As 3D printing companies prepare to release financial results, 3DPI asked experts in the additive manufacturing industry for their perspective. In this article we provide market insights as Q3 earnings season gets underway.

Industrial 3D printer manufacturer Arcam AB (STO:ARCM) reported earnings last week and Groupe Gorge (EPA:GOE) released new results yesterday. Tomorrow two companies active in the 3D printing space will publish results with U.S. Proto Labs Inc. (NYSE:PRLB) and Japan’s Ricoh Co Ltd. (TYO:7752) reporting.

Also tomorrow Camtek Ltd. (NASDAQ:CAMT) and Eastman Kodak (NYSE:KODK) are expected to report numbers, although the later has not confirmed this will be the case. While Camtek is by no means a 3D printing company, they have previously benefited from investor interest around additive manufacturing. Therefore it will be interesting to note whether the company chooses to mention 3D printing on tomorrow’s call.

The coming month of November will see analyst’s join earnings calls and listen to CEOs and CTOs answer questions and it will be interesting to see how any weakening in sales performance is rationalised. Reports from Organovo (NASDAQ:ONVO), 3D Systems (NYSE:DDD), ExOne (NASDAQ:XONE), Nano Dimension (TLV:NNDM), VoxelJet (NYSE:VJET), Materialise (NASDAQ:MTLS) and Stratasys (NASDAQ:SSYS) are all expected in the coming weeks.

Stratasys were recently upgraded to a strong buy recommendation by researcher’s Zacks. The research company has set a price target of $23 on Stratasys stock, currently trading at close to $20.

Conversely Zacks have reappraised their position regarding 3D Systems. While Zack’s analysts commented the, “3D printing market presents a favorable long-term investment opportunity as a large number of engineers, designers, architects and entrepreneurs are resorting to 3D solutions for primary designing and product modeling,” this is not a view they extend to 3D Systems it appears. With a price target from Zacks of $13.10 the firm are below the investment community consensus value of $15.23.

Contributing to the this consensus number is Piper Jaffray, the firm have matching target price on 3D Systems and have expressed pessimism about the industrial 3D printing landscape. At Piper Jaffray Troy Jensen is responsible for a regular survey of approximately 70 3D printer manufacturers and 3D printing service-bureaus.

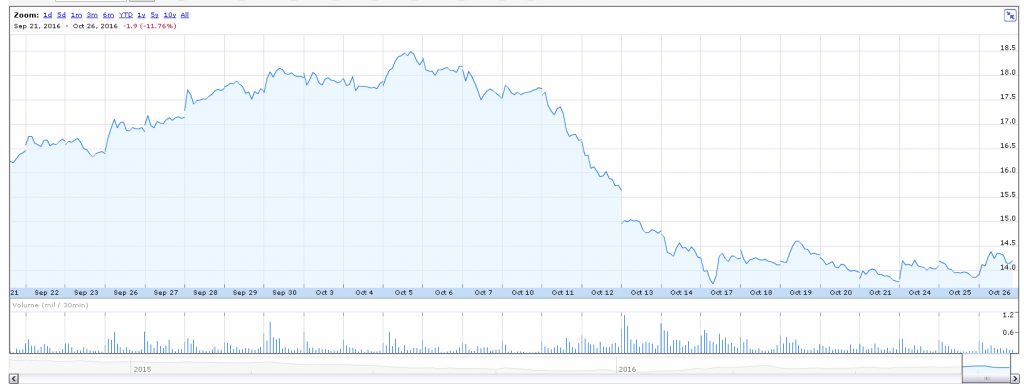

In a recent statement the Piper Jaffray analyst wrote that he expects both 3D Systems and Stratasys to miss earnings targets. Looking at the stock price performance of 3D Systems during the past month, which has navigated south from almost $18.50 on October 5th to current price of $14.23, in the short term it may appear they have a valid point.

3D printing industry experts comment

3DPI speak with 3D printing investment analysts on a regular basis, including acknowledged experts such as Terry Wohlers, of the Wohlers report – now published for over 20 years. While preferring not to comment directly on Q3 earnings Wohlers said, “The 62 companies that manufactured and sold industrial-grade 3D printing equipment last year are developing a competitive environment that we have not seen in the past.”

An equally impressive number of materials companies, some of which are global brands, are also entering the 3D printing industry. We believe that these companies, coupled with countless others that offer a wide range of services in 3D printing, will help take the industry to a new level. It will not happen overnight, so patience will be important.

This sentiment was echoed by Chris Connery at research firm CONTEXT. In an email conversation with 3DPI Connery said,

The Industrial/Professional printing segment continues to struggle, seeing -15% fewer printers shipped in the first half of 2016 compared to last year. The market is hopeful that GE (including their pending acquisition of SLM Solutions and Arcam), EOS, Concept Laser, EnvisionTEC, Prodways, HP, Ricoh, Carbon and others can help to make up the difference in the shortfall of Industrial/Professional printers shipped to date in 2016, but this side of the industry will be lucky to see any volume growth in 2016, with printer shipments more likely being below 2015 by the time the year ends.

The Personal/Desktop side of 3D Printing, now considered to be almost a completely different market than the Industrial/Professional side, continues to show nice growth, however with +15% more printers shipping in the first half of 2016 than in 2015. And with the 2nd half typically accounting for 57%-61% of the unit volume totals on this side of the business, new product announcements from market leaders XYZprinting, Ultimaker and others, as well as pending shipments against super successful crowdsourced efforts, 2016 is shaping up to be on track to show 35%+ growth in printer shipments compared to 2015.

Difficult, but interesting

While a number of analysts are bearish on the industrial 3D printing segment, others remain upbeat.

One such analyst/investor is ARK, the New York based firm who earlier this year launched their exchange traded fund for 3d printing stocks (BATS:PRNT). With recent uncertainty around the future of the $1.4 billion GE bid for Arcam AB and SLM Solutions the fund has taken a hit, returning to price levels last seen at the start of September.

At this stage it may be useful to remind readers of a point we often make at 3DPI, stock prices are rarely the best way to gauge the health of an industry. Geared towards meeting short term metrics and fostering an investment culture where buying and selling patterns often move with herd like characteristics rarely acknowledges long term value creation. Indeed, certain investment activity can be detrimental to growth or the advance of technology as the actions of activist hedge funds demonstrate. Furthermore, many of the most exciting 3D printing companies are not publically traded.

Earnings calls during 2016 have been dominated by one theme: uncertainty. On the macro stage, the culmination of the U.S. presidential election will remove some doubt about the future. In more 3D printing industry specific terms, the entry of HP (NYSE:HPQ) into the market during the final quarter of the year will remove one the most persistent explanations for weaker than forecast demand, that potential customers were deferring purchase until HP made Multi Jet Fusion available.

3DPI will be covering financial results during the coming weeks, so to ensure you receive our up to date analysis subscribe here.