From the Covid-19 pandemic to the recent Suez canal blockage by the Ever Given container ship, events have exposed significant weaknesses in supply chains across the globe over the past year. Add Brexit trade tensions and the threat of various global tariff impositions into the mix, and conventional supply chains look decidedly fragile as we emerge from the pandemic.

“We have seen with the recent pandemic the vulnerabilities of the physical supply chain to systemic disruption,” says Quan Lac, Head of Additive Manufacturing at Siemens Energy, Americas. “There have been numerous examples of additive manufacturing being used to mitigate conventional supply shortfalls through digitally-enabled distributed manufacturing,” he adds.

With this in mind, could 3D printing become a core technology for connected digital manufacturing in the near future?

This sentiment is also echoed by Xometry’s Director of Application Engineering, Greg Paulsen, who reasons “the ability to seamlessly source the same parts from multiple suppliers in a network provides both a parallel capacity advantage as well as geographic flexibility” to supply chains. According to Paulsen, global supply chains need to become more resilient to disruption, regardless of the cause, and 3D printing may play a significant role in this.

It is worth considering, though, that “the discussion on reshoring and supplier diversification in global value chains (GVCs) did not start with the Covid-19 pandemic,” as the World Trade Organization (WTO) points out. Instead, “the rapid expansion of GVCs ended after the global financial crisis as a result of pandemic-unrelated factors that have and continue to affect the trend towards a reorganization of supply chains.”

As the organization outlines, these factors include challenges in factor price differentials between countries, such as the erosion of wage differences, technological progress like robotization, changes in trade policy environment leading to increased trade costs and policy uncertainty, and structural changes to the world economy.

3D Printing Industry spoke to Xometry, Siemens, Protolabs, and Shapeways about where opportunities lie for the 3D printing sector to capitalize on these developments and how offering on-demand 3D printing as a service could bolster supply chain resilience in the future.

Noah Mostow, a Research Associate at additive manufacturing consultancy firm Wohlers Associates, also provides insight into how events over the past year may have provided favorable conditions for accelerating the adoption of 3D printing among manufacturers going forwards. Meanwhile, WTO staff share a global perspective on the factors influencing supply chains and further discuss customs duties on digital goods.

How Covid-19 highlighted global supply chain fragility

When manufacturing ground to a near halt at the beginning of last year as the coronavirus rampaged across continents, gaps began appearing in supply chains spanning medical, automotive, aerospace, industrial goods, and many other industries. 3D printing was able to plug some of the holes in supply chains where conventional manufacturing could not match demand, such as for the production of Personal Protective Equipment (PPE) and components for medical devices like ventilators.

Numerous 3D printing service providers and companies equipped with additive manufacturing capabilities were able to redirect their production output to support the pandemic relief effort, highlighting the potential viability of digital manufacturing to lessen or even completely prevent future supply chain disruptions. The Wohlers Report 2021 revealed additive manufacturing grew by 7.5 percent to nearly $12.8 billion in 2020, despite the pandemic’s challenges.

“Surveys and research point towards the fact that the Covid-19 pandemic and political developments raising policy uncertainty accelerate the digitization of manufacturing,” the WTO offers. “To what extent this will affect trade remains an open question, though. Early evidence from the hearing aid industry suggests, for instance, that additive manufacturing led to an increase in trade as additive manufacturing raised productivity and boosted overall demand.”

Of course, it is essential to remember that 3D printing does not make sense for all parts, and challenges surrounding digital inventories, high entry costs, and qualification and certification remain.

“This global crisis may prove to be the catalyst for accelerated digital manufacturing.”

According to the latest market research from industrial 3D printing consultancy specialist AMPOWER, metal additive manufacturing could achieve annual growth of more than 29 percent over the next four years, despite a stagnation in the market due to the Covid-19 pandemic.

The extent to which metal 3D printing and additive manufacturing more generally could help bolster supply chains worldwide as we emerge from the pandemic is echoed by Lac. “This global crisis response effort may yet prove to be the catalyst to accelerate digital manufacturing through additive manufacturing, as an accepted alternative to established physical supply chains across different industries.”

Lac adds that in terms of high-end metal applications, one of the critical challenges for the technology remains integrating conventional post-processing steps into digitally connected value chains. However, research is underway in this area. As the world emerges from the pandemic, he believes multiple industries could stand to benefit from end-to-end additive manufacturing as a tool to improve supply chain resilience.

