Biotechnology specialist BIOLIFE4D has filed for an Initial Public Offering (IPO) with the US Securities and Exchange Commission (SEC).

Though BIOLIFE4D has yet to price its IPO, it has revealed that it aims to raise $17.5 million via the move, which will see a significant amount of its shares become publicly traded. Using any cash raised, the firm says that it intends to expand its R&D operations, as a means of “commercializing” the mini 3D bioprinted heart it has been working on for at least four years.

BIOLIFE4D’s bioprinting ambitions

According to BIOLIFE4D, there are over 100,000 people on the organ transplant waiting list in the US alone, and many more are in need but don’t qualify for transplantation. To make matters worse, the firm says these patients also face a myriad of other challenges, not only when it comes to cost, but the risk of potential complications and donor organ rejection.

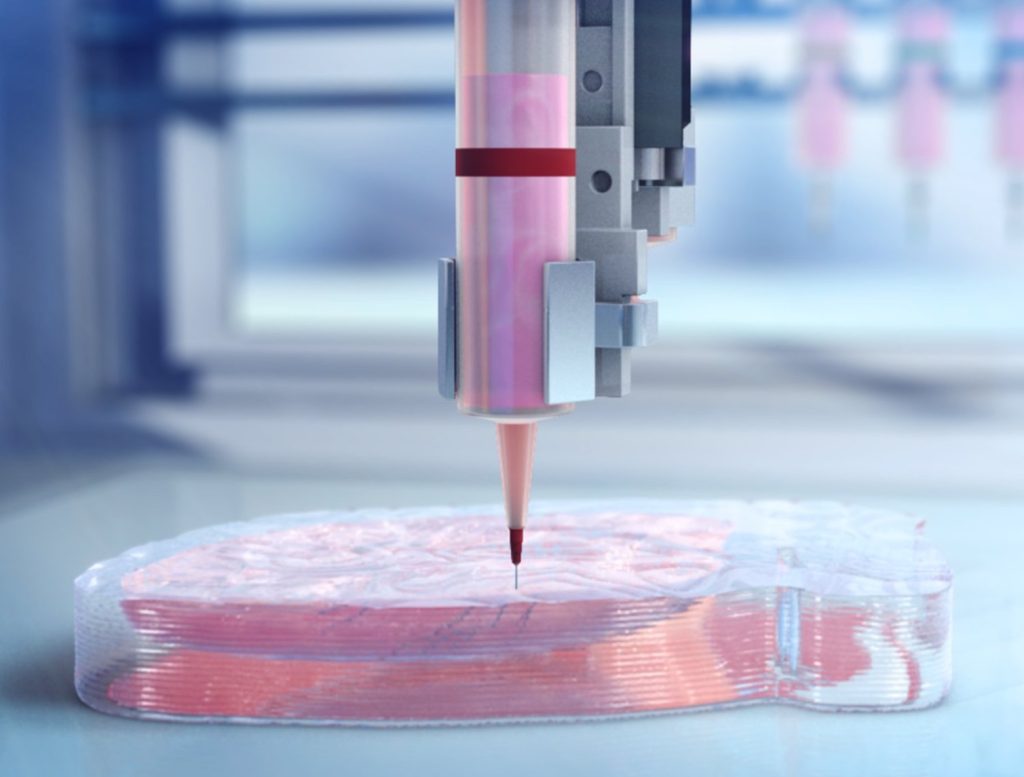

With this in mind, BIOLIFE4D has come up with a novel means of creating heart tissues from patients’ own cells, which promises to drastically reduce the time they have to wait for organ grafts. Using an MRI scan of a patient’s heart, the company’s approach sees it create an exact digital replica via 3D modeling software. This model is then turned into transplantable tissues using a custom bio-ink, containing patient stem cells taken from a blood sample, as well as undisclosed nutrients.

Once printed, the resulting structure is later moved into a bioreactor, in which its cells can begin self-organizing and fusing into living tissues, that ultimately start ‘beating’ in unison. Theoretically at least, BIOLIFE4D says this process is capable of producing fully-formed hearts that are a “perfect genetic match for the patient,” freeing them from the risk of rejection that “plagues conventional methods.”

However, the company’s R&D is understood to remain at a pre-clinical stage, meaning that its technology is still a considerable way away from commercializing as desired. That being said, BIOLIFE4D has passed several scientific milestones since announcing the creation of its first 3D bioprinted heart tissues in 2018, which should provide reason for optimism to investors in its potential upcoming IPO.

The next year, the firm reported that it had successfully bioprinted a mini-heart, which was said to be capable of mimicking some of the functionalities of the real organ. On its website, BIOLIFE4D also boasts of having developed stem cell-derived mitral and aortic heart valves, designed to replace the damaged valves of patients, and make treatments involving the use of clot-preventing blood thinners obsolete.

