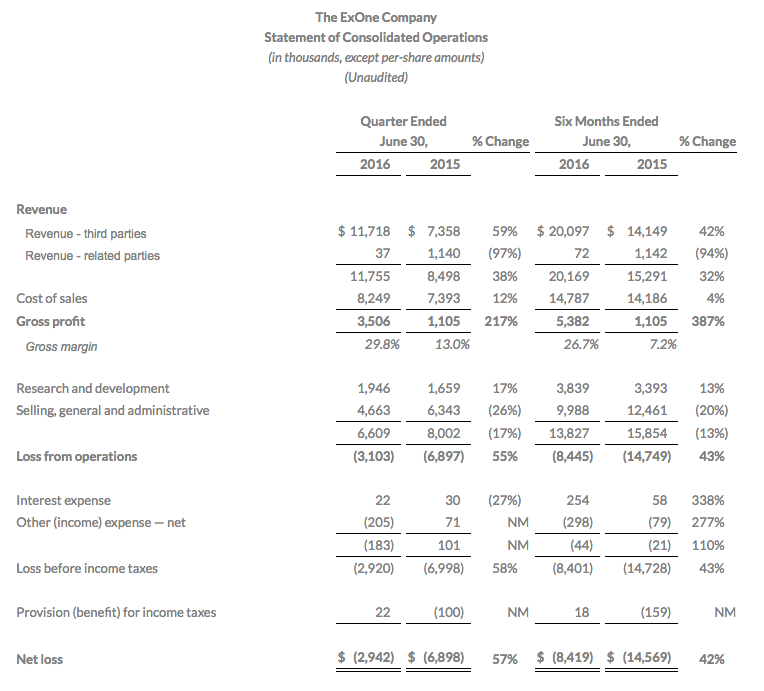

The ExOne Co. (NASDAQ:XONE) report record financial results in their second quarter earnings. In a statement issued after the NASDAQ stock market closed on Tuesday, S. Kent Rockwell, CEO and Chairman, explained the 38% year on year increase was, “Driven by sales of our larger indirect machines.”

For the quarter ended 30 June 2016, ExOne report total revenue of $11.8 million (Q2 2015: $8.5 million). The figures for the first half of the year show revenue of $20.2 million, compared to $15.3 million for the same period in 2015. Rockwell said, “We continue to see stronger acceptance of our technology through further machine productivity enhancements and broadened material choices.”

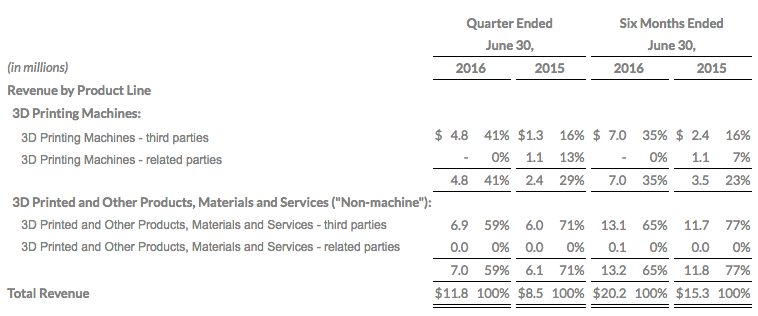

Revenue can be further analyzed between sales of 3D printing machines and non-machine sales. $4.8 million (41%) of total revenue is attributable to printer sales, with the remaining $7 million (59%) relating to “non-machine” sales of 3D printed and other products, services and materials. The comparative figures for 2015 were 29% for machines and 71% for non-machine.

ExOne’s increased sales are accompanied by an improvement in gross profit margin, with 29.8% versus 13% for the comparative period. The company reported gross profit of $3.5 million for the quarter (Q2 2015, $1.1 million).

These gross margins are below some of their competitors in the industrial market such as 3D systems who reported a gross profit headline margin of 50.9%. When analyzed a more granular level 3D Systems’ gross margins show 76.4% for materials and 32.6% for 3D printers. The volume of sales at 3D Systems, $158 million for Q2 2016, versus $11.7 million for ExOne may also account for some of the difference with economies of scale playing a role in gross profitability.

