Industrial 3D printer manufacturer Desktop Metal (DM) has reiterated that it expects to generate $260 million over FY 2022, 131.3% more than it managed last year.

Desktop Metal made its forecast alongside the release of its Q2 2022 results, which show that it generated record-breaking revenue of $57.7 million, over three times the $19.0 million it reported in Q2 2021. On the firm’s earnings call, CEO Ric Fulop credited this growth to the strength of its metal 3D printing offering, contributions from acquisitions and “momentum in blue chip customer adoption.”

“It was a fantastic quarter for our business,” Fulop said on the call. “We saw another quarter of top line strength, recording the highest quarterly revenue in the company’s history. I’m pleased with this quarter’s results. We continue to deliver for our customers, and that is driving excellent financial performance, including revenue growth at scale and margin expansion.”

“We continue to see momentum in blue chip customer adoption of our AM 2.0 solutions across industries.”

Desktop Metal’s Q2 2022 financials

Desktop Metal reports its financials across two main divisions: Products and Services, with the former bringing in the majority of its revenue during Q2 2022 at $52.7 million, and the latter generating $5.0 million. These figures represent continued growth, as Desktop Metal’s Q1 2022 financial results show that it attracted revenue of $43.7 million, meaning that it achieved a 32% sequential improvement.

This growth was driven by the company’s metal product platform, the revenue of its acquired businesses and its success in capturing a share of what Fulop called “attractive opportunities” with “strong secular growth drivers.” Customers such as Ford, Nissan, Saudi Aramco and Honeywell were name-dropped on Desktop Metal’s call as growing customers in the quarter that use its printers in “mass production.”

Fulop highlighted how he’s particularly excited about the way clientele are “expanding their deployments with new orders beyond their initial systems,” a phenomenon that’s becoming a “meaningful revenue driver” and a barometer for its business.

On the cost front, Desktop Metal’s operating expenses came in at $46.1 million in Q2 2022, and while this reflects a 162% improvement on its spending in Q2 2021, it continues to seek out cost-saving opportunities. One way the firm is doing so, is via a streamlining program that’s already seen Desktop Metal lay-off 12% of staff, and is designed to recover $100 million in efficiencies over the next 24 months.

“As part of a product portfolio evaluation, we’re tightening our focus on products and development programs that prioritize scale and margin expansion across high-growth applications,” explained Fulop on the call. “We have also initiated a plan to consolidate our global facilities footprint to increase efficiencies and further reduce our fixed cost base.”

| Revenue ($) | Q2 2021 | Q2 2022 | Variance ($) | Variance (%) | Q1 2022 | Q2 2022 | Variance ($) | Variance (%) |

| Products | 17.6m | 52.7m | +35.1m | +199.4 | 39.5m | 52.7m | +13.2m | +33.4 |

| Services | 1.4m | 5.0m | +3.6m | +257.1 | 4.2m | 5.0m | +0.8m | +19.0 |

| Total | 19.0m | 57.7m | +38.7m | +203.7 | 43.7m | 57.7m | +14m | +32.0 |

| Cost of Sales | 16.6m | 49.3m | +32.7m | +197.0 | 45m | 49.3m | +4.3m | +9.6 |

| Gross Profit/Loss | +2.4m | +8.4m | +6m | +250.0 | -1.3m | +8.4m | +9.7m | +746.2 |

Cross-industry growth-drivers in Q2

Fulop explained on Desktop Metal’s earnings call that it continued to see “consistent customer adoption across a range of end markets” during Q2 2022. In particular, the CEO said the firm’s offering is gaining traction amongst defense clientele, with the Defense Logistics Agency having awarded it a contract worth a potential $15 million, to broaden 3D printing’s adoption across the US Armed Forces.

During the call, Fulop also revealed that Desktop Metal’s aerospace business is growing, with the likes of Lockheed Martin, Rolls-Royce, Northrop Grumman, Precision Castparts and Consolidated Precision Products increasingly using its 3D printers for end-use parts, and Collins Aerospace now deploying them in aircraft interior production.

