Hot on the heels of a significant chain of acquisitions in recent years – from Phenix to Geomagic, Medical Modelling to a specific R&D division of Xerox, Digital PlaySpace to Sugar Lab and many more – 3D printing giant 3D Systems has announced that it has entered into a definitive agreement to acquire Robtec of Sao Paulo, Brazil: The largest South American additive manufacturing service bureau and the region’s leading 3D printing and scanning products distributor. The transaction maximises 3D Systems’ Quickparts custom manufacturing expansion plans and regional reseller coverage.

Robtec is recognised as the leading Latin American 3D print manufacturing resource and delivers high-end rapid prototyping and custom manufacturing services. The company brings with it established long-term relationships with leading automotive and aerospace players such as Embraer, Siemens, Volkswagen, Fiat, CenPra, Visteon and Mercedes. Robtec also boasts some two decades of additive manufacturing service bureau experience with substantial production capabilities. It is expected that the transaction will be completed within the next ninety days, subject to customary closing conditions. Investors should watch for the ramifications as the acquisition is anticipated to immediately accredit 3D System’s cash generation, contributing to non-GAAP earnings per share within the first year.

Anyone following 3D printing stocks will know that 3D Systems has lost a third of its value in 2014. This decline can also be seen across other publicly floated 3D printing players. We must remember that the deflation in value is relative to the incredible amounts of hype and speculation in 2013 that were inflated by the disconnect between the current reality of the generic set of technologies termed 3D printing, i.e. one too many ‘Just like Star Trek’ analogies, and the actuality; the nature of our pre-emptive culture, which now thrives upon trends that are extrapolated from social media and internet driven data – 50,000 Likes for 3D printing on Facebook is not equal to 50,000 potential unit sales.

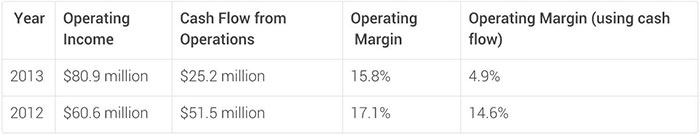

What we could, perhaps should, be looking at is not 3D Systems’ lower Q4 operating margin, but the permeation into new sectors such as space and food, fashion and in-store for-business deals with large office supply chains. The bottom line is an important indicator regarding the negation of risk. Fund managers will be considering this perspective closely. Individual investors have a greater range of free play. Many will also be drawn to pure cold mathematics and short-term evaluations. Many will feel inclined towards simply following the flock for stability in their portfolio. But how many are really — and genuinely — reading about the technology itself, the range of deals being made and the actuality of the technology over the strange fictional world created by reporters in much of the mass media?

Another consideration is that the general public are still strapped for cash, debt driven economics has a more tainted name these days and the majority of people are still thinking about how to lower their food shopping bill rather than what plastic things they can print at home. They are enamoured by 3D printing, love reading about it – thus one of the few social media metrics that does say something: 3D Printing Industry, the very publication that you are reading, is second only to MakerBot for Facebook Likes in the 3D printing sector – but most people have yet to find a persuasive reason to buy a home desktop 3D printer. This, at least in part, is why I’d suggest 3D Systems has started to increase its emphasis in pitching the Cube range more specifically at designers. This isn’t a Lucosade strategy — the drink that used to be marketed as being for health benefits and now is marketed for energy benefits when, in fact, it is just fizzy e-numbers and a glucose-fructose syrup has replaced genuine fruit derived nutrition in our liquid diets — this is more a shift of emphasis towards the natural user base of 3D printers at home, prototyping designs in the home office. There will certainly also be mindfulness regarding competing with MakerBot, now owned by major (indeed, realistically in terms of revenue from an investors perspective, the only) rival in the marketplace, Stratasys. The Cube series now faces off against the MakerBot series just as 3D Systems faces off against Stratasys (as it has since the late 80s).

Not as many people as anticipated purchased a Cube home 3D printer for Christmas in 2013. Does this mean that desktop 3D printing is going the same way that virtual reality did?

