FDM 3D printer producer Stratasys has announced the acquisition of DLP machine manufacturer Origin in an agreement worth up to $100 million in cash and stock.

The merger, which should be completed by January 2021, will see Stratasys re-enter the resin system market following the launch of its V650 system last year. According to the firm’s analysis, the deal could provide it with annual revenue rises of $200 million by 2026, and strengthen its position in the medical and industrial sectors.

“We believe Origin’s software-driven system is the best in the industry at combining high throughput with incredible accuracy,” said Yoav Zeif, CEO of Stratasys. “When combined with our industry-leading go-to-market capabilities, we believe we will be able to capture a wide range of in-demand production applications.”

Stratasys’ $100m deal: A breakdown

Stratasys’ acquisition is still subject to approval and closing conditions, but once it’s completed, the deal will be broken down into several installments. While $60 million will be paid upfront upon closing, $6 million of this is subject to share retention, and the other $40 million will be contingent on performance-based earnouts.

Additionally, only $55 million of the fee will be paid in cash, with the rest set to consist of $45 million worth of shares. Once the merger has been completed, the Origin team will be retained, and join Stratasys to continue developing its technology and product platform, with a full global re-launch planned for mid-2021.

The firm’s projections have shown that the 3D printing market will grow to around $25 billion by 2025, with sales from polymer resin-based systems set to increase annually by 20 percent. In this context, Stratasys’ decision to acquire Origin can be seen as an attempt to gain a bigger slice of a potentially lucrative market.