Analyzing BIOLIFE4D’s financials

BIOLIFE4D’s plans for an IPO are detailed in the S-1 registration statement it submitted to the SEC last week. In what is a lengthy document, the firm outlines how it would spend any funding raised from the move, pledging to spend $7.2 million on lab gear and materials, as well as around $1.3 million on G&A, and $1.1 million on working capital loan repayments.

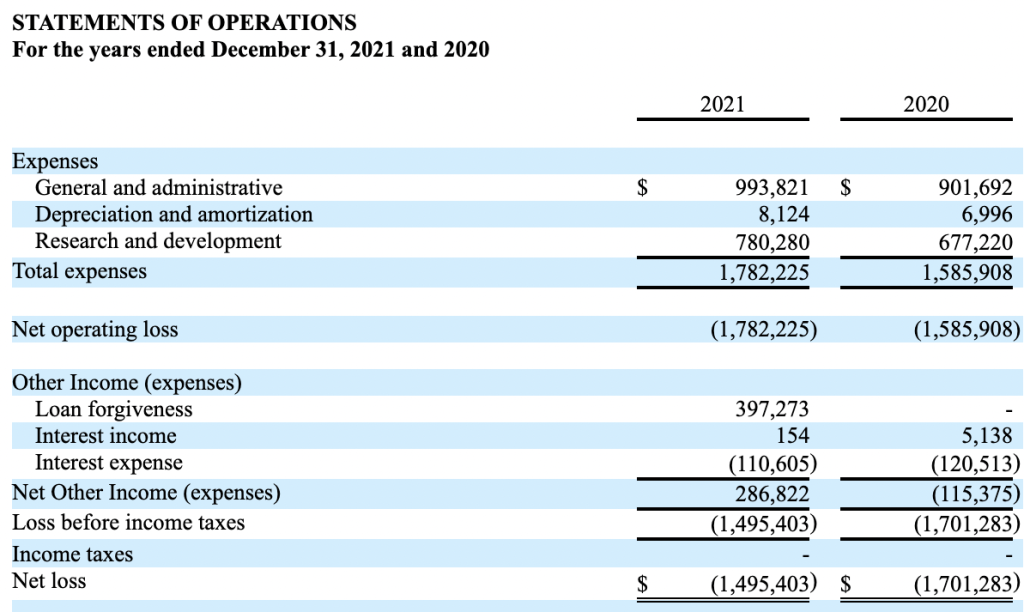

The statement also reveals that as of yet, the company hasn’t generated any revenue to fund its activities whatsoever, hence its total expenditure of $1.8 million last year resulted in an operating loss of the same amount. Of this spending, just under $994,000 was tied up in G&A expenses, while $780,000 was shelled out on R&D and around $8,000 of this was due to depreciation and amortization.

In the past, BIOLIFE4D has actually already turned to selling common stock, as a means of bankrolling its ongoing 3D bioprinting research efforts. Back in early-2018, the firm filed for a $50 million IPO with the SEC, albeit under Regulation A+ rules. Since then, the bioprinting specialist is believed to have raised just $6.8 million from investors, with $2.14 million of this coming from share sales in 2020 and 2021.

While offerings launched under Regulation A+ tend to be dubbed ‘mini-IPOs,’ as they’re subject to a number of limitations, the shortfall between BIOLIFE4D’s projections and the funding it has attracted raises questions about its latest IPO.

For its part, the firm says via its statement that 3D bioprinting has reached a level of maturity whereby “commercially viable bioprinting solutions can be created through optimization, not invention.” However, BIOLIFE4D also concedes that investing in its securities “involves a high degree of risk,” as its success depends upon its ability to 3D print a viable human heart, and this “has never been successfully done” before.

Bioprinting’s growing investor appeal

The technology behind 3D bioprinting may still be at an early stage of development, but that hasn’t stopped investors continuing to back its developers, based on its promise to address the wider transplant market. Just last month, Regemat 3D raised over €500,000 in funding, capital it has already earmarked for R&D.

In Australia, meanwhile, Inventia Life Science has attracted $25 million (USD) in investment, which it plans to put towards the commercialization of its RASTRUM 3D bioprinter. With further R&D, the company believes its platform could be used to address a biomedical R&D and drug discovery market worth more than $40 billion.

In the mainstream 3D printing sector, 3D Systems has also continued to pour investment into its Print to Perfusion 3D bioprinting activities. Through its acquisition of Volumetric Biotechnologies last year, in a deal that could be worth up to $400 million, the firm ultimately aims to expand its research in this area and develop a range of bioprinted organs.

To stay up to date with the latest 3D printing news, don’t forget to subscribe to the 3D Printing Industry newsletter or follow us on Twitter or liking our page on Facebook.

For a deeper dive into additive manufacturing, you can now subscribe to our Youtube channel, featuring discussion, debriefs, and shots of 3D printing in-action.

Are you looking for a job in the additive manufacturing industry? Visit 3D Printing Jobs for a selection of roles in the industry.

Featured image shows a rendering of the printhead of BIOLIFE4D’s 3D bioprinting platform. Image via BIOLIFE4D.