Earlier this month Groupe Gorgé SA (EPA:GOE) published their updated financial statements for first six months of 2016. The share price of the company has fallen from €22 prior to publication to below €21 currently.

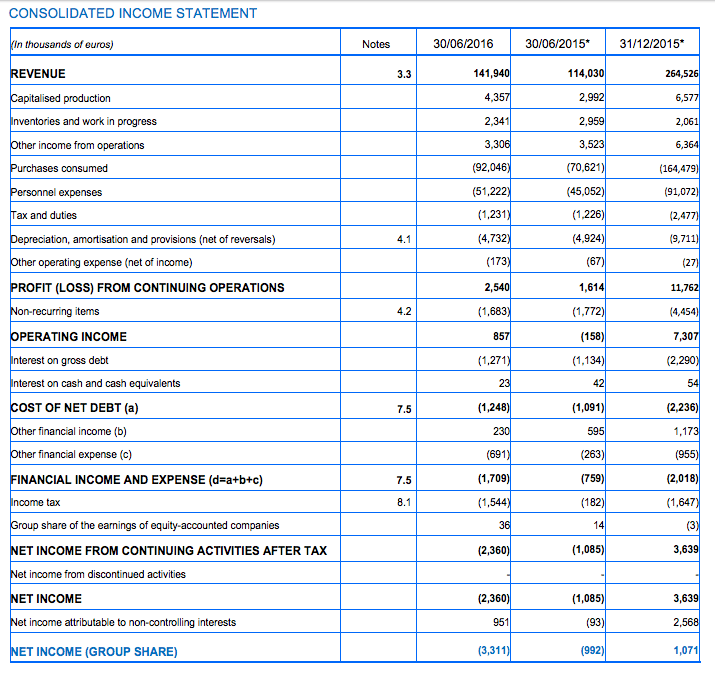

The results show that while the French company remains profitable at a gross level, entry into the 3D printing space has eroded margins and resulted in a bottom line loss of €3.3 million.

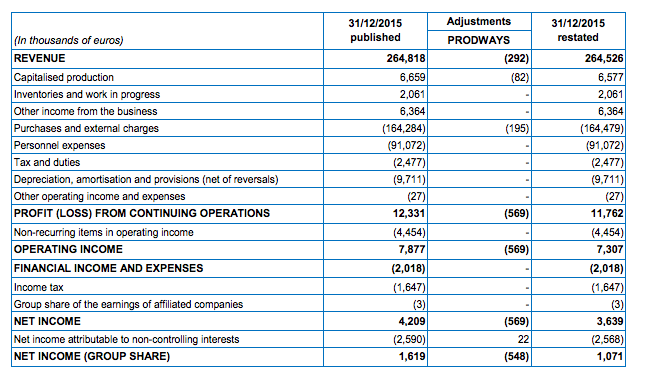

Accounting errors discovered

The financial statements also show that the accounts for 3D printing subsidiary Prodways contained an error for 2015. Groupe Gorgé attribute the €569 thousand mistake to “the omission of a credit note, the unwarranted recognition of a tangible asset in progress and an inventory error.” These errors happened while Prodways was in the process of implementing a new Enterprise Resource Planning (ERP) system.

Founded in 1990, Groupe Gorgé has four income streams. The established divisions of Smart Safety Systems, Industrial Projects and Services and Protection in Nuclear Environments were joined by a 3D printing division in 2013. As previously reported, Groupe Gorgé purchased Phidias Technologies in May of that year.

The company attributes the 3D printing divisions loss making to the fact they, “are not at the same stage of maturity” as the other segments. Furthermore, 3D printing has underperformed the expectations and forecasts made previously by the company, albeit “slightly.”

In total the company reported revenue of €141.9 million for the first six months of 2016. The 3D printing segment contributed €12.4 million to this figure, but also a €4.1 million operating loss. By comparison the largest segment by revenue, Industrial Projects and Services (IPS), generated €56.4 million and €2.8 million in operating income. This is an increase of 20.6% by revenue and 2.3 times greater operating than the comparative period for 2015.

