British engineering firm and metal 3D printer manufacturer Renishaw has released its Interim financial results for the six months ended December 31st, 2019. Revenue for this period stood at £259.4 million, a 13% decrease from the £296.7 million reported for the corresponding period last year.

Reductions were apparent in all regions, with the most significant being APAC which saw a 20% decrease. This was attributed to a challenging trading period from the global macroeconomic environment, caused by US and China trade tensions and weaker demand in the machine tool sector. Profit before tax was also reported at £14.3 million compared to £59.6 million in the prior year.

In an investor call, Will Lee, CEO of Renishaw, stated, “If we look to start with the segmentation, the metrology area [saw] 13% overall reduction. Really, the big driver [is] the subdued markets that we’re seeing for our industrial metrology products. ”

“In comparison to the first half of 2019, we had a number of orders from consumer electronics contract manufacturers over in APAC, we have not seen those in this year.”

| Region | 2020 £m |

2019 £m |

Change % |

Change after constant exchange rate % |

| Total revenue | 259.4 | 296.7 | -13 | -14 |

| APAC | 106.8 | 131.2 | -19 | -20 |

| EMEA | 89 | 100.1 | -11 | -12 |

| Americas | 63.6 | 65.4 | -3 | -9 |

Renishaw revenue by segmentation

Renishaw’s revenue for this period has been separated into two categories, metrology and healthcare products. Metrology includes machine tool probes, co-ordinate measuring machines (CMM) probes, the Equator gauging system, as well as other aids used for high-accuracy parts. Revenue from this segment stood at £241.5 million, a 13% decline from £277.7 million last year.

Lee added, “What we are starting to see is the beginning of an upturn from the semiconductor market. We saw that first for the demand for our laser encoder, which tends to be used in equipment at earlier stages in the semiconductor manufacturing processes. And more recently, the beginnings of an upturn for our optical encoder, which tends to be used in equipment used later on in the semiconductor manufacturing process.”

Revenue from the healthcare segment also declined from £19 million last year to £17.8 million. Nonetheless, Lee notes a growth in the company’s neurological product line due to increased demand for its neurosurgical robot. An adjusted operating loss of £1.5 million was also recorded in this sector, whereas the corresponding previous period saw a break-even point. Metrology operating profit stood at £17.4 million, compared with £52.2 million last year.

| Revenue Segment | 2020 £m |

2019 £m |

Change % |

| Metrology | 241.5 | 277.7 | -13 |

| Healthcare | 17.8 | 19 | -7 |

Streamlining operations

Regarding the company’s laser powder bed fusion systems, Lee stated that “We see relative stability for 3D printing at the moment. I think the bit that’s really important for me here is this question and assumption that for us, our traditional businesses are ones that have huge potential too. There are wonderful opportunities for both of those areas of the business, the traditional probing and also the additive manufacturing.”

The 500Q machine, in particular, was highlighted due to its developments in terms of part quality and process stability. Lee continued, “Additive manufacturing [is] a long-term investment for us. This is something that takes time, which we have the patience to develop. We’re very pleased with the development of the technology that we are doing, the parts that we are making, and that is now coming through roughly in line with our expectations.”

Furthermore, according to Allen Roberts, Group Finance Director, Renishaw, the company has reduced the production cost base where necessary, however, “the profit effect of these reductions will be more pronounced in the second half.” The 76% decrease in profits was attributed to Renishaw’s relatively high fixed costs and high margins. Lee went on to say that the company is “very much looking at the productivity of the group and looking at our cost base.”

“In combination with looking better at prioritization and making sure we are focusing the excellent resources that we do have on projects that we think are going to make a real difference to the mid- to long-term profitability. We have, due to reduced demand, have a lower number of direct manufacturing staff now at our manufacturing facilities.”

Moreover, Renishaw ended this period with unaudited cash and cash equivalents of £71,307, while the year prior stood at £100,504.

Renishaw’s Interim Report 2020 can be accessed here. The full 2020 Annual report will be released this August.

Keep up to date with industry-relevant financial reports this season by subscribing to the 3D Printing Industry newsletter, following us on Twitter and liking us on Facebook.

