How do you run a 3D printing business and what are some of the important strategic events coming up? In this article an experienced 3D printing industry leader gives insights into the future of 3D printing and how to benefit from it.

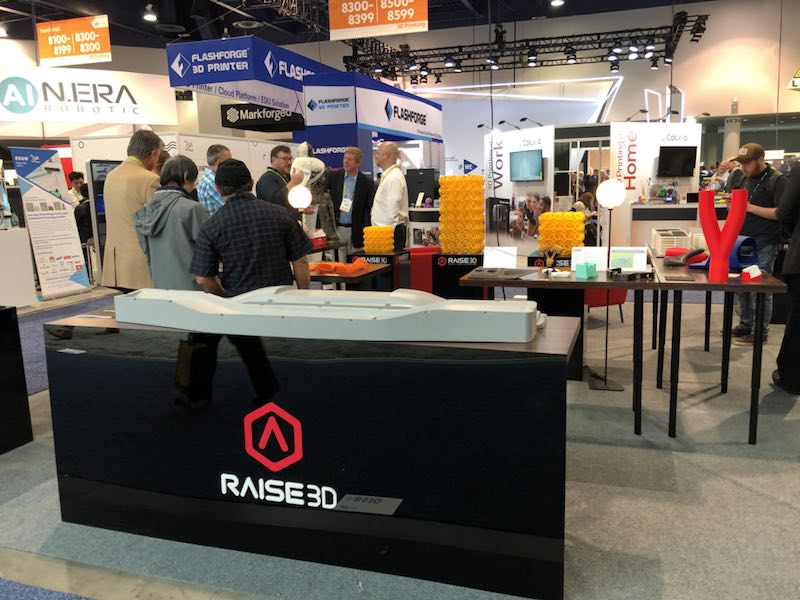

Raise3D occupies a position in the market that is increasingly likely to be contested – that of the mid-tier professional printer. Last year, the 3D printer manufacturer was shortlisted in the 3D Printing Industry Awards by our readers for the Raise N2 FFF 3D Printer. The company is highly regarded across the industry for high quality and reliable 3D printers.

I caught up with Diogo Quental the newly appointed CEO to find out more about his plans for the company.

3D Printing Industry: Congratulations on your new position as CEO at Raise3D. You have earlier experience with several 3D printing companies, what prompted you to move?

Diogo Quental: There are a lot of amazing companies and people in 3D printing. So, it was not an immediate decision. In the current situation of fast market growth, the management teams must be ambitious to drive the company to where the market goes. This usually requires a muscled organization that can adapt quickly. And it is quite a challenge to the management team, to which corresponds an even higher challenge – and often an unfair situation – to the rest of the team. Managing this balance between both teams is not easy when you need to go fast; very often these teams will have two different speeds. As a CEO, if you lose touch with the stakeholders or with the team, either you slow down (not an option in a fast-growing market) or it’s time for you to pack & go. I don’t think I am necessarily the best person in managing these balances – I tend to overspeed. Therefore, I tried to identify a position in an already fast-growing and ambitious company.

In Raise3D I have found the fit I was looking for: an ambitious management team, but also an extremely ambitious, dedicated, bright and well-prepared team ready to do whatever takes to reach the company goals. I think we are all growing together.

DQ: We are adapting our organization to our understanding about the market outlook.

From the questions we are receiving from Corporate Users (our target) and all movements we can see in the industry, we understand there is an acceleration in the transition into digital additive manufacturing.

We think that Corporations will do this transition in 5 stages:

Acquisition of a couple of units, just for basic experimentation or prototyping – currently, corporations that did not reach this stage yet are probably treating this topic as urgent;

Acquisition of a small systems (5 to 25 units), for internal training of key staff. We expect to see strong demand for this stage in early Q4;

Implementation of small scale pilot projects in manufacturing, just as a proof of concept. We expect to see in Q4 demand for this stage coming from most innovative corporations;

Implementation of real scale pilot projects in manufacturing, to ensure a full comprehensive understanding of the process and allow the scale up. We expect to see in Q3 2019 demand for this;

Gradual implementation of large scale digital additive manufacturing systems where there is a business case. We expect to see in Q1 2020 demand for this stage.