“We have already seen some great examples of digital manufacturing enabled by additive manufacturing in the healthcare sector during the pandemic,” Lac offers. “Even prior to the pandemic, different industries like oil and gas, maritime and automotive have been active in the development of digital warehouse concepts utilizing AM, to make step-change reductions against conventional supply chain lead times and inventory, to improve overall supply chain resilience.”

Initially, Lac foresees applications that require fewer regulatory controls as ideal candidates for manufacturers looking to transition to a digital warehouse. The challenge for broader industry adoption of more regulated applications, he says, will be how to qualify and certify components through an end-to-end digital value chain.

Reassessing supply chains beyond Brexit

Aside from the pandemic, 2020 saw the UK enter and conclude the transition period of its exit from the European Union (EU), throwing up tariff concerns from firms looking to import and export goods between the two markets and subsequently causing supply chain headaches for all involved.

The vagary of Brexit and increased scrutiny on supply chains due to the pandemic has left manufacturers in “a state of flux,” according to 3D printing service bureau 3DPRINTUK. The company has observed a “tangible move across industry” to localize production where possible while maintaining timelines, cost-effectiveness, and quality of production. It is also aware of some companies that use international service providers having their orders refused.

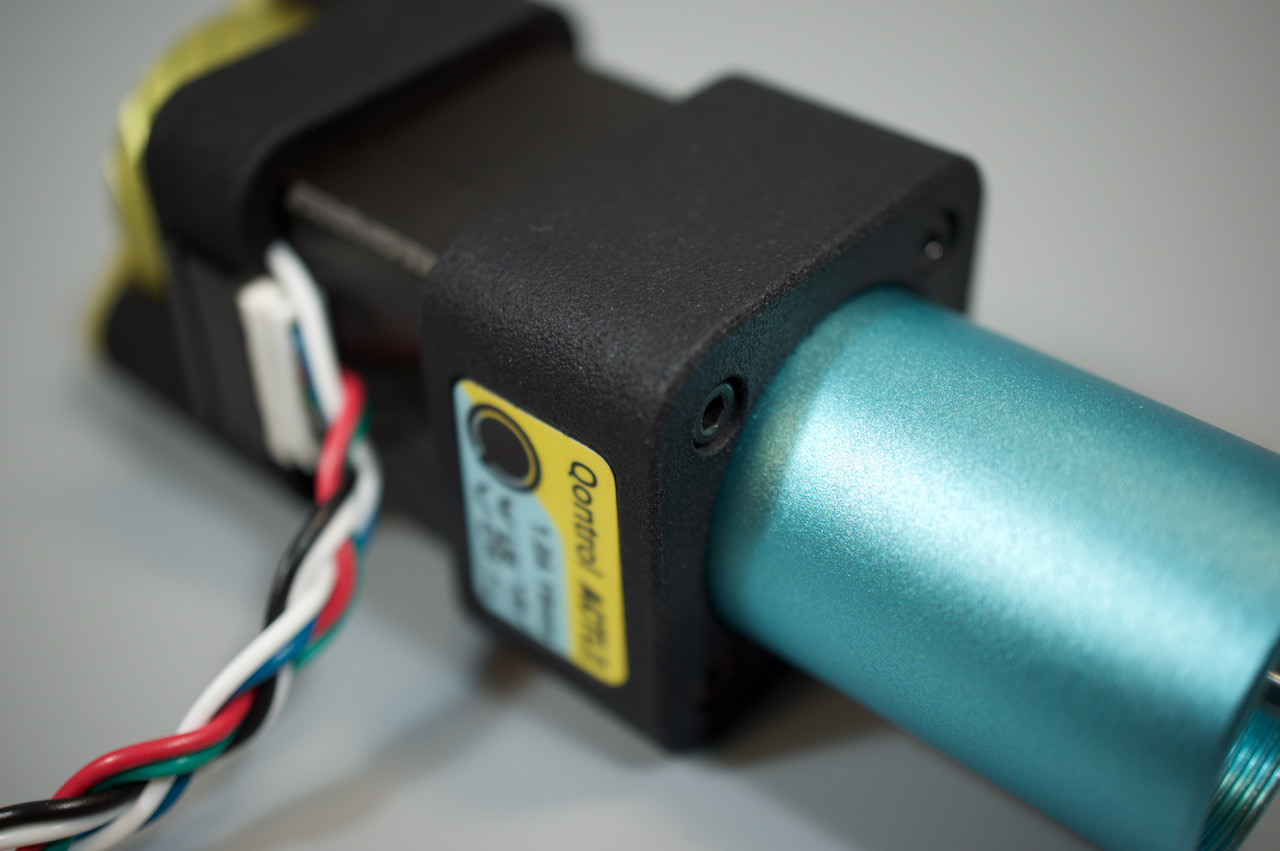

This was the case for one of 3DPRINTUK’s new customers, Qontrol, which uses 3D printing throughout the design cycle of its quantum science R&D instruments.

