3D printed electronics supplier Nano Dimension has agreed to sell 25 million American Depositary Shares (ADSs) to investors, raising around $100 million in funding.

The agreement has valued the company’s shares at $4.00 each, but this is 31.7 percent less than its share price had been at the close of trade on Thursday evening. As a result, Nano Dimension’s shares have since fallen in value by 24 percent, from $5.86 to $4.43.

Nano Dimension intends to use the additional funding as working capital following a difficult Q3 2020 which saw it make a net loss of $20.7 million. The deal also represents a continuation of the firm’s growth strategy, and it has now raised $215.3 million via direct offerings, that could be put towards future acquisitions.

Acquisition opportunities ahead?

Nano Dimension’s latest offering was managed by the Fordham Financial Management subsidiary ThinkEquity will see it secure $100 million in funding, minus agent fees and other expenses.

In total, the company generated just $438,000 in revenue during Q3 2020, below analyst projections of $1.2 million. Nano Dimension’s net $20.7 million loss resulted in a corresponding $0.45 reduction per share, significantly more than the $0.08 forecast.

According to the firm’s CFO Yael Sandler, its Q3 results actually exceeded expectations. “These are not disappointing results per se,” said Sandler. “The reduced revenues in 2020 as a result of the COVID-19 pandemic being prolonged and re-emerging crises, were in fact expected to be lower than we have achieved.”

As well as servicing its running costs, Nano Dimension has also earmarked its newly-raised cash for pursuing strategic opportunities such as possible business combinations. Although the firm has yet to indicate where it would make reinvestments, its latest deal does follow a string of direct offerings this year, including a $35.9 million deal just six months ago.

When the agreement is concluded on November 23rd, Nano Dimension will have raised a total of $215.3 million in funding in 2020. Given that the firm’s CEO Yoav Stern confirmed on a call with analysts that it had spent just $2.4 million on development during the quarter, this increases the prospect of it redeploying funding elsewhere.

