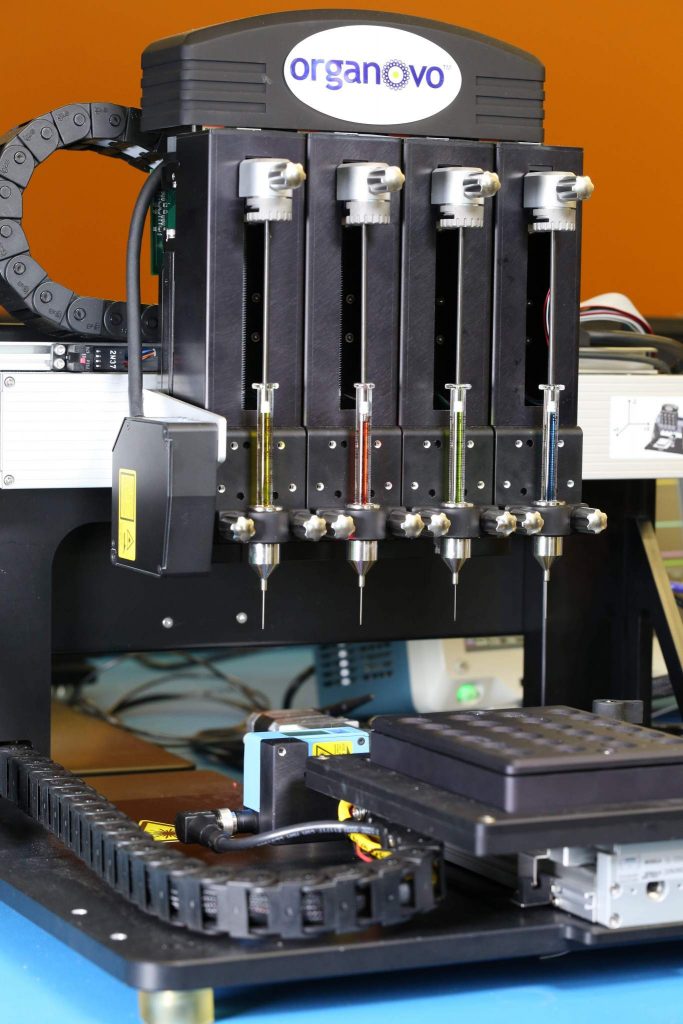

Organovo (NASDAQ:ONVO) shares fell in response to a financing update yesterday: the company received a 15% hit to its stock price during NASDAQ trading. The California based 3D bioprinting company took a blow to their 3D printed kidneys after the market reacted unfavourably to news the company is seeking further investment.

According to documents filed with the Securities and Exchange Commission (SEC) Organovo plan to bring in more money via a public offering of ordinary shares.

Plans to raise $25 million

Organovo expect to raise approximately $25 million through the sale of 9 million shares at $2.75 per share. On Wednesday this week, prior to the end of day announcement, stock was trading at $3.50. When markets opened yesterday the price dropped to $2.85, a $0.65 decrease. In later trading Organovo recovered slightly to reach a close of $2.96.

Brokers Jefferies LLC and Evercore Group LLC are handling the stock sale as joint book-running managers. Potential investors are invited to request a prospectus from either of these New York based firms.

Organovo will face questions from investors when it hosts an investment call to discuss Q2 earning early in November. The company were scheduled to make a preliminary earnings release earlier this month on October 11th according information from online finance resource, Daily Finance.

Long term Organovo investors must be experiencing something akin to a roller coaster ride. Since the company first went public in 2012 the share price has seen highs of $12.50 and lows of $1.56. Speculators have heralded the company as the next Apple and phrases such as, “the buying opportunities of a lifetime” pepper investment analyst overviews.

Spectacular rewards from biotech investment

However, biotech is a sector where historically only a small number of promising start-ups ever succeed in making good on early promise. But for those few who manage to overcome technical and regulatory hurdles and commercialise their IP, the rewards can be spectacular.

Organovo’s 3D printed liver and kidney assay products have received a warm reception from the target market: pharmaceutical companies looking to minimize risk when bringing new drugs to market. The company also has a revenue stream in its 3D printed skin product, with one customer, the cosmetics firm L’Oreal stating this product will reduce the need for animal testing.

Such noble ambitions take both time and money, and for investors focused on short term performance these may appear to be running out. However, for those more interested in the application of the science behind 3D bioprinting or regenerative medicine then share price is far from a useful indicator.