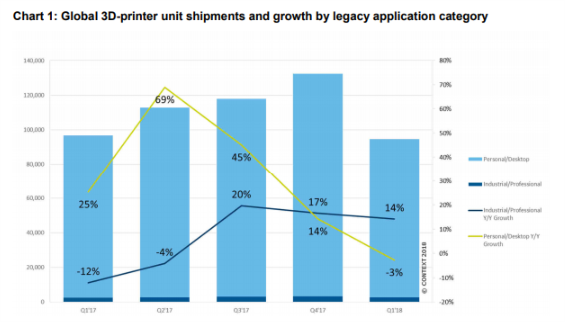

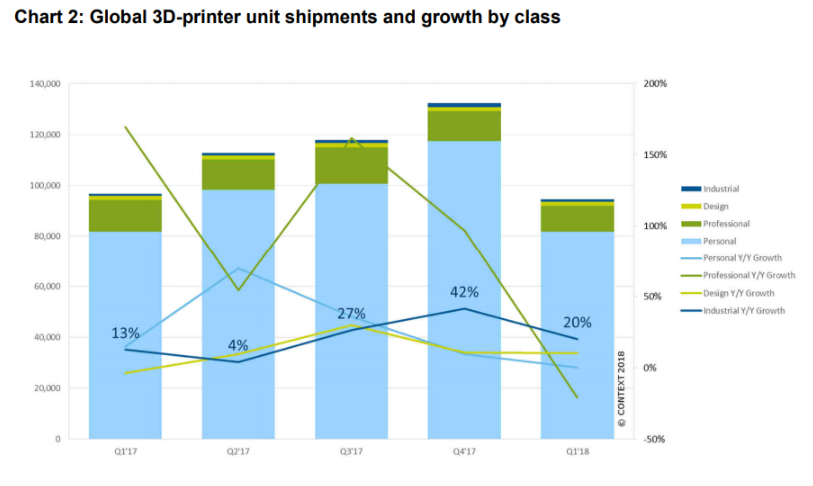

Desktop 3D printing is in decline claims new research by London based firm CONTEXT. “Shipments of Personal/Desktop 3D printers saw their first ever year-on-year drop in Q1 2018 with 3% fewer printers shipping globally than in Q1 2017,” reads the report.

How does this research match the experience of the wider 3D printing industry?

CONTEXT analyst Chris Connery avoids the, seemingly seasonal, trap of declaring the death of 3D printing*. Indeed, the primary focus of the report – like this site – is the industrial 3D printing industry.

“This near-term downturn is expected to be an anomaly rather than a trend: vendors like 3D Systems are again focusing on this class of printers,” says Connery as VP for Global Analysis at CONTEXT.

Data collection in this market segment is no easy task. Many active participants are not listed on a stock exchange, and thus as private ventures they are neither subject to auditor scrutiny nor regular publication of financial data.

Yet, as our 3D Printing Industry team spends a sizeable amount of time with manufacturers, end-users and the wider 3D printing community – we are probably better positioned than many when it comes to telling which way the wind is blowing.

Industrial 3D printing forecast for 2018

The industrial/professional 3D printing segment represents more 81% of all global 3D printer revenues, says CONTEXT. Business here is reported as solid with the segment up 14% year on year, even in the traditionally seasonally weaker first quarter.

Industrial 3D printing trade for the remainder of 2018 is set to be brisk. “We are forecasting a 21% Y/Y printer shipment growth in the Industrial/Professional segment currently ,” says Connery.

The CONTEXT report differs in methodology from other analysis of the additive manufacturing sector in that shipments rather than sales – or orders – are reported. Under the accrual basis of accounting sales can be recorded prior to physical dispatch of goods. The most recent Wohlers Report records an 80% increase in metal additive sales from 2016 to 2017.

As principal author Terry Wohlers told 3D Printing Industry at the time, “ Desktop Metal sales, reported for the first time, contributed 20.2% of the total.”

CONTEXT research found, “Desktop Metal shipments seem to still be delayed with one Reseller indicating volume shipments not until the end of the year or into 2019.” Connery says, “So we also saw great demand for Desktop Metal machines in 2017, with great pre-orders, but have not seen bulk shipments yet against those orders.”

“The biggest wildcard for this Industrial/Professional side of the market might be Desktop Metal”

Personal and desktop 3D printing forecasts

As the industrial additive manufacturing segment boasts not only substantially greater revenues and readies itself for seemingly inevitable expansion, the desktop market may feel dismayed by the CONTEXT finding that in the sub $2500 category of Personal/Desktop 3D printers 3% fewer units shipped year-on-year. In part, this decline is attributed to “the lack of a true consumer market.”

“A true consumer market would be akin to “a 3D Printer in every house. For sure the Hobbyist market is also a consumer market (and a key market for desktop 3D Printers) but the nature of a hobby is that you have to “work at it” and “tinker” with it continually where more “True” consumer devices are plug and play. True consumer markets are marked by significantly higher volumes (millions of units instead of tens or hundreds of thousands of products).”

How does the experience of enterprises working in this market match the CONTEXT data?

The XYZPrinting Da Vinci Jr is still one of the best selling 3D printers on Amazon. Vinson Chien, Director at XYZPrinting, tells me “XYZ still remains stable in Q1, 2018. Of course, growth is not as fast as previous years.”

