In a lengthy earnings call with investors and analysts this morning 3D Systems presented their most recent financial results and addressed the future of the company. Presentation of the second quarter’s results was quickly covered in less than 15 minutes. But analysts extended the call by almost another hour with a detailed Q&A session.

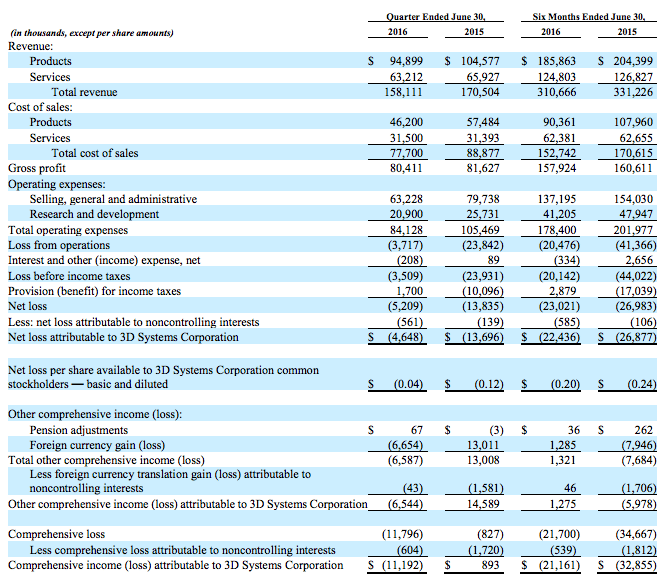

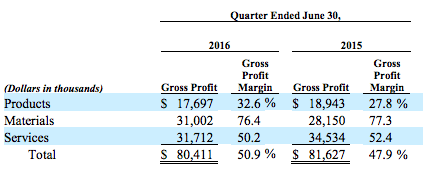

The company reported revenue of $158.1 million for the second quarter of 2016. This is a 7% decrease on the comparative period for 2015, but represents a $5.5 million increase on the first quarter of this year.

The year on year revenue decrease is greater than investment analyst consensus expectations; this perspective anticipated a 5.6% decrease in revenue compared to the reported 7%.

Today’s results show 3D Systems Corporation made a loss of $11.2 million for the quarter (Q2 2015 $893k profit). This takes the loss for the year to $21.1 million, an $11.8 million improvement on the comparative figure for 2015.

This quarter also represents an improvement on Q1 where the net loss was $17.8 million.

Anticipated Strategy Announcement

CEO and President Vyomesh Joshi spoke to investors on Wednesday morning during his second earnings call since he joined 3D Systems in April. The CEO came out of retirement to lead the company and as a former executive vice president of HP he brings a wealth of experience, and insight into the potential rival.

VJ’s announcements regarding strategy were keenly anticipated but precise details were not to be forthcoming on today’s call. Interested parties will have to wait until September 12th to learn how 3D Systems plan to achieve profitable growth when the company presents at Chicago’s IMTS event.

The CEO did provide an overview of the key initiatives guiding the strategy. At the core of this is VJ’s view that, “3D Systems has a powerful synergistic and differentiated technology portfolio.”

The reported 11% increase in revenue from the healthcare segment is seen as, “Evidence that customers are relying on [3D Systems] end-to-end solutions to power advanced digital manufacturing workflows,” said VJ.

John McMullan, executive vice president and CFO, is a former colleague of VJ from his time at HP and presented the Q2 results and the priorities for moving forward.

The decrease in operating expenses was primarily due to the lower amortization ($8.8 million), or depreciation, and costs related to stock based incentive packages ($7.2 million). In the case of the later these are most likely to be non-recurring savings. McMullan reported that the business generated $12.9 million of cash from operations, and $9.5 million from free cash flow.

The revenue gains in healthcare (11%), materials (12%) and software (8%) were insufficient to offset the decreases reported in on demand manufacturing services (-20%) and printers (-30%). The decrease in printer revenue was partly due to a renewed focus on quality and ensuring rushed shipping of products was not at the expense of quality, explained the CEO.

McMullan added the decline in printer revenue was, “Primarily driven by the timing in orders for higher end professional and production printers.” This ties in to early speculation that potential customers may be delaying investment until later in the year when other major industrial players like HP and Carbon bring products to market.

