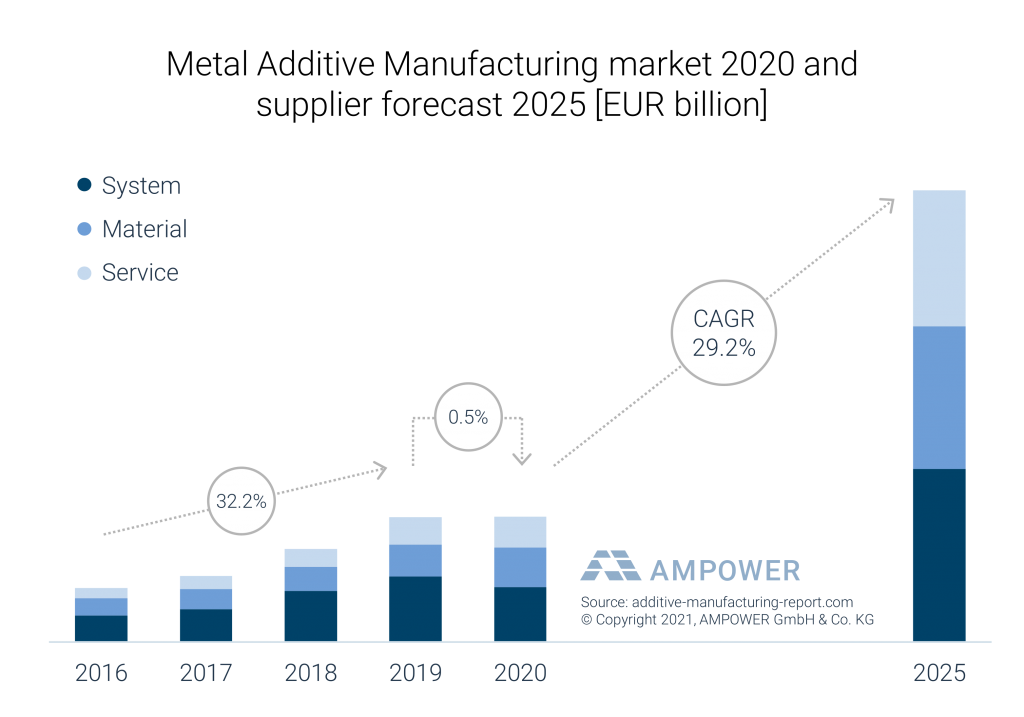

Industrial 3D printing consultancy specialist AMPOWER has predicted that metal additive manufacturing will achieve annual growth of more than 29% over the next four years.

In the advisory firm’s latest market research, it found that although COVID-19 has restricted recent revenue increases to materials and services, a rapid recovery will soon see metal 3D printing grow by over 29% until 2025. AMPOWER’s report also values the polymer 3D printing market at twice that of metal, but only anticipates annual growth there of 15%, due to the continued prevalence of PBF systems.

“Powder bed systems still account for the majority of 3D printing processes in the industrial sector for both metal and plastic,” said Dr. Maximilian Munsch, Co-author and Partner at AMPOWER. “For 2025, we expect a decrease in this share and a significant increase in sales of alternative additive technologies such as Binder Jetting (BJT) in metal, and Area Wise Vat Polymerization (DLP) in polymer.”

“In the future, new technologies will continue to decisively drive growth.”

Metal AM tipped to recover

Based on over 300 interviews conducted with industry sources, AMPOWER’s survey has been targeted towards machine suppliers, enabling it to cover around 10% of the global system install base. The research has also placed an emphasis on talking to end-users, yielding a mixed market dataset that’s designed to predict future developments.

In general, the company’s report found that the pandemic has caused the metal 3D printing market to stagnate, with revenue generated from equipment sales suffering from an acute fall in demand. Customers were especially reluctant to invest in the aviation sector during 2020, although AMPOWER’s research indicates that this was somewhat offset by increased investment within the space segment.

Similarly, the firm’s report makes reference to U.S-based manufacturers driving demand with the development of 3D printed rocket engines, reflecting the progress of companies like Relativity Space and Rocket Lab. Based on these new areas of metal additive manufacturing opportunity, as well as the receding pandemic, AMPOWER anticipates annual growth in the market of 29.2% until 2025.

