Israeli 3D printed electronics manufacturer Nano Dimension has reported a sequential quarterly reduction in revenue of 59% within its Q1 2021 financial results.

Between Q4 2020 and Q1 2021, the firm’s revenue fell from $2 million to $800,000, a decline it has attributed to the continued impact of COVID-19 on demand for its DragonFly 3D printers. On Nano Dimension’s earnings call, however, its CEO Yoav Stern unveiled plans for its $1.5 billion 3D printing warchest, including the impending launch of three new machines, which should boost its revenue moving forwards.

Following the publication of the company’s financials, its shares have remained flat, only falling slightly from $6.41 to $6.18, suggesting that investors remain convinced of its longer-term growth potential.

During Nano Dimension’s earnings call, Stern told analysts and investors that even though he’s displeased with the firm’s Q1 revenue performance, he remains “excited” about its recent R&D advances. “I’m a little bit unhappy about our development on the revenue, because I think we pushed forward during the end of COVID-19 to build up our marketing and sales organization,” said Stern.

“We are not fast enough. I think we should have been faster,” he added. “Now that customers are starting to come back to their offices, we are accelerating our sales and marketing efforts. We’re spending in an efficient manner but without holding back, because we want our sales and marketing organization to be all set, ready and affecting it [revenue] within the next quarter.”

Nano Dimension’s Q1 2021 financials

Although Nano Dimension has built up a cash balance worth $1.5 billion, its quarterly turnover remains comparatively low, as it continues to build on its portfolio and acquire revenue-generating subsidiaries. In terms of the company’s traditional business, the sales of its DragonFly LDM machines struggled during the pandemic, as demand from clients in its pandemic-stricken core markets dried up.

However, the firm has recently announced the sale of one DragonFly 3D printer to the University of Quebec, which will be reported during Q2, and Stern said that he now anticipates “accelerated growth in this area.” Stern also highlighted that Nano Dimension is currently negotiating with customers in three different regions about buying further machines, suggesting that the market is “slowly waking up.”

Elsewhere, the company’s ramped-up promotion efforts were reflected in its sales and marketing expenses, which rose from $800,000 in Q1 2020 to $2.7 million in Q1 2021. Over the same period, Nano Dimension also increased its R&D spending from $1.7 million to $3.7 million, reflecting the fact that it has quadrupled the size of its product R&D teams, and hired senior staff from Orbotech and Verint to lead the development of its upcoming machines.

| Nano Dimension Results ($) | Q1 2020 | Q1 2021 | Difference (%) | Q4 2020 | Q1 2021 | Difference (%) |

| Revenue | 0.7m | 0.8m | +15 | 2m | 0.8m | -59 |

| Net R&D Expenses | 1.7m | 3.7m | +118 | 3.7m | 3.7m | – |

| Sales & Marketing Expenses | 0.8m | 2.7m | +238 | 2.4m | 2.7m | -13 |

| G&A Expenses | 1m | 3.4m | +240 | 3.5m | 3.4m | -3 |

| Comprehensive Loss | 2m | 9.3m | +365 | 17.4m | 9.3m | -47 |

A ‘three-axis’ plan for growth

During Q1 2021, Nano Dimension raised $332.5 million via a direct share offering, taking its total raised at the time to over $1 billion, and Stern has now outlined a ‘three-axis’ strategy on how it plans to deploy this funding. In the first of these axes, the firm intends to ramp-up the marketing behind its DragonFly systems, as it prepares for the re-opening of markets in the U.S, Europe and Asia later this year.

By contrast, within the company’s second product R&D axis, it has already made significant recent progress, and Stern announced that it has three new machines under development. Nano Dimension’s soonest-launching system will be its ‘DragonFly 4’ machine, an upgraded version of its original 3D printer, which is expected to be in the hands of customers by “early summer” 2021.

