Award winning 3D software company Autodesk (NASDAQ:ADSK) has reported is financial earnings for full fiscal year and fourth quarter 2019.

Headline revenue the year ended January 31, 2019 was reported at a record $2.57 billion, compared to $2.1 billion in 2018. For Q4 2019, revenue was reported at $737.3 million, an increase of 33.13% on Q4 2018 which was $553.8 million.

As a performance metric, Autodesk also reports an Annualized Recurring Revenue (ARR) of its Maintenance and Subscription plans. To be viewed independently of revenue, total ARR for FY2019 was reported at $2.75 billion, with Subscription plan ARR accounting for $2.20 billion.

“Fusion is really on fire”

Autodesk is the developer and provider of a variety of different 3D design tools used across industry. Most familiar to an additive manufacturing audience perhaps is its 3D modeling and simulation software Maya, and the Fusion 360 and Netfabb offerings, both of which have earned the company 3D Printing Industry Awards.

Throughout 2018, and the company’s FY2019, notably in 3D printing Autodesk launched Netfabb 2019; inaugurated a multi-million dollar advanced manufacturing center in the UK; and it adopted the 3MF file format – the successor to the .stl. In addition, the company entered into a number of additive manufacturing partnerships with OEMs and research institutions, including Farsoon Technologies and NASA’s Jet Propulsion Laboratory (JPL) – that will be making use of the company’s generative design tools.

Autodesk generative design is provided through a feature for its Fusion 360 software which has been part of the company’s product consolidation. When speaking to investors on the call FY2019’s results, Andrew Anagnost, Autodesk President and CEO, said “Fusion is really on fire […] in terms of user growth, [it is] probably the fastest growing platform in the industry right now.”

Addressing generative design in particular, Anagnost added, “There’s traditional hardline manufacturers that are using the generative capability inside of Fusion to kind of explore a series of design options that would traditionally kind of have been 3D printed natively and then what they’re doing is saying wow, this is a better than I ever had, and they turned it into enrolment. So they’re actually using the capability inside of Fusion to explore design space they never explore it before.”

In another recent announcement, for FY2020, the company also confirmed that it would be opening a specialist Generative Design Field Lab in Chicago to maximise the potential of this tool which has proved useful to partners including HP and GE Additive.

Of course, the company’s software portfolio does reach much further than additive manufacturing however, and a number of more wide-reaching milestones were also completed throughout the year. Speaking generally about the past 12 months for the company Anagnost, said, “In fiscal 2019, we achieved multiple milestones putting us in an excellent position to deliver on our fiscal 2020 targets and advance the company to the next chapter of growth.”

Autodesk revenue by category

Autodesk revenue is reported in three categories: Subscription, Maintenance and Other. Subscription refers to net revenue generated by leasing its software products, both as desktop and SaaS platforms to customers. Maintenance refers to the upgrade and technical service plan Autodesk provides to customers of its software. And Other encompasses the company’s revenue from consultancy, training and further, miscellaneous services.

| Revenue | Q4 2019 | Q4 2018 | Variance $ millions | % |

| Subscription | 550.00 | 293.70 | 256 | 87.27% |

| Maintenance | 137.40 | 219.80 | -82 | -37.49% |

| Other | 49.90 | 40.30 | 10 | 23.82% |

| Total | 737.30 | 553.80 | 184 | 33.13% |

For FY2019, Subscription revenue was reported at $1.8 billion, a 101% increase on FY2018 Subscription revenue which was $894.3 million. For Q4 2019, Subscription revenue was $550 million, compared to $293.7 million for the same period in 2018.

Of the total $2.57 billion in revenue for FY2019, Maintenance in Q4 2019 accounted for $137.4 million, compared to Q4 2018 Maintenance revenue which was $219.8 million. For the FY2019, Maintenance revenue was $635.1 million, a decrease of -35.82% compared to to FY2018 which was $989.6 million.

