Automated post-processing system manufacturer PostProcess has published its findings from the 2021 edition of its Additive Manufacturing Post-Printing Industry Trends Survey.

Following hot on the heels of 2020’s pandemic-dominated report, the firm says that this year’s survey shows 3D printing firms are starting to put what they’ve learned from COVID-19 into practise, with post-processing becoming a priority for those starting to enter “higher volume production,” and many opting to deploy just a single additive manufacturing technology.

A deep-dive into post-processing

Launched in 2019, PostProcess’ now-annual survey is designed to encourage the users of post-processing systems to share their experiences of utilizing the technology in practise. By collating the resulting data, the firm then aims to plot a course for the post-printing and 3D printing industry, as well as integrating its learnings into the products it brings to market itself.

Past editions of the poll have provided fascinating insights, shining a light on the relationship between resin removal and surface finishing, as well as helping identify some of the industry’s key trends and challenges, thus this year’s survey promises to be similarly insightful about the post-pandemic prospects of those operating in the sector.

Demographically, 51% of the contributors to PostProcess’ third survey have used 3D printing for more than five years, up from the 45% reported in 2020, meaning that its results are as well-based as ever. At 52%, more than half of participants also originate in Europe, with 39% coming from the U.S, and respondents hailing from over 25 industries across the board, ranging from automotive to the medical industry.

Identifying 2021’s AM tech trends

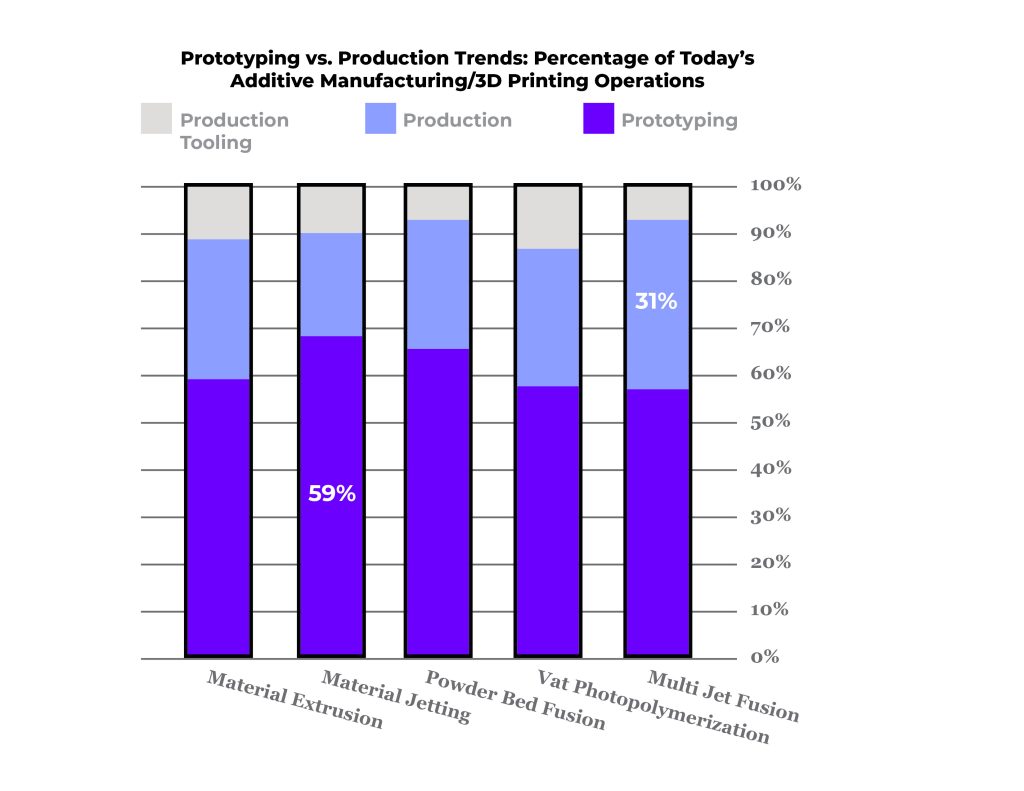

PostProcess found material extrusion, vat photopolymerization, and powder bed fusion (PBF) to be the most common technologies used by respondents to its 2021 poll. However, compared to the same period of 2020, the firm also identified a fall from 70% to 50% of those using more than one production technology, suggesting that manufacturers are starting to specialize to optimize their workflows.

Similarly, when it comes to extrusion 3D printing’s pain points, contributors reported part consistency, lead times and damage as their top three. Interestingly though, while these users highlighted the most pain points of any technology surveyed, vat photopolymerization saw the largest swing in priorities, with adopters shifting focus from labor and throughput issues, towards safety and sustainability.

According to PostProcess, the growing concerns of vat photopolymerization users are most “likely due to the growth of resin-based solutions,” in addition to “the special considerations that tie into this technology.”

On the post-processing front, the firm found (as in previous years), that support removal and surface finishing were the top two most used technologies, something it sees as dependent on the needs of 3D printers themselves. For the third straight year, participants also said that part finishing was their number one concern in this area, although this percentage declined from 75% to 53% between 2019 and 2021.