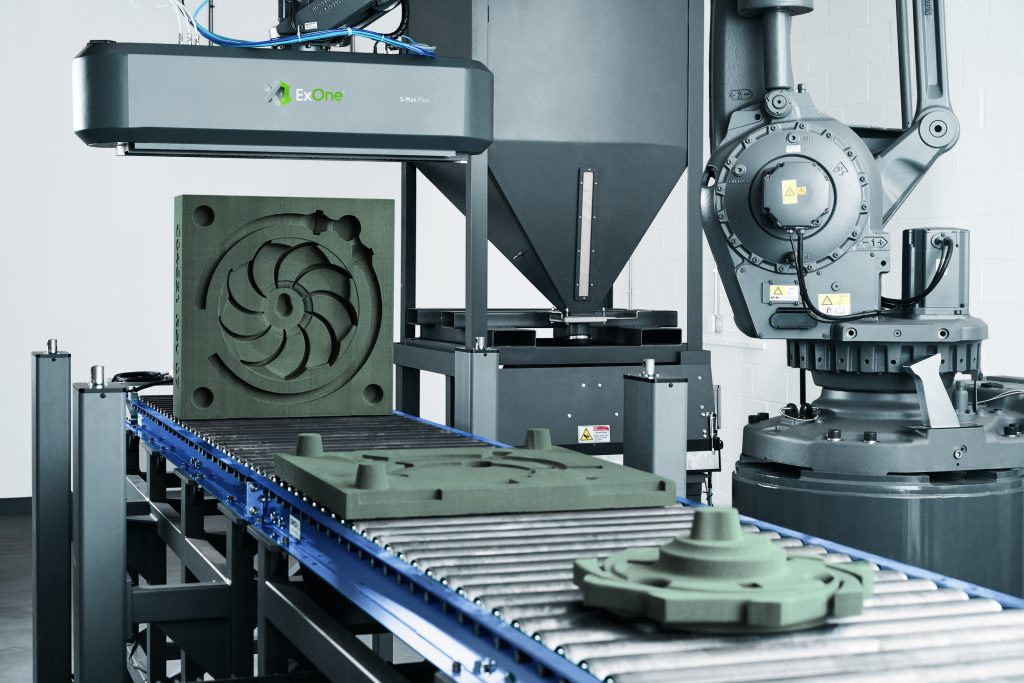

When it comes to Desktop Metal’s product portfolio, it’s said to have seen strong traction across all its metal 3D printers in Q2 2022, including its P-50 Production System. In terms of new launches, the company introduced the S-Max Flex 3D printer in April 2022, the lowest priced system to ever feature its ExOne subsidiary’s technology, which is expected to find adoption in metal casting applications.

The FreeFoam 3D printing resin also launched at the end of the quarter, a material capable of expanding to 2-7 times its size without tooling, that was invented by acquired Desktop Metal subsidiary Adaptive3D. Elsewhere, Fulop said on the company’s call that it continues to seek out ways of “monetizing its robust IP portfolio” of over 650 patents and applications, to “create new revenue opportunities.”

Finding the path to profitability

Given Desktop Metal’s strong start of the year which has seen revenue growth “trend towards its expectations” and its “strong execution on opportunities,” Fulop reiterated its $260 million FY 2022 guidance on its earnings call. However, the CEO also said the firm is “monitoring the macroeconomic environment,” and suggested its guidance is based on the assumption that current issues don’t worsen.

Fulop reaffirmed Desktop Metal’s EBITDA forecast of -$90 million as well, though he added that “continual sequential improvement” in this metric is expected as it cuts expenses in H2 2022. The company’s CFO James Haley followed this up by highlighting its improved cash position of $255.7 million, boosted by a $115 million convertible notes offering in May, which has given it a “stronger balance sheet.”

“Given the uncertain macro environment that has become more challenging in 2022, we felt that it was prudent to raise a moderate amount of cash,” added Haley. “As a result, Desktop Metal’s cash balance, combined with the impacts from the strategic integration and cost optimization initiative, provides the company with a sufficient runway to reach cash flow breakeven and fund our long-term growth opportunity in AM 2.0.”

To stay up to date with the latest 3D printing news, don’t forget to subscribe to the 3D Printing Industry newsletter or follow us on Twitter or liking our page on Facebook.

For a deeper dive into additive manufacturing, you can now subscribe to our Youtube channel, featuring discussion, debriefs, and shots of 3D printing in-action.

Are you looking for a job in the additive manufacturing industry? Visit 3D Printing Jobs for a selection of roles in the industry.

Featured image shows Desktop Metal’s ExOne S-Max Flex 3D printer. Photo via Desktop Metal.