On-demand digital manufacturing provider Protolabs has published a new study that investigates the state of play of Europe’s battery industry.

The study, which surveyed 200 industry executives from seven European countries, looks at how prepared the sector is to meet the challenges of securing its domestic battery cell supply chain and capturing more of the global battery market. With global battery demand expected to increase by 14 times by 2030, a domestic battery supply will be imperative for Europe to meet its climate goals as the fossil-fuel age gives way to the electric.

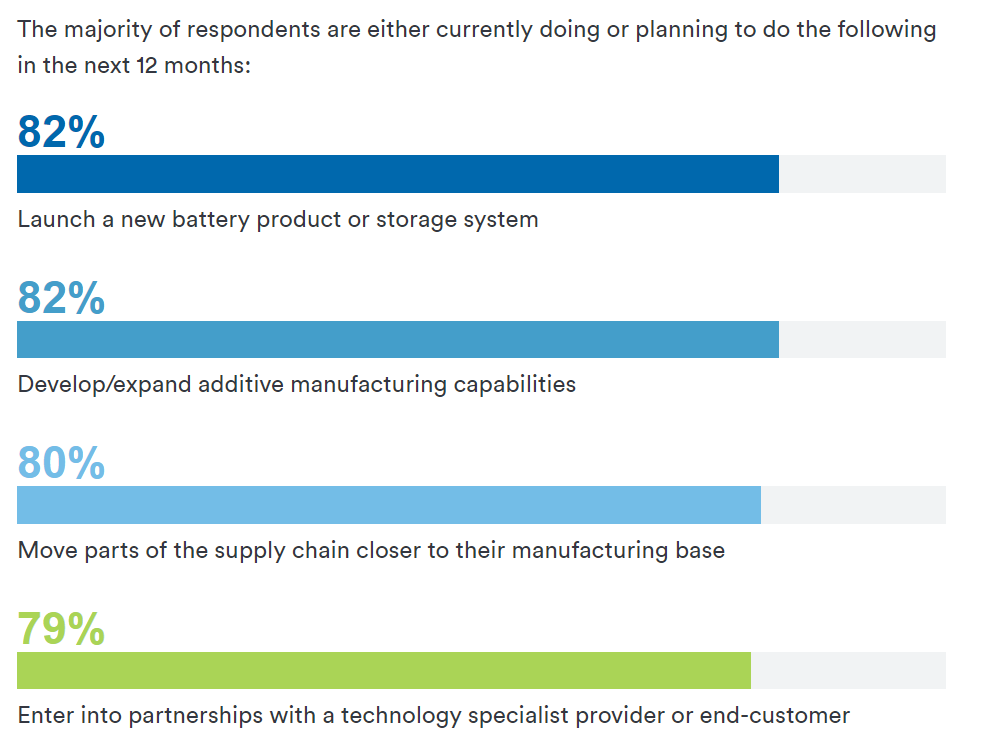

To aid this shift, 82 percent of survey respondents are either currently, or are planning to, develop or expand their additive manufacturing capabilities in the next 12 months, the report states. Additionally, 80 percent of respondents plan to re-shore parts of their supply chain closer to their manufacturing base.

3D printing batteries

While leveraging 3D printing technologies for battery production is still in the relatively early stages, adoption of the technology is increasing within the sector. A number of 3D printing companies are making advancements in this area, having identified a market for the technology in the production of batteries for electric vehicles (EVs).

For instance, last year UK-based Photocentric launched an entirely new division dedicated to the R&D of eco-friendly 3D printed electric batteries for drones, delivery robots, and EVs, while 6K Energy invested $25 million in a new facility dedicated to identifying sustainable energy storage alternatives. In May, the Sakuu Corporation unveiled a new industrial-grade 3D printer specifically optimized for producing EV batteries at scale shortly after being awarded three new patents to advance its 3D printed solid-state batteries.

Elsewhere, Swiss mining and investment firm Blackstone Resources claims to have developed a 3D printing technology capable of producing high energy-density lithium-ion batteries, and a novel method of 3D printing electrodes for lithium-ion batteries has been developed at the California Institute of Technology (Caltech). 3D Printing Industry has contacted Blackstone Resources for comment.

Responding to Europe’s growing EV demand

According to the International Council on Clean Transportation (ICCT), there are currently an estimated 1.8 million EVs on Europe’s roads, with this number to increase to at least 30 million by the end of the decade in line with the European Union’s (EU) targets. In fact, Europe’s EV sales overtook China’s for the first time since 2015 in 2020, becoming the largest EV market in the world.

