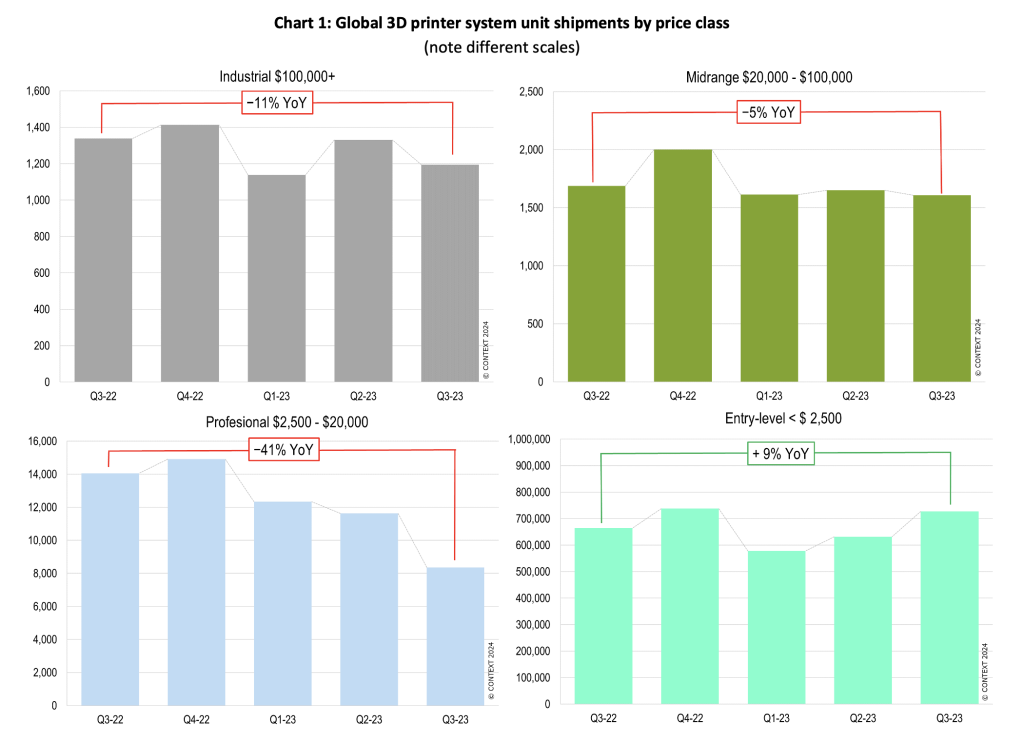

A new report from market intelligence firm CONTEXT has highlighted stagnating “industrial” 3D printer shipments during Q3 2023.

