Voting shortlists for the 2021 3D Printing Industry Awards are now open. Who do you think should receive top honors this year? Have your say now.

Market intelligence specialist CONTEXT’s latest industry report has revealed that shipments of the 3D printing sector’s most expensive machines rose dramatically during Q2 2021.

During the quarter, the firm says that the sales of 3D printers costing over $20,000 bounced back after a COVID-hit 2020, with the top producers of industrial systems reporting “exceptional organic shipment growth.” While CONTEXT’s data shows that such shipping still didn’t return to pre-pandemic levels, it also highlights how users are turning to 3D printing to secure supply chains, creating future opportunities.

“As economies around the globe continued to recover from, battle against or learn to live with COVID-19, organizations began to settle into their new normal,” said Chris Connery, VP of Global Research at CONTEXT. “While capital expenditures were largely put on hold a year ago, spending had opened up by the second quarter of this year and this led to phenomenal year-on-year shipment growth.”

Charting an industrial recovery

CONTEXT’s latest figures reinforce what it found in Q1, that the recovery of Western 3D printing markets was gathering pace, and suggest this trend could well continue into the near future. Between Q2 2020 and 2021, the firm’s data shows that the shipments of ‘industrial’ machines priced more than $100,000 rose by 61%, while those of ‘design’ systems priced $20,000-$100,000 also jumped by 43%.

Although these figures represent a respective 10% and 5% decline against the pre-COVID period of Q2 2019, CONTEXT points out that an industrial and design recovery saw their shipments account for 64% of all printer revenue earned during Q2 2021.

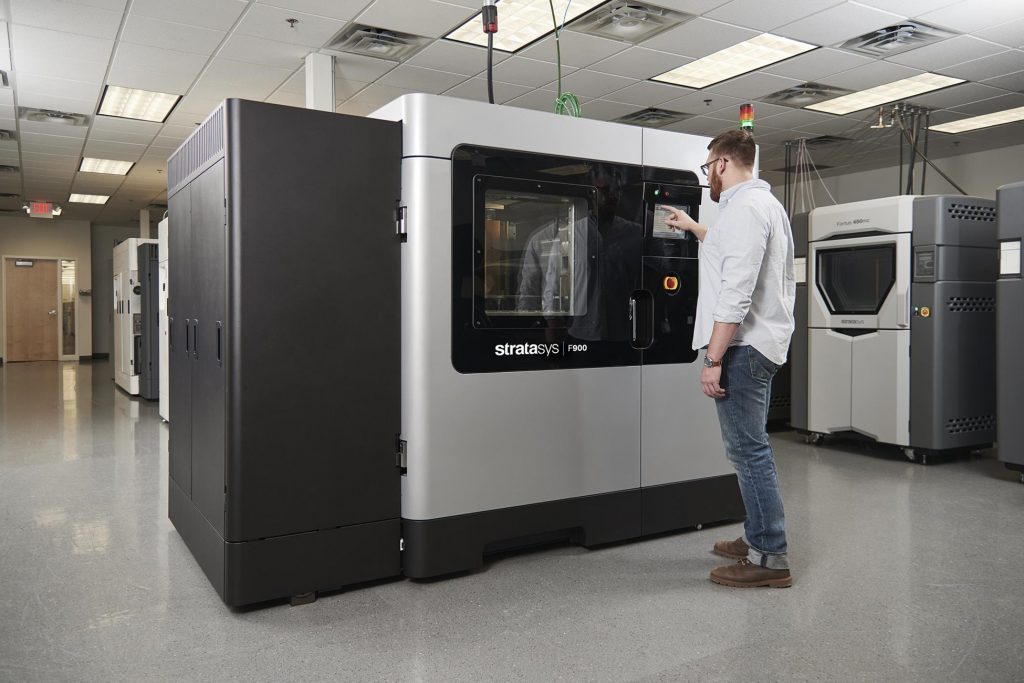

Compared to last year, when the company reported soaring Chinese domestic shipments, it also says that this “super-acceleration” is “leveling off,” and most shipping rises were seen in North America. In particular, the firm has identified the growth exhibited by eight of the top ten industrial system manufacturers as being behind this trend, with Stratasys, 3D Systems and UnionTech all putting in strong revenue performances.

