How is 3D printing changing supply chains? The prospect of decentralized spare part production, reduction of storage costs, and active control of entire supply chains – benefits long touted as the future of additive manufacturing. But what if these benefits are not just futuristic concepts but current realities?

During the 2023 AM Forum in Berlin, speakers from Daimler, Materialise, CNH, Stratasys, and the German Navy considered such questions, including what is the future of 3D printing in the supply chain?

Currently, the global supply chain faces its fair share of challenges. Businesses are seeking resilient and efficient alternatives, from port bottlenecks to truck breakdowns and manufacturing stoppages due to part shortages.

Read more from AM Forum Berlin.

Automotive supply chain and 3D printing

Matthias Schmid, CDO of the Centre of Competence for Additive Manufacturing at Daimler Truck AG, provided a detailed peek into this paradigm shift. He highlighted Daimler’s journey towards embracing 3D printing as an integral part of its supply chain, affirming, “We’re [a] global acting company and as a global acting company…we faced a lot of crises which had a huge impact on supply chains. Considering this, we started to analyze our supply chains…and asked ourselves if we could reduce the involved parties to the absolute required minimum.”

Schmid elaborated, “Everything that can be digitized will be digitized. So start building a digital value chain.” He noted that their digitalization approach involves identifying suitable products, enhancing and storing the data, and making it available for production or sales.

For Daimler, the early results look promising. “From our portfolio of about 320,000 spare parts, we identified 40,000 as feasible for 3D printing. Currently, we have more than 1,500 parts available in our digital warehouse,” Schmid confirmed. These 3D parts are made available to their production sites and customers via license issuance, facilitating on-demand production.

Daimler’s selection of spare parts for 3D printing was initially based on simple geometries and raw material selection. Schmid added that in certain cases, it is possible to “use a little bit of AI to do it in an automated way.”

