A new report from market intelligence firm CONTEXT has highlighted a decline in shipments of Industrial, Midrange, and Professional 3D printers in Q4 2023.

However, Entry-Level systems continued to perform well, cannibalizing the sales of certain more expensive offerings. Nearly one million Entry-Level 3D printers were shipped worldwide in Q4 2023, representing a new quarterly record.

Global Industrial 3D printer shipments fell by 13% YoY, while Midrange and Professional models were down by 7% and 32%, respectively. Context attributes this sluggishness to high-interest rates, which have led companies to delay investments into new capital equipment. Those impacted by “sticky” inflation are also adopting cheaper hardware alternatives.

Professional users are recognizing that 3D printers in the sub-$2500 price range now offer the features and functionality of more costly models. As such, shipments of Entry-Level 3D printers achieved 35% growth YoY in Q4. Bambu Lab, a market leader in this space, saw its shipments increase by 3000% in 2023.

Despite the sluggish performance of non-Entry-Level 3D printers, Chris Connery, global head of analysis at CONTEXT, remains optimistic about the state of the economy and the potential offered by pent-up demand.

“In spite of inconsistent regional economic growth and recovery, many aspects of key economies around the globe remain positive”, he stated. “We’re seeing strong GDP growth projections for China and stronger than expected GDP growth and high stock market levels in the US for example. All indications are that demand has simply shifted out.”

Industrial 3D printers face falling shipments

Industrial 3D printers costing more than $100,000 accounted for just over 50% of all global systems’ revenues in 2023. However, global shipments of these 3D printers dropped by 13% compared to Q4 2022. This decline was largely driven by a 25% drop in the sale of industrial polymer 3D printers.

CONTEXT reports that polymer vat photopolymerization 3D printers showed particular weakness, with shipments falling by 39% YoY. Chinese firm UnionTech and US-based 3D Systems, the two leading companies in this space, experienced declining sales for these 3D printers.

Operating out of Shanghai, UnionTech boasts a 49% market share in the Industrial Polymer category. Primarily selling to mainland China, the company is experiencing an uneven recovery from the country’s nationwide Covid lockdowns that occurred in the first half of 2022. Consequently, 3D printer shipments have fluctuated unevenly from quarter to quarter.

3D Systems is facing continued challenges associated with weak demand from the dentistry sector, which is a key end-market for its vat photopolymerization technology. This poor demand is associated with economic pressures, which have limited consumer spending on cosmetic dental procedures.

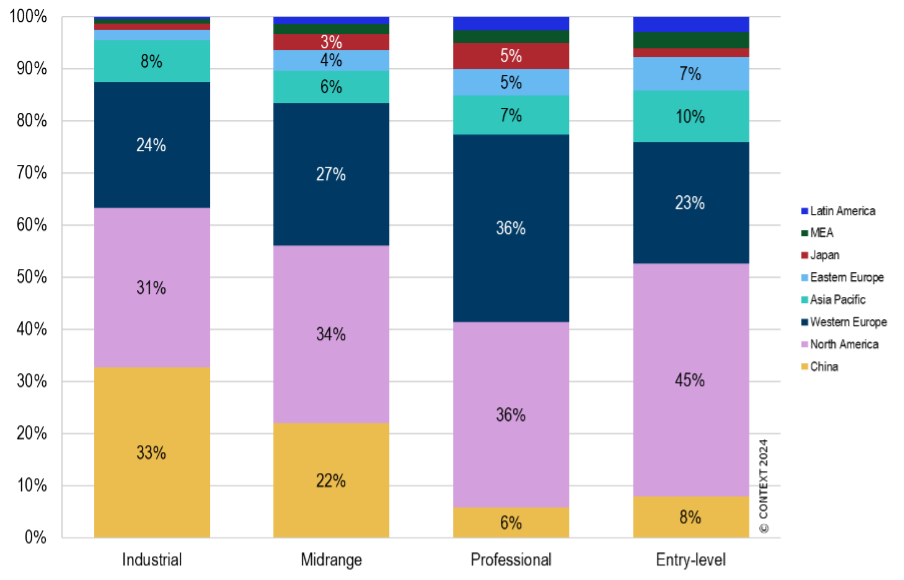

Despite an overall decline in the Industrial category, shipments of Industrial metal 3D printers increased by 4% YoY. This was driven by increasing sales of directed energy deposition (DED) 3D printers around the world, and the growing powder bed fusion (PBF) market in China. The country remains the top market in the world for the Industrial price class. 33% of the Industrial 3D printers shipped in Q4 2023 went into domestic China.

When considering 2023 as a whole, the Industrial 3D printer market was significantly impacted by high-interest rates and reductions in capital expenditure. Consequently, FY 2023 Industrial 3D printer shipments fell by 9% when compared to 2022.

