3D printer manufacturer Stratasys has revealed within its latest financial results that it managed to achieve marginal revenue growth during Q1 2021.

Over the first quarter of 2021, the firm met the revenue expectations it set last year, generating $134 million, a slight 1% improvement on the $133 million reported in Q1 2020. Stratasys’ return to revenue growth can largely be attributed to a 41% increase in its system sales, which in turn, was driven by a rise in demand from its dental, medical and education clients.

Since the results were released, Stratasys’ shares have dipped by 2.5%, potentially reflecting an acknowledgement by investors that the firm matched its Q1 2020 performance, but without recording any areas of substantial organic growth in comparison to Q1 2019.

On a conference call with analysts and investors, Stratasys CEO Yoav Zeif emphasized that the company’s return to pre-pandemic revenue levels demonstrates the success of its “laser-like focus” on polymer-based manufacturing. “At Stratasys, we have committed to being at the forefront of the polymer 3D printing market,” said Zeif.

“3D printing is migrating from being primarily a prototyping tool to full-scale digital manufacturing platforms at mass-production levels,” he added. “Stratasys is leading this transformation with manufacturing applications in polymers, which we believe to be a higher value opportunity than metals.”

“We continue to be energized by the tremendous potential that our business and our industry has, especially in end-use part manufacturing.”

Stratasys’ Q1 2021 bounce-back

Stratasys reports its revenue across two main segments: Products and Services, and the former continued to generate the majority of its income during Q1 2021, bringing in $90 million. On the earnings call, Zeif attributed this figure, which represents a 9% rise compared to Q1 2020, to the firm’s network of over 200 channel partners, claiming that it’s now the “largest and most experienced” in the industry.

Impressively, the company also says that its Q1 hardware growth wasn’t rooted in the strong sales of one specific machine, but that it actually saw its revenue rise across all hardware platforms, reflecting signs of a wider economic recovery within its end-markets.

However, not all areas of the firm’s Product portfolio regained ground at the same pace in Q1 2021, and its consumables business continued to struggle. As the year progresses, the company expects to see a sequential quarterly recovery in this area, although it acknowledges that a return to consumables growth could yet be inhibited by ongoing global supply chain issues.

The company’s Services division also failed to return to pre-pandemic revenue levels during Q1 2021, generating just $44 million, 12% less than the $50 million reported in Q1 2020. In particular, the firm’s polymer manufacturing services were affected by a lack of demand from key clients in the automotive and commercial aerospace industries, which continue to suffer adversely from COVID travel bans.

To some extent, Stratasys was able to offset the revenue it lost via its Services segment during Q1, by reducing its GAAP spending on operating expenses by $5.9 million compared to Q1 2020. This 7% cut was made possible by the savings identified as part of the firm’s ‘strategic resizing,’ which was rolled-out in Q2 2020.

| Revenue $ | Q1 2020 | Q1 2021 | Variance ($) | Variance (%) |

| Products | 83m | 90m | +7m | +9 |

| Services | 50m | 44m | -6m | -12 |

| Total | 133m | 134m | +1m | +1 |

Stratasys’ action-packed Q1

On the firm’s earnings call, Zeif highlighted some of the key milestones it reached during Q1 as being central to its return to growth, including the launch of its GrabCAD partner program. According to Zeif, the establishment of an online software ecosystem, which enables the company’s clients to “better address 3D printing opportunities,” has led the platform’s membership to grow to 8.8 million.

Stratasys also released its GrabCAD connectivity Software Development Kit (SDK) in Q1, which allows customers to closely monitor their fleet of machines, and control them using MES applications. Later, as an added benefit, the company integrated the industry-standard ‘MG connect’ protocol into its systems as well, providing users with greater communication between monitoring and analytic programs.

Software advances aside, Stratasys also announced launches during Q1 with its J850 Pro and J5 Denajet 3D printers, which no doubt played their part in the company’s 41% system sales increase. Zeif reserved particular praise for the release of the J5, saying that the dental-focused system has “seen excellent customer traction,” and clients have complemented its speed, volume and ease-of-use.

