Wohlers Associates, the Colorado-based additive manufacturing consultancy firm operating under ASTM International, has released its Wohlers Report 2024.

The annual report highlights the key 3D printing trends and forecasts and has now reached its 29th consecutive year of publishing.

This year’s edition outlines that the additive manufacturing industry has grown by 11.1% to an estimated valuation of $20.035 billion, exceeding the $20 billion mark for the first time in the industry’s history. Interestingly, this figure is significantly higher than that reported by fellow market intelligence firm AMPOWER, which touted a 3D printing market valuation of €10 million for 2023.

Terry Wohlers, head of Advisory Services and Market Intelligence at ASTM International and the report’s principal author, told 3D Printing Industry that the true additive manufacturing market size is actually “much larger than what we report.”

According to Wohlers, the global market estimate excludes capital spent on additive manufacturing within organizations, such as Adidas, NASA, and Stryker. The value of research, development, prototyping and tooling within these companies is also omitted, along with that of parts 3D printed by original equipment manufacturers.

“The value they are producing with AM adds up to a significant amount, but it is impossible to quantify,” explained Wohlers.

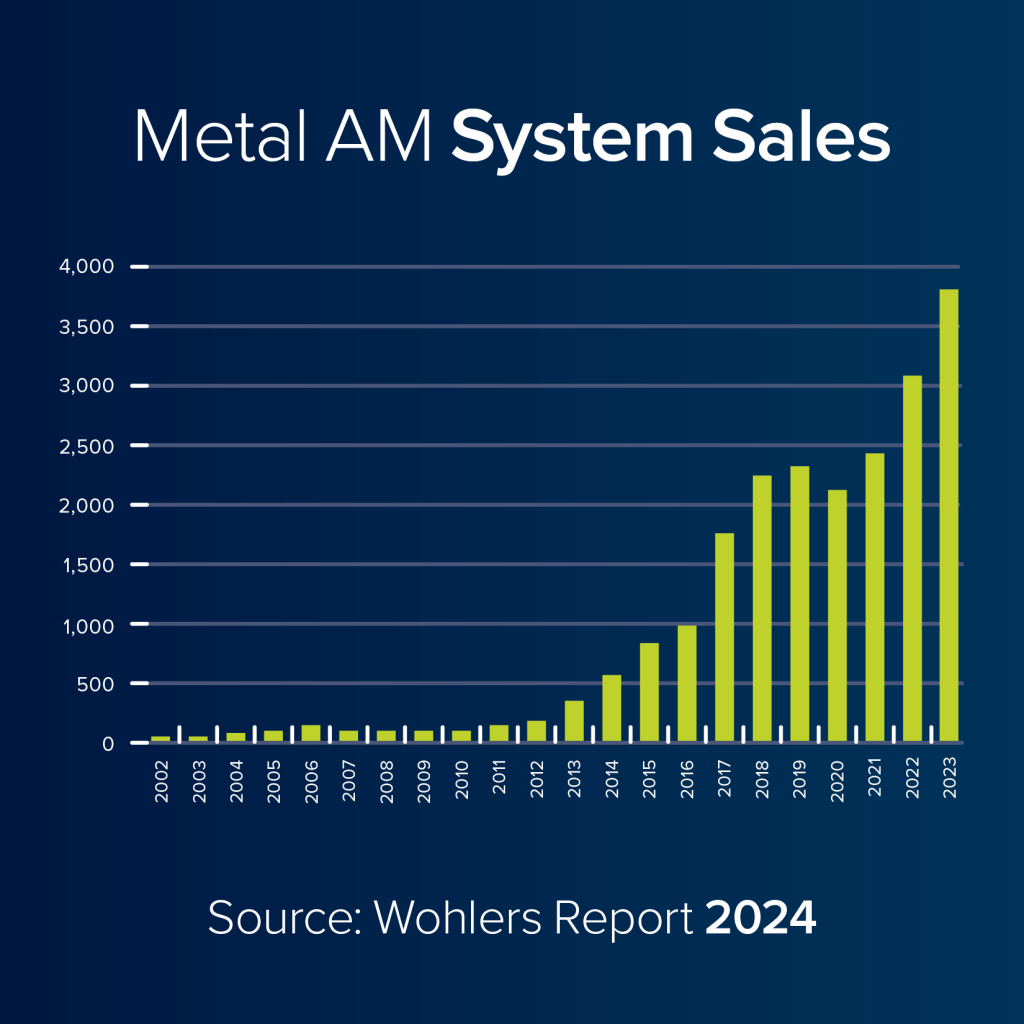

Additionally, shipments of metal 3D printers reportedly grew by 24.4% in 2023. Having tracked this particular market segment for the past 21 years, Wohlers Associates estimates that 3,793 metal 3D printers were sold in 2023, up from 3,049 in 2022.

Looking to the future, Wohlers expects a shift in 3D printing to high-volume production of end-use parts. Driven by improvements to 3D printers and post-processing, the report predicts that production will move from thousands of parts to hundreds of thousands, with million-part production runs anticipated for small components.

2024 Wohlers Report highlights the current state of 3D printing

The 2024 Wohlers report was produced using information and data provided by 245 3D printing organizations, including service providers, contract manufacturers, system manufacturers, and material producers. Over 110 people, including 100 3D printing experts from 35 countries, contributed to the report.

According to Wohlers, the firm’s refined methodology allows it to stand out within the additive manufacturing market intelligence space. “We have developed and refined a methodology over the 29 years of producing the report. The history of AM growth is well documented in our reports,” stated Wohlers. “No other company has this history or foundation upon which we built this know-how over the years.”

