Industrial laser specialist Nuburu is set to go public via a merger with Special Purpose Acquisition Company (SPAC) Tailwind Acquisition Corp (TWND).

Through the deal, Nuburu and Tailwind Acquisition plan to combine into a $350 million enterprise supported with $334 million in gross proceeds, and another $100 million provided by asset management firm Lincoln Park Capital.

The agreement marks the latest in a 3D printing SPAC merger trend, which emerged after Desktop Metal went public in late-2020. During the 20 months since, SPACs have targeted 3D printing firms in takeovers worth over $13 billion, and though the popularity of these deals had seemed to enter a recent lull, they now appear to be back in vogue as a way of rapidly becoming listed and raising capital.

“As electrification and advances in manufacturing drive growth in our target markets, this capital infusion is intended to provide continued momentum for Nuburu,” said Mark Zediker, CEO of Nuburu. “We are focused on growing our customer base, expanding our distribution channels, accelerating development of our ultra-high brightness product family and scaling our manufacturing operations to meet demand.”

“Our partnership with TWND is expected to accelerate our expansion plans to allow us to benefit from a position of strength in the public markets.”

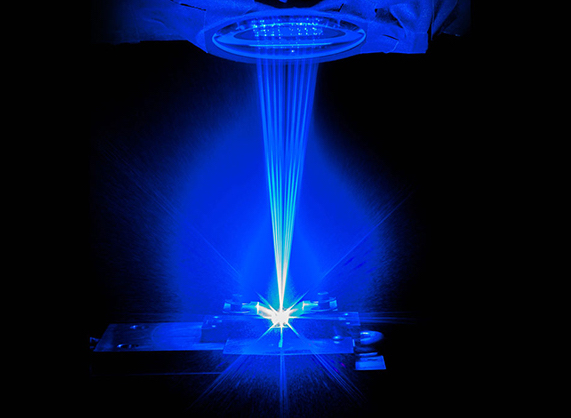

Nuburu’s blue laser technology

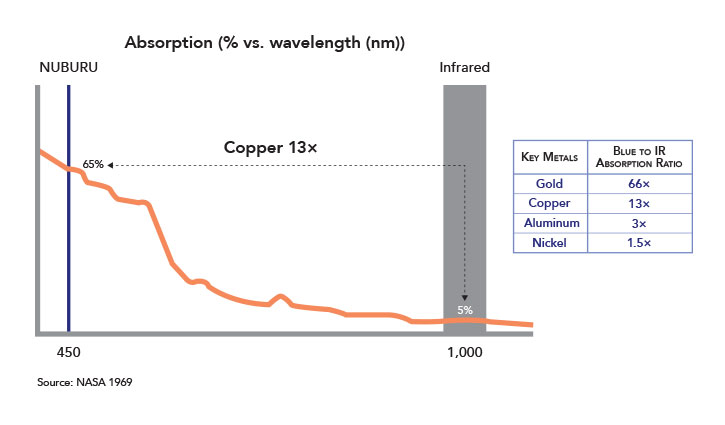

While Nuburu was established in 2015, it wasn’t until the introduction of its first industrial blue laser two years later that it was able to truly carve out a market niche of its own. In general, blue lasers offer better print quality than laser diodes when it comes to 3D printing with copper, stainless steel or aluminum, as these reflect large amounts of light energy.

Copper, in particular, is known to be better at absorbing blue light than other wavelengths, and using its AO and AI lasers, Nurburu says it’s possible to 3D print dense parts from the alloy ten times faster than those of its competitors. When used in a Laser Metal Deposition set up, the firm says its lasers can even weld copper onto steel, or copper onto other copper, something that’s impossible with infrared.

Over the last two years, the laser specialist has sought to build on its market-leading position by expanding its portfolio. To fund this expansion, Nuburu raised $20 million in late-2020, which it earmarked for the development of an ‘AI’ welding system. This was closely followed by Nuburu gaining seven patents related to its visible laser technologies, and it now holds 170 granted patents and applications.

As part of its latest pre-IPO expansion in May, Nuburu has also revealed it’s working with Essentium on a blue laser-based metal 3D printer. Interestingly, its partner is better known for its Fused FIlament Fabrication (FFF) operations, and agreed to go public itself last year. While Essentium’s SPAC merger collapsed in early-2022, the firm has since licensed the technology behind Nuburu’s foundational patent, and the pair are understood to still be working on their new system.

Financing future growth opportunities

Having entered a business combination agreement with Tailwind Acquisition, Nuburu is now in the process of becoming publicly-listed. Once the transaction is complete, the resulting enterprise will be listed under the ticker ‘BURU.’ The deal, which values Nuburu at $350 million, is still subject to the approval of both firms’ shareholders, but is expected to be wrapped up by early-2023.

Under the terms of the agreement, each TWND non-redeeming stakeholder will receive one preferred share for every Class A common stock that’s not redeemed at a price of $10.00 per share. The deal also allows Nuburu to raise additional capital through the issuance of convertible notes prior to its closing. Using any funding raised, the firm plans to invest in R&D and unleash a cross-industry expansion.

“Our goal at TWND is to partner with a founder-led company that has a large addressable market and is positioned for rapid and sustainable long-term growth,” adds Chris Hollod, CEO of TWND. “We are pleased to have the opportunity to join forces with Nuburu, a business offering solutions in metal processing that are critical to 3D printing, aerospace, consumer electronics, and e-mobility.”

3D printing SPAC mergers return

SPAC mergers offer privately-traded companies a faster, less-regulated route to going public than traditional IPOs allow, and this has made them popular among 3D printing firms in the last couple of years. Earlier this year, Fathom Digital Manufacturing went public via a merger with Altimar Acquisition Corp II that saw it raise an estimated $80 million.

In September 2021, Shapeways and Velo3D announced SPAC mergers of their own, amid a surge in similar transactions which saw Markforged, Redwire, Shapeways and more go public via similar deals. That said, not all these deals agreed by additive manufacturing firms went through last year, and Bright Machines’ $1.6 billion SPAC merger collapsed with “market conditions” reportedly to blame.

As long ago as 2014, before these deals were even called SPAC mergers, Nano Dimension went public via a reverse merger. Since then, having raised over $1.5 billion from investors, Nano Dimension has bought shares in Stratasys and made many acquisitions including DeepCube, Admatec, Formatec, Global Inkjet Systems and Nanofabrica.

To stay up to date with the latest 3D printing news, don’t forget to subscribe to the 3D Printing Industry newsletter or follow us on Twitter or liking our page on Facebook.

For a deeper dive into additive manufacturing, you can now subscribe to our Youtube channel, featuring discussion, debriefs, and shots of 3D printing in-action.

Are you looking for a job in the additive manufacturing industry? Visit 3D Printing Jobs for a selection of roles in the industry.

Featured image shows a Nuburu blue laser. Photo via Nuburu.