Delving into polymer analysis

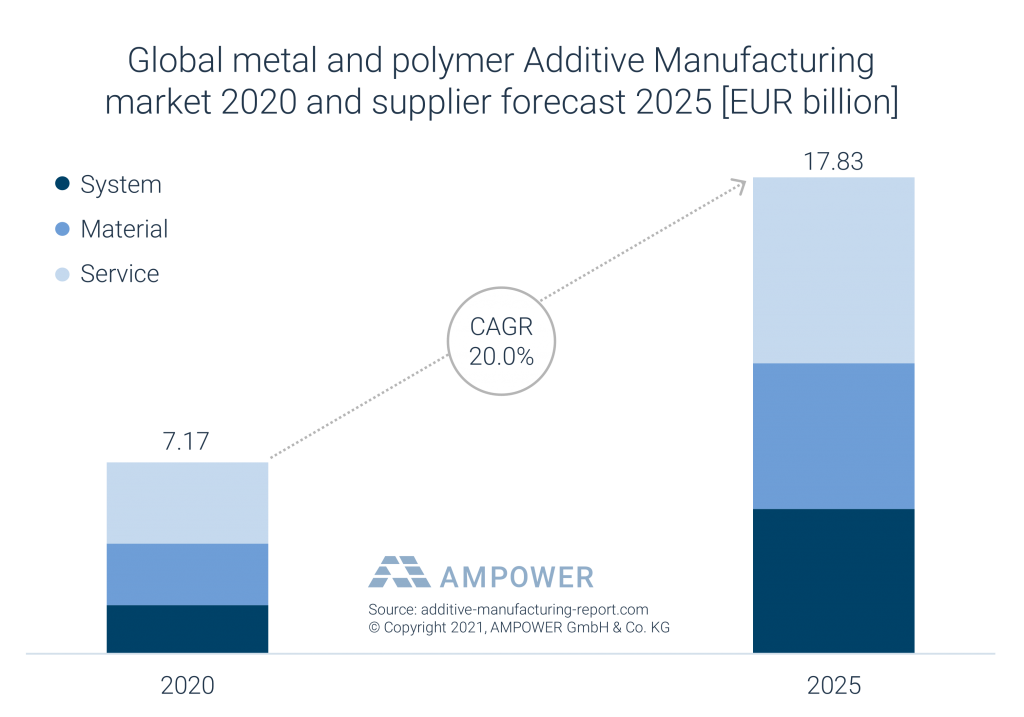

Unlike AMPOWER’s previous research, the company’s latest survey has canvassed the views of polymer 3D printing users as well. At €5 billion, the firm’s report values the polymer market at around twice that of its metal equivalent, but in future, it expects to see significantly slower annual growth from plastic machines, materials and services at a rate of approximately 15%.

However, AMPOWER’s research has still identified a strong market for polymeric materials and on-demand manufacturing during 2020, and it projects a combined valuation for metal and plastic 3D printing of €17 billion by 2025. Interestingly, the company also anticipates that future growth will now primarily be driven by low-cost technologies, which are increasingly offering better value than traditional production processes.

“The costs of new 3D printing processes are falling continuously and are closing in to those of traditional manufacturing technologies,” concluded Matthias Schmidt-Lehr, a Partner at AMPOWER. “As a result, additive manufacturing is growing significantly more than the manufacturing industry in conventional technologies.”

Those interested in accessing AMPOWER’s latest report can now do so via the company’s website.

Turbulence in market analysis

Although 3D printing market analysis can sometimes provide an interesting insight into how the industry’s performing financially, many such reports are limited in scope, and at times they can prove to be well off the mark.

In 2018, for instance, market intelligence firm CONTEXT identified a decline in desktop 3D printer shipments within its Q1 report. However, many 3D printing industry manufacturers disagreed with CONTEXT’s findings at the time. The company later reported a post-pandemic desktop revenue boom.

More recently, Lux Research ranked 3D printing as one of its top twelve technologies to watch, heading into 2021. The company’s report identified workflow automation, new technologies, and moves towards serial production, as key indicators that additive manufacturing continues to have significant growth potential.

Elsewhere, consultancy firm Wohlers Associates recently published its now-well-established 3D printing industry report for the 26th year. Surprisingly, the study found that the industry actually continued to grow during 2020, rising to an overall valuation of $12.8 billion despite the impact of COVID-19 on client demand.

To stay up to date with the latest 3D printing news, don’t forget to subscribe to the 3D Printing Industry newsletter or follow us on Twitter or liking our page on Facebook.

Are you looking for a job in the additive manufacturing industry? Visit 3D Printing Jobs for a selection of roles in the industry.

Featured image shows the Metal LB-PBF 3D printing process. Image via DMG MORI.