“We have been long-time regular customers of a continental-European print service,” says Dr. Josh Silverstone, CTO of Qontrol. “Very simply, we needed to place an urgent order with them just before Christmas 2020, and they refused it down to uncertainty around Brexit.”

The company turned to 3DPRINTUK to fulfill the order, and will now use the company as its primary 3D printing service going forwards. 3DPRINTUK itself has had to adapt to logistical disruptions, customs issues, and uncertainties at the British border resulting from Brexit. The company has stopped its road freight for international orders, with UPS express fulfilling them “until things settle.”

The service bureau offers companies based in the UK that are using 3D printing services from the continent may benefit from taking a “fresh look” at manufacturing in the UK to relieve some of the issues and uncertainties they may be facing with European suppliers, such as delays and additional logistical costs. The company recently acquired fellow London-based 3D printing service bureau Additive to strengthen its position in the UK market and expand its services.

The WTO also reasons that supply chain disruption could be brought about as a result of new trade relations between the EU and UK following Brexit, where “GVCs and regional value chains could be affected if trade costs associated with non-tariff measures (e.g., standards, certifications, rules of origin) make it too costly to import parts and components from the UK to the EU or to export parts and components from the EU to the UK for assembly and to export the final product to the EU.”

The organization suggests that while large companies might have the financial resources and scale needed to absorb some of these increases in trade costs, “small and medium-sized enterprises integrated into these GVCs might be disproportionately adversely affected by the increase in trade costs and become no longer competitive.”

Mitigating disruption through digital manufacturing platforms

The UK is also facing the imposition of duties from across the pond in retaliation for a potential UK digital services tax on tech firms. Ceramics, games consoles, and furniture could all be hit by US tariffs if the UK Government decides to proceed with the tax, which it claims will help ensure tech firms pay their fair share. Given this, it’s becoming clear that heavy dependence on a single source for materials and parts is no longer sustainable, particularly if that source is overseas.

Paulsen believes distributed manufacturing platforms have the potential to mitigate such supply chain disruptions, as well as those arising because of a “downed freighter, tropical storm, or global pandemic” through self-healing networks.

“Additive manufacturing adds responsiveness into the mix, with the ability to tune parts in a matter of hours in some cases,” he says. “The more additive manufacturing is adopted for production parts, the greater the flexibility will be for manufacturing locally or through service networks.”

Paulsen sees the expansion of 3D printing for end-use parts across multiple industries, with mass customization and low-volume production having already been applied to consumer products, medical devices, and automotive parts. “NewSpace is an emerging industry that has embraced AM in its aerospace applications with some fantastic results,” he says. “I am very interested in defense, where there are active initiatives to evaluate and understand where and how additive manufacturing can enter their procurement cycle.”

As Paulsen points out, “defense procurement is often slower relative to the private sector,” with all involved eager to gain momentum in 3D printing and distributed manufacturing platforms. Paulsen identifies challenges for individual companies and potentially whole supply chains in transitioning to a digital manufacturing model, creating a robust inventory as one of the most significant obstacles currently facing manufacturers looking to respond to supply chain gaps.

“Buyers in companies often do not have sufficient technical data, including CAD, drawings, and other documentation, to replicate a product,” he explains. “An excellent technical data package can mean that re-sourcing an item is practically a drag-and-drop experience – in Xometry’s case, we mean that literally.”

The effect of a digital border tax on 3D printing

Ongoing conversations around how to treat digital goods are also gaining momentum, such as whether a digital border tax could slow down the adoption of 3D printing. The WTO’s moratorium on customs duties for electronic transmissions is still in place, with some countries valuing the moratorium as an instrument to facilitate online and offline trade. In contrast, others believe lifting it could help promote digital industries related to additive manufacturing.

