A new report from market intelligence firm CONTEXT has highlighted shifting regional patterns for Industrial 3D printer sales in Q2 2023. This has been driven by failed merger activity and the emergence of “laser wars” within the metal 3D printing space during Q2 2023.

Recent acquisition and merger distractions have reportedly driven a continued reduction of capital expenditure in key end-markets for Western vendors. These distractions include Stratasys’ shareholders’ recent rejection of the company’s proposed acquisition of Desktop Metal. On the other hand, Eastern vendors saw strong year-on-year (YoY) growth, especially in shipments within China.

“Discussions between the likes of Stratasys, 3D Systems, Desktop Metal, and Nano Dimension have so far failed to produce the world’s first $1B 3D printing company, but efforts to that end have not yet been abandoned,” explained Chris Connery, head of global analysis at CONTEXT.

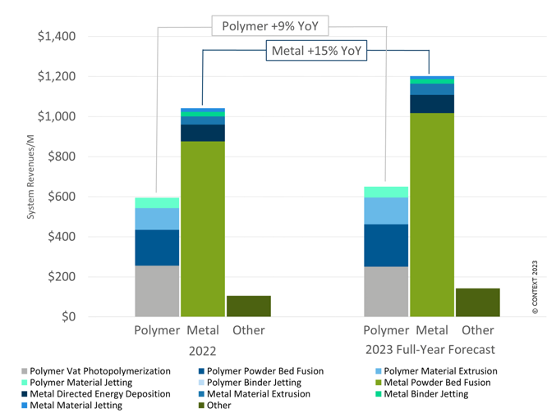

Whilst unit sales for Western industrial vendors are reportedly low, focusing on producing more expensive systems is driving revenue growth. Indeed, the burgeoning “laser wars” have seen manufacturers incorporate up to 26 lasers into metal powder bed fusion 3D printers, increasing revenue in the process. CONTEXT claims that the “laser wars” will drive 15% full-year revenue growth for the Industrial metal 3D printer space.

“Laser wars” to drive revenue growth despite unit-sales decline

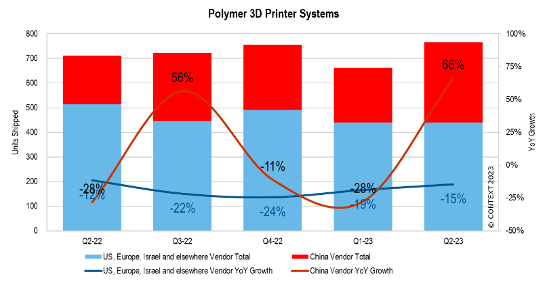

According to CONTEXT, Industrial 3D printer shipments were segmented along regional lines in Q2 2023. Most of the demand in China has been met by domestic vendors, whilst Western vendors fulfilled orders in the US, Europe, and the rest of the world.

China was once again the world’s largest Industrial 3D printing market, with 38% of such 3D printers shipped in Q2 2023 going to China. North America had a market share of 29%, whilst Western Europe accounted for 23%.

Despite regional COVID lockdowns in Shanghai in 2022 causing uneven growth in domestic shipments in China over the last year, the latest figures show an uptick in unit sales in this region. Q2 2023 saw unit sales of Industrial polymer 3D printers, especially vat photopolymerization products from UnionTech, grow 66% in China. Alternatively, western vendors saw a 15% decline in selling 3D printers.

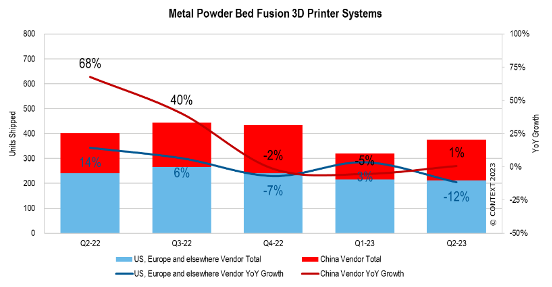

The Industrial metal 3D printing market reportedly remained focused on powder bed fusion, with these 3D printers accounting for 74% of all Industrial metal systems shipped in Q2 2023. Western Industrial metal 3D printer shipments dropped 12% YoY, while Chinese vendors saw shipments grow 1%.

CONTEXT has noted that manufacturers are now focusing less on the number of 3D printers being shipped and more on the sale of larger, more efficient, and expensive models. Therefore, although powder bed fusion shipments by Western vendors dropped by 5% YoY in H1 2023, revenues grew by 21%. These 3D printers are often characterized by a large number of lasers. The “laser wars” were reportedly introduced to the West by companies such as Nikon, SLM Solutions, and Velo3D.

In China, the likes of Xi’an Bright Laser Technologies, Farsoon Technologies, Eplus3D, and Hanbang United 3D Technology have also joined the “laser wars,” with their 3D printers incorporating 16, 20, and even 26 lasers. As these new mult-laser offerings hit the market, CONTEXT expects revenues will rise, regardless of a drop in unit shipments.

