“May you live in interesting times,” resonates with many involved in the metal 3D printing industry, an ironic phrase regarded by some as a curse. Magnus René, CEO of the Arcam Group AB, might one of the last to agree. In the 3D metal printing market Arcam are unique. Holding propriety Electron Beam Melting (EBM) patents the company is at the forefront of cutting edge industries such as aerospace and medicine. I asked Arcam’s CEO about some of these developments.

René compares today’s additive manufacturing landscape to an earlier career experience in another industry at the frontier of technology.

“I was with a company that developed and released the [semiconductor] printers that are used still to this day for manufacture. Those were also interesting times, we really felt that we were changing the way things were manufactured.”

Speaking to me over the phone from Boston, where the Swedish company opened their U.S. HQ last year, René explains the appeal and excitement of the 3D metal printing industry. As CEO of a company with over 100 patents covering additive manufacturing he has some valuable and unique insights.

3D printing metal insights

René thinks there are several misconceptions about AM technology and it’s use in 2016. The first is, “how big an impact AM has already.” 3DPI readers are familiar with headline figures such as the $5.1 billion calculated by Wohlers Associates, but may be surprised by how pervasive use has become. Illustrating the point René says, “1 out of 30 hip surgeries involves components that come from an Arcam system. I think that is amazing.”

This proliferation is due in part to Arcam customers like Exactech. The U.S. bone and joint restoration specialists saw AM’s potential and were early adopters. The level of geometric complexity 3D printing enables means that acceptance of an implant by the body is much higher. The previous generation of hip, knee and other implants relied upon a coating to bond with the human body. Implants manufactured via AM feature intricate lattice structures that encourage bone ingrowth. As an integral design feature of the implant, integration is more likely and failure due to peeling or degradation of the coating is unheard of.

René says, “In 2010, Exactech were one of the first to get FDA approval for a product made by additive and that was by EBM. They are a good example of how this market is developing.” He explains, “That product has been and is manufactured by a contract manufacturer here in the U.S.” One such contract manufacturer is DiSanto, one of 2 acquisitions Arcam made during 2014. DiSanto’s services provide a relatively risk-free way for enterprises to test the water before taking the plunge with a capital investment. “This really shows how a company starts with a product and then they move on with new products and new ways of manufacturing as well. I think this is a really good example of how this market is growing,” René confirms.

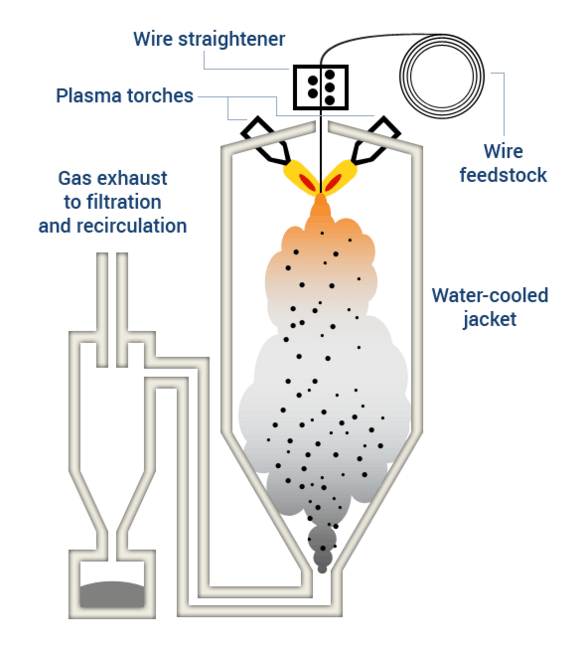

DiSanto provides a logical path to the wider adoption of AM for potential customers and Arcam’s other acquisition is equally grounded in a similar longterm thought process. Canadian metal powder manufacturer, AP&C is a frontrunner in metallurgy for AM. A position held for more than a decade. PyroGenesis developed the Plasma Atomization IP during the 1990’s and Arcam acquired this IP along with other company assets. I ask René whether recent proclamations from PyroGenesis about a return to the metal powder sector are cause for concern.

His response is adamant, “We have patents and we have know-how that is totally different from what PyroGenesis have.” The 2 patents filed by Arcam in November of last year are testament to this. He adds, “And remember at AP&C our capacity, we own more than 50% of the titanium powder market for additive. Maybe we own 70% of the market.”

This in-house know-how has increased powder yields from the AP&C reactors. By my estimates, in 2015 a typical reactor had a capacity of 50 tons per year, now each powder reactor can produce around 60 tons of powder. Is this accurate?

“Yes, between 40 & 60 tons a year. It depends on what material you use. Its correct that they are becoming more and more efficient.”

Metal powder producer AP&C have optimized and scaled up tech

During the past year AP&C have rapidly increased production capacity. The addition of a 3rd powder reactor in September 2015 was followed by the announcement of a 4th and 5th in the same month. Further expansion was announced in May this year and will bring total annual production capacity to 750 tons.