The most profitable segment, Smart Systems, earned €3.4 million in operating income from €53 million revenue. While this was an increase on the comparative period for 2015, these most recent results are down on those from the prior financial statements in December last year. Looking at the movement in revenue from H2 2015 in comparison to H1 2016 shows that 3 of the 4 segments Groupe Gorgé operates in took a hit. Only 3D printing improved, with €9.8 million in revenue for H2 2015 versus the €12.4 million for these most recent numbers.

Targeting 3D printing for Medical and Dental

Groupe Gorgé is targeting several specific market segments for their 3D printing ventures to be a success. In setting medical and dental as one of the niches where they plan to “ultimately achieve a leadership position” they are not alone. The health market is already a sector where 3D printing companies such as Arcam with their metal medical implants and EnvisionTEC with hearing aids have already made substantial progress.

Entry into the medical and dental markets by Groupe Gorgé, and success in these markets will require a challenge to existing competitors. This may not be an easy task.

Furthermore, Groupe Gorgé must contend with other new entrants in the medical sector such as Rize. The Boston based company revealed to 3DPI that they have discussed hearing aid manufacture using their technology.

Other companies such as Arfona are also eying the dental market with biocompatible materials and a partnership with industry specialists.

While Groupe Gorgé state, “the technologies developed by its subsidiary Prodways still have great potential” they also add, “the time necessary for these applications to come up to speed is greater than anticipated.” Increased competition is a sign of a maturing market, and often that means profit margins will be eroded if companies decide to compete upon price.

If Groupe Gorgé are able to move competition away from price and instead offer a superior 3D printing solution to clients, this may still not be enough: primarily due to the earlier lead taken by others in the field. The first mover advantage can often provide a strong competitive edge, especially if there is a substantial investment required for customers to switch products.

The purchase of a dental laboratory during June by the company is intended to facilitate “the transformation of conventional manufacturing methods towards additive manufacturing.” Currently this purchase is contributing to losses rather than profits in the 3D printing division.

A critical turning point

The next important date for investors and analysts following this company will be October 25th when the company reports numbers for the quarter ending 30th September. These returns will establish whether claims that, “the decline in profitability reached its turning point in the middle of the year” are valid.

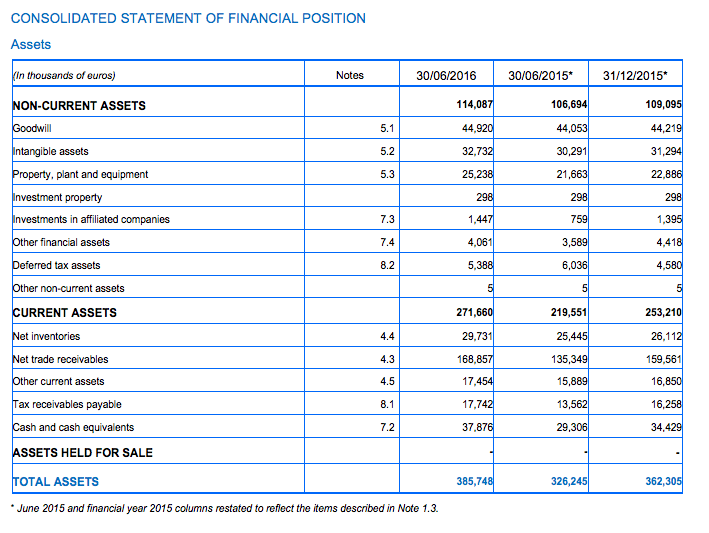

Groupe Gorgé have cash flow available from their profitable divisions to support 3D printing and held €37.8 million in cash and equivalents at the period end. The company certainly has the funds available to support the loss making division for the foreseeable future, even with a €12 million increase in long-term liabilities on the comparative.

The question is more whether they will be able to catch up with others who already have a head start and if the high-throughput 3D printing still impresses as it did in 2013, especially then others including 3D Systems with the Figure 4 modular system are also making moves in this space.