PostProcess’ operational insights

When it comes to total post-printing outlay, PostProcess’ survey found that respondents are increasingly spending over a quarter of their budget on the activity, with the share of those doing so rising from 23% to 31% since last year. This increase was most clearly reported by DED users, although these represented a minority of the poll’s participants, and extrusion 3D printer adopters said they spend the least.

By contrast, it was those manufacturers requiring the use of removal processes that reported spending the most on post-printing, as a percentage of their additive manufacturing budget. PostProcess says this is largely down to the fact that their parts “likely need multiple techniques to finish,” necessitating the usage of various machines, as well as spending on the staff training required to operate them.

Interestingly, the firm’s survey also showed that the proportion of manufacturers using 3D printing for prototyping fell dramatically between 2019 and 2021, from 65% to 52%. This potentially marks a significant change in attitudes among its poll’s participants, as 57% of them said in 2019 that the technology would be used for prototyping for the next 3-5 years, but in 2021, only 44% felt this was the case.

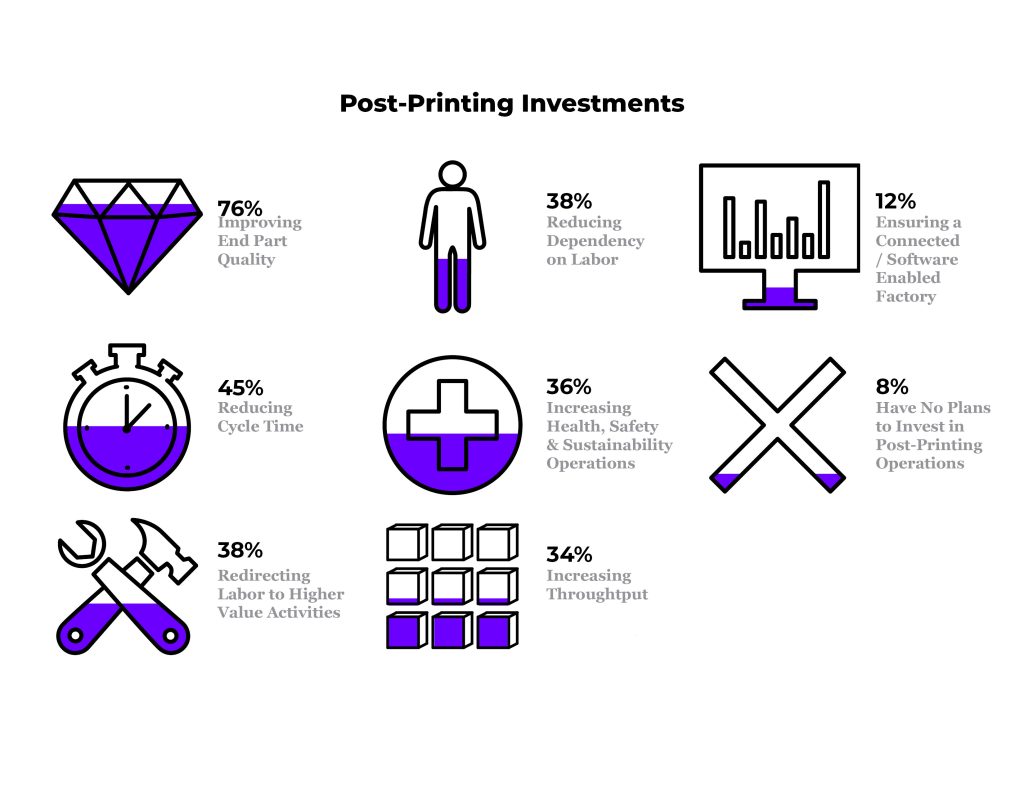

In keeping with this wider shift towards printed parts being deployed within ‘production-like environments,’ 76% of respondents said their future investment in 3D printing would revolve around improving end part quality, while post-processing-wise, 60% reported that they were seeking to optimize the health, safety and sustainability of their operations.

Moving forwards, PostProcess says that 32% of manufacturers reported an intention to increase their use of 3D printing post-COVID, with the majority of those being based in Europe. In particular, these users, which tend to hail from the ‘job shop’ industry, suggested they were most likely to buy new PBF or vat polymerization systems, and material jetting adopters proved more reluctant to do so.

Those interested in reading the 2021 edition of PostProcess’ Additive Manufacturing Post-Printing Industry Trends Survey in full can do so here.

To stay up to date with the latest 3D printing news, don’t forget to subscribe to the 3D Printing Industry newsletter or follow us on Twitter or liking our page on Facebook.

For a deeper dive into additive manufacturing, you can now subscribe to our Youtube channel, featuring discussion, debriefs, and shots of 3D printing in-action.

Are you looking for a job in the additive manufacturing industry? Visit 3D Printing Jobs for a selection of roles in the industry.

Featured image shows an engineer using a PostProcess machine. Photo via PostProcess.