Chien adds, “I suspect that the market will have dramatic growth in the near future, as there is still a large amount of people who are unaware of 3D printing. We will undoubtedly reach this untapped market, through community innovation, so we are not worried about small market fluctuations.”

“We will continue to provide entry-level (sub $2500) printers to the market, but we are also expanding our portfolio. We have just opened our commercial line of printers and have expanded our mid-level printers, with the daVinci Color. With such a diverse range of products, we expect to see some variation in sales within our portfolio.”

U.S. 3D printer manufacturers were also surprised by the news.

Ben Malouf, Director of Marketing Aleph Objects, Inc. said, “There was year-over-year growth in Q1 for LulzBot 3D Printers (as opposed to the decline seen in the overall personal/desktop segment.) This growth shows there is continued strong demand for versatile, reliable desktop solutions in professional and educational environments, and we are excited about the high demand for the new LulzBot Mini 2 released in June 2018.”

For a broader perspective, 3D Printing Industry asked a well established US reseller for comment. Matterhackers CEO Lars Brubaker told us, “MatterHackers has seen strong growth in all areas of 3D printing throughout Q1 and Q2 of this year, including the sub-$2500 range.”

The state of the desktop 3D printing industry in 2018

Does this new report provide useful information about the state of the 3D printing market, and if not where might be a better place to find this information?

Indicators of general trends around desktop 3D printing can be found in the users of file sharing platforms like Thingiverse and MyMiniFactory. For Thingiverse, web traffic reached a high of 12 million sessions at one point in Q1 2017, the comparative figure for Q1 2018 was 20 million. The same data for MyMiniFactory shows that traffic increased by 80%.

In retail, the supermarket chain Aldi began selling 3D printers on a seasonal basis, it will be interesting to see if the experiment is repeated this Christmas.

Looking to the most powerful retailer on the planet, another picture emerges. Amazon recently introduced 3D printing filament as an AmazonBasics product. The implication is that the data-savvy e-commerce site is reacting to simple economic forces of market demand.

However, beyond this recent move a consideration of the best selling 3D printers on Amazon should be made. And more importantly whether they are included in the recent data. The current best selling 3D printers on Amazon include the Comgrow Creality Ender 3 and Geeetech Acrylic Prusa I3 Pro B Unassembled 3D printer DIY Kit. Notably many in the sub-$2500 segment are enjoying an increased range of low cost ways to work with 3D printers – specifically machines that come in kit form.

In particular, Anet and Creality are among 2018’s most purchased, bought, sought after, and discussed by the 3D printing community. The CONTEXT data includes Prusa Research kits, but, “we generally do not include kits directly in our assessment by brand and generally only include finished goods. So Anet and Creality are not specifically included by name but are generally assessed in our “Others” category which we assess by way of tracking other areas of the Supply Chain (like hot ends).”

Adjusting the basket

Price tracking indexes, such as the UK Retail Price Index, often use a “basket” of commonly purchased goods as a proxy to comment on factors like inflation. Over time, the contents of this basket is likely to change, this is to ensure the goods in the basket still reflect average consumer purchasing behavior.

While the sub $2500 may have captured many 3D printers in the past including Makerbot, Tiertime, Flashforge, XYZ, Raise and Ultimaker the market has moved.

Now the sub $1000 bracket is where a majority of the lower priced 3D printers can be found. Many of the aforementioned group have sought to move into a higher price bracket as they market 3D printers to a engineering and design groups within enterprises. The most recent 3D printers from Raise3D and Ultimaker are solid examples of this approach.

The old basket of mainly European and North American 3D printers must now be adjusted to reflect the current market. In 2018 many of the best selling 3D printers come from Chinese enterprises, and frequently are sold in kit form.

It can be argued this has brought mixed blessing. In 2013 a 3D printer such as the UP+2 was priced around $2000, now the equivalent costs $200. However, while desktop 3D printing may be more accessible in terms of pricing, consumer experience in terms of after sales support is sometimes perceived as lower – although this is not always the case.

The commodification of consumer 3D printing

In a certain way it is possible to talk of the commodification of 3D printing.

The recent exit of Printrbot from the desktop 3D printer this week follows the decision by RepRap pioneer Dr. Adrian Bowyer to cease commercial activity at RepRapPro in January 2016.

While the departure of well liked and respected pioneers from the 3D printing market could be interpreted as a negative indication, the counterpoint is that the seeds sown ten years ago by the RepRap project are in one way bearing fruit.

It is true that many best-selling 3D printers – especially at lower price points – are Open Source in neither name nor nature, yet it is clear they share a lineage. While it may be apparent to those in the 3D printing industry that the CONTEXT report does not mark the death of 3D printing, such a phrase is likely be a headline (as it is often during summertime) in the coming weeks.

Read more about the wider impact of trade war tariffs on additive manufacturing in this article with insights from 3D printing insiders.

Get all the latest 3D printing news direct to your inbox, subscribe to the free 3D Printing Industry newsletter. Also, follow us on Twitter, and like us on Facebook.

Looking for a change of pace? Seeking new talent for your business? Search and post 3D Printing Jobs for opportunities and new talent across engineering, marketing, sales and more.

*Fellow journalists preparing an article on the annual summer death of 3D printing are invited to contact us.