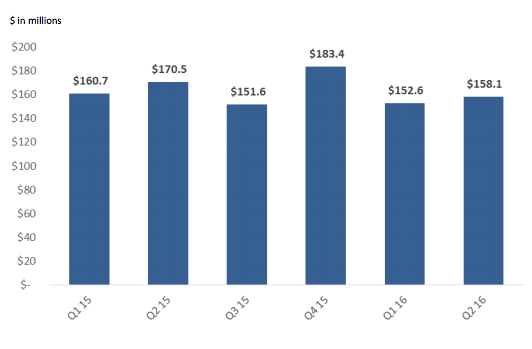

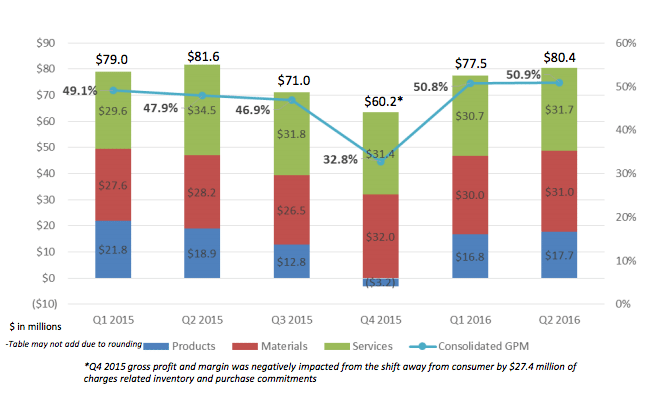

“Gross profit margin was flat sequentially,” said McMullan. Analysis of the 50.9% (47.9% Q2 2015) headline gross profit margin illustrates the ‘razor and blade’ business model of 3D Systems. Of the three revenue streams, Materials have the highest gross margin earning 76.4% (77.3& Q2 2015). In comparison Products, e.g. 3D printers and software, have a gross profit margin of 32.6% (27.8% Q2 2015). In short, 3D Systems sell less profitable 3D printers in order to earn higher profits on the consumable materials.

The third revenue stream, Services, has a gross profit margin that sits close to the headline average at 50.2% (Q2 2015).

“The decrease in products revenue for the quarter and six months ended June 30, 2016 was primarily driven by lower sales of 3D printers and the discontinuation of consumer products,” explains the company’s 10-Q filing with the SEC. A concern for investors is that lower sales of 3D printers will feed a decrease in the demand for the more profitable materials in the future.

The company’s 10-Q gives further details and states, “In addition to changes in sales volumes, including the impact of revenue from acquisitions, there are two other primary drivers of changes in revenue from one period to another: the combined effect of changes in product mix and average selling prices, sometimes referred to as price and mix effects, and the impact of fluctuations in foreign currencies.”

Shifting away from the consumer market has decreased the expenses associated with research and development and these savings will need to be balanced with investment in, “quality, infrastructure and other key areas,” for the long-term. McMullan reinforced VJ’s earlier belief that 3D Systems has a strong technology platform and, “the broadest portfolio in the industry.” The CFO also acknowledged that, “Things were little bit bumpy,” regarding the company’s historic trajectory.

Focus on production

VJ explained that 3D Systems will focus on production printers, rather than professional grade printers and the strategy will target increasing the installed base in this area. A second focus will be on new materials which are, “The key for our business.” The CEO revealed that since joining the company he has directed employees to concentrate on materials management as an important business.

Broader demand trends were also addressed by VJ. In particular growth in the prototyping market would be difficult and that a focus on light production would likely be a better option. This will involve continued innovation around the 3D Systems range of production printers and looking at use cases in vertical markets. “The solution based approach,” will be an important part of this strategy. As noted previously, this approach can require a significant level of engagement with customers.

VJ pointed to growth in healthcare as a model to replicate in the aerospace, automotive, consumer goods and other verticals. When this is achieved he believes company-wide growth will be sustainable.

Quality and supply chain issues were the focus of one analysts question and VJ explained that the hire of a supply chain and operations officer from HP will address issues such as shipping product before it is ready and ensuring optimal inventory levels. He acknowledged the company have work to do in this area.

The reception by the stock market to today’s news was favorable and shares were up in early trading. The second half of the year is likely to produce some interesting news and as more companies enter the production and professional 3D printing space the reaction of incumbents such as 3D systems will be closely scrutinized.