The formnext powered by TCT 2017 conference has established a new benchmark for the broader 3D printing industry, with 470 exhibitors occupying nearly double the floor space compared to 2016, and more than 20,000 people in attendance throughout the week.

Numerous announcements for new systems, partnerships, and materials were on display to attract visitors. The event illustrated just how much a technology landscape can change within a short time frame.

Highlighted below are four trends across the additive manufacturing value chain that stood out at this year’s event with their relative impact on the industry’s outlook.

Metal 3D printing for fused filament fabrication (FFF) is no longer a novel concept.

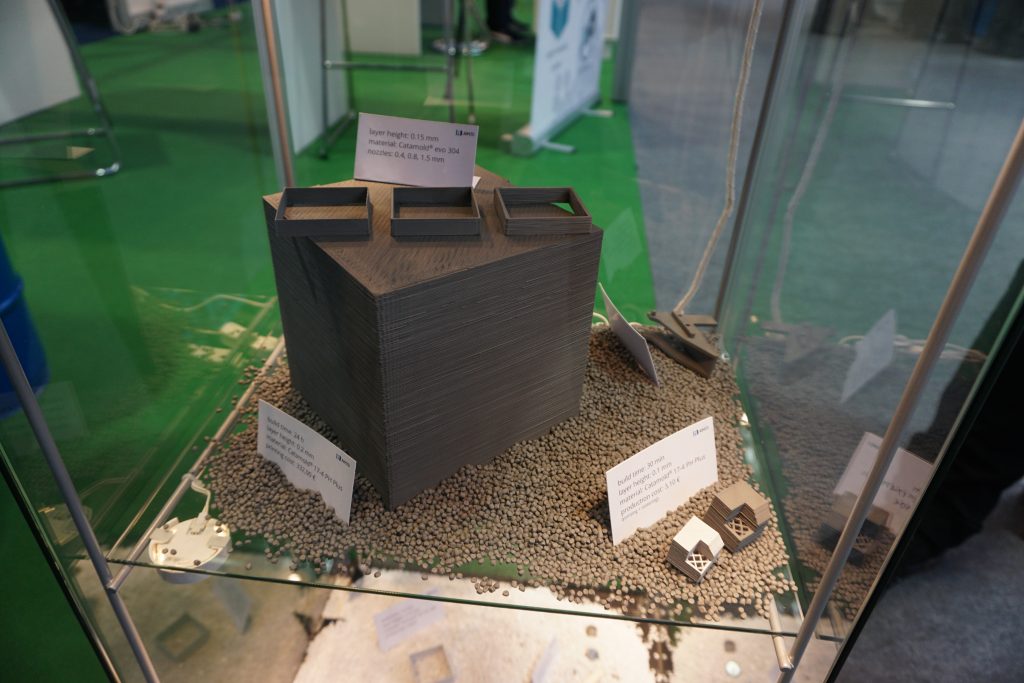

In addition to Markforged and Desktop Metal that offer their own metal FFF solutions, BASF offers a flexible stainless steel filament called Ultrafuse based on its Catamold metal injection molding (MIM) technology and has made it available for all open FFF systems.

Apium Additive Technologies and Gewo3D are among the companies that have tested the filament with success, while Aim3D has gone a step further and demonstrated parts printed with standard MIM pellets of the same 316L stainless steel composition

High Importance: Metal 3D printing technologies are the fastest growing market segment and carry high premiums for end users looking to make metal prototypes and production parts.

Given the extensive install base for FFF systems, metal injection molding-based filaments extend the technology to address functional prototypes and some production parts not possible due to stringent strength requirements, but efficient post-processing wash and sinter steps, dimensional tolerance variation, and porosity challenges remain.

