The International Data Corporation (IDC) has updated its Worldwide Semiannual 3D Printing Spending Guide forecasting market-wide spending on additive manufacturing throughout 2018.

IDC’s international team of analysts looked at key markets across 9 regions including Europe, Asia/Pacific and the U.S.

In the trifecta of 3D printing, hardware will constitute $6.9 billion, materials $6.7 billion, and software will experience a slower growth than the rest of the market.

Led by The Big Three: Automotive, Aerospace and Medicine

Of the 7+ industries analyzed Discrete Manufacturing, i.e. making distinct items such as cars, planes and toys, is expected to come out on top of spending. Second, is 3D printing in healthcare, with an estimated total spend of nearly $1.3 billion in 2018.

A number of heavyweight industrial projects are likely to contribute to this trend. In 2017 defense and aerospace manufacturer Lockheed Martin spent $350 million on a new center for advanced satellite production that would include industrial additive manufacturing. In medical, one of the biggest spends of the year was laid out by the National Institutes of Health’s $6.25 million center for 3D bioprinting and regenerative medicine.

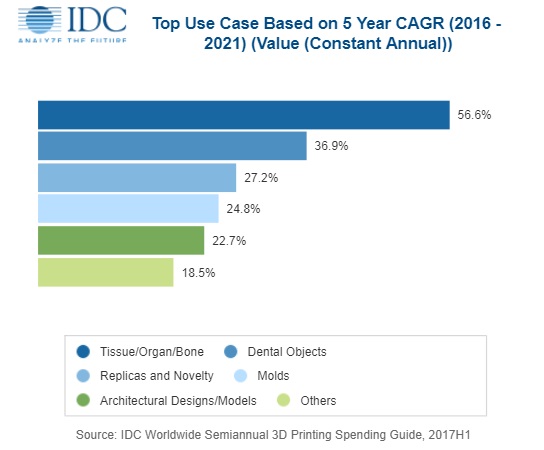

Healthcare is also expected to experience the fastest growth, turning an estimated compound annual growth rate (CAGR) of 35.4%. 3D printing/bioprinting solutions for tissue, organ and bone are cited as leading the spend.

On-demand services

Marianne D’Aquila, research manager, Customer Insights and Analysis at IDC comments, “3D printing solutions have moved well beyond prototyping, to become prevalent within and across multiple industries.”

As such 3D printing services, offered by specialist 3D printing bureaus and 3D printer manufacturers, are expected to reach an annual spend of £5.5 billion by 2021, with a focus on on-demand part production and supply-chain system integration.

D’Aquila continues, “Parts for new products, aftermarket parts, dental objects, and medical support objects will continue to see significant growth opportunities over the next five years as 3D printing goes more mainstream.”

“The healthcare industry is also poised to double its share of spend through 2021 as the benefits of cost-effective customized printing continue to be realized.”

The tip of the iceberg

As expected, the U.S. will be the region doing the most spending in 2018 and Western Europe follows, together providing almost two thirds of the forecasted goals.

Interestingly China, who dominated the floor at CES 2018, will be the third largest region with more than $1.5 billion in spending this year.

Overall, 6 of the 9 regions analyzed will experience a CAGR greater than 20% by 2021.

IDC’s Worldwide Semiannual 3D Printing Spending Guide is available in summary online here.

“Even though there are amazing innovations nearly every day in the way 3D printers are used in key industries, including automotive, aerospace, and medical,” concludes Tim Greene, research director, Hardcopy Peripherals and 3D Printing,

“we believe that we’re still just scratching the surface of the potential for 3D printing as an enabler of digital transformation.”

Nominate the best of 3D printing in the second annual 3D Printing Industry Awards here.

Stay on top of trends – subscribe to the 3D Printing Industry newsletter, follow us on Twitter, and like us on Facebook here.

Featured image shows a graphic representating all the areas consider in IDC’s Semiannual 3D Printing Spending Guide 2018. Image via IDC