Investors in 3D printer manufacturer ExOne (NASDAQ: XONE) have seen the value of their holding increase significantly during the past 5 days. In this short space of time the share price of ExOne has risen from $6.47 on Friday to over $8, a gain of 23.6%.

ExOne, headquartered in North Huntingdon Pennsylvania, is the manufacturer of a range of industrial 3D printers. The company is a specialist in binder jetting technology and provides Additive Manufacturing systems and components to a range of industries including automotive, aerospace, heavy equipment and energy.

What is behind the growth in ExOne’s share price?

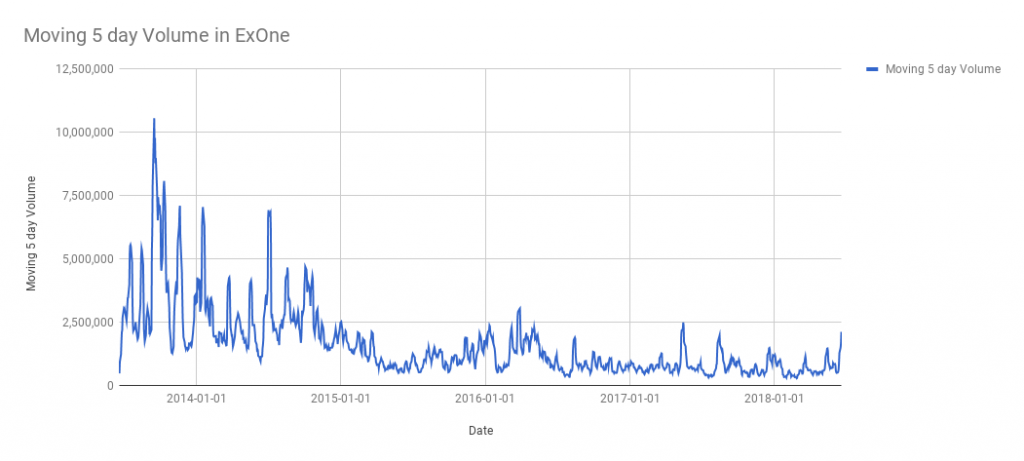

Matching the recent share price increase is the increase seen in trading volume of ExOne shares. Trading volume can be an important indicator of trends, and frequently share price movements will follow when a change in volume is observed. On the 20th June 2018, the volume of ExOne shares traded was 674,800. This number is the highest since August 2017.

It is also interesting to look at the number of shares traded over a longer period. Analysis of the volume of shares traded shows that in the past 5 days 2.1 million shares exchanged hands. The previous time this volume of trading in ExOne stock occured was in May 2017, when financial results were published.

Share price movements can be attributed to several factors. These include supply and demand, and the introduction of news (positive or negative) about an enterprise. The most recent significant news about ExOne was the publication of the company’s financial results for the first quarter of 2018. This took place on May 10th. The latest numbers of ExOne show a 9% increase in revenue, at $11.9 million. Also noteworthy is the growing order backlog, for Q1 2018 this figure increased by 20% to $26.1 million.

As previous articles on 3D Printing Industry have noted, investment activity in the metal Additive Manufacturing sector can serve as a rising tide that raises all ships. Specifically, high profile (and high value) investments by GE and the separate fund raising activity by Desktop Metal have provided validation for the readiness of the technology for wider adoption. “Without a clear news item or event to rally ExOne’s stock price and trading volume, the likely explanation comes from the company’s metal binder jetting 3D printers that is in the same class as Desktop Metal, 3DEO, Digital Metal, HP’s rumored metal multijet fusion, and GE’s expected metal binder jetting system,” said Dayton Horvath, Industry Analyst and Consultant.

“ExOne’s stock is rather accessible, and considering the recent hype and investments made in Desktop Metal, ExOne may gain favor from some investors as a bet on their technologies.”

3D Printing Industry contacted a number of other industry analysts and ExOne investors for comment on the recent movement. However, this polling did not reveal any additional information.

Analysts forecast additional growth of +50%

In the absence of public information it is tempting to speculate as to the cause of this increased volume of share trading. Reasons could include the signing of a substantial contract by ExOne or even a potential takeover. Current analyst forecasts see ExOne reporting $70 million in revenue for 2018, and place an average price target of $12.50 on the 3D printer manufacturer.

3D Printing Industry will continue to watch for movements in the share price of ExOne, which may yet see further appreciation. In particular it is interesting to observe the short interest, a figure that shows the number of share investors have sold short but are yet to be covered by a purchase. If the market begins to move against these short sellers, for example additional news becomes available that bodes well for the future, then a surge in buying would occur as the shorts sellers move to cover positions. As at the end of May, short interest in ExOne was 2.7 million, or 24% of the total number of ExOne shares held by public investors.

For more 3D printing investment news, subscribe to the 3D Printing Industry newsletter, follow us on Twitter, and like us on Facebook.

Looking to get involved in a new project? Join the 3D Printing Jobs board.

Featured image shows A 3D binder jetting print head. Photo via ExOne.