Israeli 3D printed electronics manufacturer Nano Dimension has announced the planned sale of $332.5 million worth of shares to investors via a registered direct offering.

The deal will be managed by investment bank ThinkEquity, and should be completed by January 19th 2021, taking the firm’s total cash raised to $1 billion. Nano Dimension says that it intends to utilize the investment for “pursuing strategic opportunities,” implying that it could be lining-up potential acquisition targets.

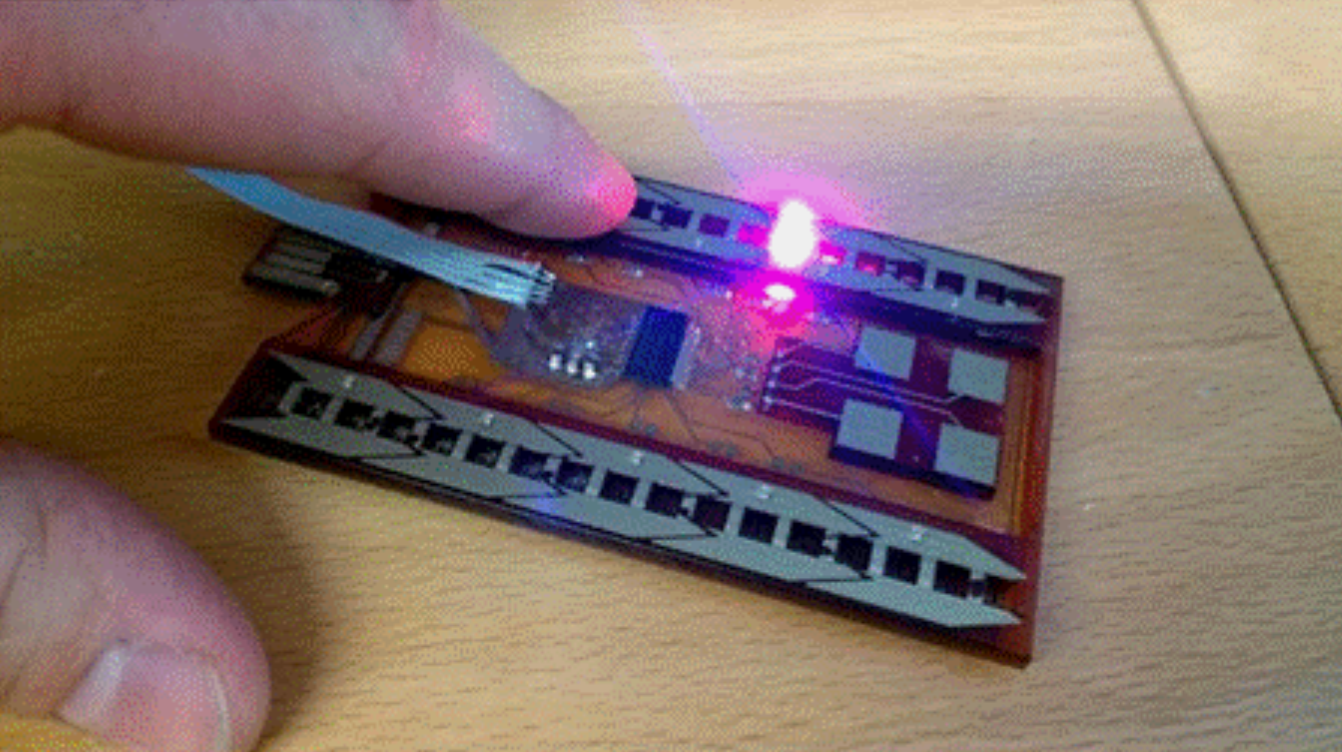

DragonFly 3D printing technology

Nano Dimension’s 3D printing capabilities center around its proprietary DragonFly system, which fabricates customized circuit boards on-demand. Effectively, the technology works by embedding capacitors within the layers of PCBs, lowering the required number of production steps, while reducing their costs and lead times.

Over the last three years, the company has continually upgraded its machine, releasing the larger Dragonfly Pro before its most recent iteration, the DragonFly LDM. While Nano Dimension does leverage its printers to provide an on-demand production service, its revenue remains low, and the firm mainly focuses on finding it new applications.

The DragonFly has been used to fabricate everything from radio frequency (RF) systems to IoT communication devices, and the firm has also patented several elements of the system, including its dielectric ink. Recently, alongside it share offering, Nano Dimension announced that it has patented “rigid-flexible printed circuit board fabrication using inkjet printing.”

Revealing the patent’s approval is likely to have driven up the company’s stock value and reinforced its position in the eyes of investors as an early leader in what is an emerging market.

Nano Dimension’s $1 billion war chest

In the latest of its string of share offerings, Nano Dimension has entered into a definitive agreement with investors that will see it sell 35 million shares at a price of $9.50 each. The firm’s offering prices its stock at a discount compared to the $11.43 it was trading at during the day the move was announced on January 13th, 2021.

As a result, Nano Dimension’s shares have dropped by 9%, standing at $10.38 on the NASDAQ exchange by close of play on Friday. The $332.5 million in gross proceeds generated by the transaction (minus offering expenses), have been earmarked by the company as “working capital” for unspecified general “corporate purposes.”

However, within its accompanying statement, the firm also made reference to “possible business combination transactions.” Although Nano Dimension has paid lip service to its acquisition plans before, the fact that it has now raised over $1 billion, will intensify analyst speculation that an expansion could be imminent.

3D printing’s 2021 renaissance?

2020 was a difficult year for the industry’s biggest firms, with the likes of 3D Systems and Stratasys suffering revenue declines that forced them into business restructurings. Since the turn of the year though, investors have shown a renewed interest in 3D printing stocks, and 3D Systems’ shares rose by 90% after its preliminary Q4 financials were revealed.

Similarly, Stratasys’ shares have increased in value from $20.72 to $31.85 during 2021, reflecting a growing optimism among investors that during H2 2020, the industry turned a corner. Although this wasn’t reflected in Nano Dimension’s Q3 figures, in which it generated just $438,000 in revenue, the firm could now choose to boost its income via an acquisition.

Given that the pandemic has effectively reduced the share value of 3D printing’s smaller companies, now might be the opportune time for Nano to expand on its verticals. Stratasys, for instance, purchased Origin for $100 million in December last year, while Desktop Metal has acquired EnvisionTEC in a $300 million deal.

Whether or not Nano Dimension grows into other areas remains to be seen, and this could prove to be dependent on the direction of the pandemic. But for now at least, even though the firm is generating very little revenue, the optimism surrounding its potential will continue to draw the attention of investors.

To stay up to date with the latest 3D printing news, don’t forget to subscribe to the 3D Printing Industry newsletter or follow us on Twitter or liking our page on Facebook.

Are you looking for a job in the additive manufacturing industry? Visit 3D Printing Jobs for a selection of roles in the industry.

Featured image shows Nano Dimension’s DragonFly 2020 Pro system 3D printing PCBs. Photo via Nano Dimension.