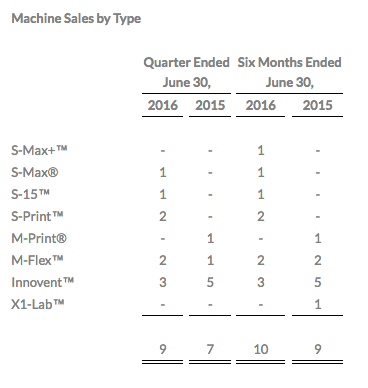

Clients in industries such as aerospace, automotive and energy use ExOne industrial 3D printers. The high cost of the machines and specialist nature of the equipment means there are often lengthy lead times between initiation of a potential customer relationship and machine purchase. The company acknowledge that, “Given the long sales cycle and significance of a machine’s average selling price relative to total revenue, fluctuations in machine-sale revenue vary from quarter to quarter.” Furthermore they do not claim, “that such quarter-to-quarter fluctuations are necessarily indicative of larger trends.”

Order backlog now at $19.5 million

However, these results appear to indicate that customers are becoming more familiar with ExOne technology and recognize the benefit 3D printing can bring to an enterprise. ExOne report that their order backlog has increased by $3.1 million since the first quarter of 2016. This brings the total value of the order backlog to $19.5 million. Rockwell commented on this saying the pipeline has, “set us up well for ongoing revenue growth in the second half of 2016.”

The company offer 3D printers in a range of formats that are suitable for applications in production through to rapid prototyping or research and education. Printing on demand and consultancy services are also offered by the company. These later services often provide a useful way for potential customers to test the water before making a major capital investment in a 3D printer. Building a sales pipeline strategy in this manner is an approach evident across the major players in the industrial 3D printer market.

Indirect printing drives profits

3D printing with ExOne machines is based around the binder jetting process and the S-Max and S-Print industrial production printers are designed for sandcasting foundries and can create, “complex sand cores and molds.” This removes the need to fabricate a physical mold can make savings in both time and money during a production cycle. ExOne believe that traditional methods for producing castings are, “the most time and labor-intensive portion, hampering the ability of manufacturers to remain agile.”

The company say their, “Patternless process offers design freedom, improved efficiency and eliminates storage.” These printers can use silica sand to create molds and cores with the advantage that this material is already in widespread use by foundries. This means customers will frequently have materials handling processes in place. It is this indirect printing category that is driving profits.

The M-series 3D printers, the M-Flex and the larger M-Print, are designed for direct metal 3D printing. These machines can be used with stainless steel, bronze, Alloy IN 625, iron or tungsten.

The company provides unaudited information showing breakdown of sales by machine model. This data shows that a total of 9 machines were sold during Q2 (Q2 2015, 7).

Increased research and development spend

By creating a portfolio of industrial materials suitable for 3D printing ExOne can expect to continue to generate revenue through sales of consumables. To support this area, the company increased R&D expenditure by 17% compared to the same quarter in 2015. The work related to materials and binders is undertaken by the ExOne Materials Application Laboratory (ExMAL).

Other indirect expenses related to selling and general administration decreased to $4.6 million for the quarter (Q2 2015, $6.3 million). This is a 26% decrease year on year.

The result of these activities was a $2.9 million net loss for the second quarter. This is an improvement on prior year performance of 57%. The net loss for Q2 in 2015 was $6.8 million. The company is headed in the right direction and beat analyst expectations around EPS by $0.10, reporting a figure of -$0.18. In the previous year EPS was -$0.48. The company explained these improved figures as, “primarily due to higher gross profit and lower SG&A expenses.”

The company have a healthy balance sheet showing $31.8 million in cash and equivalents, a $12.5 million increase since the 31 December 2015 reported position. Inventories remain stable at $19.9 million and there is no sign of any rapid expansion in liabilities.

Evolution, not revolution

ExOne are currently smaller than several other 3D printing companies who at first glance appear to be their rivals. However, any appraisal of the company must factor in the technology they have brought to market. The indirect 3D printing machines are addressing a market that other larger companies are not. And this technology can bring a demonstrable competitive advantage over traditional foundry methods. If the company can expand its presence in industries such as automotive and energy then substantial sales may be possible.

The company also stands to benefit from the continued and committed leadership of CEO Rockwell who previously invested $15 million in the company to repay a credit line.

These latest results are encouraging and further evidence of a maturing market and the benefits of long term consumer education and relationship building. Revolutionizing manufacturing was never going to be an overnight event, but ExOne’s Q2 numbers are certainly a step in the right direction.