While prophecies of doom and gloom are reliable staples for headlines and social media, the economic reality for insiders appears somewhat different, according to a new survey of the 3D printing industry.

Our 2024 3D Printing Industry Executive Survey shows that most 3D printing leaders expect a positive 2024 regarding both the internal and external business environments for additive manufacturing.

Our annual survey of executives and leaders in the additive manufacturing sector asked for economic expectations of the forces shaping the 3D printing industry. C-level executives, founders, presidents, executive directors, owners, analysts, and investors all responded.

We asked these leaders for their perspectives on both general business conditions, the macro-economic factors, and broad trade winds beyond the company’s direct influence, and their view on internal operating conditions. The latter been circumstances within the executives’ control.

Broadly speaking, the results were positive, notably 62% hold a positive view of external conditions, and 68% believe internal business conditions are favorable or very favorable.

This article kicks off our annual series of insights into the industry, and we look forward to always enlightening conversations on social media.

2024 Business Conditions in the 3D Printing Industry

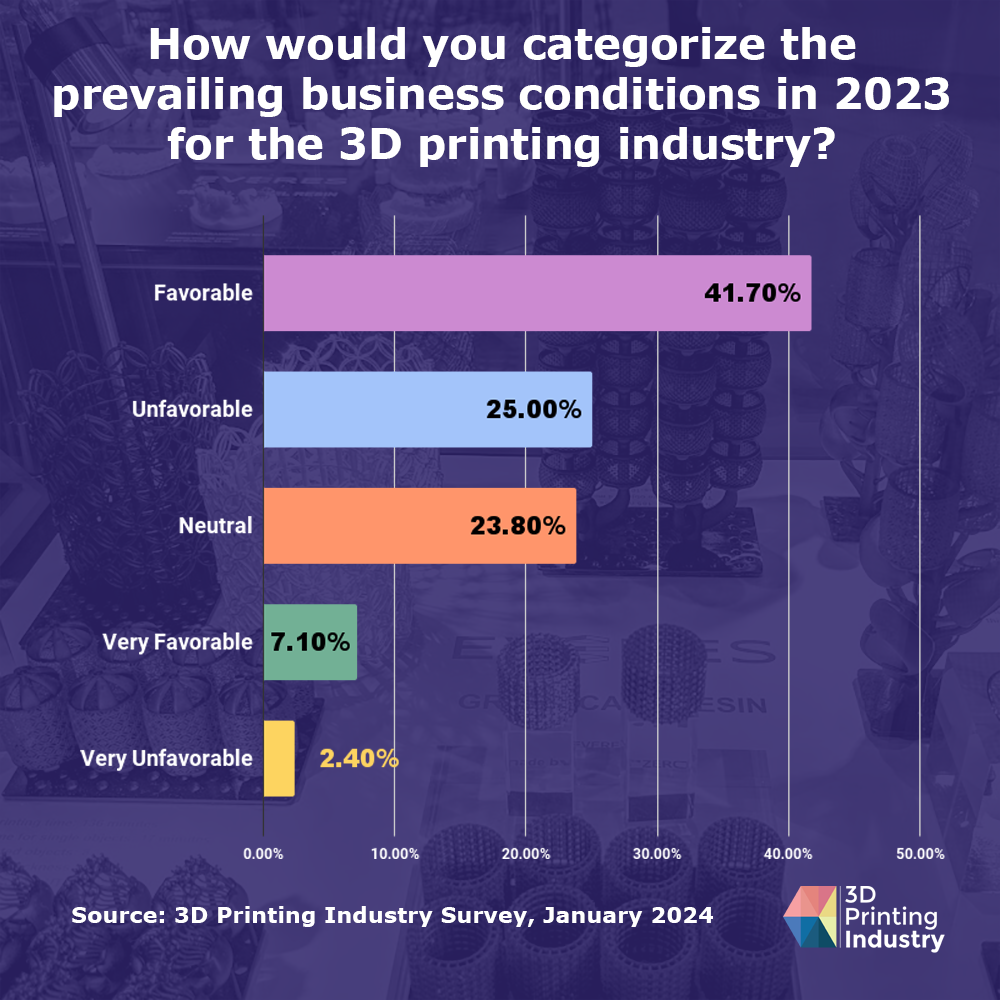

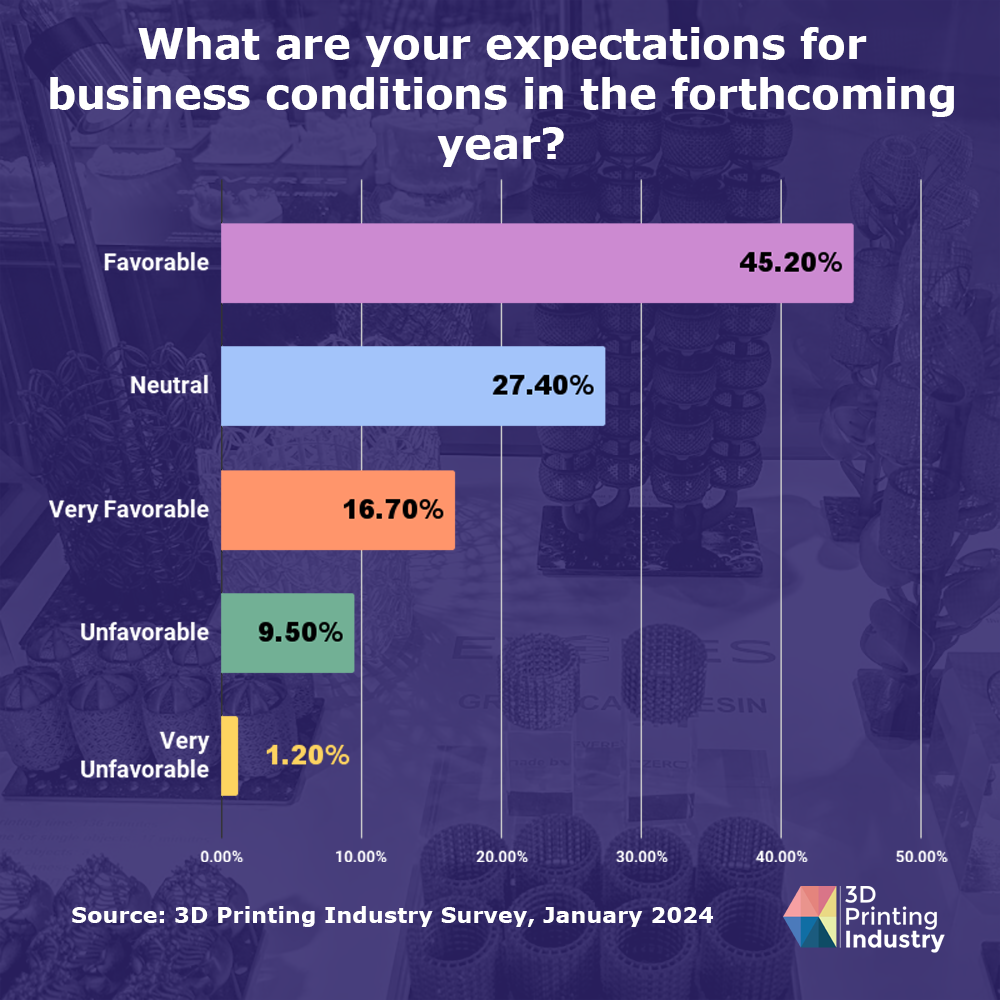

This question refers to external factors and influences, including macroeconomic factors, market conditions, and regulatory, political, legal, and social factors. We asked 3D printing leaders for their assessment of forthcoming business conditions in 2024 and in the year most recently concluded. The chart below summarizes the results for the prior year.

Confidence in the business environment has increased, from 49% holding a positive view in 2023 to 62% believing the external macroeconomic factors, market conditions, regulatory, political, legal, and social factors are favorable in 2024. A 27% increase on the sentiment in 2023.

Those respondents with a neutral outlook increased by 13%, while the total number of 3D printing industry executives with a negative view of business conditions for the year fell by 60%.