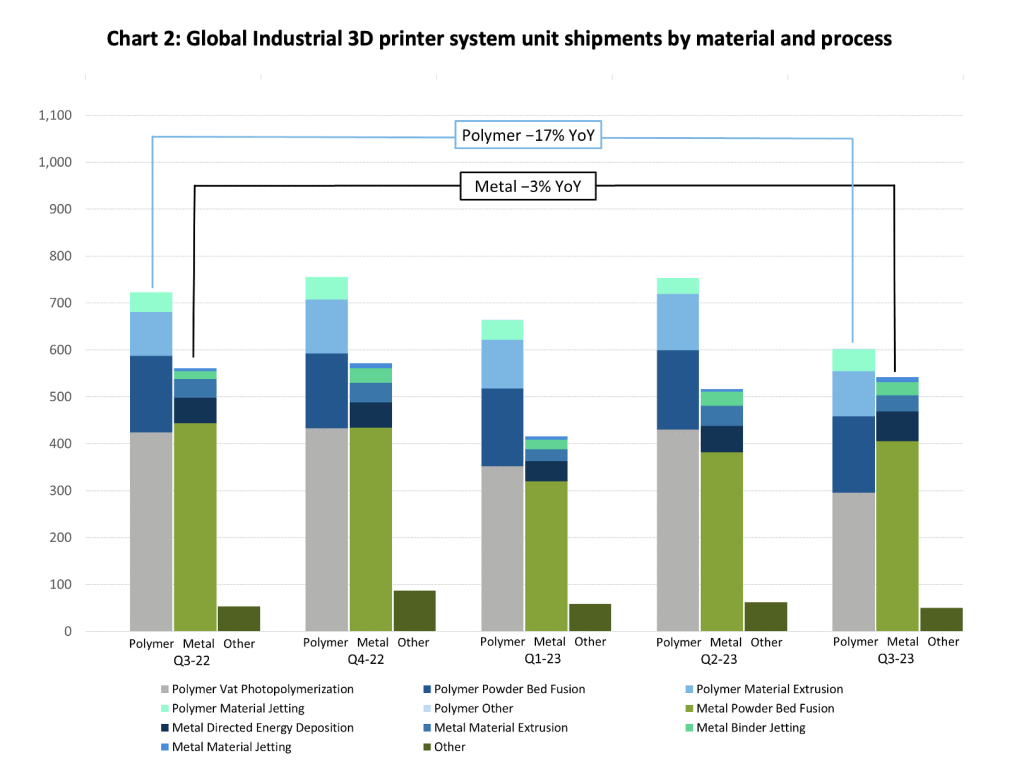

Global Industrial polymer 3D printer shipments fell 17% YoY, with metal system shipments experiencing a 3% decline compared to Q3 2022. This decline has reportedly been driven by inflation and high interest rates that are impacting key markets.

Failed merger and acquisition activity from the likes of Stratasys, 3D Systems, Desktop Metal, and Nano Dimension, along with increased layoffs, also led to a shifting focus away from market growth towards profitability.

However, entry-level 3D printers continue to be the fastest growing segment within the 3D printing industry, cannibalizing the sales of professional systems. The recent rise of Shenzhen-based desktop 3D printer manufacturer Bambu Lab has contributed to this accelerated growth, with fellow Chinese company’s Creality and Elegoo also leading this market. The decline in the “professional” segment can certainly be seen as linked to features appearing on sub-$2500 3D printers that were previously unavailable.

CONTEXT also revealed that, based on rolling five-year global shipment rates, 8.1 million polymer FDM 3D printers have been shipped in that period. Data from Filamentive’s Material Sustainability Survey found the median filament use was 2kg per month or 24kg per year. Combined with CONTEXT data, this suggests potentially 194,400 tonnes of filament annually, a value in the region of $3.9 billion.

“Many public 3D printing firms in the West began shifting their attention from market growth to profitability and have recently been distracted by failed mergers and layoffs,” explained Chris Connery, head of global analysis at CONTEXT.

“Although these woes were reflected in the wider global market as well, there were pockets of opportunity and glimpses of strength in some 3D printer segments, especially in the often-overlooked Entry-level portion of the market.”

The chart below suggests that 2.7 million 3D printers were sold across all categories during the twelve months leading up to Q3’23. “Of the brands tracked CONTEXT shows just over 2M entry-level (below $2,500) FDM 3D printers have shipped globally in the last 4-quarters from Q4-22 through Q3-23,” said CONTEXT.

Industrial 3D printer shipments fall in Q3 2023

CONTEXT reports that, during Q3 2023, global shipments of Industrial 3D printers costing more than $100,000 dropped by 11% YoY. A 17% decline was witnessed in the Industrial polymer 3D printer segment, with a 3% drop for Industrial metal 3D printers.

The largest market for this price-class of Industrial 3D printers is within China. Shipments of such 3D printers to China declined by 16% compared to the same period in 2022, mainly due to weak polymer-based system shipments. Vat photopolymerization 3D printers performed especially poorly, with this being the largest category within the Industrial polymer space. If vat photopolymerization systems are excluded, Industrial polymer 3D printer shipments grew 2% YoY.

CONTEXT highlights that these poor shipment figures continue to be influenced by the economic effects of the COVID-19 pandemic. Weak demand within certain dental markets contributed to the poor results of companies such as 3D Systems.

SLA 3D printer manufacturer UnionTech, an Industrial 3D printing market leader, has experienced ‘lumpy and inconsistent’ results in Q3 2023. The company’s Industrial shipments fell by 28% compared to 2022, when the company was experiencing accelerated recovery from the Shanghai lockdowns.

However, some pockets of growth have been highlighted within the PBF polymer 3D printer segment. EOS, one of the biggest companies in this category, reportedly experienced ‘excellent’ shipment growth for such systems. Additionally, Stratasys witnessed an 11% YoY increase in the shipment of Industrial polymer 3D printers.

Ultimately, despite overall shipment decline, Q3 2023 saw global Industrial 3D printer revenues increase by 2% YoY.

Shipment decline and revenue growth in metal 3D printers

According to CONTEXT, the 3% decline in Industrial metal 3D printer shipments was largely driven by a 9% shipment fall in powder bed fusion (PBF) systems. CONTEXT calls PBF 3D printers the largest and most strategically important category of 3D printers within the Industrial metal 3D printing market.

China and North America, the top two regions in the Industrial Metal 3D printing space, experienced YoY shipment declines of -8% and -6%, respectively. However, in spite of poor shipment activity, overall metal 3D printer revenues were 8% higher than in Q3 2022.

This revenue growth has been driven by inflationary price increases and growing popularity in more expensive large build-volume, multi-laser powder bed fusion systems.

