Market insights firm CONTEXT has reported that 3D printer shipments in U.S. and European markets are starting to recover but remain below pre-pandemic levels.

In H1 2020, CONTEXT identified a rapid rise in domestic demand for Chinese industrial 3D printers, which saw the shipment growth of native firms outstrip that of their Western rivals. However, with its Q1 2021 figures, the company now says that this recovery is starting to be reflected in the U.S. and Europe too, with the overall number of high-end 3D printer shipments rising by 43% compared to Q1 2020.

“Shipments of new products continue to be a main driver of growth in the 3D printer industry, indicating that markets remain eager to try new technologies in an effort to find the ever-elusive silver bullet,” explains Chris Connery, VP of Global Analysis at CONTEXT. “With more new products on the horizon this year than seen in recent periods, the projection for 2021 is now one of solid shipment growth.”

A cautious industrial outlook

Following CONTEXT’s earlier reports of sequential shipment growth in Q3 2020, its latest analysis has identified an acceleration of this trend, particularly within the industrial polymer printing market. Compared to Q1 2020, the shipments of such systems increased 74% in Q1 2021, outstripping figures from Q1 2019 by 12%, but this wasn’t reflected in the shipping of high-end metal printers, which rose by just 4%.

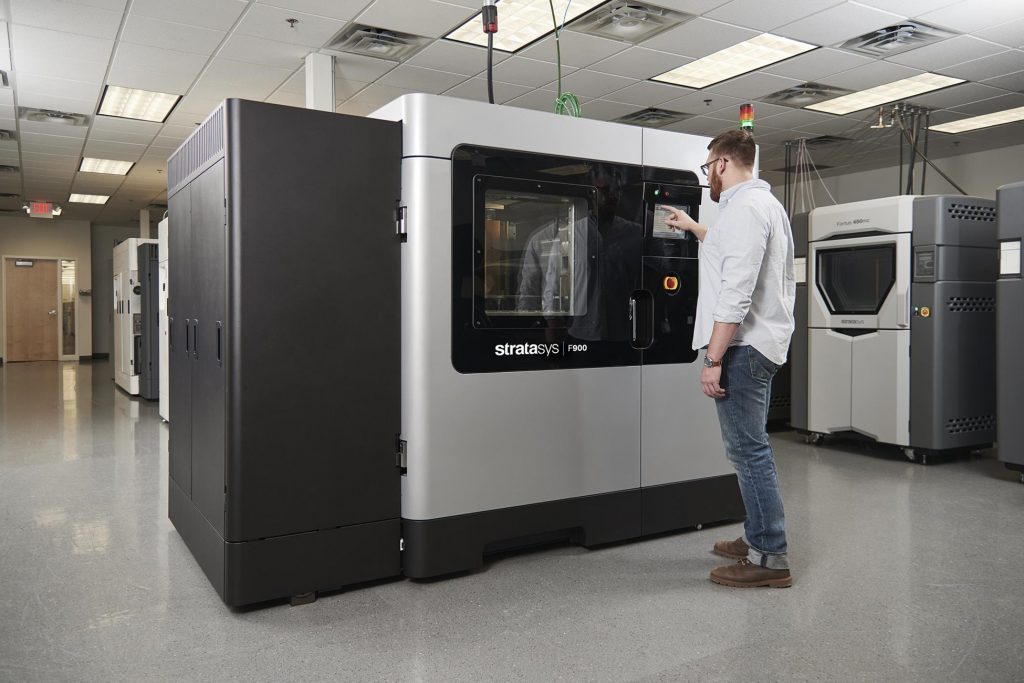

According to CONTEXT, this rebound in high-end polymer system demand can be attributed to growth from China’s UnionTech, as well as strong sales performances from Stratasys, Carbon, HP, 3D Systems and EOS. However, despite these positive insights, the analysis firm also cites the ongoing Western vaccine rollout as a factor in China remaining the largest market for industrial shipments during Q1 2021.

Additionally, over the course of Q1 2021, global shipments of industrial 3D printers still lagged 3% behind the figures achieved in Q1 2019, and looking ahead to H2 2021, Connery says that COVID-related restrictions could yet disrupt vital in-person trade shows like RAPID and Formnext, adding that their potential reach “is still unclear.”

Analyzing the ‘COVID bump’

In terms of what CONTEXT dubs ‘design’ class machines, priced from $20k-$100k, it attributes the majority of the segment’s 11% annual shipment growth to Western firms. While Chinese demand for design-level systems did increase by 66% between Q1 2020 and Q1 2021, companies operating outside of Asia accounted for 81% of total sales, with Stratasys, 3D Systems and EnvisionTEC majorly driving shipments.

Professional 3D printers, or those costing $2.5k-$20k, benefited from a “COVID bump” according to CONTEXT, in which workers have increasingly sought out feature-rich systems for working from home. Compared to the pre-pandemic period of Q1 2019, the unit-volume shipments of professional machines grew by 22% in Q1 2021, with revenue generated in this area rising 45% over the same period.

Finally, with regards to personal, kit and hobbyist printers costing less than $2,500, CONTEXT has questioned whether the boom in demand seen during the pandemic is sustainable. The analysis firm speculates that supply shortages may have caused double ordering, skewing figures, while fully-assembled system shipments fell 24% sequentially, indicating inconsistent growth across the category.

A COVID-dependent recovery

While CONTEXT’s analysis of Q1 2021 paints a mixed picture of a partially-recovered 3D printing industry, it says that it’s long-term outlook for the sector remains “exceedingly positive.” Having liaised with many machine vendors, the firm has found that interest in metal systems from new clientele is starting to ramp up, with particular interest being expressed from within the oil and gas industry.

Once the rest of FY 2021 has played out, CONTEXT is also forecasting a 23% rise in revenue gained from the sale of industrial, design and professional systems to “institutional” clientele. While anticipating that polymer launches from Markforged and Desktop Metal will drive sales growth, CONTEXT sees metal-centric releases from Nexa3D, Essentium, SLM Solutions and ExOne as vital to this as well.

Ultimately, the company’s projection for FY 2021 is one of “solid shipment growth compared to both 2020 and 2019 for all types of printers,” which marks the continued transition of 3D printing from prototyping into full-scale manufacturing, but Connery also retains at the report’s conclusion, that these predictions depend heavily on the pandemic continuing to recede.

“All this activity bodes well for growth in 2021 – as long as global COVID recovery is not halted,” concluded Connery. “The longer-term outlook remains bullish for the AM technologies most focused on volume serial production (including powder bed fusion and vat photopolymerization of polymers and binder-jetting of metals), as the movement of 3D printing into serial production, rather than merely prototyping, accelerates.”

The nominations for the 2021 3D Printing Industry Awards are now open. Who do you think should make the shortlists for this year’s show? Have your say now.

To stay up to date with the latest 3D printing news, don’t forget to subscribe to the 3D Printing Industry newsletter or follow us on Twitter or liking our page on Facebook.

For a deeper-dive into additive manufacturing, you can now subscribe to our Youtube channel, featuring discussion, de-briefs and shots of 3D printing in-action.

Are you looking for a job in the additive manufacturing industry? Visit 3D Printing Jobs for a selection of roles in the industry.

Featured image shows Stratasys’ F770 3D printer, one of the systems CONTEXT has identified as being behind ‘design’ machine shipment growth. Photo via Stratasys.