This morning Stratasys Ltd. (NASDAQ: SSYS) reported their financial results for the second quarter of 2016.

The quarter was the final reporting period for CEO, David Reis, who it was announced previously would be stepping aside for Ilan Levin. Like Reis before him, Levin held leadership positions at Objet before Stratasys acquired the company in 2012. Reis will still be involved with the company as an executive director.

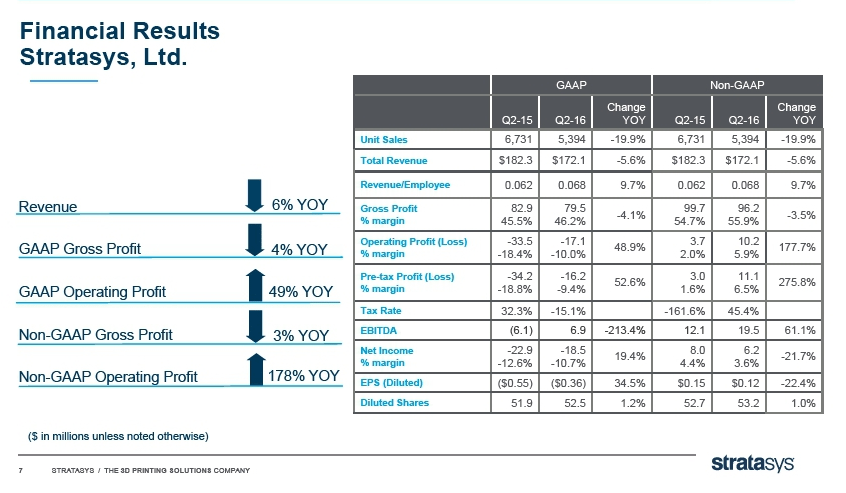

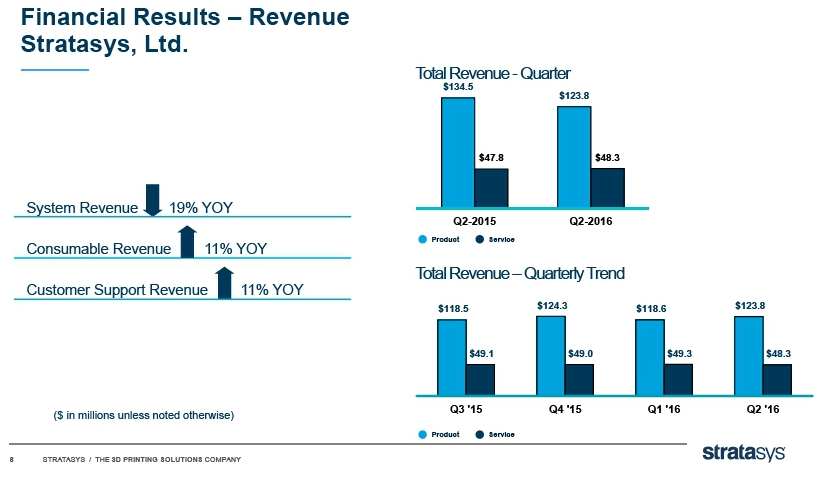

Total revenue for the quarter was $172.1 million with a net loss of $18.5 million or -$0.36 per share (-$0.44 Q1 2016). This is an increase of $4.2 million in revenue compared to the first quarter of the year.

However, in year on year performance total revenue decreased by $10 million from Q2 2015’s $182.3 million. The majority of this decrease was attributable to sales within the product classification.

Stratasys generated $6.9 million from operations in the quarter, compared to $31.6 million in the previous quarter.

With these results Stratasys did not meet pre-release analyst consensus expectations. These were for $176.71 million in revenue. However on non-GAAP adjusted revenue the company reported $0.12 EPS, double the expectation of analysts $0.06 EPS.

Opening at $22 the stock initially dropped to $20.88 on the news. Trading at these prices the stock is above its 52 week low of $14.48, but still some way below the $33.13 high and the $136.46 peak of early 2014.

Stock prices for many 3D printing companies rallied yesterday after 3D Systems reported earnings for the second quarter. At one point, the stock was showing a daily gain over 20%.

The company sold 5,125 3D printing and additive manufacturing systems during the first quarter; today’s earnings call reported an increase of 269 in that number.