The WTO refers to a couple of studies that have looked into the impact of revoking the moratorium, within which electronic transmission or digital trade is referred to as physical trade that can be replaced by electronically transmitted trade: “Simulations suggest that revoking the moratorium and imposing tariffs on electronic transmission (i.e., digital border tax) would lead to a drop in digitized trade that tends to be higher for developing and least-developed countries.”

Higher trade costs could, therefore, slow down the adoption of 3D printing. However, ultimately “it’s the size of the digital border tax and how responsive the industry is that would determine how the development and adoption of specific technology would evolve.”

However, the WTO points out that for some of its members, tariffs on electronic transmissions could be used as a trade policy to support infant domestic industry: “With a few exceptions, most developing countries are net importers of digitalized products. Some developing country WTO members believe that the moratorium is likely to make developing countries even more dependent on imports of digital products from developed countries.

“In their view, lifting the moratorium would provide them with the policy space to support domestic digital industrialization. There is, however, no consensus among WTO members on this issue.”

AM carving out a “major role” in end-use production parts

According to the World Economic Forum (WEF), essential factors to consider concerning cross-border transmissions of 3D printing CAD files include the classification of files as goods or services, rules of origin, and customs revenues. The rate and successful adoption of digital manufacturing processes by manufacturers will play an essential role in future conversations surrounding the moratorium and taxation of digital goods.

On-demand digital manufacturing provider Protolabs manufactured tens of millions of dollars worth of parts during the pandemic, the revenue from both previous customers and new clients relying on Protolabs’ digital manufacturing services for the first time.

“The Covid-19 pandemic greatly accelerated the adoption of digital manufacturing and the processes that drive it, as companies adapted to disrupted supply chains and a new level of urgency,” says David Giebenhain, Global Product Director for 3D Printing at Protolabs. “Fast forward to today; we are seeing many of these customers come back and use our services in ways they never have before.”

The company estimates that nearly 20 percent of its Covid customers are already on track to grow their revenue in 2021, with an expected average increase of 168 percent compared to last year. “We are early in the year, so we only expect that number of returning customers to grow,” adds Giebenhain.

The digitized services on offer from Protolabs include subtractive and additive processes, namely injection molding, CNC machining, sheet metal fabrication, and 3D printing. Giebenhain explains that while the company’s new customers may have turned to digital manufacturing out of necessity, they have since returned to increase their supply chain agility beyond the pandemic.

“With that, the path towards digital manufacturing was laid long before the pandemic,” he says. “Engineers and product designers today are under immense pressure to develop new, innovative products while also adapting to the macrotrend of mass customization. The evolving marketplace and events over the last year have underlined the need for a more agile supply chain that can respond to the demands of today, not six months ago.”