Mixed success within the Midrange and Professional space

In Q2 2023, Midrange 3D printer sales are said to have outperformed those from the Professional price class.

Q2 2023 reportedly saw 7% YoY growth in the shipment of Midrange 3D printers, a 2% increase compared to the previous quarter. According to CONTEXT, this growth was largely driven by high sales of a sub-class of low-end polymer powder bed fusion 3D printers, mainly from Formlabs. Rising domestic shipments of vat photopolymerization 3D printers in China, largely from UnionTech, also impacted this growth.

UnionTech has seen accelerated sales of its latest line of mid-priced 3D printers, contributing to recent growth. Formlabs recent success is said to stem from the creation of what is essentially a new category of 3D printer. However, it is noted that shipments of these 3D printers are beginning to plateau.

On the other hand, in the Professional 3D printer space, unit shipments dropped 30% YoY in Q2 2023, following a similar decline in Q1 2023. FDM/FFF 3D printer shipments fell 36%, while those of SLA systems dropped 30%. This poor performance was reportedly driven by UltiMaker BV and Formlabs, who both saw steep YoY unit shipment declines.

Bambu Lab: a leading force in desktop 3D printing

The CONTEXT report states that Shenzhen-based 3D printer manufacturer Bambu Lab, which recently launched the X1E desktop 3D printer, has “taken the Personal 3D printer market by storm.” In fact, Bambu Lab was reportedly the market share leader in the fully assembled class of Personal 3D printers for Q2 2023.

Overall, Personal and Kit & Hobby 3D printers saw a 12% unit shipment increase and 22% YoY system revenue growth. The report claims that this success was thanks entirely to Bambu Lab and AnkerMake, the latter of which continued to deliver against its successful Kickstarter campaign. When both companies are excluded, Personal 3D printer shipments fell by 28% compared to Q2 2022.

Creality, a “former market leader,” saw a marginal increase in Personal 3D printer shipments. However, most other vendors are said to have experienced double-digit YoY shipment declines.

Creality reportedly remains dominant within the desktop segment of the 3D printer market and is still said to be the “undisputed leader” in the DIY Kit & Hobby class. Here, the China-based company reported a 4% shipment increase. However, Creality’s competitors in this space haven’t fared so well. Prusa Research saw unit shipments drop by 7% YoY in Q2 2023.

Varied macroeconomic forecast causes mixed outlook

On the whole, CONTEXT highlights mixed unit shipment results for Q2 2023. Half of the top ten revenue-leading manufacturers of 3D printers costing over $2,500 saw YoY shipment growth in the first half of 2023. This includes the likes of EOS, UnionTech, HP, Velo3D, Nikon, and SLM Solutions. However, Stratasys, Desktop Metal, 3D Systems, and Formlabs all saw shipment decline.

Connery highlights the “wide variation of macroeconomic forecasts” driving these varied results. “Many vendors are dealing with longer sales cycles, some facing a push-out of orders while others point to strong demand in Q2 2023; some point to early signs of a recovery, but others still see the global economic environment as challenging and uncertain.” Moreover, with global interest rates remaining high, Connery points to the cost of capital as limiting spending on new hardware.

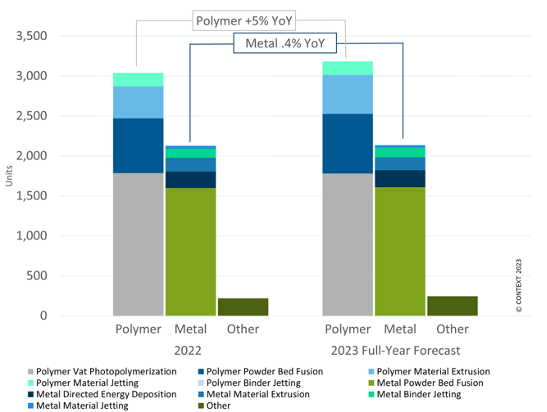

Overall, CONTEXT expects to see 3% unit shipment growth and 14% system revenue growth by the end of 2023. Inflationary price increases are set to drive 9% industrial polymer 3D printer revenue growth and 5% unit shipment increase.

The growing global trend around producing more expensive but more efficient multi-laser metal powder bed fusion 3D printers is expected to augment the effects of inflation. As such, CONTEXT expects 15% full-year revenue growth for the industrial metal 3D printer space.

Subscribe to the 3D Printing Industry newsletter to keep up to date with the latest 3D printing news. You can also follow us on Twitter, like our Facebook page, and subscribe to the 3D Printing Industry Youtube channel to access more exclusive content.

Are you interested in working in the additive manufacturing industry? Visit 3D Printing Jobs to view a selection of available roles and kickstart your career.

Featured image shows Eplus3D’s new EP-M1550 metal 3D printer which can incorporate up to 25 lasers. Image via Eplus3D.