China dominating the metal 3D printer market

PBF 3D printers dominated the metal additive manufacturing market in Q4 2023, making up 72% of all metal 3D printers shipped throughout the quarter. DED technology also performed well, growing by 30% in Q4.

Although PBF system shipments were down in North America and Europe, they grew 25% YoY in China. Most of these metal 3D printers were shipped domestically.

The four companies that shipped the most PBF 3D printers in Q4 2023 were Chinese, Xi’an Bright Laser Technologies (BLT), Farsoon, Eplus3D, and HBD. What’s more, 52% of all PBF 3D printers being shipped around the world come from Chinese vendors. Western manufacturers of PBF systems saw shipments of their units fall by 20%.

It is not just the PBF space that is being dominated by Chinese firms. In Q4 2023, 43% of all global industrial metal 3D printer shipments went into China. Most of this demand is being met by domestic companies.

CONTEXT’s figures for all of 2023 indicate that shipments of Industrial Metal 3D printers decreased by 3%, with fewer PBF units shipped than in 2022. However, shipments of DED and binder jetting systems grew by 15% and 2%, respectively.

Mixed results for Midrange and Professional 3D printers

Although shipments of Midrange 3D printers costing between $20-100K grew 16% sequentially in Q4 2023, they fell 7% YoY. CONTEXT calls the performance of this category “a bit of a mixed bag,” with some firms faring better than others.

Chinese 3D printing company Flashforge performed well in Q4 2023, witnessing increased demand for its WaxJet 3D printer. Similarly, high-speed polymer 3D printer manufacturer Nexa3D benefitted from its acquisition of Taiwan-based firm XYZprinting’s SLS 3D printing business.

Throughout 2023 as a whole, Formlabs and UnionTech were leaders in the Midrange space, posting growth figures of 88% and 123%, respectively.

The segment as a whole, however, only saw 2% growth YoY. Industry stalwarts Stratasys, Markforged and 3D Systems all experienced a double-digit percentage drop in their shipments of Midrange 3D printers.

The market for Professional 3D printers, in the $2.5-$20K price range, saw shipments decline YoY for the ninth consecutive quarter in Q4. For the entire year, shipments fell by 33%. Every Professional 3D printer manufacturer in the global top ten, except Nexa3D, shipped fewer units in 2023 than in 2022.

Those within the professional space are beginning to recognize that entry-level 3D printers, previously viewed as being for consumers, now include features that rival more expensive systems. Inflation has also altered the purchasing habits of customers, who have turned to more affordable options in the Entry-Level market.

Key operators in the Professional space, such as UltiMaker, Formlabs and Raise3D, are working to expand their product portfolios to combat these market trends.

Entry-Level 3D printers dominate industry sales

Q4 2023 saw a new record high for the number of Entry-Level 3D printers shipped in a single quarter, with a figure of 993,000. Creality impressed with 38% growth YoY in Q4 2023. However, fellow Shenzhen-based desktop 3D printer manufacturer Bambu Lab stood out with a staggering 3000% YoY growth in shipments.

This substantial figure is testament to the impressive rise the company has experienced over the past year. CONTEXT previously reported that the firm has taken “the personal 3D printer market by storm.”

The significance of Creality and Bambu’s performance is exemplified by the fact that, once they are excluded from the Q4 2023 data, shipment growth in this price class falls from 35% to just 2%. Indeed, some Entry-Level 3D printer manufacturers have not fared well in Q4. Toybox, for instance, has experienced a 51% decline in unit shipments.

For the full year, Entry-Level shipments rose by 19% YoY, with global inflation expanding the market base for these more affordable 3D printers. Chinese vendors are dominating this market, producing 94% of the Entry-Level 3D printers shipped in 2023, up from 88% in 2019.

A conservative financial outlook for 2024?

According to Connery, many forecasts for 2024 remain conservative. However, he does point to industrial players who have identified strong signs of pent-up demand.

US companies have reported strong demand from defense customers, following investment from the federal government. GE Additive, part of the newly independent company GE Aerospace, is expected to allocate a substantial portion of its $650M 2024 spending to 3D printing. 2024 will also see UnionTech expand its product portfolio, following its recent expansion from polymers to metals.

CONTEXT expects total worldwide shipments of 3D printers in all classes to achieve single-digit growth in 2024. This is forecast to increase to double-digit percentage growth by 2025. Connely hopes “that the pent-up demand seen on the horizon can be pulled-into 2024.”

Want to help select the winners of the 2024 3D Printing Industry Awards? Join the Expert Committee today.

What does the future of 3D printing hold?

What near-term 3D printing trends have been highlighted by industry experts?

Subscribe to the 3D Printing Industry newsletter to keep up to date with the latest 3D printing news.

You can also follow us on Twitter, like our Facebook page, and subscribe to the 3D Printing Industry Youtube channel to access more exclusive content.

Featured image shows Bambu Lab’s X1E 3D printer. Image via Bambu Lab.