When it comes to customers, CONTEXT suggests that vendors saw a growth in demand from clients within their long-standing dental and aerospace verticals in Q2, as well as those in new sectors. In fact, according to the firm’s data, pandemic-induced supply disruption has now created an appetite among manufacturers to “explore technologies” which help mitigate future risks, including 3D printing.

Dovetailing desktop shipments

In stark contrast to the 68% rise in desktop printer shipments it identified during H1 2020, due to an increase in home working because of COVID-19, CONTEXT has now reported a complete reversal of this trend in Q2 2021. The firm’s data shows that sales of the sub-$2,500 pre-built desktop category it dubs ‘professional’ machines, fell by some 32% from Q2 2020 to Q2 2021.

Similarly, shipments of what CONTEXT refers to as ‘DIY’ systems may have risen 18% over the same period, but this marked a significantly lower level of growth than that seen during previous quarters. While the company’s analysis has revealed that resin LCD machines seem to buck this trend, as they accounted for 46% of all fully-assembled printers sold in Q2 2021, it adds that hobbyist demand is “waning.”

Comparatively, CONTEXT says that the shipments of more capable ‘professional’ printers, like those produced by Markforged or Photocentric, were less affected by the COVID outbreak in Q2 last year, thus their 38% annual increase is unsurprising.

Instead of attributing this growth to a rise in demand, the firm credits it to the launch of new machines in the category by established manufacturers. CONTEXT highlights Formlabs’ SLS-based Fuse 1 3D printer as a prime example of this, and also points to the strong annual shipping growth of UNIZ, Zortrax and Desktop Metal 3D printers (via its EnvisionTEC subsidiary), as being a key contributing factor.

Taking the wildly-varying Q2 performances of 3D printing’s different machine grades into account, the company has forecast that FY 2021 will end in “great year-on-year growth” for the sector, with shipments expected to be 9% above FY 2019 levels. However, according to Connery, these projections don’t necessarily represent organic growth, and the picture is slightly different once M&A activity is removed.

“Optimism needs to be tempered when it’s based on marketing activities associated with new public listings,” adds Connery. “The outlook for the 3D printer-only market is further clouded by the fact that individual companies have seen growth as a result of mergers and acquisitions, [but] even parsing out individual technology trends and focusing only on net-new shipments, forecasts for 2021 are robust.”

Cross-analyzing CONTEXT’s data

While market analyses aren’t always able to capture the complexities of their target sectors, on this occasion, CONTEXT’s appears to align with the financials published by 3D printing firms themselves. During Q2 2021, Prodways achieved 44% revenue growth, generating a significant amount of this via dental sales to the Straumann Group, which is in keeping with the trends identified by CONTEXT.

Likewise, CONTEXT’s assertion that the growth seen in professional system sales during Q2 was down to new product launches, is supported by Markforged’s financial results. Having reported a 44% annual revenue rise for the quarter, the firm’s CEO Shai Terem hailed the success of its “new key products and software updates” as being vital to its strategy of “meeting growing demand for its solutions.”

Elsewhere, when it comes to the increased M&A activity Connery refers to, it is well-publicized that 3D printing firms continue to use acquisitions as a way of accessing new markets. In one such case, Stratasys recently bought over Xaar 3D, in a move that will provide it with full control over a HSS development team, which will now work on its H Series systems moving forwards.

To stay up to date with the latest 3D printing news, don’t forget to subscribe to the 3D Printing Industry newsletter or follow us on Twitter or liking our page on Facebook.

For a deeper dive into additive manufacturing, you can now subscribe to our Youtube channel, featuring discussion, debriefs, and shots of 3D printing in-action.

Are you looking for a job in the additive manufacturing industry? Visit 3D Printing Jobs for a selection of roles in the industry.

Featured image shows Stratasys’ F770 3D Printer. Image via Stratasys.