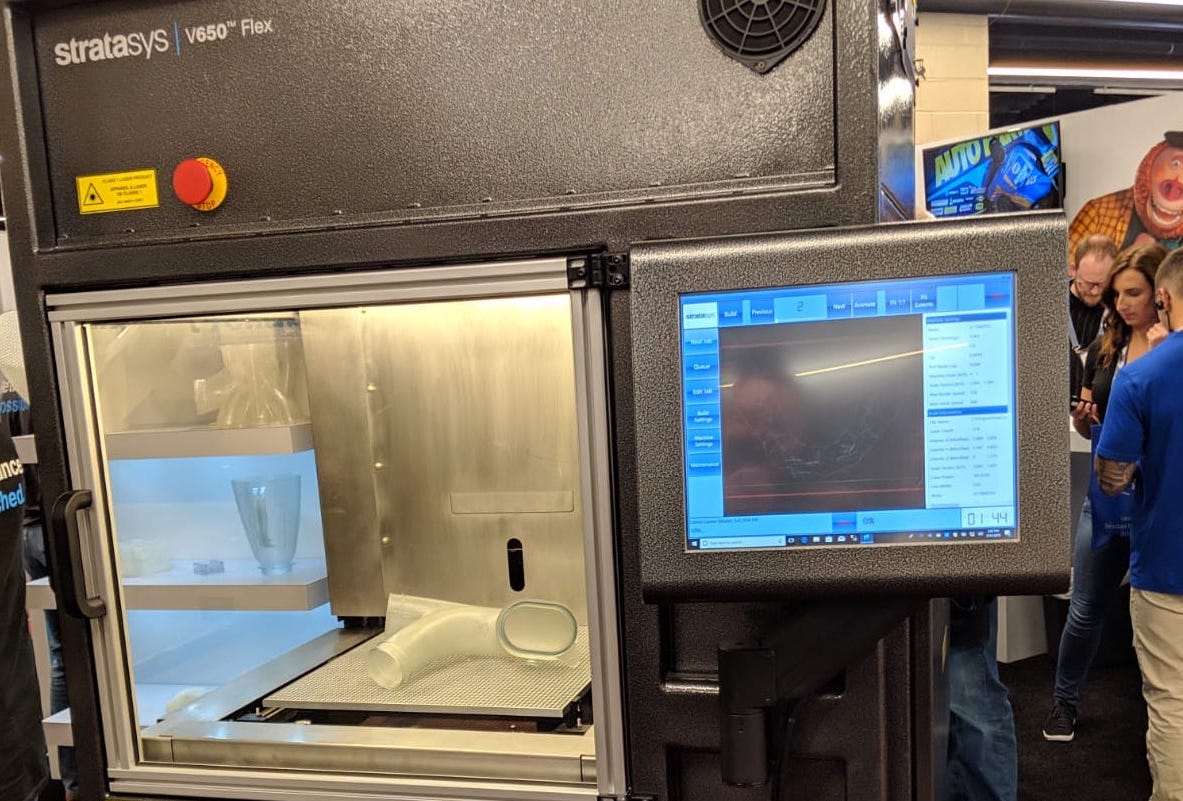

Stratasys revealed its first resin-based system at AMUG 2019, with the industrial V650 Flex. The machine had been used to deliver parts via the company’s Direct Manufacturing service, and at the time, the firm said that it was commercializing the technology to meet a demand for an application-specific solution.

With its acquisition of Origin, Stratasys has now opted to expand further into the polymer resin 3D printing market, where according to Zeif, its clients are seeking a mass-manufacturing alternative.

“Our customers are looking for AM solutions that enable the use of industrial-grade resins for the mass production parts with process and quality control,” added Zeif. “Together with our intended entry into PBF technology, the acquisition of Origin reflects another step in fulfilling our objective to lead in polymer AM.”

Origin’s scalable 3D printing technology

Since leaving stealth mode in 2018, Origin has been focused on delivering mass manufacturing to the 3D printing industry. The company’s Origin One system, which is powered by its proprietary high-speed P³ technology, has been designed to make additive production as automated and scalable as possible.

Origin’s flagship machine features modular hardware making it easy to upgrade, as well as cloud-driven software that automates the printing process. The company has also set up an open material ecosystem for its printer, including compatibility with DSM, Henkel, and BASF resins, which Stratasys now stands to inherit.

This flexibility enabled Origin to fabricate millions of clinically validated nasal testing swabs, facial shields, and ventilator splitters at the height of the pandemic. Given that Stratasys values the additive medical and dental markets at over $1 billion each, the Origin One could provide it with a valuable entry point into these markets.

For Origin, the deal has provided access to Stratasys’ extensive marketing resources, and the firm’s CEO Christopher Prucha emphasized this during the Q&A on Stratasys’ conference call. “We believe that Stratasys has by far the best service and go-to-market platform of any 3D printing company,” said Prucha.

“As a start-up, we don’t have that infrastructure, so we really see this combination as allowing us to achieve our vision, and a way of getting that global install base,” he added. “We had various options, but we decided that joining Stratasys was by far the best outcome, not only for Origin but for our partners and customers as well.”

Stratasys enters the DLP market

With the acquisition of Origin, Stratasys has shown that it intends to carve out its own niche in a DLP market that’s crowded with potential competitors.

Carbon, for instance, made its Digital Light Synthesis (DLS)-powered L1 3D printer available to customers last year on a subscription-based model. The machine has a ready-made production process that enables ‘immediate high-volume production.’

More recently, optical system developer In-Vision launched its HELIOS UV light projector designed specifically for resin-based DLP systems. With its new engine, the company aims to enable faster cure times for clients, as well as compatibility with a greater number of photopolymer resins.

Similarly, open-platform 3D printing specialist atum3D released its DLP Station 5-365 EXZ machine, at Formnext Connect. The new system features the firm’s open resin platform, which accepts the use of any functional third party material, and a build height almost double that of its DLP Station 5-365 printer.

To stay up to date with the latest 3D printing news, don’t forget to subscribe to the 3D Printing Industry newsletter or follow us on Twitter or liking our page on Facebook.

Are you looking for a job in the additive manufacturing industry? Visit 3D Printing Jobs for a selection of roles in the industry.

Featured image shows a row of Origin’s ‘Origin One’ DLP 3D printers. Photo via Stratasys.