But AP&C’s fortunes are not intrinsically tied to the adoption of EBM. “Actually we sell as much powder to laser [powder bed fusion] machine users as we do to EBM machine users. Roughly half of the powder we make at AP&C goes into laser machines.”

Talking about the parts made by the machines he says that approximately “half of our [metal powder] sales go into aerospace and half to implants. Long term however we are very sure that the aerospace market will be much bigger than the orthopedic market.” This is because of the sheer volume of metal used in aerospace.

Despite these textbook examples of horizontal and vertical integration René says Arcam have no immediate plans for further acquisitions.

I am interested to know about how the machine business is developing and ask René about this. He explains that Arcam’s primary markets of aerospace and orthopedics share a common characteristic. Both industries are tightly regulated. Materials and processes are subject to certification and qualification and must receive regulatory approval. This can be a lengthy process.

So, should observers expect a typical Arcam customer to have a lag between purchase of an initial machine and after qualification has taken place to see an order for more machines?

“Yes, that’s normally what happens. Customers start with 1 or 2 machines and over time they move into production and they add more machines. Normally they start with buying a machine or 2 and move into production, which may be many machines or not so many machines.”

In line with other listed companies Arcam cannot comment directly on sales outside of stock market regulator designated periods. So when asked about sales of Arcam’s most recent iterations, the Q10plus and Q20plust, René refers to information already in the public domain. Last week Exactech published a press release saying that they bought 2 more EBM systems for production. Also, Alcoa purchased a Q20plus in May.

The lengthy sales cycle goes someway to explaining the number of Arcam machines installed worldwide. At just over 150 this number may appear low. Placed in the context of Wohlers Associates research, who report total sales of 808 metal AM systems for 2015, the number appears much more reasonable.

Restructuring activity by other companies in the advanced manufacturing field may provide additional insight. For example, Alcoa will split later this year in order to focus separately on its upstream and downstream business. The downstream company will be called Arconic and it’s Engineered Products and Solutions (EPS) segment will handle additive manufacturing. The EPS division contributes approximately 60% of income after tax to Arconic’s p&l. The company has expressed its opinion on the evolving aerospace landscape in the past saying the industry is in a phase of transition. Additive technology may prove a critical component during this transition as it allows enables companies to increase the rate of innovation.

Machine sales across the industrial 3D metal printing market are accelerating.

Data from researchers at Roland Berger indicates that, excluding binder jetting and directed energy deposition methods, worldwide 1601 metal powder bed fusion systems were sold by 2014. Adding sales from 2015 this gives 2409 machines, a 50% increase year-on-year.

A key driver of this growth is the relatively recent burst of competition driven by innovation in the aerospace industry. Specifically the battle between two next generation engines.

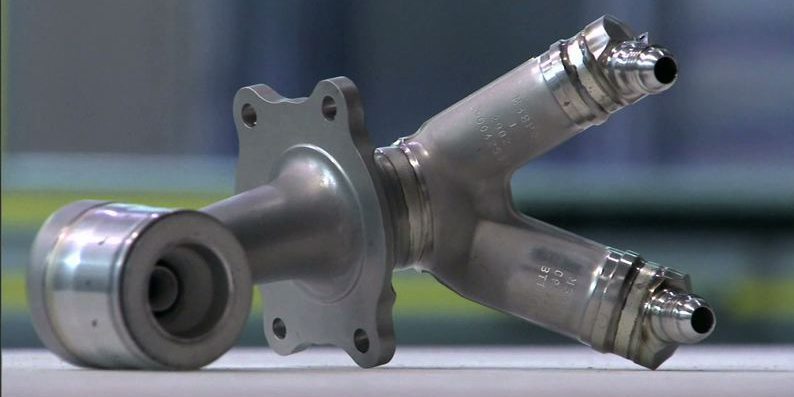

The LEAP engine developed by GE Aviation and Snecma via joint venture company, CFM International is competing with the Pratt & Whitney PurePower Geared Turbofan (GTF) engine. Aviation and additive manufacturing commentators have praised each engine for using new manufacturing techniques, including 3D metal printing, to improve performance. The prevalence of the LEAP fuel nozzle in conference presentations has led some to joke that its inclusion in a slide deck is compulsory.

Arcam have sold EBM machines to both CFM and Pratt & Whitney. René does not go into detail about the specifics of how these customers use the machines. With multi-billion dollar R&D projects and decade long lead times information security in the aerospace industry is tighter than some governments.

Additive manufacturing drives innovative next generation engines

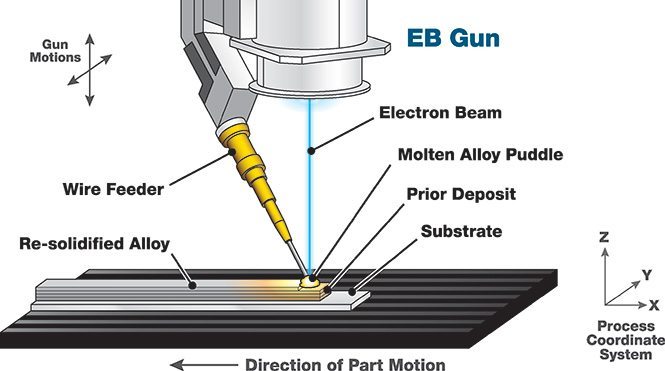

GE previously announced their use of Arcam’s EBM to manufacture low-pressure turbine blades from the super-alloy, titanium aluminide. Furthermore, a patent held by United Technologies Corporation (UTC), Pratt’s parent company, may provide some insight into how EBM is used.