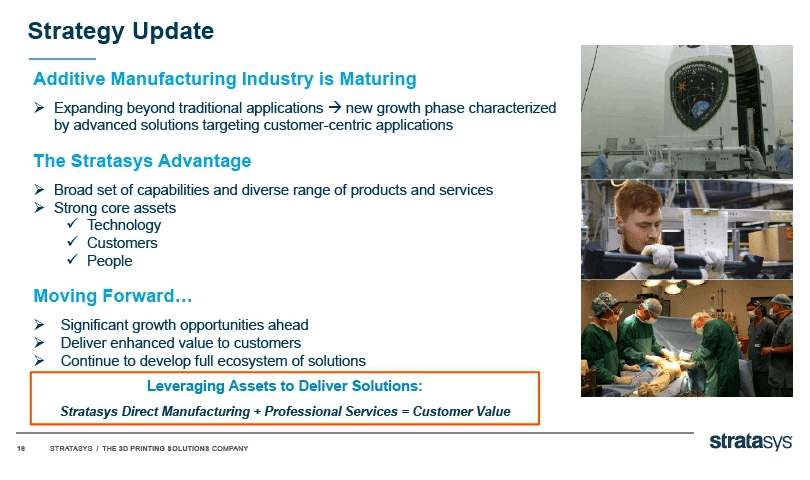

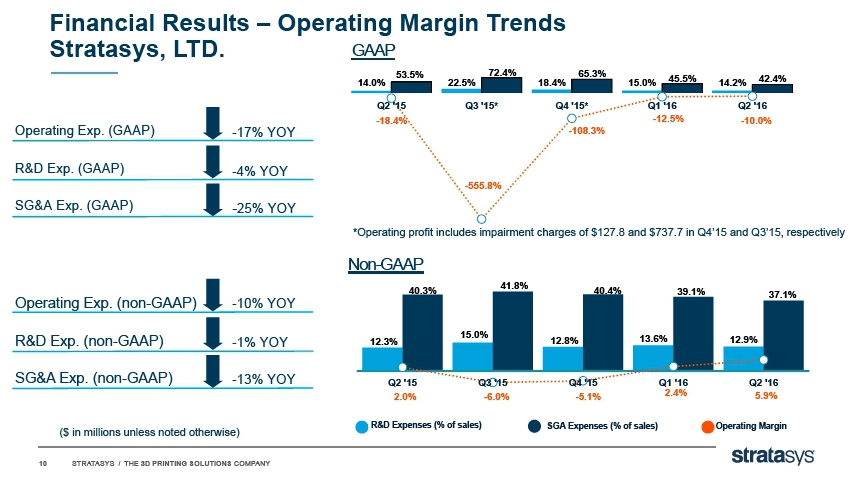

Given the tough macro-economic environment, expectations for today’s earning call were low. The results released today, while important, should be considered together with the company’s longer-term prospects. Speaking about the company’s performance Levin said, “Compared to the first quarter, we observed stronger margins and a substantial increase in non-GAAP operating profit. Our margins benefitted from a sales mix that favored our higher-end systems, including the recently launched J750, the industry’s most advanced full-color, multi-material 3D printer, as well as our ongoing efforts to improve operations, and reduce operating expenses.”

Levin was keen to communicate a core part of strategy is, “Building value around high value applications.” The CEO made the point that FDM and Polyjet are good “applications for full solutions” and the company has a “long runway with these technologies,” in the core industries. These are, “aerospace, automotive, and medical, which will rely on these technologies to enhance their businesses.”

A direct manufacturing service was recently introduced, “to accelerate the adoption of 3D printing by customers” but will, “not generate a significant amount of revenue,” rather this will serve to bring in new customers said Levin.

Speaking about the GrabCAD community Leven said, “GrabCAD Print is currently available in free public beta in North America.” GrabCAD represents a, “significant part of R&D expenditure” which the company believe is necessary to ensure the line is competitive in the market. However, Stratasys are not expecting a large amount of revenue from this area, even going into 2017.

Erez Simha, CFO & COO and Shane Glenn, VP of Investor Relations joined the new CEO on the call.

The quarter also saw Tim Bohling join as Chief Marketing Officer

No changes in full year guidance

Full year revenue guidance remained unchanged from Q1’s stated range of $700 to $730 million. The company had previously announced earnings expectation to be in the range of an $84 to $67 million loss for 2016, these also remain unchanged. Strategic plans are for a modest improvement in gross margins in the range of 54% to 55%, for this quarter GAAP gross margins were 46.2%. This is an increase of 0.7% on Q1, but the company need to improve margins by 7.8% in the next 6 months if they are to hit the year-end target.

The company had previously announced that $45 million of 2016’s $60 to $70 million capital expenditure would be used to complete a new facility in Israel, there was no update to the spend on this project.

While these results end the trend of consecutive decreases in revenue, year on year numbers tell a different story. Analysts such as Piper Jaffray’s Troy Jensen believe the slow down in revenue at Stratasys and 3D Systems is because, “Several customers have and will likely continue to pause purchasing to assess these new HP offerings.” Resellers may also decide to switch to HP products and when firm data on orders and performance of the HP MultiJet Fusion range arrives a period of share price volatility is likely.

In mid July, analysts at stockbroker Piper Jaffray set a revised price target of $24 for Stratasys. This lower target was accompanied by a change in recommendation from ‘overweight’ to ‘neutral’.

Hints for the future

Investors looking for hints about the future of Stratasys might be advised to look outside the company. On demand contract manufacturers, Proto Labs were named by HP in May as part of group of users who will receive early access to the MultiJet Fusion 3D printers.

Proto Labs own a range of 3D printers, including Concept Laser and 3D Systems machines, in addition to CNC milling tools and injection molding equipment. As Proto Labs are not tied to any individual manufacturing technique their reaction may provide an early indication to the fortunes of Stratasys, 3D Systems and HP for 2017.

Takeover Target?

The 3D printing industry landscape is undergoing an eventful period of change. The proclamations of multi-national giants such as Ricoh, HP and Canon are starting to bear fruit as these glacial giants begin to enter the market. No longer content to act as resellers and with vast resources available, the mode of market entry remains to be seen. But, with an ever increasingly crowded competitive field, acquisitions and exits become more likely. As 3D printing’s addressable market expands the attraction of a ready-made market leader may prove irresistible.