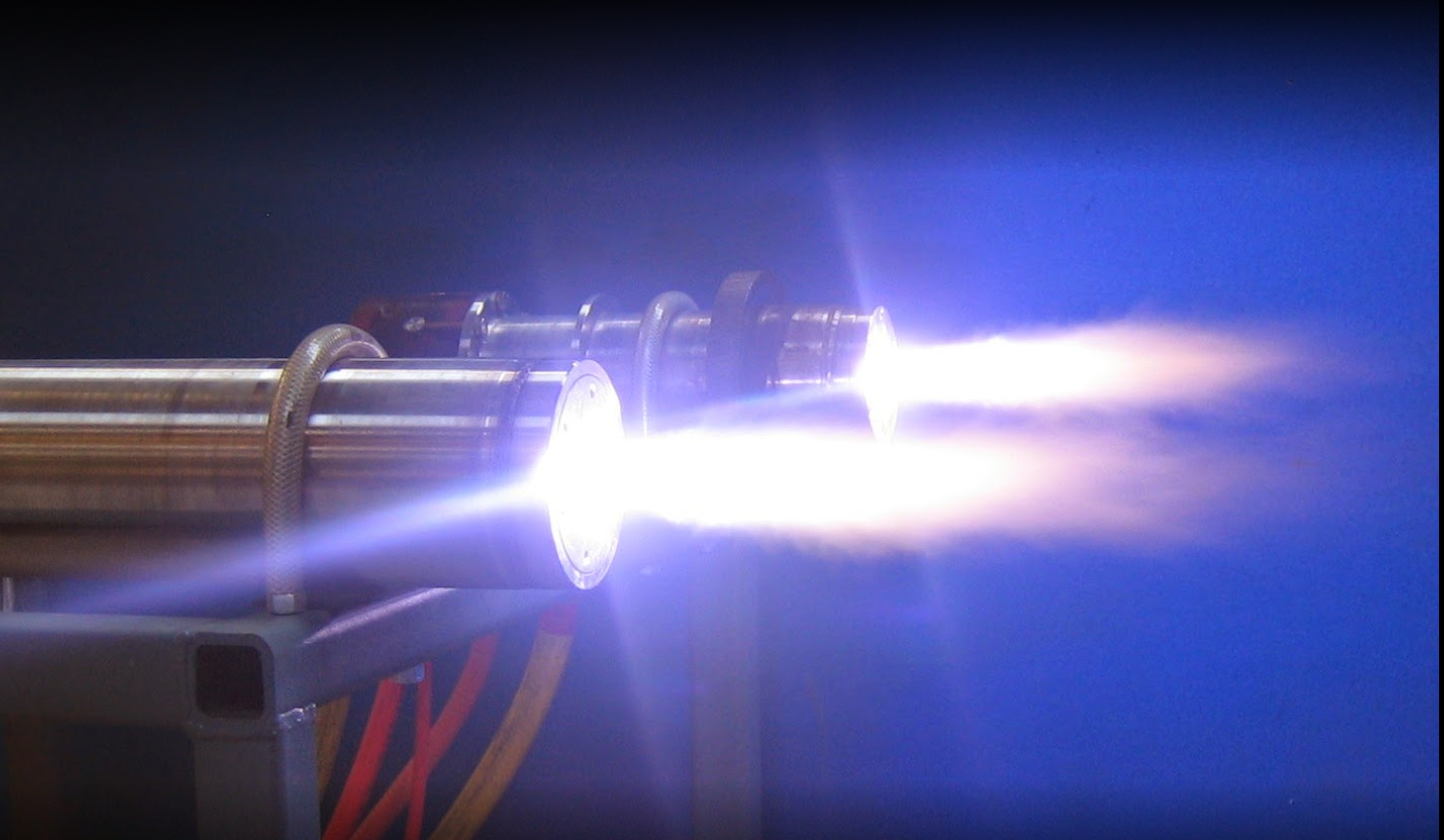

In 2019, PyroGenesis’ Board of Directors approved the establishment of PyroGenesis Additive, a spin-off company tasked with producing metal powders for the 3D printing industry. Soon after, the additive branch completed a special order for an unnamed government entity, using its NextGen plasma atomization system to produce a reactive metal powder with properties similar to those of titanium.

PyroGenesis is one of only a few metal powder producers in the world to process materials using the plasma atomization process (PAP) – a method that the company originally patented in 1995. In 2019, the firm collaborated with French metal processing specialist Albert & Duval for the production of powdered titanium 3D printer feedstock using its PAP process.

In recent years, the firm has placed emphasis on the importance of strategic partnerships, having secured contracts in excess of $32 million by the end of 2018. Midway through 2019, PyroGenesis received approval to raise $3 million through non-brokered private placement financing.

Listing application details

To process the NASDAQ listing, PyroGenesis has appointed Nelson Mullins Riley & Scarborough LLP as its US legal council. The listing remains subject to approval until relevant regulatory requirements are satisfied, which should take between six to eight weeks. Therefore, PyroGenesis hopes to list its shares before the end of Q1 2021.

“We believe this listing will also enhance trading liquidity by broadening our appeal to a larger shareholder base, in the US and internationally, as we execute our business plan and drive long-term shareholder value,” continued Pascali. “We are very much looking forward to elevating the company’s profile with this listing.”

According to the firm, funding will not be associated with the listing and a “reverse stock split” will not take place. In due course, PyroGenesis will file a Form 40-F Registration Statement – required for companies residing in Canada but that have securities registered in the US – with the US Securities and Exchange Commission (SEC). If PyroGenesis’ application is successful, the firm will trade on both exchanges under the ticker symbol ‘PYR’.

In a prior announcement detailing the approval of the board to move forward with the NASDAQ listing, VP IR-Comms and Strategic BD at PyroGenesis, Rodayna Kafal, stated the listing was the “next natural step” for the firm.

“We believe a NASDAQ listing should, amongst other things, provide additional opportunities to attract institutional and retail investors, this allowing the company to further broaden its investor base, and increase the visibility and credibility of the company worldwide thereby attracting additional sales, partnerships, and M&A opportunities,” she said.

Recent NASDAQ developments

The NASDAQ is the second largest stock exchange by market capitalization worldwide, behind the New York Stock Exchange (NYSE).

Towards the tail end of 2020, 3D printer electronics supplier Nano Dimension agreed to sell 25 million American Depositary Shares to investors on the NASDAQ, raising around $100 million in funding. The firm aims to use the additional funding as working capital following a difficult third quarter, in which it made a net loss of $20.7 million. Nano Dimension was approved for listing on the NASDAQ in 2016.

Meanwhile, German 3D printer manufacturer voxeljet switched from the NYSE to list on the NASDAQ in August 2020, after its shares became increasingly volatile following the release of its Q2 financial results. Elsewhere, Israeli food tech company Meat-Tech 3D began the process of filing for an IPO to trade on the NASDAQ in the final quarter of 2020, with the firm expecting the IPO to commence “as soon as market conditions permit”.

Subscribe to the 3D Printing Industry newsletter for the latest news in additive manufacturing. You can also stay connected by following us on Twitter and liking us on Facebook.

Be sure to subscribe to the Another Dimension podcast on your chosen podcast player to make sure you never miss an episode.

Looking for a career in additive manufacturing? Visit 3D Printing Jobs for a selection of roles in the industry.

Featured image shows metal alloy powder. Image via PyroGenesis.