2024 Operating Conditions in the 3D Printing Industry

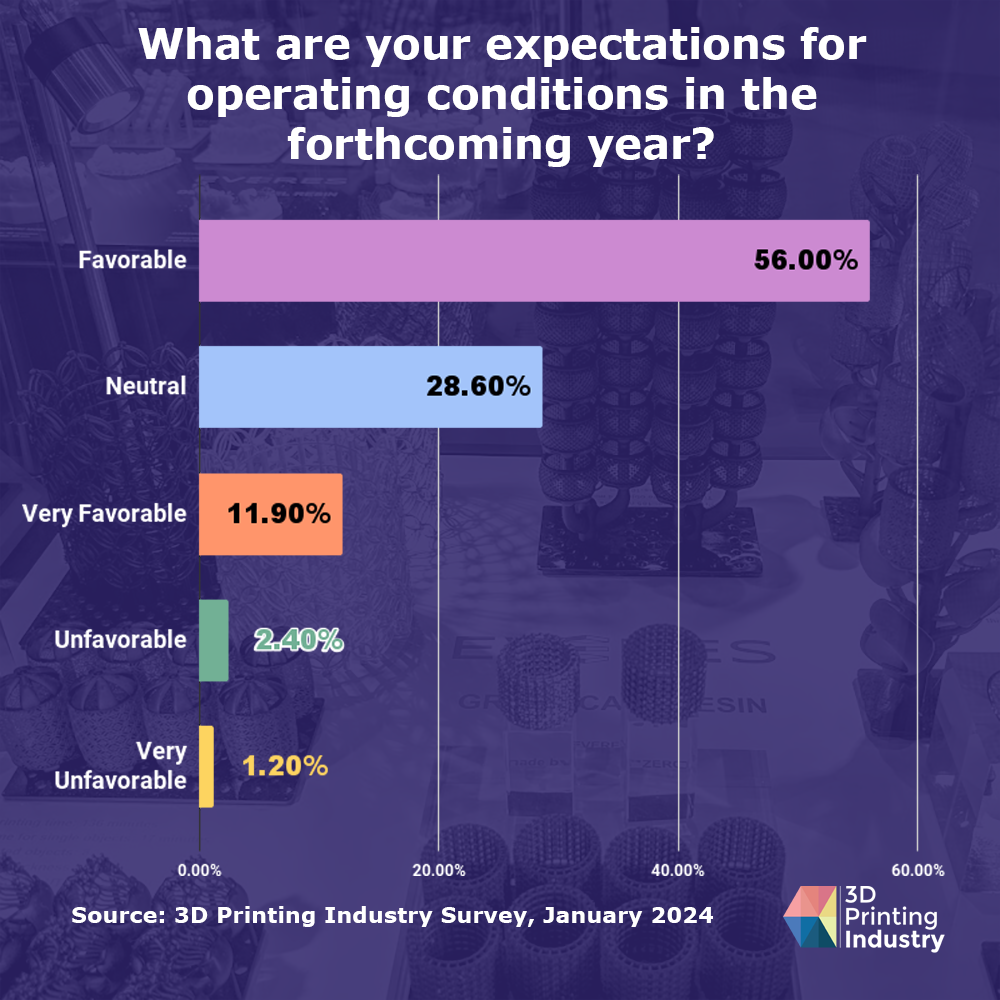

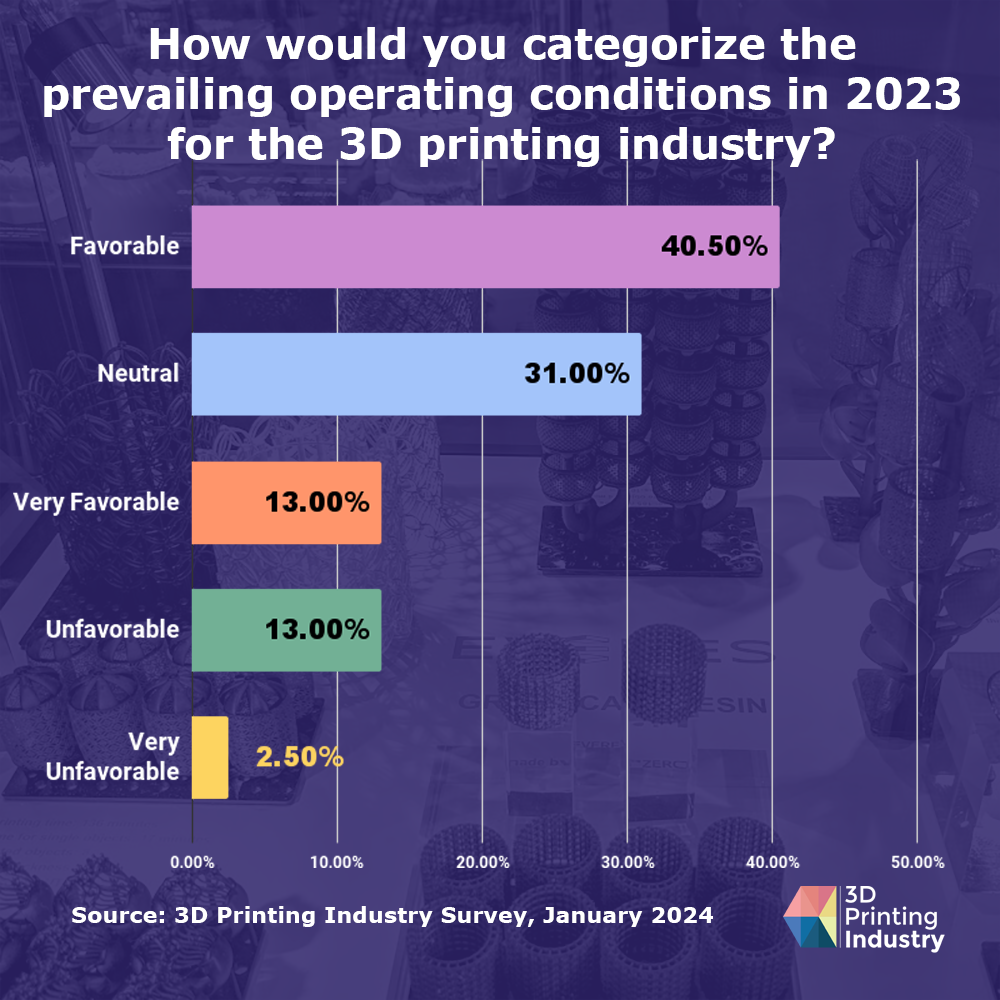

We also asked the leaders for insights on operating conditions, this question refers to internal factors and influences within the enterprise

According to the 3D Printing Industry Executive Survey, a bullish spirit is rising regarding operating conditions, with 56% of 3D printing industry leaders expecting a favorable internal environment in the coming year.

This general optimism must be tempered with a slight decrease in the number of executives anticipating a very favorable year, with 2024 numbers dropping to 11.9%

The percentage of 3D printing industry executives taking a negative perspective on the year has fallen by 80%, with only 3% of executives surveyed anticipating an unfavorable or very unfavorable 2024.

The majority (54%) viewed 2023 operating conditions as positive at their organization; this view has grown, with 68% of leaders believing 2024 with be favorable or very favorable for their company.

In total, 120 3D printing industry leaders and experts provided information.

3D Printing Industry Optimistic for 2024

The results may appear unexpected. The tone appears initially at odds with that often seen in social media posting and even the regular CEO-led investor calls where listeners have become accustomed to hearing the phrase “macro-economic headwinds” repeatedly deployed to justify lack-luster financial results. Taking these channels as examples, a pinch of caution should be apparent. Firstly, social media is notorious for rewarding the increasingly extreme – leaving voices of moderation unheard among shrill warnings of a falling sky. Secondly, investor calls, in the main, have become so tightly scripted and reliant on generalities as to become a marginal source of insight. The generalities can be likened to saying stock prices moved due to the combined activities of buyers and sellers – certainly truthfully, but vague enough to provide no insight. Most 3D printing enterprises are also in private hands, and not subject to public reporting requirements in the of a listed entity.

A third explanation for the results is feasible: the companies making money with additive manufacturing are either too busy to be posting on Threads or disinclined to provide motivation to potential competitors. This leads to a self-selection bias whereby a negative view is amplified.

Let us know your thoughts about these results. We’d love to hear!

If you would like to take part in future surveys please provide contact details using this form.

This week, more insights from the 2024 3D Printing Industry Executive Survey will be published. Make sure you don’t miss, subscribe to the 3D Printing Industry newsletter.

You can also follow us on Twitter, like our Facebook page, and subscribe to the 3D Printing Industry Youtube channel to access more exclusive content.

Are you interested in working in the additive manufacturing industry? Visit 3D Printing Jobs to view a selection of available roles and kickstart your career.