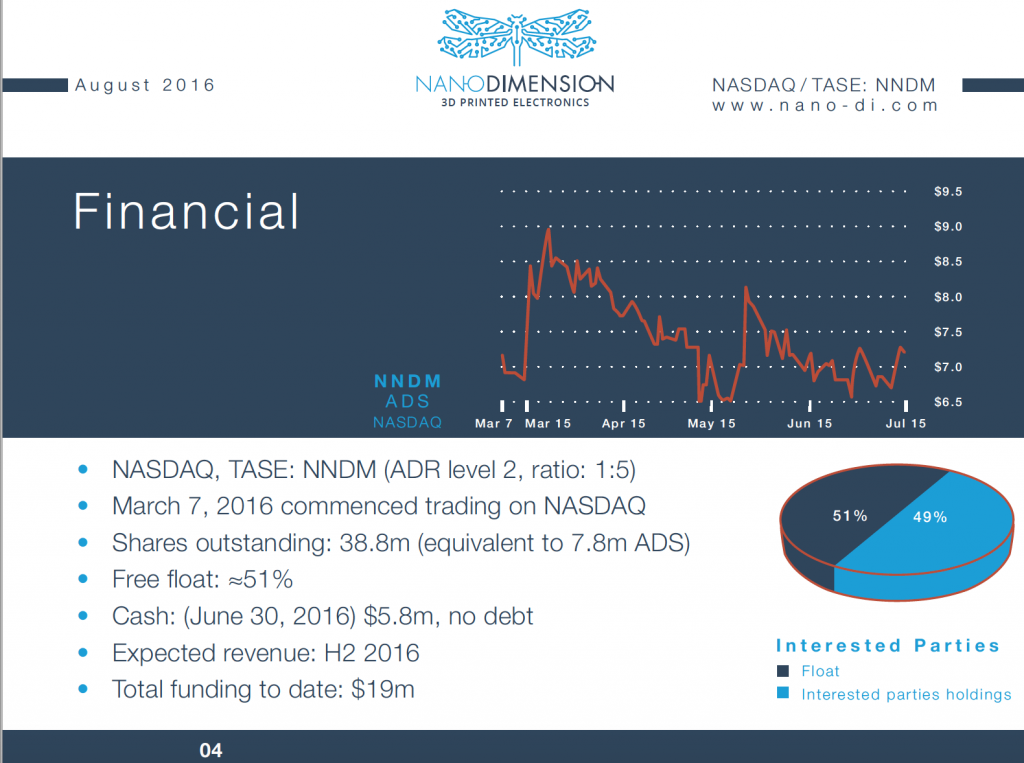

Further proving that they are anything but microscopic when it comes to business, Nano Dimension Ltd. has raised a $12 million investment from a public offering of 1,850,000 American Depository Shares (ADSs), with 277,500 additional ADSs being offered to underwriters in a 45-day overallotment period. If they succeed in overallotment, the gross proceeds may rise to $13.8 million.

National Securities are running the books for the offering, with Lake Street Capital Markets acting as co-manager. The price per ADSs is set at $6.50, which has fluctuated marginally in the region of $1. All shares are being offered exclusively by the company, rather than external traders.

It’s a smart move for the company. So far in 2016 it has maintained a steady rate of breakthroughs, from 3D bioprinting, covered by us in May, to the electricity conductive fabric we reported only last week. This investment means that we should see Nano Dimension afloat for another 3-5 years, presumably with the same relentless approach problem-solving in the 3D printing industry.

See below for last year’s financial chart, as reported in the company’s current Investor Presentation (which can be downloaded from their website in exchange for your email address).

The key areas the company want to pour the proceeds into are: sales and marketing, expanding production, research and development, and licensing. Investments in sales and marketing are especially poignant considering the launch of their sales strategy, proposed for the current quarter in their financial report at the end of June.

As an average consumer spending much of my time online, I’m wondering what this investment could mean for their approach to digital marketing, if anything at all. And, always eager to see the latest tech in action, I’m hoping we may finally see some demo videos on their Youtube account…