For FY2019, Other revenue was reported at $132.40 million compared to FY2018’s Other revenue of $172.7 million. For Q4 2019, Other revenue was $49.9 million, up 23.8% on revenue for the same period in 2018 which was $40.3 million.

| Revenue | FY 2019 | FY 2018 | Variance $ millions | % |

| Subscription | 1,802.30 | 894.30 | 908 | 101.53% |

| Maintenance | 635.10 | 989.60 | -355 | -35.82% |

| Other | 132.40 | 172.70 | -40 | -23.34% |

| Total | 2,569.80 | 2,056.60 | 513 | 24.95% |

Net loss for the full year 2019 was reported at $80.8 million, compared to FY2018’s net loss of $566.9 million.

Referencing the business segments in his statement about the results, Anagnost said, “With less than 20 percent of our revenues coming from maintenance, we are effectively finished with our business model transition and now look forward to executing on our multi-year growth strategy.”

Business model transition

The company ends the year with $886 million in cash and cash equivalents that, along with marketable securities, accounts receivable, prepaid expenses and other current assets contribute to $1.6 billion in total current assets. In 2018, the company ended the year with $1.1 billion in cash and cash equivalents, and total of $1.8 billion in total current assets.

Scott Herren, Autodesk CFO, concludes, “With over $300 million in free cash flow for the year, we delivered well above our target and are demonstrating the cash generating power of our model. Fiscal 2019 was a year of solid execution as we accomplished multiple financial milestones that have positioned us well to keep driving growth in fiscal 2020 and beyond.

“We’re exiting the business model transition with a much more predictable business at 95 percent recurring revenue and feel confident about our free cash flow goal for fiscal 2020.”

The full financial results for Autodesk’s Q4 and FY2019, including FY2020 guidance, is available here.

For more of the latest 3D printing financial results subscribe to the 3D Printing Industry newsletter, follow us on Twitter and like us on Facebook. Seeking jobs in engineering? Make your profile on 3D Printing Jobs, or advertise to find experts in your area.

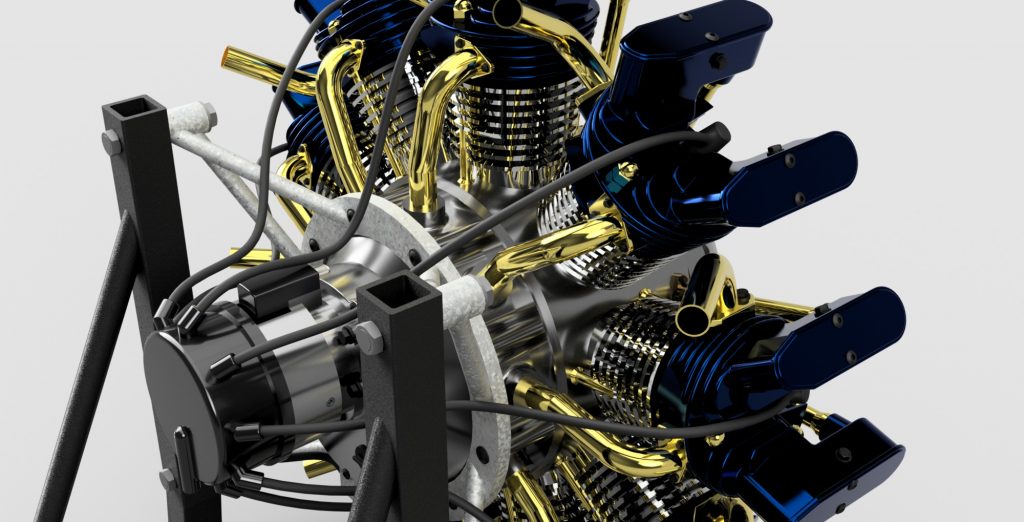

Featured image shows different permutations of a model made using generative design. Screengrab via Autodesk.