The method described here addresses advanced cooling technology within the high-pressure turbine. “Uber-cooling” of the airfoil is possible through additive manufacture with a super-alloy as EBM enables internal passages to be incorporated within the airfoil. While this cooling technique is possible using conventional ceramic or refractory metal cores, use of AM brings the passages, “3x to 6x closer to the airfoil surface.”

If the production targets announced by engine manufacturers are to be believed then rapid expansion of the AM metal market is around the corner. GE plan to make 2,000 engines annually by 2020 and Pratt have taken orders for 7,000 engines. Furthermore, the head of Additive Manufacturing at GKN Aerospace, Rob Sharman, said, “Working in partnership with Arcam we have made significant progress towards the goal of using EBM in the manufacture of production aerospace components.” GKN say they use Arcam machines, “for small to medium sized titanium parts.”

Given the indications that Arcam’s machines are a vital part of the engine manufacturing process it might be reasonable to assume a sizeable increase in sales.

René refuses to be drawn on whether the financial markets have mispriced Arcam stock. He says, “I know everything about Arcam expect for the valuation.”

While the share price may not be soaring, components made on Arcam machines will soon be reaching record highs. As we reported NASA are testing nozzles made from alloy Inconel 718 and Rocket Lab continue to progress towards launch later this year.

Sustained Innovation

Early development work for EBM was in collaboration with Chalmers University of Technology in Gothenburg, Sweden. Currently Arcam has approximately 50 people engaged in R&D and EBAM 2016, the first conference on EBM, was held in April. Such an avid focus on technology appears to be paying dividends, and the company continues to file patent applications. How does a business sustain such a prolonged period of innovation and advancement of scientific knowledge?

With modesty the CEO says, “Oh, I don’t know what to answer to that.”

Continued partnership with education institutions seems to be a clear strategy here. Arcam collaborates with several universities, “here in the U.S. with Oakridge national labs for example” says René. EBM is an appealing technology for researchers given its practical applications and relative novelty when compared to more established manufacturing techniques. Researchers working with the technology at this stage can also expect high impact papers as a result.

This approach to research was also seen with the installation of Arcam machines in the Pratt & Whitney Additive Manufacturing Innovation Center at the University of Connecticut. The occasion also marked the North American introduction of Arcam’s A2X machines in 2013.

Arcam’s corporate culture seems to buck the trend for career progression via leap-frogging, or workers climbing the corporate ladder by frequently changing companies. 4.6 is the median number of years the U.S bureau of labor stats report as the time most people stay with a company. What is it about Arcam that encourages people to stay so much longer? “Well, of course the fact that we are in a company that is growing and changing every year makes it interesting. But also the fact that we are really driven by our wish to transform the industry. We really want to change the industry. I think that is appealing to anyone in this business.”

The future of additive manufacturing with metal

The uplist of Nano Dimension onto the NASDAQ in May and announcements by Optomec and Voxel8 have generated a buzz this year about printing with electrically conductive materials. Additive manufacture of printed circuit boards (PCB) and semiconductors is an intriguing prospect. During the 90s, René was head of operations at Micronic Laser Systems, a manufacturer of advanced lithography equipment for the semiconductor industry. Also he holds an MSc in electrical engineering. I ask him for his thoughts on the application of AM technology to electronics and whether Arcam have any interest in this area.

“I think that’s an industry where we could make a lot of sense. Particularly if you look at the semiconductor industry they are often complex machines built not in super high volumes and in particular materials. Going down the line that could be an interesting vertical.”

Another interesting development is news that Norsk Titanium are bringing a plasma arc welding and titanium wire AM machine to market which they call Rapid Plasma Deposition. Does this present a challenge to Arcam’s EBM?

“Its an interesting technology that is complementary to what we are doing. It is typically good for larger, more heavy-duty parts in the aerospace industry. But not so much for smaller parts with lots of design freedom.”

Confident of Arcam’s strength René says of the future, “Next is to use the strong international presence we have built and leverage that to continue to serve our customers and move into production based applications.”

Forecasts suggest the metal additive manufacturing industry will continue to grow during the remainder of this decade. Process optimization and other technical advances mean that cost reduction from using AM machines and materials are likely. This, and other developments such as enhanced software algorithms and real time feedback systems will encourage greater adoption of the technology for production, or industrialization. AM systems may also form an important component of Industry 4.0.

There is plenty of wild speculation passing as news in this industry. Companies, academics and even occasionally journalists can be equally guilty of riding the hype train. Magnus René prefers to let Arcam products do the talking. Wrapping up the interview I ask him about the future of the additive manufacturing industry.

His clear answer, “more production.”

I’d say that falls into the category of interesting times.