Specialty alloys and metal powder producer Carpenter Technology Corporation (NYSE: CRS) has reported its financial results for the fourth quarter and full year 2019. Net income for the year was reported at $167 million, compared to 2018 which was $188.5 million. For Q4, the three months ended June 30, 2019, net income was reported at $48.9 million, with the quarter experiencing the strongest quarterly operating income performance ($67.9 million) since FY 2013.

| ($ in millions) | Full Year 2019 | Full Year 2018 | Variance $ millions | % |

| Net Income | 167 | 188.50 | -22 | -11.41% |

| Net Sales Excl. Surcharge | 1,942.10 | 1,792.30 | 150 | 8.36% |

| Operating Income | 241.4 | 189.30 | 52 | 27.52% |

A strengthened additive manufacturing portfolio has led some of the company’s strategy within the past year, which commenced with its joining of the GE Additive Manufacturing Partner Network in Q1, and the $79 million acquisition of British metal powder producer LPW Technology (now integrated in Carpenter Additive) in Q2 2019.

“Our fiscal year 2019 performance demonstrates the value of strong execution of our commercial and manufacturing strategies which drove consistent year-over-year revenue and earnings growth in the Aerospace and Defense and Medical end-use markets,” stated Tony Thene, Carpenter Technology’s President and CEO. “We also continued to look to the future and took innovative steps to strengthen our leadership position through targeted investments in key emerging technologies,”

“This past year we significantly advanced our additive manufacturing platform by adding powder lifecycle management solutions through the acquisition of LPW Technology Ltd.”

Carpenter Technology FY 2019 reporting by business segment and end-use market

Carpenter Technology has two reportable business segments, Specialty Alloys Operations (SAO) and Performance Engineered Products (PEP). SAO encompasses the company premium alloy and stainless steel manufacturing operations, whereas PEP comprises its Dynamet titanium business, Carpenter Powder Products (CPP), Amega West, Latrobe and Mexico distribution businesses, PBF specialist CalRAM (acquired February 2018), and business from LPW, which includes additive manufacturing powder supply, and the provision of powder handling equipment. As such, PEP also includes activity from the Carpenter Additive brand, launched by the campy in May this year to help build the company’s image in this sector.

FOR Q4 2019, SAO net sales were reported at $532 million, compared to $518.3 million in Q4 2018. For PEP, which includes the company’s additive manufacturing businesses, Q4 2019 net sales were reported at $126.4 million, compared to $116.3 million in Q4 2018.

For the full year 2019, SAO generated net sales of $1,967.3 million compared to $1,803.8 million for the full year in 2018. PEP full year 2019 net sales were reported at $479.7 million, an 11.6 percent increase compared to PEP net sales for FY2018 which were reported at $429.7 million. Consolidated pounds of PEP sold across 2019 (comprising Dynamet, CPP and LPW businesses) equated to 267.5 thousand, compared to 265.6 lbs across the full year 2018.

| Net Sales | Q4 FY2019 | Q4 FY2019 | Variance $ millions | % | FY2019 | FY2018 | Variance $ millions | % |

| Specialty Alloys Operations | 532.00 | 518.30 | 13.70 | 0.03 | 1967.3 | 1803.8 | 164 | 9.06% |

| Performance Engineered Products | 126.40 | 116.30 | 10.10 | 0.09 | 479.8 | 429.7 | 50 | 11.66% |

| Total (unconsolidated) | 658.40 | 634.60 | 23.80 | 0.04 | 2447.1 | 2233.5 | 214 | 9.56% |

By end-use market, Aerospace and Defense is Carpenter’s strongest area, accounting for $1,051.5 million in net sales for FY2019, compared to $957.1 million in net sales for FY2018. This market is followed by Industrial and Consumer, which in FY2019 accounted for $298.5 million in net sales, compared to $295.9 million in FY2018. Medical is the next largest market for Carpenter, accounting for $176.3 million in net sales for FY2019 compared to $149.3 million in net sales in FY2018.

Closing comments

The company ends FY2019 with $27 million, having started the period with $ 56.2 million. The company also has experienced a 41% increase in backlog in FY2019 compared to FY2018, its 12th consecutive quarter of year-over-year backlog growth.

Concluding financial statements for FY2019, Thene stated, “Looking ahead, we are focused on advancing our solutions approach, capturing additional productivity and capacity gains through the Carpenter Operating Model, and investing in the future of our industry and our end-use markets,”

“We believe the further execution of our strategy will enhance our long-term growth potential and drive sustainable long-term value creation for our customers and shareholders.”

Carpenter Technology Corporation’s full financial results for Q4 and FY2019 can be accessed here.

Keep up to date with industry-relevant financial reports this season by subscribing to the 3D Printing Industry newsletter, following us on Twitter and liking us on Facebook. Seeking jobs in engineering? Make your profile on 3D Printing Jobs, or advertise to find experts in your area.

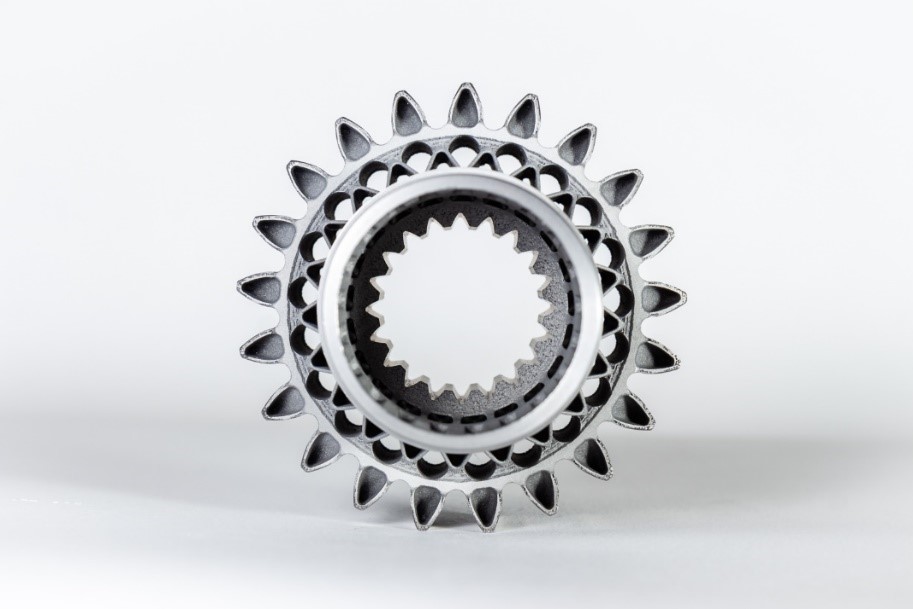

Featured image shows Carpenter Additive metal powder. Photo via Carpenter Additive