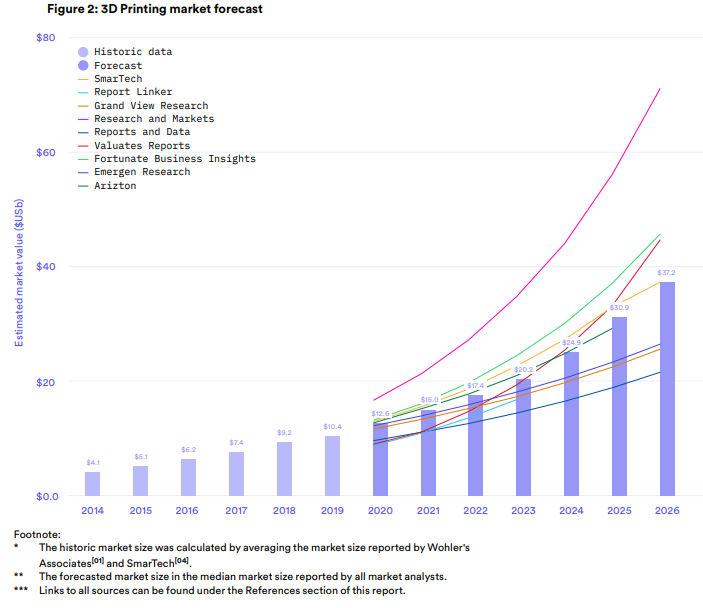

The global 3D printing market grew by 21 percent in 2020 compared to 2019 to an estimated value of $12.6 billion despite the effects of the Covid-19 pandemic, according to on-demand manufacturing platform 3D Hubs’ 2021 3D Printing Trends Report.

The annual report suggests that limited access to traditional manufacturing technologies as a result of Covid-19 helped to accelerate the adoption of additive manufacturing throughout last year, with 65 percent of engineering businesses increasing their usage of 3D printing compared to 2019.

Looking ahead, the report predicts that the 3D printing market will more than double in size over the next five years, reaching an estimated value of $37.2 billion in 2026.

The 3D Printing Trends Report

The latest edition of 3D Hubs’ 3D Printing Trends Report seeks to review the overall market growth of additive manufacturing, including the impact of Covid-19, alongside revealing where demand is highest for the technology and the barriers to adoption it still faces.

The report is comprised of data from three main sources, including a survey conducted by 3D Hubs with 1,504 engineering businesses. The report also collected data via a systematic review of news reported by the media, and identified market trends through comparing various market analyst reports such as Wohlers Associates’ recently released 2021 State of 3D Printing report.

Last year’s 3D Printing Trends report also predicted long-term growth for the additive manufacturing sector, bolstered in part by the raising of more than $1.1 billion by 3D printing startups in 2019.

Market growth despite Covid-19

At the beginning of last year, manufacturing ground to a near halt as the coronavirus rampaged across continents, shutting down factories and halting production within many industries. As a result, gaps began opening in supply chains where demand outstripped supply.

According to 3D Hubs’ report, 3D printing gained “mainstream exposure” for its role in rapidly producing Personal Protective Equipment (PPE) and components for medical devices such as ventilators. With global supply chain disruption making it harder for businesses to source parts from overseas, more local and distributed manufacturing setups such as 3D printing were turned to for both prototyping and end-use parts.

While the 3D printing sector hasn’t been completely resilient to the past year’s challenges, the report states the technology “is nevertheless set to continue growing 17 percent year-over-year in the next three years.”

The survey carried out by 3D Hubs reveals that, as a result of the pandemic, 33 percent of engineering businesses increased their 3D printing usage, while half of the 1,504 respondents maintained their usage. The firm attributes this finding to engineering firms having more downtime than usual, giving their teams the chance to focus more time on research and development, testing and prototyping.

The report suggests firms also realised lead time benefits of 3D printing over machined and injection molded parts for some applications.

