Investing in the stock market can be a risky business and an easy way to quickly lose a lot of money. However, the potential for returns in excess of those offered by more stable investments are an attractive proposition for many. This is especially true when interest rates are at such a low point.

I spoke with some of the team behind a new 3D printing focused investment fund to find out about opportunities for investors and how the experts select stocks.

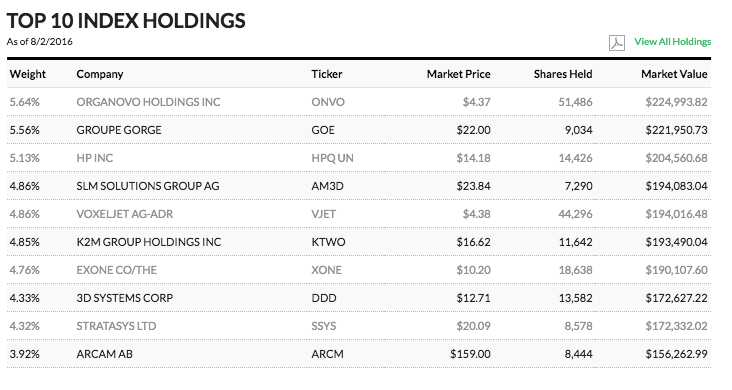

Ark Investment Management LLC recently launched an investment vehicle focusing fully on 3D printing, “It’s a global equity ETF that is built to replicate the total 3D printing index that is owned and operated by ARK. It currently has 40 equity holdings and rebalances quarterly,” says Tom Staudt, Ark’s Director of Product Development. “The purpose of the fund is to provide direct access to investing in the 3D printing industry,” he adds.

Diligent investors must perform research to identify undervalued companies or opportunities for growth. This requires both a particular skill set and a fairly substantial time commitment. A professional investment manager can perform these tasks for you, in return for a fee of course.

Aside from research, fund managers aim to add value in another way; by reducing risk through diversification. Rather than place all their eggs in one basket, investors might purchase shares in multiple companies. Then if one company’s stock price falls this is not so problematic.

Individual company stocks often move through a wide range of prices, displaying what is termed volatility. Volatility can be reduced by half with a portfolio of 10 companies, and the standard deviation of returns continues to decrease, albeit a slower rate, when more companies are added.

However, portfolio diversification is not always practical for the smaller investor. This is due in part to the transaction costs involved. Buying and selling shares incurs a fee from the broker, and these fees will be a greater percentage of the total value when the sums involved are small.

What is an ETF?

An Exchange Traded Fund (ETF) is one way an investor can access the advantages of a diversified portfolio. Rather than buying shares in multiple companies the investor purchases shares in the ETF, incurring only a single transaction fee. The ETF uses the investor’s money to buy assets in a particular category; this could be commodities, bonds or shares of companies in a specific industry, such as 3D printing. Additional benefits include the favorable tax treatment of some ETFs. ARK’s 3D Printing ETF is traded on the BZX Exchange, the largest of Bats Global Markets (BATs) stock exchanges, under the ticker PRNT.

“We’ve done research on 3D printing for quite some time and we look at the industry as a whole. As companies surface in our research we add them to a big list that becomes our universe of the 3D printing index,” says Catherine Wood, CEO and Chief Investment Officer. Wood founded ARK in 2014 and was previously the manager of investment assets valued at over $5 billion for AllianceBernstein.

“We invest solely in disruptive innovation. Our research starts when we identify, a new general purpose technology platform,” she says. This is because, “You can innovate on top of platforms, and technology platforms tend to follow a declining cost curve which then spurs unit growth. We think 3D printing fits into this classification.”

Picking 3D printing stocks

Tom Staudt explains the process for including a stock in ARK’s 3D printing ETF, “The criteria is ARK’s research into the companies involved in the 3D printing ecosystem. The research determines the trajectory of the company and its focus, and whether or not it is included. There are also liquidity and minimum market capitalization criteria.”

Shares in certain public companies listed on a stock exchange may be less frequently traded than other companies. This means it can be more difficult to sell or buy shares if a counterparty to the other side of the trade is not immediately available. In such situations the company may be said to be illiquid.

