Market insights firm CONTEXT has published a report claiming that the Chinese and desktop 3D printing markets are leading the global recovery from the COVID-19 pandemic.

According to the company’s analysis, China’s domestic industrial 3D printer shipments jumped by 24 percent between Q1 and Q2 2020, while the global shipments of desktop systems increased by 68 percent in the same period.

By contrast, between Q2 2019 and Q2 2020, CONTEXT’s dataset shows a 38 percent decline in the revenue gained by Western firms from industrial systems. These figures suggest that for now at least, the broader industrial recovery remains firmly rooted in China, but the desktop market continues to grow around the world.

“As China came back online in Q2 2020, so too did demand for industrial printers,” said Chris Connery, VP of Global Research at CONTEXT. “Indeed, many Chinese vendors reported seeing shipments not just rise compared to Q1, but also witnessed even higher shipment rates than a year ago.”

“While overall shipments improved slightly from Q1 to Q2 thanks mostly to a bounce back in China, they remained very low in Western markets,” added Connery.

Is desktop 3D printing on the rise?

CONTEXT’s research, which tends to focus on shipments rather than sales, has portrayed an increase in client demand for desktop systems as a key recovery driver across the wider industry. Within the firm’s report, it broadly identifies desktop machines under two main categories: ‘professional’ systems priced from $2.5k to $20k, and ‘personal’ printers worth $2.5k or less.

In the professional category, the company’s data draws a direct link between the home-working necessitated by COVID-induced lockdowns, and a marginal increase in desktop shipments. What’s more, as professional users continue to seek more robust feature sets, global desktop system producers have been able to raise prices, enabling them to grow revenue by 7 percent between Q2 2019 and Q2 2020.

Although Ultimaker isn’t publicly-listed and doesn’t publish its full financials, the company reported “double-digit” revenue growth during H1 2020. As a result, even though it’s not possible to verify Ultimaker’s claims, they do appear to reflect this trend, in that engineers working from home are increasingly becoming a market for these professional machines.

PPE production and shipment growth

Similarly to CONTEXT’s professional system numbers, its data on personal printers also shows a surge in demand, but on a quarterly basis between Q1 and Q2 2020, and on a larger scale at 68 percent. Given that many low-cost machines are shipped via supply chains related to China, the country’s early recovery from the pandemic in Q2 may well have contributed to this boost in shipments.

Interestingly, Connery identified one growing market for desktop systems as having had a particular impact on the growth in shipments made during Q2: professionals making PPE. Although he stopped short of saying that it made up for the revenue lost via closed markets, Connery said that hobbyist activity represented a quick-win for the industry during the quarter.

“It is generally anticipated that the need for PPE (and thus the printers to make PPE), was only short-term,” explained Collins. “But the expectation is that this strange pandemic phenomenon helped put 3D printing back on the radar for many general consumers and hobbyists.”

Although the analysis firm’s claims surrounding the hobbyist production of PPE have been widely-reported, its assessment of industrial markets is less conclusive. While there’s no doubt that many industrial firms ceased production during lockdown, CONTEXT’s claim that this led to a 27 percent decline in the revenue of system producers doesn’t tell the whole story.

SLM Solutions for instance, reported 90 percent revenue growth during H1 2020, reflecting the company’s strong order backlog and loyal customer base. Consequently, it can be concluded that while desktop shipments grew during Q2 2020, that not all industrial system manufacturers have been impacted on in the same way by COVID-19.

CONTEXT’s data shows an uneven recovery

In addition to identifying a trend towards the adoption of desktop systems, CONTEXT’s report also asserts that 3D printing demand hasn’t recovered evenly around the world. According to the firm’s data, global aggregate revenues from new printer shipments rose by 5 percent from Q1 to Q2 2020, but the majority of this growth originated in China.

Chinese manufacturer Farsoon for example, doesn’t publish its full financials, but reported earlier this month that its revenue had doubled between Q1 and Q3 2020. Given that the pandemic eased in China before it did elsewhere, it’s possible that Chinese firms are slightly ahead in a longer ‘U-shaped’ recovery, but this could be levelled-up as COVID-19 subsides.

In terms of recovering the demand for industrial systems in Western markets, CONTEXT has surveyed a number of vendors that reported a “renewed interest” in 3D printing technology throughout Q3. Although this proposed recovery is somewhat pandemic-dependent, the firm’s data also shows that the final quarter usually accounts for 29 percent of each year’s shipments.

