On-demand manufacturing marketplace Xometry has gained $75 million in equity funding, taking its total raised since 2013 to $193 million.

The investment round was led by funds and accounts advised by T. Rowe Price Associates, with participation from Durable Capital Partners and ArrowMark Partners. Return investors such as BMW i Ventures, Greenspring Associates, Dell Technologies Capital and Robert Bosch Venture Capital also contributed to the funding.

According to the company, its revenue has doubled for each of the last five years, and it plans to use the additional capital to continue expanding on its ordering capabilities, services and its customer base.

“Xometry is focused on helping manufacturers navigate the current disruption associated with supply chain flexibility, reshoring and shift to digital manufacturing,” said Randy Altschuler, CEO of Xometry. “We’re thrilled to be working with T. Rowe Price, Durable Capital Partners and ArrowMark Partners as we build on our strong growth.”

“This funding will enable us to continue to accelerate our business through investments in our software platform, new products, and other initiatives.”

Xometry’s growing online marketplace

Founded in 2013, and based in Maryland, USA, Xometry provides a range of CNC machining, 3D printing, injection molding, and design services via its network of production partners. The company is known for its proprietary AI algorithms that connect customers, varying from start-ups to fortune 100 firms, with optimal manufacturing solutions.

Thanks to a series of substantial investments, which now total $193 million, Xometry has been able to rapidly expand its online marketplace in recent years.

An initial investment from BMW i Ventures and GE Ventures in June 2017 was followed by a further $25 million of funding, committed by the Foundry Group. Since securing another $50 million investment from Greenspring Associates, Xometry has sought to reinvest its newly-acquired capital in building on its portfolio of services.

In August 2018, the company introduced an SLA 3D printing service as well as launching a new high-definition version of its proprietary instant quoting engine. The firm’s new proprietary software platform allowed its users to see their designs in clear and precise detail, which provided them with improved manufacturability feedback.

Later, in December 2019, Xometry began its European expansion with the acquisition of fellow service provider Shift. The takeover enabled Xometry to expand on its CNC machining, sheet metal processing, and post-processing services on the continent. More recently, the company has continued to grow its marketplace via the addition of ExOne’s binder jetting services, and even launched its own credit card.

Following its latest round of funding led by T. Rowe Price Associates, Xometry has stated its intention to further expand on its product offering and develop its suite of services.

Xometry’s $75 million funding round

Although Xometry is not publicly-listed and it doesn’t publish its full financials, the company says that it has consistently doubled its revenue since 2015. As a result, the newly-raised funding can be seen as a sign of confidence from investors in the firm’s market-based business model.

The digital nature of the firm’s manufacturing business has somewhat mitigated the impact of the COVID-19 pandemic. Based on what we know of the firm’s financials, Xometry has been able to take advantage of supply chain instability, and use it as an opportunity to expand its customer base. Leveraging the additional funding, the company now intends to add to its product portfolio, in order to maintain and build on its growing number of clients.

Additionally, as part of the investment deal, Jim Rallo has joined the company as Chief Financial Officer (CFO). Rallo previously served as CFO and President of Liquidity Services, leading the company’s Initial Public Offering (IPO) in 2006. In his new role, Rallo will be tasked with maintaining the firms’ reportedly strong revenue growth into the future.

Following last month’s announcement that Desktop Metal will be going public, Rallo’s appointment could also pave the way for a similar IPO from Xometry. Speaking to 3D Printing Industry after the news broke, Arno Held, CVO of AM Ventures, said that after the pandemic, the industry would see a “strong boost in the widespread use of industrial AM.”

Consequently, now could be an ideal time to go public, as 3D printing’s reputation as a valid alternative to traditional supply chains has arguably never been higher. According to Henry Ellenbogen, Managing Partner and CIO of Durable Capital Partners, Xometry’s unique business model makes it well-positioned to take advantage of future market growth.

“Xometry has become a leader in delivering fast, cost-effective on-demand manufacturing solutions in North America,” said Ellenbogen. “Their business model enables them to continue to add manufacturing capabilities and expand globally to capture an increasing portion of the $260B global market.”

Nominations for the 2020 3D Printing Industry Awards are still open, let us know who is leading the industry now.

The fourth edition of the 3D Printing Industry Awards Trophy Design Competition is now underway. Enter your design for the chance to win a CraftBot Flow 3D printer.

To stay up to date with the latest 3D printing news, don’t forget to subscribe to the 3D Printing Industry newsletter or follow us on Twitter or liking our page on Facebook.

Are you looking for a job in the additive manufacturing industry? Visit 3D Printing Jobs for a selection of roles in the industry.

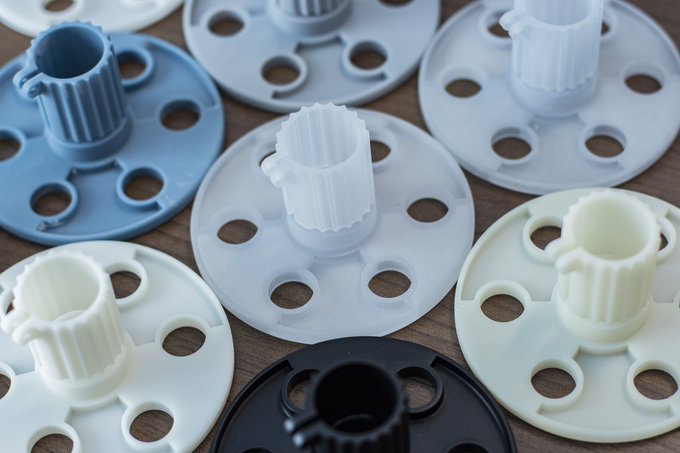

Featured image shows a range of SLA 3D printed parts produced by one of Xometry’s manufacturing partners. Image via Xometry.