Describing the firm’s other two machines as “next-gen production machines for fabrication of PCBs and hybrids,” Stern said that they remain around 18-24 months away from release. Nano Dimension is internally developing custom materials for these new printers, but according to Stern it’s also considering “buying companies that merge into this R&D effort.”

Finally, the company’s third-axis, which refers to its acquisition ambitions, has seen it buy up Nanofabrica as well as purchasing DeepCube for $70 million in April 2021. Although neither acquisition was made in time to generate revenue during Q1 2021, Stern described them as “early bird” purchases that are expected to aid Nano Dimension’s product development efforts, and enable it to access new markets.

Moving forwards, Stern said that the company is currently negotiating the acquisition of four or five companies in the U.S. and Europe, but it’s waiting for permission to visit their premises before sealing any deals. As a result, the easing of pandemic-related restrictions should see Nano Dimension continuing to invest heavily in its M&A activities later in 2021.

“On the third axis, I’m happier and more content than the other two, because while the results of M&A are coming in a binary manner, which means it ain’t happening overnight, we announced two acquisitions,” said Stern. “It’s difficult for you to follow how gradually quarter-by-quarter we see results from M&A, but it’s coming.”

A long-term growth proposition?

Nano Dimension hasn’t issued any financial guidance for the rest of FY 2021, but Stern concluded the earnings call by describing the firm as a “long-term player” in the PCB market. In fact, Stern said that as the company’s different axes begin to overlap, it’ll become well-positioned to solve issues such as the global semiconductor shortage, and transform the current ’analog’ industry into a ‘digital’ one.

“In summary, within a reasonable amount of time, all three of the axes are going to lose their orthogonality, and slowly merge into one direction,” concluded Stern. “Our product activity, M&A and Go-To-Market thrusts, being built now to deliver future synergy and complementarity, are planned to gradually merge, leverage off of each other and fuel a mutually accelerated growth.”

To stay up to date with the latest 3D printing news, don’t forget to subscribe to the 3D Printing Industry newsletter or follow us on Twitter or liking our page on Facebook.

Are you looking for a job in the additive manufacturing industry? Visit 3D Printing Jobs for a selection of roles in the industry.

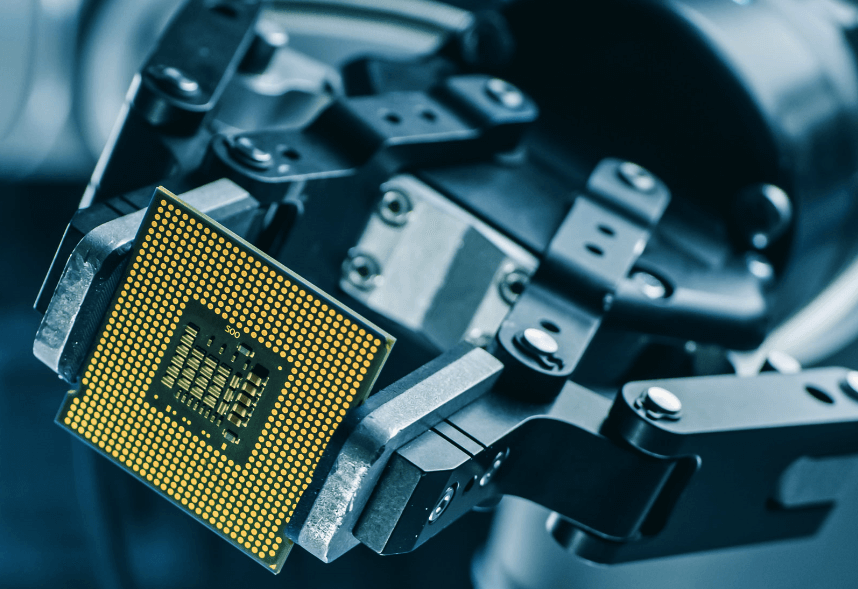

Featured image shows Nano Dimension’s DragonFly LDM 3D printing technology in action. Photo via Nano Dimension.