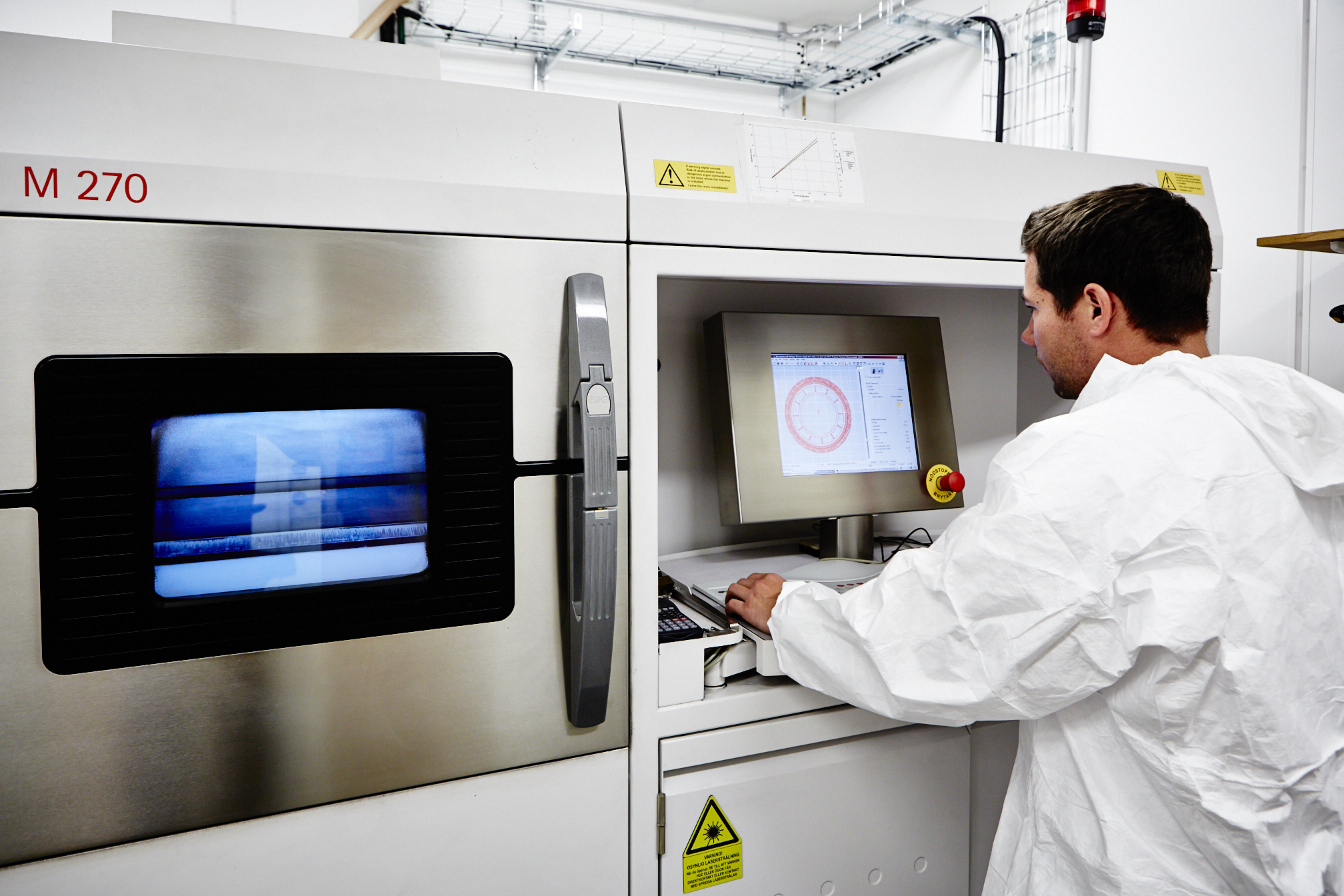

Protolabs recently unveiled a new digital e-commerce experience allowing for collaboration, increased transparency, and automated manufacturability feedback for all of its service offerings. Simultaneously, the purchase of online manufacturing platform 3D Hubs earlier this year has added a distributed supplier network expanding the firm’s pricing and lead time options. The company has also invested in expanding its 3D printing capabilities and now has over 200 3D printers offering six 3D printing technologies spanning metal, plastic, and elastomeric materials.

“We have long anticipated increased adoption of digital as the marketplace continues to demand innovation and increased customization,” says Giebenhain. “Our expanded offerings available in quick-turn fashion using our new e-commerce experience sets us up well to meet the increased demands for additive manufacturing.”

Looking beyond Protolabs, Giebenhain believes the additive manufacturing industry is “set up extremely well” to take advantage of opportunities for increased demand. “Additive manufacturing is carving out a major role in the world of end-use production parts thanks to advances in areas like metal 3D printing and technologies that print with production-grade plastics,” he explains. “Today, we are able to produce geometries using metal material fit for flight and thermoplastics suitable for surgery.”

Despite this, the transition from conventional supply chain models to digital manufacturing is hugely complex for manufacturers. Giebenhain acknowledges this, saying, “companies may not be ready to reinvent how they do business, especially when it comes to embracing new manufacturing partners in an online setting. There is a significant barrier that needs to be overcome, and I think that will remain the biggest challenge for our industry.”

What he has seen over the past year, though, is that companies that leaped towards digital manufacturing have no plans to go back to old, conventional ways of business as they enter a post-pandemic world. This trend highlights that there are real benefits to digital manufacturing once the “barriers of change” are overcome.

Supply chain management and creating value

While an increasing number of companies transitioning to 3D printing and digital manufacturing is undoubtedly encouraging, it is worth pointing out the technology does not make sense for all applications. According to Ward Ripmeester, Director of Global Supply Chain at 3D printing marketplace and service provider Shapeways, supply chain management is “all about creating value for customers,” There are some applications for which 3D printing does just that.