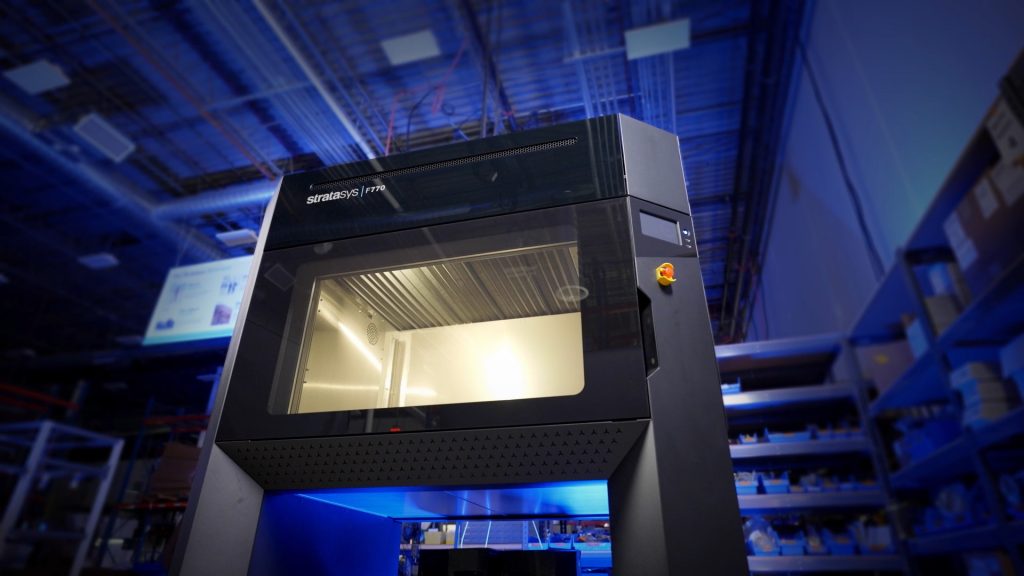

More recently, the company has announced the release of its Origin One, H350, and F770 machines, and Zeif believes that they will each “play an integral role” in its future growth. Similarly, Stratasys’ $100 million acquisition of Origin is expected to yield revenue returns by Q4 2021, while its purchase of RPS should allow it to make inroads into the SLA market, with an upturn in earnings projected for Q1 2022.

Polymer market challenges ahead?

When questioned on the earnings call about the competitiveness of Stratasys’ upcoming H350 machine, Zeif highlighted its accuracy and “exceptional nesting efficiency,” as areas where Stratasys believes it betters HP’s MJF systems. Additionally, Zeif argued that the H350 “provides full control of the printing process,” which is a vital element of material certification.

Later in the call, Zeif was also questioned on the story broken by 3D Printing Industry, that Stratasys’ heated build chamber patent has expired, potentially leading to increased competition from FDM rivals AON3D, ROBOZE and INTAMSYS. In response, Zeif quoted an aerospace client as saying that the firm “continues to have the best heated chamber on the market,” and that it only needed help to “make it a manufacturing machine.”

Zeif added that Stratasys’ software, materials and hardware portfolio, as well its line-up of regulatory and certification sign-offs, put it into a unique market position. “Even if someone comes in with a new Ultem system, it’s still many years behind us in terms of certifying it for aerospace and automotive,” argued Zeif. “Our people will also keep working on new patents, IP and better heated chambers.”

Stratasys’ outlook for 2021

Although Stratasys has decided against issuing full-year guidance due to the unpredictability of COVID-19, it has forecast growth in the “mid-teens” for Q2 2021, and anticipates this trend will continue throughout the year. With the launch of the firm’s new hardware, it also believes that its consumables will soon begin to recover, as additional product sales tend to rise two quarters after a machine’s release.

In terms of the company’s balance sheet, it raised $230 million in capital during Q1, giving it $530 million in liquid cash as of March 31 2021, and positioning it well for further expansion. Interestingly, Zeif was open about the fact that Stratasys is “actively looking for responsible M&A activities,” and suggested that the firm’s vast infrastructure makes it attractive to start-ups seeking to scale their technologies.

“Looking to the rest of 2021, we will continue to prioritize strategic investments that we expect to yield significant returns and sustained profitability in the years to come,” concluded Zeif. “With a fortress balance sheet and multiple growth opportunities in front of us, we are poised to build incremental value for our shareholders.”

To stay up to date with the latest 3D printing news, don’t forget to subscribe to the 3D Printing Industry newsletter or follow us on Twitter or liking our page on Facebook.

Are you looking for a job in the additive manufacturing industry? Visit 3D Printing Jobs for a selection of roles in the industry.

Featured image shows Stratasys’ F770 3D printer. Photo via Stratasys.