GE has revealed that it managed to return to revenue growth during Q2 2021 thanks in part to a strong recovery in demand within its Aviation business.

For the three months ending June 30 2021, GE turned over $18.3 billion, $600 million (or 3%) more than it managed to generate over the course of Q2 2020. The firm’s marginal revenue recovery can be attributed to a 33% increase in orders, received largely within its Power and Aviation divisions, the latter of which became a hive of 3D printing activity during the quarter.

Although GE’s financials mark a welcome return to growth for the company, after its revenue declined 20% during FY 2020, its takings still fell 36% below the $28.8 billion it reported in the pre-pandemic Q2 2019. That being said, following the results’ publication, shares in the firm have risen 3% premarket, suggesting that investors are mildly encouraged by GE’s turnaround.

“The GE team delivered strong overall performance in the second quarter,” said H. Lawrence Culp Jr, CEO of GE. “Orders and revenue returned to growth, our operating margins expanded across all segments, and we generated positive industrial free cash flow. Momentum is building across our businesses, driven by Healthcare and services overall, with Aviation showing early signs of recovery.”

GE’s promising Q2 2021

While GE doesn’t report on the financials of its additive manufacturing-focused GE Additive subsidiary directly, it’s possible to assess its performance through other related segments of its wider business. Broadly speaking, GE splits its results into five key categories: Power, Renewable Energy, Aviation, Healthcare and GE Capital.

During Q2 2021, Power was the company’s fastest growing division, and it generated $4.8 billion worth of orders, 67% more than the $2.9 billion reported in Q2 2020. Over the same period, GE’s Healthcare and Renewable Energy revenue also increased by 15% and 14% respectively, while income at its GE Capital business rose by 27%.

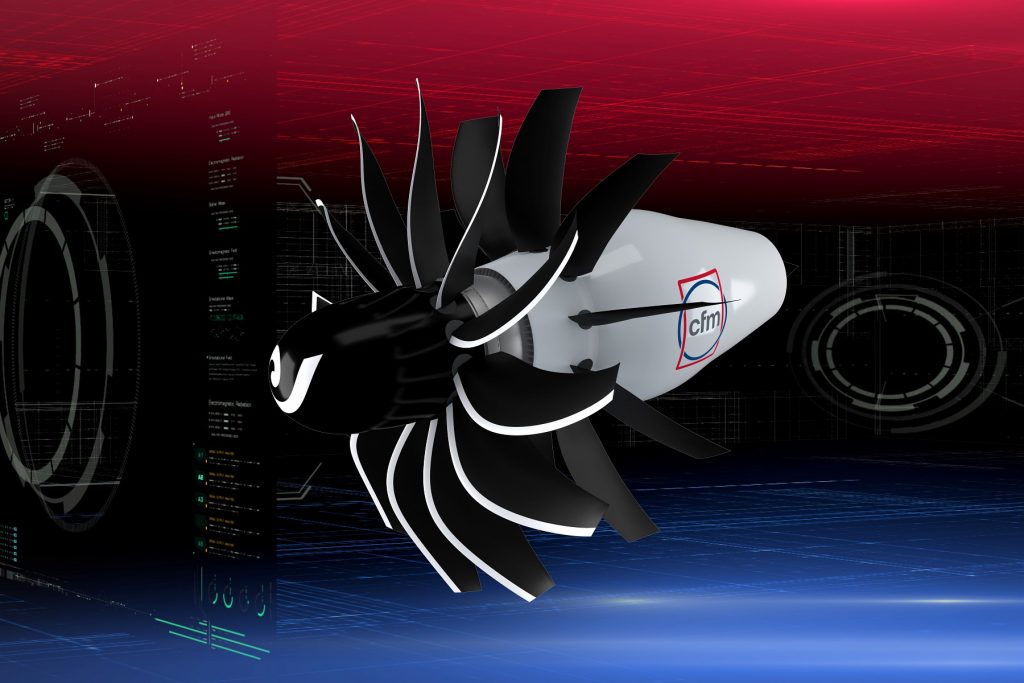

Most significantly though, Q2 2021 saw the company’s Aviation revenue begin to bounce back after it fell 41% during a disastrous COVID-hit FY 2020. It’s also likely that the segment accounts for much of its 3D printing activities, given that it’s known to operate at least 27 Arcam 3D printers which produce parts for its GE9X commercial aircraft engines.