Shift from prototyping to production

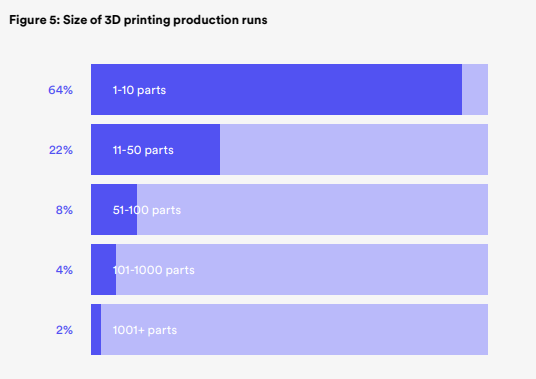

While 3D printing is currently primarily used for prototyping, the report states that engineering companies are seeing the benefits of the technology “increasingly for end-use parts.” According to 3D Hubs’ survey, 47 percent of engineering businesses deploy 3D printing for prototyping while 29 percent use the technology for aesthetic or functional end-use parts.

In fact, more than half of engineering businesses revealed they had increase their use of 3D printing to produce functional end-use parts during 2020, while 30 percent reported their use of 3D printing for end-use parts remained the same in 2020 compared to 2019.

According to the report, the industries that reported the largest increase in their use of the technology for end-use parts included biotechnology, transportation, and automotive. As the report points out, “biotechnology and automotive are industries that especially benefit from the design complexity 3D printing offers” while the transportation sector tends to deploy the technology to produce spare, custom parts that are otherwise hard or expensive to source.

Looking ahead to 2021 and beyond

The report predicts 3D printing to “continue on its path of growth” in 2021, with 73 percent of engineering businesses estimating they will produce or source more 3D printed parts this year compared to 2020.

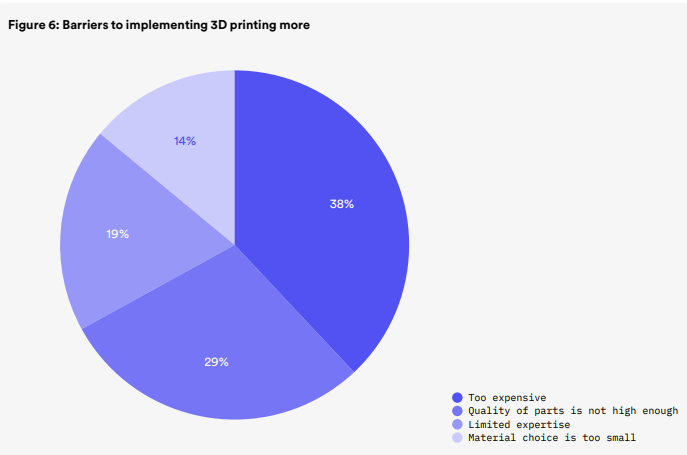

However, cost, part quality, limited expertise, and material choice limitations are all factors holding back the adoption of additive manufacturing, according to respondents of 3D Hubs’ survey. The report points to the higher price point per part for high volumes of 3D printing compared to other manufacturing technologies, as well as the higher cost of metal 3D printing technologies such as selective laser melting (SLM) and direct metal laser sintering (DMLS).

Counteracting these perceived barriers, according to the report, is the greater design flexibility offered by 3D printing which can lead to improved strength-to-weight ratios and more efficient parts. In addition, the report sees the development of new materials and techniques within metal 3D printing as a means to lower the cost of the technology.

Rounding off its report, 3D Hubs asked more than 1,500 3D printing users in its community to predict how they foresee the industry evolving throughout 2021. The general consensus among respondents is that there will be a continued shift towards more end-use parts and the cost of the technology will gradually become cheaper in order to open the technology up to more applications.

Hybrid manufacturing is also predicted to “make bigger strides” this year, as is the improvement of “material freedom”, workflow software, and surface finishes and alloys in 3D printing.

The full Additive Manufacturing Trends Report 2021 from 3D Hubs can be read in full here.

Subscribe to the 3D Printing Industry newsletter for the latest news in additive manufacturing. You can also stay connected by following us on Twitter and liking us on Facebook.

Looking for a career in additive manufacturing? Visit 3D Printing Jobs for a selection of roles in the industry.

Featured image shows a 3D printed part produced by 3D Hubs on HP’s Multi Jet Fusion. Image via 3D Hubs.