Nano “not judging success” by revenue

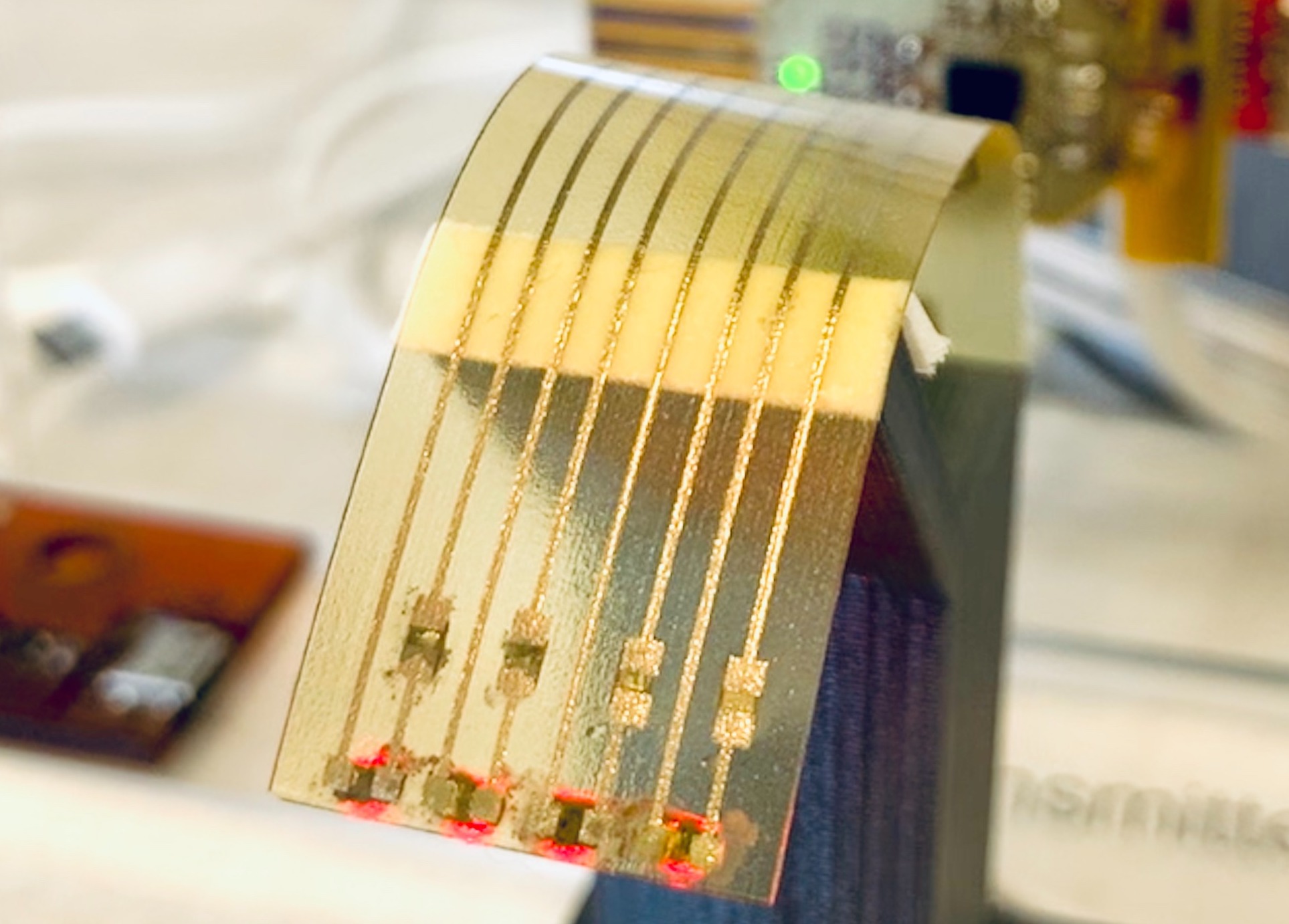

The company’s share price has been volatile during the last week, and it had risen steadily from $3.58 to $5.86 before the announcement of its direct offering. Nano Dimension recently announced a major breakthrough in its technology for fabricated Print Circuit Boards (PCBs), causing this steady increase to take place.

Earlier this year, the firm also announced a “major breakthrough” via a partnership with military sensor specialist HENSOLDT, which saw it fabricate a double-sided ten layer PCB. Similarly, Nano Dimension has worked with polymer producer REHAU to achieve an ‘AME milestone’ by 3D printing an electronic touch sensor using its DragonFly LDM machine.

Based on its recent progress, the company has estimated that the value of the 3D printed electronics market will grow to $2.3 billion by 2029. During Nano Dimension’s Q3 earnings call, Stern indicated that the firm was best positioned to spearhead the emerging technology’s adoption due to its market-leading position.

“I’m starting to see signs of competition, which I’m very happy about, but they are far behind,” said Stern. “We have our next-generation machine coming based on investments, but not before the beginning of 2022. So we have a very, very strong feeling about our success.”

“We are not judging, at this point, our success by quarterly revenues, that will come later,” he added.

The advantages of additive manufacturing for electronics

The suppliers of additive manufacturing for electronics is slowly expanding.

3D printer manufacturer Azul 3D for instance has partnered with electronics firm DuPont, to introduce “next-generation 3D printed electronics.” As part of the deal, Azul will deploy its HARP technology to expand the adoption of 3D printing into “previously inaccessible” applications.

Precision micro dispenser manufacturer nScrypt has deployed its SmartPump conical pen tip to successfully 3D print solder and adhesive dots in the 50-micron range. The breakthrough could advance the fabrication of flexible hybrid electronics including irregularly-shaped electronics boards.

Elsewhere, the US-based Nextflex consortium has entered into a cost-sharing agreement with the Air Force Research Laboratory (AFRL). The deal will see the U.S. Department of Defense (DoD) provide up to $154m in funding to develop 3D printed electronics for military applications.

To stay up to date with the latest 3D printing news, don’t forget to subscribe to the 3D Printing Industry newsletter or follow us on Twitter or liking our page on Facebook.

Are you looking for a job in the additive manufacturing industry? Visit 3D Printing Jobs for a selection of roles in the industry.

Featured image shows Nano Dimension’s DragonFly LDM 3D printing technology in action. Photo via Nano Dimension.