3D Printing Industry is currently seeking feedback on material usage across the sector. Have your say in the Spotlight on Resin 3D Printing Survey now.

Chinese metal 3D printer manufacturer Hanbang United 3D Technology (HBD) has announced the closure of a $60 million Series A funding round.

Led by Qianhai FOF, and supported by Grand Flight Investment and CITIC Securities, the investment has been hailed by HBD as the “largest first-ever round of its kind.” Using its newly-raised capital, the firm has already outlined plans to build an R&D and production center in Shanghai’s Lingang New Area free trade zone, through which it aims to expand on its overall ‘industry coverage and market share.’

“Metal 3D printing is rapidly maturing, and will become a new technology comparable to traditional machine tool processing and production methods in the future,” said HBD CEO Jianye Liu. “The current mainstream aerospace, industrial, medical, mold and other fields, and other industries will also be more applied to metal 3D printing technology, giving birth to trillion-level market opportunities.”

“HBD is confident that it will do better in the future. While growing rapidly, HBD will also promote the faster and better development of the entire Chinese metal 3D printing industry.”

HBD’s hybrid metal printing portfolio

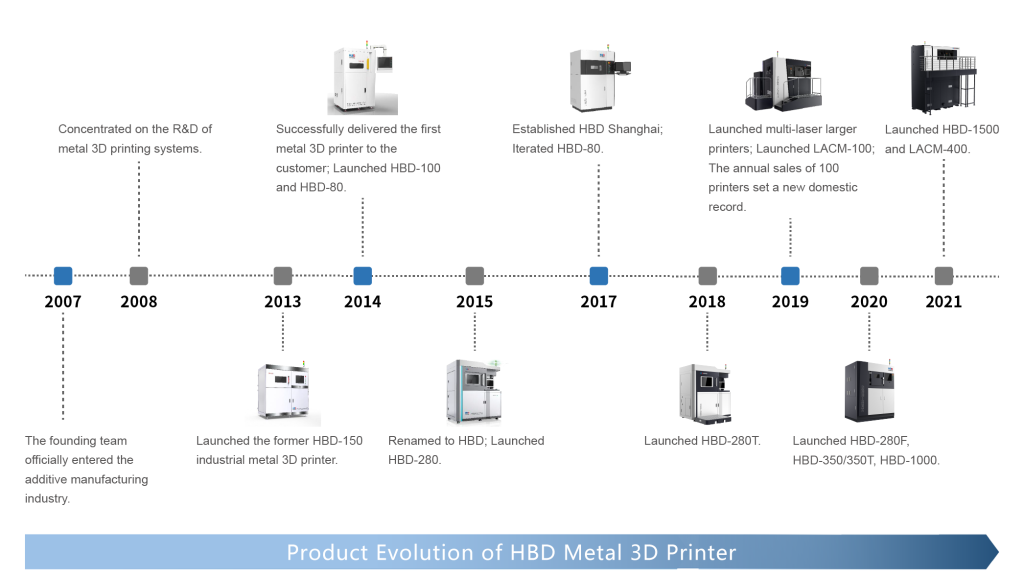

Based in the city of Zhongshan, HBD entered the metal 3D printing industry in 2007, but didn’t launch its first machine, the HBD-150, until 2013. Since then, the firm has gone on to release a whole host of 3D printers powered by the same selective laser melting (SLM) technology, ranging from the 120mm x 80mm HBD-80, to the HBD-1500, which packs a more substantial 460mm x 460mm x 1500mm build area.

Using its larger machines, HBD claims that many of its aerospace, automotive and energy sector clientele have already been able to resolve their manufacturing pain points. In one such use case, the company says a customer has previously deployed its technology to optimize the geometry of a reactor heat exchanger to such an extent, that it reduced the part’s height from ten meters to just 400mm.