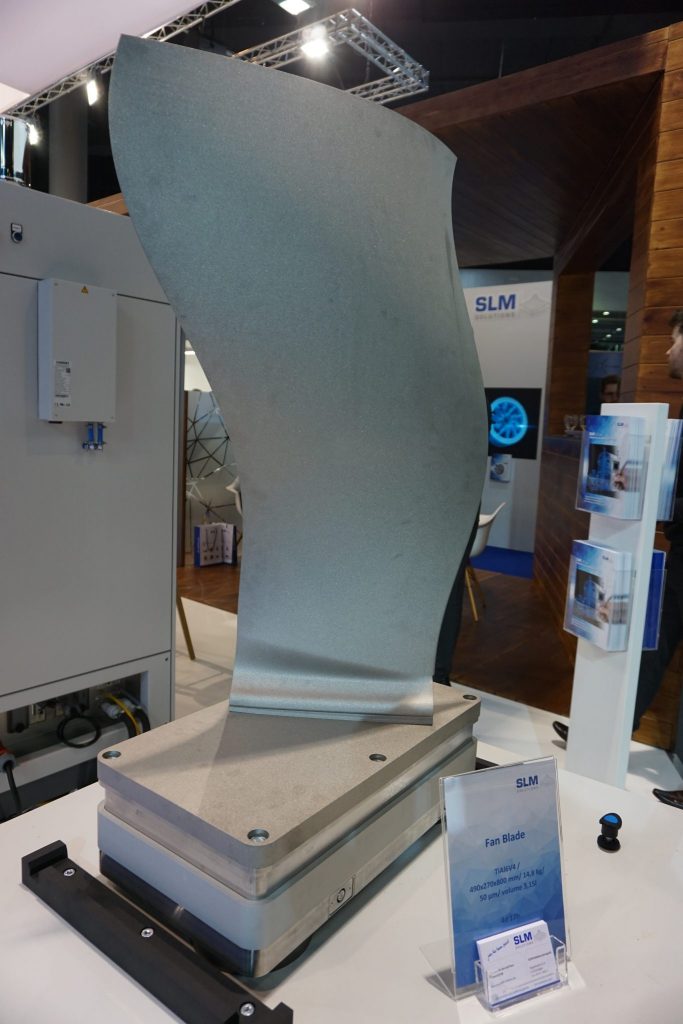

Industrial direct metal laser sintering 3D printers are growing in build volume in an effort to support larger part applications, with a focus on production parts.

Announcements from GE/Concept Laser (ATLAS), SLM Solutions (SLM 800), Adira (Addcreator), and Renishaw (RenAM 500Q), along with Xi’an Bright Laser Technologies’ 1.5 meter metal demonstration parts were all on display at Formnext.

Medium Importance: Increased build volume broadens applicability for functional prototyping of larger parts, and supports near term molds and tooling applications that until recently were too large for existing powder bed systems. Despite addressing a large-part market segment, productivity remains limited with deposition rates below 200 cm3/hr in ideal conditions and does not satisfy the step change required for production applications outside high margin industries such as aerospace and defense, medical and dental, and motorsports.

Selective laser sintering (SLS) and high speed sintering (HSS) 3D printers gain additional entrants while current manufacturers push productivity limits.

Voxeljet shows VX200 HSS 3D printer for prototyping applications, diverging from the HSS technology’s positioning towards production parts.

HP launches Jet Fusion 3D 4210 Printing Solution update, which claims break-even economics for plastic parts less than 110,000 units using HSS technology.

EOS P 500 SLS 3D printer launches to compete for production part applications using two lasers and productivity claims in excess of any other SLS or HSS system available.

Ricoh AM S5500P SLS 3D printer was announced in 2015, and launched the following year. The 3D printer has a completely open materials platform and a sizeable build volume compared to other systems noted here.

High Importance: SLS and HSS are now direct competitors for production applications, with similar deposition rates and a potential for better materials thanks to HP’s continued progress with its materials development kit. While the hardware limitations in the existing SLS install base will remain, creating a new materials ecosystem combined with a competitive 3D printer landscape may begin to fulfill the promise for quality parts at production scale that Jabil and other contract manufacturers require.

Recent acquisitions help complete product and service offerings for large additive players:

ANSYS acquired 3DSIM, an additive manufacturing simulation technology company that helps users simulate designed-for-additive parts as well as process parameter optimization

GE Additive acquired GeonX, a part simulation technology company that spans additive manufacturing, welding, machining, and heat treatment processes with a focus on parts for aerospace, energy, and automotive applications.

Materialise and Simufact announce OEM licensing partnership for Simufact’s metal additive manufacturing process simulation software within Materialise’s Magics software.

Low Importance: Companies like GE, Materialise, 3D Systems, and Stratasys are always looking to expand their offerings through acquisition, especially with respect to shoring up software competency alongside more established hardware and materials offerings.

Incorporating additive manufacturing part modeling as well as process simulation software into a broader additive solution offering is a necessary step to stay competitive as design software companies become more additive-friendly.

Specifically, software providers such as Dassault Systèmes, Autodesk, and Siemens are adding support for additive manufacturing design and manufacturing feature sets to their existing offerings. Ultimately, these recent moves are a continued sign that simulation for additive purposes will become a routine part of design workflows, and a necessary step in going from CAD file to part in progressively fewer iterations.

As exciting as formnext looks from the show floor and the announcement list, the step change many in the additive community are looking for has not yet arrived.

However, the pace of materials, printers, software, and new printing technology development will continue to accelerate and test today’s economic edge cases for tomorrow’s design and manufacturing needs.

Let us know your thoughts about this article in the comments below.

If you’d like to submit your own report for 3D Printing Industry then get in touch.

You can also subscribe to our free 3D Printing Industry newsletter, follow us on Twitter, and like us on Facebook.

Featured image shows a view from the GE Additive booth at formnext 2017. Photo by Michael Petch.