Seeking jobs in engineering? Make your profile on 3D Printing Jobs, or advertise to find experts in your area.

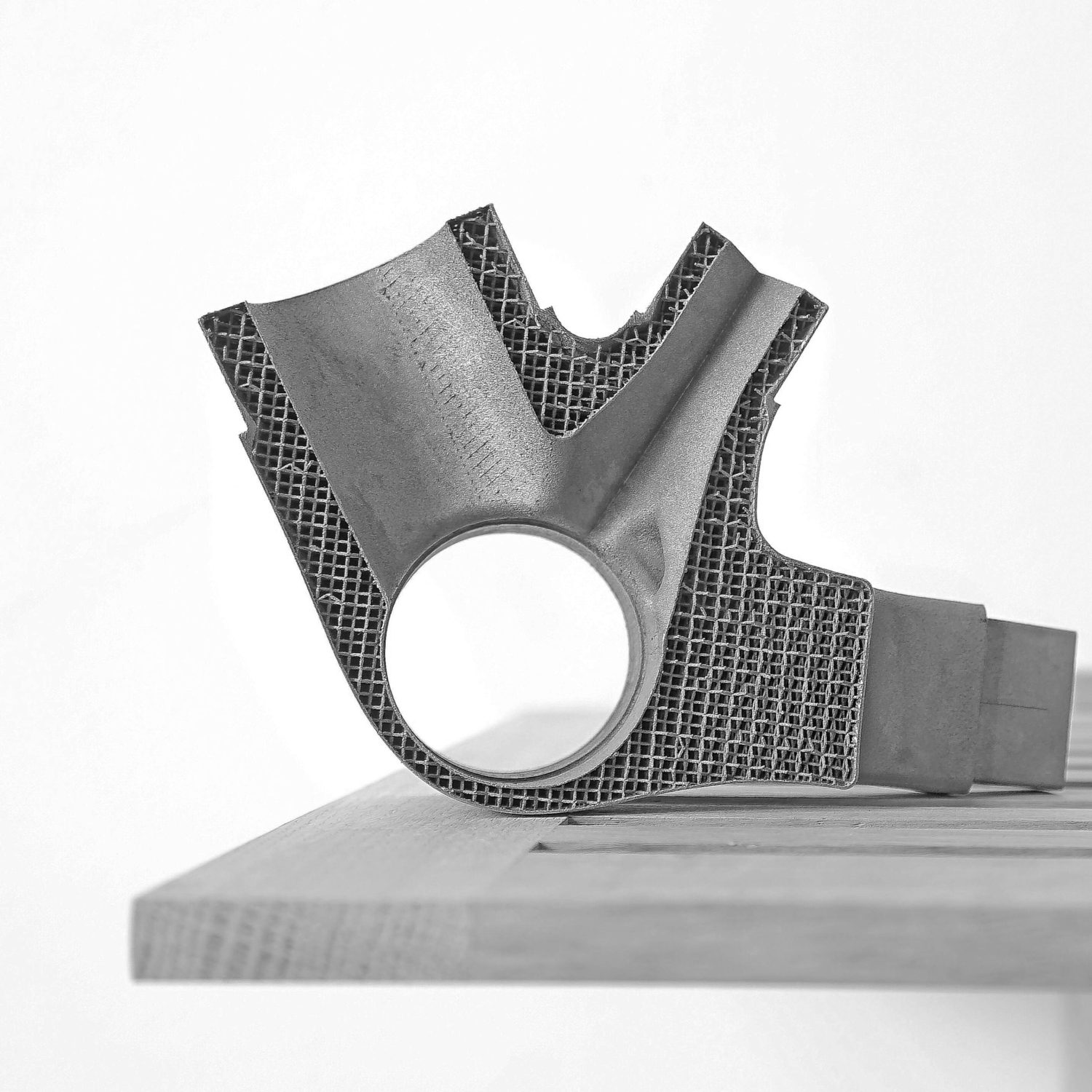

Featured image shows a Renishaw branded metal 3D printed part. Photo via Aeromet/Monty Rakusen.