Alongside its core SLM offering, HBD also markets its proprietary HBD-280F hybrid system, a set of metal powders, and units powered by what it calls ‘Laser Additive & Cutting Manufacturing,’ or LACM. Essentially a combination of metal 3D printing and laser cutting, the technology is designed to allow for the precise finishing of complex parts’ inner surfaces, without them collapsing during the process.

Protected by 200 domestic patents, as well as three international ones, and built compliant with fourteen different standards, HBD’s machines have been adopted in industry by the likes of Matsui, WeNext and CISIRI. Now, having sold more than 500 of these systems, the firm aims to leverage its newfound funding to ramp up their R&D, at a facility that it plans to build on a 6.5-acre site it acquired last year.

A $60 million expansion plan

Through its Series A funding round, HBD has secured the backing of three huge Southeast Asian investors, with a substantial amount of capital behind them. Since being founded in 2015 and 2016 respectively, Qianhai FOF and Grand Flight have already managed to drum up a combined $5 billion worth of funding to invest in assets, and CITIC Securities claims to generate $69 billion in annual revenue.

Drawing on their vast cumulative cash reserves, these venture capital firms have given HBD a funding boost that also provides it with a strong affirmation of its technology’s potential. This is especially the case given the high level of funding raised at the firm’s first significant round of financing, which as per the company’s claims, could well be unprecedented in the metal additive manufacturing industry.

Although the software-focused Oqton managed to raise $40 million in Series A funding, and metal additive specialist Velo3D gained $274 Million from its IPO in 2021, it’s possible, albeit unconfirmed, that no other metal 3D printing company has yet achieved such substantial backing for a funding round billed as Series A.

Leveraging its newfound funding, the firm intends to build in the Lingang New Area, where it will situate itself alongside high-profile businesses seeking to capitalize on the zone’s preferential tax rates, with the likes of Tesla said to be planning a Gigafactory there. HBD also anticipates that the capital will allow it to “invest in high-tech R&D, technical team building and high-end manufacturing,” in a way that enables it to continue “breaking technical bottlenecks” with its products.

“We have seen the rapid rise of metal 3D printing [technologies],” said Yun Pei, Executive Director of Grand Flight Investment. “Among them, we believe that the development mode, leading products and services presented by HBD have high-value content and long-term competitiveness. Grand Flight Investment will make full use of the strong financial and industrial background of the Far East Horizon Group to help HBD accelerate its breakthrough to the next stage of development.”

“Coupled with the substantial increase in the development of metal powder, it [metal 3D printing] is truly geared to large-scale industrial manufacturing.”

China’s booming 3D printing industry

As the first wave of the pandemic began to recede in mid-2020, it was reported by analysts such as those at CONTEXT, that the Chinese 3D printing industry was one of the fastest to bounce back, indicating both its resilience and potential for growth.

In November 2020, the market insight specialist revealed that China’s 3D printing sector had recovered more quickly than its western counterparts, particularly when it came to demand for industrial systems. This analysis has since been reinforced by the apparent success of one of the country’s leading printing firms, Farsoon, which in late-2021, revealed it had delivered record-breaking sales numbers.

These promising trends have also attracted a significant amount of investor interest in Chinese firms, with the likes of UnionTech raising $31 million in December 2021. At the time, one of the funding round’s backers, Dening Capital, described the company as “a leading enterprise in the field of SLA 3D printing in China,” and anticipated that it would continue to expand its market share moving forwards.

To stay up to date with the latest 3D printing news, don’t forget to subscribe to the 3D Printing Industry newsletter or follow us on Twitter or liking our page on Facebook.

For a deeper dive into additive manufacturing, you can now subscribe to our Youtube channel, featuring discussion, debriefs, and shots of 3D printing in-action.

Are you looking for a job in the additive manufacturing industry? Visit 3D Printing Jobs for a selection of roles in the industry.

Featured image shows a mock-up of what HBD’s proposed facility in Shanghai might look like. Image via HBD.