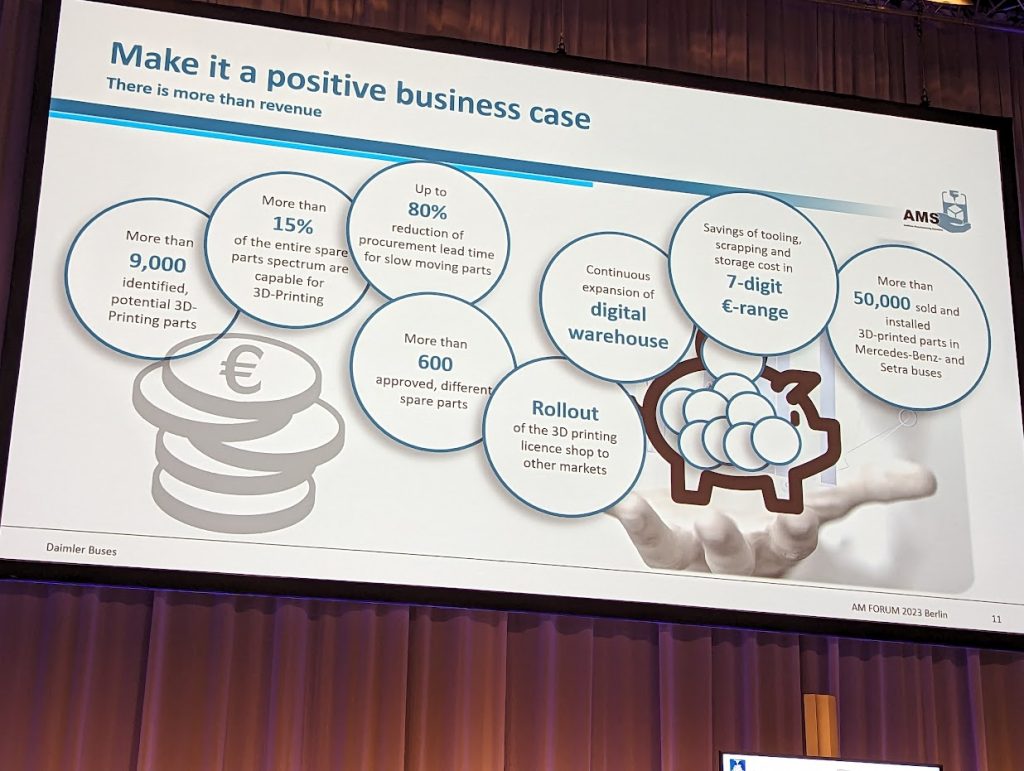

Despite its promise, Schmid acknowledged that additive manufacturing is not a magic bullet. “Most companies make the mistake of only looking at the cost of purchasing power…always compare the real cost…with switching from physical storing to digital storage, we generated savings in the seven-digit range.” Additive manufacturing, despite its initial setup costs, offers savings in storage, lead times, and even carbon footprint, enhancing its value proposition.

Ensuring value flows to the correct party is also a concern, with Daimler developing ways to manage the digital rights of 3D printed parts, preventing unauthorized reproductions. Schmid said that digital rights management (DRM) has been developed. However, he admitted that the utility of DRM depends on the willingness of the 3D printer manufacturer to allow access to their machines.

From Daimler’s experience, the journey from a traditional to a digital supply chain takes time, but the benefits are promising. As companies around the globe face the task of making their supply chains more resilient, the shift from physical to digital might be the key to future-proofing logistics.

How is 3D printing used in logistics

Hanne Gielis, Innovation Manager at Materialise, and Peter Ommeslag, Director – Industry 4.0 Global Program Lead at CNH Industrial, unpacked the collaborative journey between their companies, outlining their pursuit of innovation in additive manufacturing and a supply chain-driven focus. CNH Industrial is a multinational producer of agricultural equipment and heavy machinery.

Sustainability, particularly in the face of population growth and reducing arable land, is a major driver. Ommeslag pointed out that “climate change has a tremendous impact on the yield of the arable land that is available.”

According to Ommeslag, the key success factors in setting up an additive manufacturing program are rooted in strategic questions. “The first thing that you do is to ask yourself the question, why are you doing it? What is your vision? What is the objective that you’re trying to get here?” For CNH, these strategic inquiries led to four primary objectives: creating agility in the face of global disruptions, managing costs, maintaining a keen focus on environmental sustainability, and addressing changing customer needs with innovations like electrification and robotics.

The CNH strategy involves building an “additive manufacturing twin” for each part in their database, effectively an enhanced copy of the part, optimized for 3D printing. This foresighted approach enables CNH to easily switch from traditional to additive manufacturing if the situation demands.

How to select parts for 3D printing? At CNH they, “asked the people responsible for manufacturing planning to send us the list of the parts that keep them awake at night,” said Ommeslag. The stress-inducing components turn into prime candidates for a 3D printed overhaul.

The additive manufacturing strategy at CNH Industrial seems particularly helpful in producing spare parts for older equipment, especially when they are hard to procure from conventional sources. Additive manufacturing steps in to fill this gap. Ommeslag noted that CNH already has “three to four hundred parts in our parts catalog that are exclusively 3D printed.”

In more urgent scenarios, such as breakdowns in the field, additive manufacturing can also be deployed, alleviating the inconvenience of low inventory or geographical disparities. Ommeslag acknowledged the frequency of such scenarios, saying, “it happens regularly,” a testament to the essential role 3D printing has carved for itself within the company’s operations.

3D printing in the German Navy

Sascha Hartig, Coordinator of Additive Manufacturing at the German Navy (Deutsche Marine), explained how 3D printing is changing supply chains in the military. The Navy, ever more dependent on reliable supply chains for operational readiness, has felt the pinch of the recent supply chain disruptions. Hartig explained, “We must keep our operational readiness high for all these ships.” He added that logistic challenges due to supply chain issues have increased.

