Over at Nanalyze, the question is asked in a recent article, “Is there a 3D Printing Industry?” Their answer is no. My answer is “Uh doyyy. Look at our header.” Really, what the tech investment blog is getting at is how to categorize the emerging 3D printing field from an investment perspective.

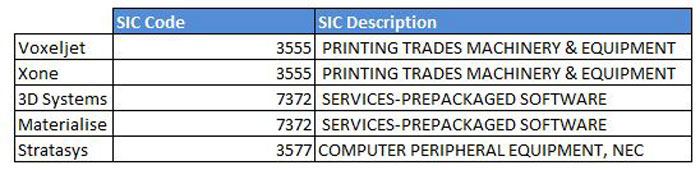

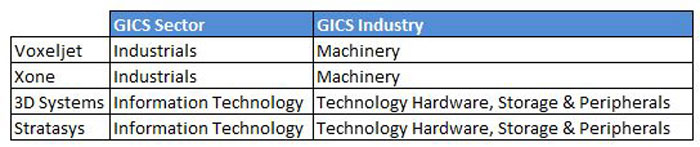

According to Nanalyze, there are two primary ways that the investment community and the SEC classify a business, either using the Global Industry Classification Standard (GICS) or the Standard Industrial Classification (SIC). Under the GICS, there are four levels of classification with 10 Sectors, 24 Industry Groups, 68 Industries, and 154 Sub-Industry Groups. The SIC only categorizes companies based on a single class of industries. And neither have any slot in which to slide the business of 3D printing. Take a look here at how our beloved 3D printing companies are classified according to SIC, followed by GICS:

But what’s the point of even classifying the nascent sector? I often ask this question about everything, particularly in reference to zoology. Why do we divide species up into distinct groups and give them funny latin names? After all, we’re all just a big lump of happenings swirling around and into each other. Who cares if Bearded Dragons are labeled Pogona vitticeps and their relatives, the Sinai agama, are distinguished as Pseudotrapelus sinaitus?

I’ve come to the conclusion that, regardless of the dead language used to do so, classification can aid in the understanding of life’s infinite details. Though it may act as an educational barrier to knowledge, at times, our series of genuses and phylums elucidate the great diversity in life in such a way as to know who does what when, where, how, and why with those specifics then adding to our overall comprehension of the reality situation. Zoologists and biologists can say that Bearded Dragons need X amount of UVB rays to survive and that Sinai agama need Y amount, but that both like to swim in rivers occasionally. Also, compared with rats or birds, the two lizards are both cold-blooded and can’t produce their own body heat. And then, occasionally, we’ll get a platypus that spans our contrived genres, until we can create new ones. Those Latin classifications may seem arbitrary and inaccurate at times, but they do serve as placeholders with which to get into the nitty-gritty of what makes life so nitty and gritty.

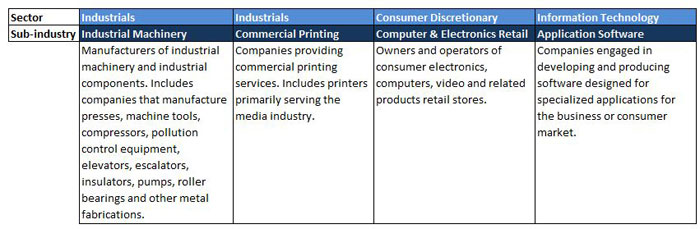

And this carries over into investment. In order to track the performance of a company, it’s useful to understand how it fits into the big picture of the international economy, specific stock markets and its own industry[1]. Nanalyze uses the example of Materialise, which recently filed an IPO. If we can classify the 3D printing industry, we can know how the Belgian 3D printing service bureau might perform alongside others in its industry, like 3D Systems or Organovo. In trying to place Materialise, Nanalyze uses the aforementioned GICS subcategories:

According to the GICS classification methodology, revenue is a major factor. In this case, the “3D printing software” segment represented only 19.6% of total revenues while the “industry” segment on the other hand accounts for 39% of total revenues. If we use an earnings analysis, we see the software segment achieving EBITDA margins of 38% with the industry segment at only 14.5%. If we took into account investor sentiment, many investors would describe Materialise’s business as a “3D printing services bureau” which would by definition fall under “Commercial Printing”.

What that jargon makes clear is that attempting to categorize, and then analyze based on those categories, the growing number of 3D printing companies is confusing. Nanalyze adds:

It remains to be seen how S&P chooses to classify Materialise. Unless 3D printing grows large enough to merit its own sector, companies will continue to be classified according to the GICS sub-segment that best defines their principal business activity which will lead to some confusion as to what these companies actually do.

Fingers crossed that the “industry” does grow enough to become an Industry so that we can all keep our jobs! In the meantime, Gary Anderson has an awesome 3D printing stock index at 3Dprintingstocks.com that can give you an idea of how the “industry” is doing as a whole. As for classification and the meaning of life, I’ll turn you over to Alan Watts:

Source: Nanalyze

[1]Not to mention how the concept of money and economies fit into the larger context of our social structure and the quest for the meaning of life.