The 2024 report predicts that the 3D printing industry will witness an increased demand for end-use parts and the emergence of new applications. This is set to be driven by the increased speed of 3D printers, which will lower cost-per-part. Competitive pressures are also expected to translate to a reduction in material pricing, further lowering manufacturing costs.

Additionally, the impact of new materials and their qualification will have a significant impact on the aerospace, defense, healthcare, and energy sectors. It is noted that the certification of new designs, and the development of industry standards, will drive further growth within the global 3D printing market.

AM trends and the future of 3D printing

The 2024 Wohlers report is not the only resource offering key insights on the current and future state of 3D printing trends. Earlier this year, 3D printing experts shared their insights on 3D printing trends and the future of 3D printing as part of the 2024 3D Printing Industry Executive Survey.

The key industry trends that were highlighted included increased adoption of 3D printing throughout various sectors and new markets, the growing role of additive manufacturing to overcome supply chain challenges, and growing use for the production of consumer goods.

Additionally, most of those surveyed offered a positive 3D printing economic outlook for 2024. Notably, 62% of respondents held a positive view of external conditions, while 68% shared a belief that internal business conditions are favorable or very favorable.

Elsewhere, a report from market intelligence firm CONTEXT highlighted the stagnation of industrial 3D printer shipments in the second half of 2023. According to the report, Q3 2023 saw global shipments of industrial polymer 3D printers fall by 17% YoY, while metal 3D printer shipments declined by 3%.

These falling shipment figures reflect a shifting focus away from market growth towards profitability, amid failed merger and acquisition activity from the likes of Stratasys, 3D Systems, Desktop Metal, and Nano Dimension, and increased layoffs.

On the other hand, entry-level 3D printers continue to be the fastest-growing segment within the 3D printing industry, cannibalizing the sales of more professional systems. Moreover, based on rolling five-year global shipping rates, there are currently 8.1 million FDM 3D printers on the market.

What does the future of 3D printing hold?

What near-term 3D printing trends have been highlighted by industry experts?

Subscribe to the 3D Printing Industry newsletter to keep up to date with the latest 3D printing news.

You can also follow us on Twitter, like our Facebook page, and subscribe to the 3D Printing Industry Youtube channel to access more exclusive content.

Are you interested in working in the additive manufacturing industry? Visit 3D Printing Jobs to view a selection of available roles and kickstart your career.

Featured image shows Wohlers Report 2024 data which highlights increasing metal 3D printer sales. Image via Wohlers Associates.