Additive manufacturing is “ideally suited” to the creation of personalized joint braces due to the high level of customization required and for addressing “slow-moving inventory items or end-of-life products with low turnover rates,” Ripmeester offers. “Once inventory holding costs start exceeding on-demand manufacturing costs, 3D printing becomes a highly viable and economical manufacturing option.”

He believes 3D printing lends itself well to a distributed manufacturing model, capable of increasing speed-to-market and alleviating local capacity constraints such as PPE shortages, which Shapeways was able to address through its supply chain ecosystem.

However, “additive manufacturing is hard with a high barrier to entry, especially for companies that have been slow to adopt digital manufacturing,” he acknowledges. “Shapeways is simplifying the complexities by helping enterprises worldwide make the shift to digital manufacturing, accomplished through our purpose-built software, automated workflows, and production capabilities.”

To date, the company has produced more than 20 million parts for a diverse range of applications, including obscure products such as 3D printed beehives, off-road device mounts, and beer monitoring devices.

“The additive manufacturing industry is making progress in playing a bigger role in global supply chains, and the ability to deliver world-class, flexible, on-demand 3D printing will propel the industry forward,” says Ripmeester.

The WTO has also identified “various megatrends” that will accelerate the adoption of advanced manufacturing technologies, reasoning, “the benefits of new advanced manufacturing technologies will be higher productivity, increased resilience during shocks and a better ability to customize products, among others.”

Increased use of robots may lead to lower demand for labor, especially within medium-skilled manufacturing. To address this, “the adoption of complementary policies, in particular labor market adjustment policies, will likely be needed to address equity concerns and provide workers in the manufacturing sector with the tools and skills needed to adapt to new market labor conditions.”

“AM offers benefits beyond creating more resilient supply chains.”

The latest State of 3D Printing report from Colorado-based additive manufacturing consultancy firm Wohlers Associates identified a seven percent increase in business by 3D printing service providers during 2020. The expansion, which represents nearly $5.3 billion in revenue, reportedly helped to fuel industry-wide growth during the period.

Noah Mostow, a Research Associate at Wohlers Associates, says that while the consultancy does not know the exact breakdown of orders from service providers related to the pandemic, “some service providers did report growth directly from their response to Covid-19.”

He adds, “the past year has shown how 3D printing can help create a more resilient supply chain for organizations. Growth of additive manufacturing as a way of strengthening supply chains will continue well beyond the pandemic.”

Mostow points out that global supply chains are susceptible to pandemics and other factors such as breakdowns in transportation, like the blocking of the Suez Canal by the Ever Given. “Note also that additive manufacturing technology offers many benefits beyond helping to create a more resilient supply chain,” he offers.

According to Mostow, the aerospace and medical device industries are “among the best suited for increased adoption of additive manufacturing” in their supply chains, while other industrial sectors positioned to increase adoption include dentistry, power and energy, and some consumer products, “such as footwear and eyewear.”

In his view, 3D printing will support these supply chains and become a significant part, depending on the products in question.

“We are seeing global adoption from corporations that see additive manufacturing as a way to strengthen and simplify supply chains,” he says. “Machines are becoming faster, and new materials are being released. The workforce continues to discover how to optimize for AM, such as learning methods of design for additive manufacturing.”

3D printing as a tool to bolster supply chain resilience

In light of global events from the past year, it has become abundantly clear that heavy dependence on a single source for materials and parts is no longer sustainable for modern supply chains, highlighting their fragility and the apparent lack of a plan from many companies to deal with the disruption once it arose.

Covid-19 may well have provided a catalyst for greater adoption of 3D printing in many industrial supply chains, with companies turning to the technology out of necessity and realizing its potential benefits could extend way beyond the pandemic. The flexibility and simplification of digital manufacturing and distributed manufacturing platforms has also been showcased for a wide variety of applications, prompting firms to consider how else they can deploy the technology to leverage cost and lead-time savings.

As additive manufacturing machines, materials and software continue to improve and become applicable to a wider variety of end-use parts, there is an opportunity for greater adoption of 3D printing by various levels of the supply chain to increase substantially in a post-pandemic, post-Brexit world.

Subscribe to the 3D Printing Industry newsletter for the latest news in additive manufacturing. You can also stay connected by following us on Twitter and liking us on Facebook.

Looking for a career in additive manufacturing? Visit 3D Printing Jobs for a selection of roles in the industry.

Featured image shows Protolabs 3D printing facility in Morrisville, North Carolina. Photo via Protolabs.