The 3D printing ‘laser wars’ were initially propagated by Western 3D printer manufacturers such as Velo3D and Nikon SLM Solutions. However, Chinese companies such as Farsoon, Eplus3D and Xi’an Bright Laser Technologies have entered this space over the past year. Eplus3D’s latest metal 3D printer, the EP-M1550, incorporates a 1558 x 1558 x 1200 mm build volume, and can be configured with up to 25 lasers.

While the PBF market witnessed widespread shipment decline, Directed Energy Deposition (DED) 3D printers performed well in Q3 2023. CONTEXT points to the recent emergence of entry-level DED offerings from companies such as Meltio as leading this growth. Elsewhere, SPEE3D shipped seven WarpSPEE3D cold spray-based 3D printers to Ukraine as part of a US Department of Defence (DoD) initiative.

Midrange 3D printers outperform professional systems

As with Industrial 3D printers, the Midrange and professional markets experienced declining shipment figures.

Q3 2023 saw shipments of Midrange 3D printers fall by 5% YoY and 2% sequentially. According to CONTEXT, this decline was somewhat reduced by strong shipments of new low-end PBF systems, mainly from Formlabs, and rising vat polymerization 3D printer shipments in China predominantly from UnionTech. Excluding Formlabs and UnionTech, shipments declined by 17%, with other key market leaders performing poorly. In fact, Midrange 3D printer shipments were down by 17% for Stratasys, 28% for 3D Systems, and 33% for MarkForged, in Q3 2023.

According to CONTEXT, Formlabs has recognised challenges within the Midrange segment, adding products with new modalities and in new price-ranges as a result. CONTEXT calls this portfolio-expansion tactic a ‘recipe for success,’ which can not only help the innovating company but also elevate the market as a whole.

The Professional 3D printing market reported a 41% decline in 3D printer shipments in Q3 2023, the sixth consecutive quarter of YoY shipment decline and the third to see a drop of 30% or more. In recent years, market leaders UltiMaker and Formlabs have offered more feature-rich products at increasingly higher price points. CONTEXT reported that this tactic has been successful in the past, but has struggled within the recent inflationary context.

Within the Professional market, demand has now shifted to cheaper, “good enough” systems. All Professional 3D printing vendors, other than newcomer Nexa3D, witnessed double-digit YoY shipment decline in Q3 2023.

Desktop 3D printing cannibalize industry sales

Unlike all other 3D printing segments, CONTEXT reports that the entry-level 3D printer market witnessed shipment growth of 9% in Q3 2023. This is primarily attributed to these more affordable 3D printers cannibalizing sales from Professional systems.

According to CONTEXT, end market buyers are increasingly determined that they can achieve similar functionality and outcomes from entry-level systems as they can from those in more expensive markets.

Desktop 3D printers are now finding use within dental, automotive, medical & healthcare, aerospace, jewelry, and consumer product applications.As such, these 3D printers are no longer limited to hobbyist and general customer use.

Chinese companies continue to dominate the desktop 3D printer market. Creality reportedly stands ‘head and shoulders above’ other companies in terms of global market share. Growth within the FDM space is exemplified by Bambu Lab, which CONTEXT previously reported as taking “the personal 3D printer market by storm.” Within the desktop LCD 3D printer market, Elegoo is showing strong growth.

Poor 3D printer shipments to continue?

Overall, despite poor 3D printer shipment figures in Q3 2023, Connery argues that 2023 “has set the stage for a rebound and 3D printer shipments look to accelerate in the years to come.”

Connery notes that global interest rates are likely to remain elevated through at least the first half of 2024, meaning near-term industrial system shipments may remain stagnant. However, CONTEXT reports that fears of regional recessions have largely abated, with the fundamental value of additive manufacturing being well recognized. This is set to clear the way toward accelerated growth, once the cost of capital lowers in the second half of 2024 and into 2025.

Moreover, Connery believes that the merger and acquisition activity of 2023 will continue into 2024. “Although the market may appear to have settled after the very public failed mergers of 2023, many companies have openly stated that they are more privately investigating strategic alternatives, meaning that sales, mergers, acquisitions and divestitures may yet lie ahead.”

As 2023 drew to a close, Nano Dimension submitted a renewed offer for Stratasys. Elsewhere, other companies such as BigRep announced plans to go public in 2024. Connery added that the Entry-level segment is “ripe for investment,” with more companies now recognising the increasing value offered by this market.

Subscribe to the 3D Printing Industry newsletter to keep up to date with the latest 3D printing news. You can also follow us on Twitter, like our Facebook page, and subscribe to the 3D Printing Industry Youtube channel to access more exclusive content.

Are you interested in working in the additive manufacturing industry? Visit 3D Printing Jobs to view a selection of available roles and kickstart your career.

Featured image shows The Bambu Lab X1-Carbon 3D printer. Image via Bambu Lab.