An example of a publically traded 3D printing company not currently included in ARK’s 3D printing ETF is Nano Dimension. Staudt says, “They were included in the universe of our research,” but did not meet the market capitalization and liquidity criteria. “As they grow and become more liquid they might be included in the future,” he adds.

Such investment funds can be categorized as either active or passive. A passive index tracker simply replicates a reference index, for example the NASDAQ or FTSE 100, and holds assets or shares in the same proportion as that index. Active ETF’s aim to produce returns better than the market through the skill of the fund manager in appraising assets.

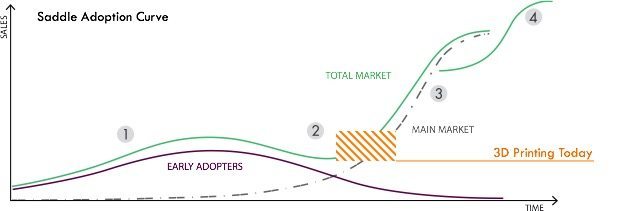

I ask Wood about the recent reports that 3D printing stocks are overvalued, “One of the things we like about starting the fund today is that we are very focused on s-curves. S-curves start out by going through a hype phase, which 3D printing went through in 2013 and perhaps into early 2014, there were a lot of mergers and acquisitions during that time. We think 3D printing is in the saddle phase of the adoption curve.” ARK investment analyst Tasha Keeney adds, “If you look at the market for end use products, which we think is the largest addressable market for 3D printing its worth about $500 billion in total, that market is less than 1% penetrated.”

3D Printing market to reach $40 billion by 2020

ARK expect the 3D printing market to reach $40 billion by 2020, this is almost double the estimates of independent consulting firm Wohler’s Associates, Inc. Tasha Keeney explains how ARK reached this figure, “We take a top down approach, which is also how McKinsey size the market. We look at the different addressable markets that 3D printing can have an impact on.” Keeney says these markets are, “End use products.” Based on those addressable markets, “We say ok, well what is the penetration rate we expect for 2020? That’s where we get our $40 billion estimate.” McKinsey are forecasting a 3D printing market of almost half a trillion by 2025. “That’s because they expect 3D printing to become integrated in the industrial manufacturing process,” says Wood. This is still a relatively small fraction of the $12 trillion global manufacturing industry.

I ask ARK for their thoughts regarding the hype around the technology in 2013/14, when even mentioning 3D printing could result in a formidable boost to a company’s share price. “That was too much, too soon and we’ve had a shake out since then. We’ve got a clear delineation in the market between the industrial and medical names on the one hand, and the consumer names on the other hand,” says the CEO.

As illustrated last week, in 2016 3D printing does not guarantee a company’s share price will perform well. “One of the reasons for the earnings misses [across the 3D printing industry] was the restructuring and the shake-out that had to take place in the consumer part of the market,” explains Wood.

But this was not the only factor that dented market confidence and 3D printing stock performance. “The 25% increase in the dollar which caused U.S. manufacturing to look uncompetitive in the global market place,” also played a role. Wood continues, “Ironically that is one of the reasons we think people are revisiting 3D printing because its going to collapse the time and cost between design and production and that the antidote to what has happened to the dollar in the last few years.”

Investing is never without risks, and frontier technology investments are arguably more risky than others. “Nanotechnology in the 1990s was the next big thing and it never happened as a group of distinctive stocks but it is happening within organizations, especially industrial organizations. This is a risk we look at all the time,” says CEO Wood.

However, despite the recent crop of “3D printing is dead” type articles ARK are confident this is far from the case. Wood explains, “What I find interesting is the number of mentions [of 3D printing in earning reports] sky-rocketed through 2013, they peaked there for a while and then went through a slight decline. And just recently in the last quarter, [mentions have] broken out to new highs. As an investor I look at that and I think that is a signal that something is gaining momentum here.”

As ARK’s investment analyst Keeney says, “Its hard to say that something has hit its peak when it hasn’t really even started yet.”