Not at all, there are certainly no empirical indicators yet. This is the pre-emptive element of our culture: analytics allow us to measure the future ever more precisely, which changes the present. 3D printing will be huge in 2020 many statements read. I also predict that it will be a significant consumer technology by then. 3D bio-printed organs will likely revolutionise human healthcare by 2025. Again, the potential that 3D printed organs would not radically change the sector, and more importantly our health, is far lower than the potential that it will. Read through the range of approaches to the problems that need overcoming to bringing the technology to fruition on a monthly basis, even here in 2014, and that level of innovation is a general marker of the trajectory. 3D printing hasn’t even got off the starting block, let alone writing it off as it approaches the finish line.

Technological progress is based upon science. Science deals with realities, theories and paradigms. The company that bases its future upon technological progress therefore deals with realities, theories and paradigms. The growth in the use of industrial additive manufacturing is a reality. The relatively large investments made by governments into 3D printing are a paradigm. The market value of the main players in 3D printing is a theory in our 2014 culture, because so much emphasis is placed upon attempting to predict where the company will be in a year’s time. Technological progress is exponential, the rate of technological adoption is ever increasing, just which technologies are adopted by the masses, who are caught between the (negative) weight of debt and the (positive) lowering of inflation inherent in capitalist economics (products are getting cheaper relative to how money is inflated), is the crux. What proportion of the population will want to download items to print at home?

We have witnessed home 3D printed circuits, metals, carbon fibre, textiles and more appear within the past twelve months, but all of these are very much developmental technologies. Why aren’t more people purchasing home 3D printers made by 3D Systems at Christmas? Remember the craze for the Thunderbirds Tracy Island model about a decade ago? It was plastic. It was cheap. Plastic things made by 3D printing are not as cheap. Yet.

In times of economic recovery, people buy utility more than novelty. When home 3D printers can produce in a range of colours and materials they will be more popular. When they can produce in a range of colours and materials and feature 3D printed circuits as fully functioning products they will breach the mass market. When they can do that for a cost approaching mass production they will find their way into some homes. Will progress with the home desktop version of the generic set of technologies known as 3D printing get that far? That is an issue that splits opinion. And that is an issue I leave to makers and manufacturers to decide. But it’s a close call that all comes down to technological progress in other sectors — most notably materials science and energy efficiency. To increase utility and decrease cost, as commentators / observers, we sit back and watch the technology evolve around us.

The above paragraphs are a focused commentary on just one of many strata of what 3D Systems does as a company, partly in reaction to some of the statements that I have seen on investment sites in the past week. The turn-over of the big publicity floated 3D printing players is as concentrated upon industrial sales and services as ever. The rate of adoption in industry has its own limiting factors, not a thousand miles apart from the variables which dictate the rate of progress in home desktop 3D printing. But the near future is looking at the least steady, while the long term technological potential is greater, as a thousand other 3D Printing Industry articles will tell you…

In services lay stability. And the decision makers at 3D Systems of course know this. In penetration of new markets lays growth. They know this too. Within these two parameters the strategic decision to purchase Robtec becomes as logical as can be.

Avi Reichental, President and CEO, 3D Systems stated: “We believe that the strong strategic and cultural fit between our companies, combined with Robtec’s on-the-ground additive manufacturing service bureau capabilities, expanded channel coverage and deep automotive and aerospace customer relationships could present significant benefits for our customers, sizeable growth opportunities for us and greater value for our shareholders. This is the right time for us to add a company of Robtec’s reputation, experience, growth record and scale in Latin America. With key operations in Brazil, Argentina, Chile, Uruguay and Mexico, proven service bureau operations and leading printing and scanning distribution activities, Robtec represents the cornerstone of our Latin American expansion plans.”

Robtec’s President Pablo Elenter said: “We are excited to become part of 3D Systems, a leading provider of the most complete portfolio of 3D content-to-print solutions available today. We plan to leverage our collective knowledge and experience for the benefit of our customers by building stronger local presence and immediately delivering the full range of 3DS products and services throughout the region.”

Under the terms of the definitive agreement, 3DS will acquire some 70% of the shares of Robtec at closing, and the remainder of the shares on the 5th anniversary of the closing. The terms of the transaction have yet to be disclosed.