In these instances, additive manufacturing has emerged as a valuable tool in the Navy’s arsenal, helping to overcome issues with obsolete parts and producing low-quantity, high-need items. Hartig shared a compelling anecdote where an essential part—a plastic bracket for the main engine stop button of an auxiliary ship—was unattainable for years, but with the application of AM, “we had 20 minutes of CAD for designing, 20 minutes of printing and afterward the problem was gone.”

Solving supply chain challenges with 3D printing is not an overnight journey. “One side is really conservative,” said Hartig, a mindset exemplified by a reluctance to change a process that has historically been satisfactory. He also noted a contrasting, more forward-thinking faction among the younger personnel, eager to use additive manufacturing for problem-solving. Striking the balance between these two perspectives, he suggested, is a task the German Navy is still grappling with. A significant victory, however, came with the successful integration of a 3D printer onboard a submarine, demonstrating the utility of additive manufacturing and changing minds in the process.

How to adopt additive manufacturing at scale?

AM Forum Berlin also provided a platform to discuss how to increase the adoption of additive manufacturing. Martin Back, Managing Director at BASF Forward AM, highlighted the hesitance among industries when adopting additive manufacturing on a larger scale. From Back’s viewpoint, the main hurdles are technology readiness, the ecosystem of traditional norms and design criteria, and the challenge of companies navigating all these issues simultaneously. He asserted the need for closer collaboration between industrial partners, material properties experts, and processing experts. “It cannot be a bilateral buyer or seller process anymore,” he said.

Rainer Grünauer, Director of Specialized Sales and Application Team at TRUMPF Laser- und Systemtechnik, emphasized the need to inspire young engineers to get interested in additive manufacturing. He also highlighted that it took his company about seven years to have additive manufacturing successfully implemented, with “around 40 to 50 projects ongoing” now. “But it takes time,” Grünauer added.

However, changing minds is just one piece of the puzzle. Andreas Langfeld, President EMEA at Stratasys GmbH, advocated for a paradigm shift in education. “We need to work with the education sector to bring additive manufacturing into the curriculum,” he urged. Langfeld coined the term “additive natives,” drawing a parallel with digital natives, to signify the new generation of engineers who grow up with additive manufacturing as a regular part of their training. The hope is that these individuals, upon joining organizations, will expedite the adoption of new production methods.

But is this strategy fast enough? While the educational shift may be a long-term solution, other nations are not waiting. Martin Back, Managing Director of BASF Forward AM, offered an insightful comparison with China. The Asian nation is swiftly adopting modern technologies, with factories taking a decidedly proactive approach.

Faster adoption can happen, but it requires a different, possibly more daring, approach. Marc Fette, CEO of Composite Technology Center (CTC GmbH), an Airbus company, elaborated on this point. CTC, according to Fette, thrives on innovation and flexibility, having fully integrated additive manufacturing into its operations. This approach not only requires internal change but also drives innovation in the broader aerospace supply chain.

Rainer Grünauer, Director of Application and Consulting at TRUMPF Laser- und Systemtechnik, acknowledged the inherent hesitation in shifting away from the highest quality benchmarks traditional engineering has been clinging to. But he warned of the danger of stagnation. “If we are not innovative, then we will maybe not have a look to the unknown amount of industry,” Grünauer declared. He highlighted the need to cultivate a mindset that is more open to innovation and risk, likening the adoption of new technologies like additive manufacturing to a captain steering his ship into “strong waters.”

TRUMPF’s Director of Application and Consulting, was asked about the pace of AM adoption worldwide. Noting that America’s “try it and see what happens” mindset and China’s strong government backing are propelling the growth of AM in these regions, he admitted Europe’s more cautious approach may be slowing progress.

Mr. Grünauer’s observation that traditional industries risk being left behind was echoed by AM Forum Berlin moderator Sven Krause, who drew attention to the strides made by Korean electric vehicle manufacturers. The underlying message was clear: European industry must become more willing to take risks or risk being left behind.

Our look at how 3D printing is used in the supply continues in part two.

Nominations are open for the 2023 3D Printing Industry Awards, don’t miss the chance to help select this year’s winners.

More articles from AM Forum Berlin.