Digital additive manufacturing, depending on the industry and application, will require different types of solutions. We expect desktop based solutions to represent a substantial share of it as they have some relevant advantages:

Versatility of material and application use: the system can be used to manufacture different parts with different materials, and at the same time;

Ease of use: contrary to industrial 3D printers based solutions, with desktop based ones the learning curve is extremely short, which increases the ROI and reduces the operation risk associated with RH turnover;

Fully scalable: manufacturers can easily adapt their investment to their internal stage of development and to their cash flow;

High Overall Operational Effectiveness: downtime risk is mitigated by the quantity of units included in the solution;

Low usage cost: the price of materials to be used in desktop solutions is lower than equivalent materials to be used in industrial solutions;

Low maintenance cost: the level of skills required, and the cost of spare parts is lower when compared with industrial solutions.

Our strategic approach is to prepare Raise3D to be a top contributor in this transition, by offering the right solution in each stage of the market development. Currently, we are focusing on:

identifying and developing a close collaboration with the best Sales Partners, who are a key success factor for the implementation of our strategy;

gain deep internal knowledge about selected Vertical Markets and needs of most demanding Corporate Customers;

aligning the product, filament, software and services’ development roadmap with the expected market development.

DQ: We think it makes all sense and we will probably meet somewhere in the middle.

The reasons are simple:

On one hand, as the market gets better informed about the real output of desktop solutions, it becomes clear that a substantial part of their needs – for which currently they use the “traditional” solution providers – can now be fulfilled with printers like the ones Raise3D designs and manufactures. This puts pressure on the incumbent “traditional” players to lower the prices of their products.

On the other hand, there is still a substantial gap between the level of knowledge of those “traditional” players and companies like Raise3D. This gap still somehow justifies, at least partially, the price difference for what are apparently similar solutions, as “traditional” players can fully understand the needs of Corporate users and provide them with tailored solutions.

There is a learning curve for companies like Raise3D to master and this cannot be done without a substantial investment. Therefore, we also expect a general increase in the prices of desktop solutions.

3DPI: What can we expect from Raise3D in 2018?

DQ: Well, there is so much to do to in such fast-growing market, that one can only expect a lot from a company like Raise3D.

Internally, we are working on our “muscle toning project”. We know that the market will evolve very fast. Therefore, if we only focus on providing the best solution for current needs, there is the risk of ending up with a fat organization. Instead of that, we want to focus on properly organizing the company and developing the Team, in such a way that we can easily evolve with the market. We see the Team as our most stable competitive advantage.

We are also working to have a closer collaboration with key Sales Partners in the on-going market transition to digital additive manufacturing. And we will pursue collaboration with leading innovation companies, such as the filament manufacturers who are participating in our Open Filament Programme.

From a customers’-eye view, all this will translate into a more knowledgeable Raise3D, with a far better communication, able to provide Corporate Solutions with an increased value. This is still a bit early for us to say more, but I mentioned before that we want to have the right solution in the right market timing.

3DPI: How do you see the wider 3D printing industry changing this year?

DQ: Currently, the level of know-how required to be in the market is quite high and growing very fast. This is likely to slow down the number of new 3D printing companies and to put additional pressure on non-performing ones.

In the meantime, this can also create some interesting opportunities to large corporate users to have a fast track to access know-how, by buying players with a poor performance.

On a different perspective, we expect the gap between “traditional” 3D printing companies and desktop 3D printing manufacturers to narrow steadily, thus benefiting Customers and fuelling further market growth.

It is possible, however, that 2018 will remain in our memory mainly as the year where materials’ manufacturers will shine! There is a powerful silent revolution inside the on-going revolution in the filament that some manufacturers are bringing to the market. Soon, it will be possible to extrude new formulas of filament that can be extruded in a normal desktop FFF printer and, after curing, have properties similar (maybe even better?) to injected metal. The consequences of this breakthrough innovation will certainly be huge.

Nominations for the second annual 3D Printing Industry Awards are now open. Make your selections now.

For more stories on 3D printing and aerospace applications, subscribe to our free 3D Printing Industry newsletter, follow us on Twitter, and like us on Facebook.