Of course, some companies’ sales performance follow different seasonal trends to others, but Q4 could be shaping up as an important financial period for a number of 3D printing firms. Connery wouldn’t commit to a definitive position on the chances of a significant Western recovery in Q4, but did say that while this is still “hopeful,” it’s “looking more challenging as the pandemic lingers longer.”

To stay up to date with the latest 3D printing news, don’t forget to subscribe to the 3D Printing Industry newsletter or follow us on Twitter or liking our page on Facebook.

Looking for a new podcast? Be sure to subscribe to the Another Dimension podcast on your chosen podcast player to make sure you never miss an episode.

Are you looking for a job in the additive manufacturing industry? Visit 3D Printing Jobs for a selection of roles in the industry.

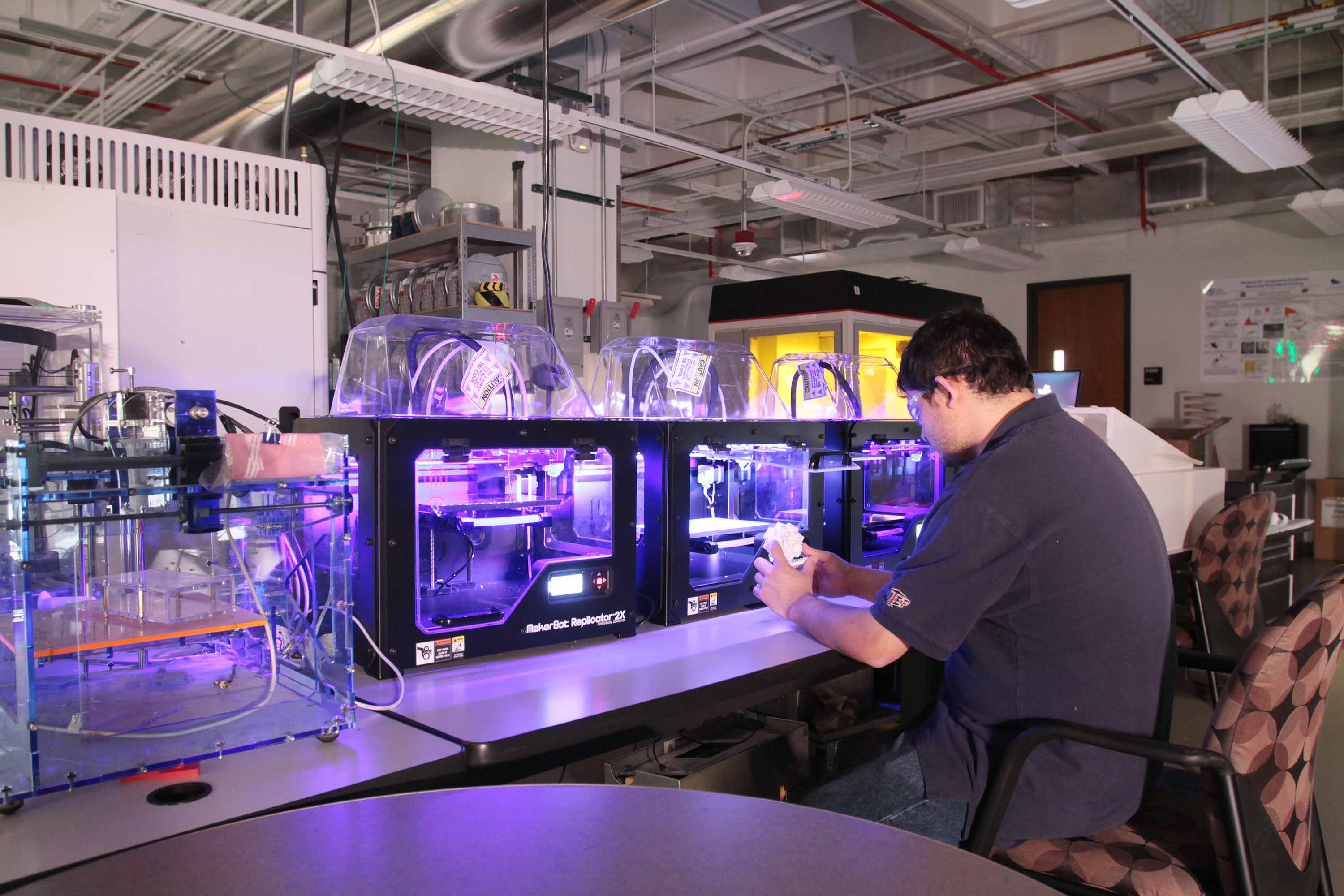

Featured image shows a desktop 3D printer farm at UTEP Keck Center. Photo via UTEP/Keck.