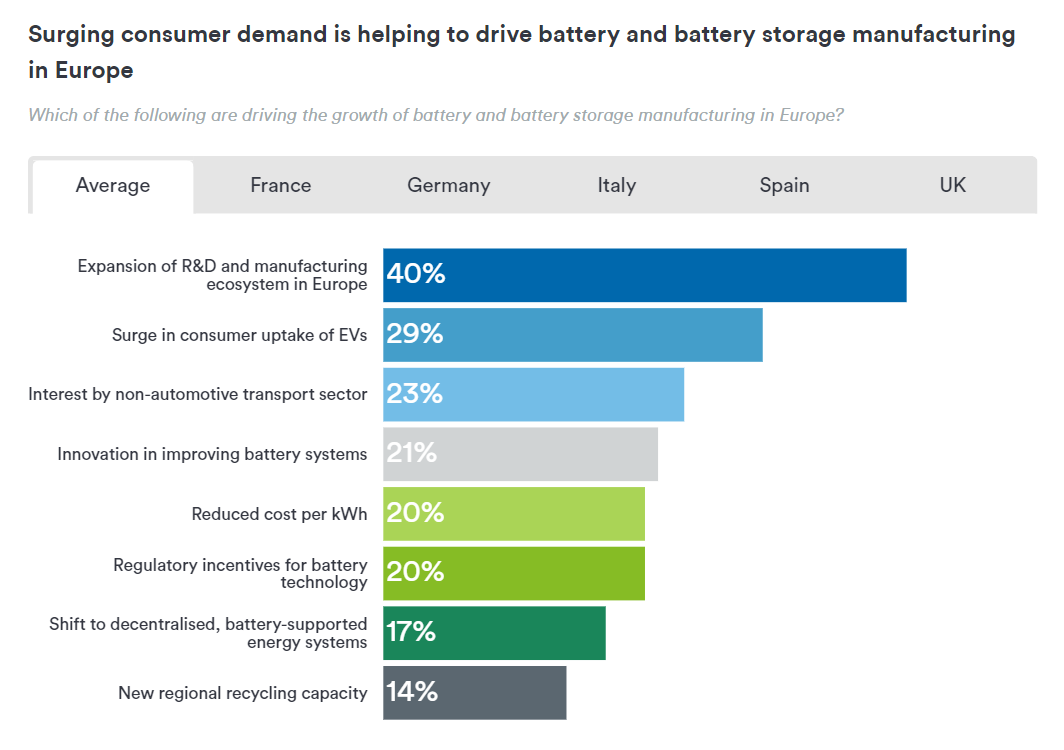

Protolabs’ report states that surging consumer demand for EVs is helping to drive battery and battery storage manufacturing in Europe. Unable to beat China on volume, European manufacturers are reportedly focusing their efforts on making batteries that are ultra-high-performance and sustainable.

More than two-thirds of survey respondents said they are confident in their R&D efforts and in innovative product design, while just over half are confident in their ability to scale up innovation.

Re-shoring supply chains with AM

In light of the Covid-19 pandemic highlighting supply chain fragilities, the report indicates an accelerated trend amongst battery manufacturers towards re-shoring and near-shoring supply chains to increase their resilience and speed to market, while lowering their carbon footprint. Eight in 10 respondents said they are either currently in the process of bringing their supply chain closer, or are planning to do so in the next year.

To aid this re-shoring effort, 82 percent of those surveyed intend to develop and expand their additive manufacturing operations, with 72 percent seeking partnerships with specialist technology providers or end-users in order to do this.

Adopting 3D printing within their supply chains for specialty components will also give manufacturers greater flexibility, an important factor in the innovation of next-generation solid-state batteries, Protolabs’ report states. Solid-state batteries can store a greater charge more quickly, and could potentially double the range of EVs.

The study also places emphasis on building greater efficiencies and environmental compliance into the European battery industry’s production processes, such as using less energy and improving recycling. The EU is planning on implementing strict new environmental standards for batteries by 2022, which are designed to eliminate imports of cheaper, less sustainable components and boost local production.

However, the study revealed many respondents are struggling with waste disposal and meeting mandatory recycling targets, meaning that a circular economy battery industry is still a way off. More than half of respondents called for increased government investment and supportive policy in order to grow the European battery industry’s market share. Fortunately, battery manufacturing appears to be a key part of the EU’s plan to decarbonize the transport sector under its Green Deal, which is aiming for climate neutrality by 2050.

One “pinch point” in increasing Europe’s battery manufacturing capacity lies in manufacturing cathode-active materials, and the risk of demand outstripping the supply of increasingly scarce raw materials. This could potentially grow as an area of interest for innovative technologies such as additive manufacturing, where novel material development manufacturing flexibility is facilitated.

The full report can be found in the study titled: “In charge: Can Europe become a battery power in the electric age?” published by Protolabs.

Nominations for the 2021 3D Printing Industry Awards are now open, have your say who is leading the industry now.

Subscribe to the 3D Printing Industry newsletter for the latest news in additive manufacturing. You can also stay connected by following us on Twitter and liking us on Facebook.

Looking for a career in additive manufacturing? Visit 3D Printing Jobs for a selection of roles in the industry.

Subscribe to our YouTube channel for the latest 3D printing video shorts, reviews and webinar replays.

Featured image shows Europe’s EV sales overtook China’s for the first time since 2015 in 2020. Photo via Sakuu Corporation.