| GE Financials {$) | Q2 2019 | Q2 2020 | Difference (%) | Q2 2020 | Q2 2021 | Difference (%) |

| Aviation | 7.9 bn | 4.4 bn | -44 | 4.4 bn | 4.8 bn | +10 |

| Healthcare | 4.9 bn | 3.9 bn | -20 | 3.9 bn | 4.5 bn | +15 |

| Renewable Energy | 3.6 bn | 3.5 bn | -3 | 3.5 bn | 4.0 bn | +14 |

| Power | 4.7 bn | 4.2 bn | -11 | 4.2 bn | 4.3 bn | +2 |

| GE Capital | -89m | -1.5 bn | -1585 | -1.5bn | -1.1bn | +27 |

In Aviation, GE’s orders rose from $3.7 billion to $5.5 billion between Q2 2020 and Q2 2021, while its revenue also jumped 10% from $4.4 billion to $4.8 billion. Over the period, the company actually saw reduced interest from its military clientele, but increased demand for its commercial engines and services, driven by larger spare part orders and renewed visiting activity, proved sufficient to offset this decline.

Revenue aside, GE has generally continued to focus on making its business leaner, with the aim of driving faster turnaround times within its Commercial Services business, and solidifying its financial position. The firm has now wiped more than $70 billion off its debt since 2018, and it made a $7 billion tender during Q2 2021, while its improved balance has enabled it to reduce its credit facility by $5 billion.

Likewise, the company’s lean spending approach, including a recently-revealed UK pension freeze, has seen its liquidity rise to $22 billion, and its FY 2021 outlook for industrial free cash flow raised from $2.5 billion-$4.5 billion up to $3.5 billion-$5 billion, suggesting that the firm’s leadership is confident current levels of demand can be sustained until at least the start of 2022.

Explaining GE’s order boom

GE might not break down the performance of its 3D printing business, but it does publicize some of its high-profile machine sales, providing an insight into their relative commercial success. For instance, at the start of the quarter, powder metallurgy firm ICD Applied Technologies announced that it had acquired a Concept Laser M2 3D printer to address unspecified “demanding applications.”

Similarly, the EROFIO Group became the first to 3D print a part using a GE Additive’s Concept Laser M Line 3D printer back in June 2021, ahead of its commercial launch later this year. With regards to aerospace, the firm’s boom in demand during Q2 2021 was also seen within its additive manufacturing business, with GE Aviation 3D printing metal parts for a Safran eco-friendly open-bladed jet engine.

Such projects have since seen GE’s Aviation division start 3D printing rather than investment casting four of its own gas turbine engine parts, reducing its related costs by up to 35%, while its long-term research alongside the University of Maryland and Oak Ridge National Laboratory recently yielded a unique 3D printed heat exchanger, that’s capable of operating at temperatures of up to 900oC.

The latter project ties into GE’s wider commitment to “innovating for a more sustainable world,” and the firm has received significant U.S. government backing to take part in similar 3D printing-based initiatives moving forwards. In one such case, the company is contributing to a $6.7 million program, in which it aims to identify ways of reducing the cost of producing turbine blades for offshore wind farms.

Searching for sustainable growth

Although GE’s leadership has responded to its growth revival by increasing its FY 2021 outlook for free cash flow, the firm’s revenue, margin expansion and EPS projections remain the same. This is despite the fact the company anticipates that its commercial engine sales will continue to rise during Q3, achieving year-on-year growth, and its Aviation division will recover to become flat for the year.

GE’s reluctance to raise its revenue goals is largely down to the continued challenges posed by the pandemic, as it could still impact on its aircraft deliveries, Healthcare division and even its wider restructuring. According to Lawrence Culp Jr, the company must therefore remain focused on realising the opportunities ahead for its Renewable Energy division, and its cash flow will naturally recover as a result.

“The team is committed to innovating for a more sustainable world with leading positions in the future of flight, precision health, and the energy transition,” concluded Lawrence Culp Jr. “With our focus on profitable growth and cash generation, I am confident we are well-positioned to achieve high single-digit free cash flow margins over time.”

“GE is transforming into a more focused, simpler, and stronger high-tech industrial company.”

The nominations for the 2021 3D Printing Industry Awards are now open. Who do you think should make the shortlists for this year’s show? Have your say now.

To stay up to date with the latest 3D printing news, don’t forget to subscribe to the 3D Printing Industry newsletter or follow us on Twitter or liking our page on Facebook.

For a deeper-dive into additive manufacturing, you can now subscribe to our Youtube channel, featuring discussion, de-briefs and shots of 3D printing in-action.

Are you looking for a job in the additive manufacturing industry? Visit 3D Printing Jobs for a selection of roles in the industry.

Featured image shows the Boeing 777X jet and GE9x engine. Photo via Boeing.