Autodesk Inc. (NASDAQ:ADSK) surprised investors and analysts with a revised full year forecast and an upbeat earnings statement.

On a call with analysts to discuss Q2 2017 earnings Carl Bass described the period as, “a terrific quarter.”

Autodesk are probably most known for their AutoCAD software, with famous applications including the design of Elon Musk’s Tesla vehicles. For 3D printing focused readers, Bass confirmed that the most recent results were driven substantially by Fusion 360 cloud subscriptions.

The company have kept good faith with a core of 3D printings avid aficionado’s by making software free to Fab Labs and garnered more good faith by supporting 3D printed prosthetics.

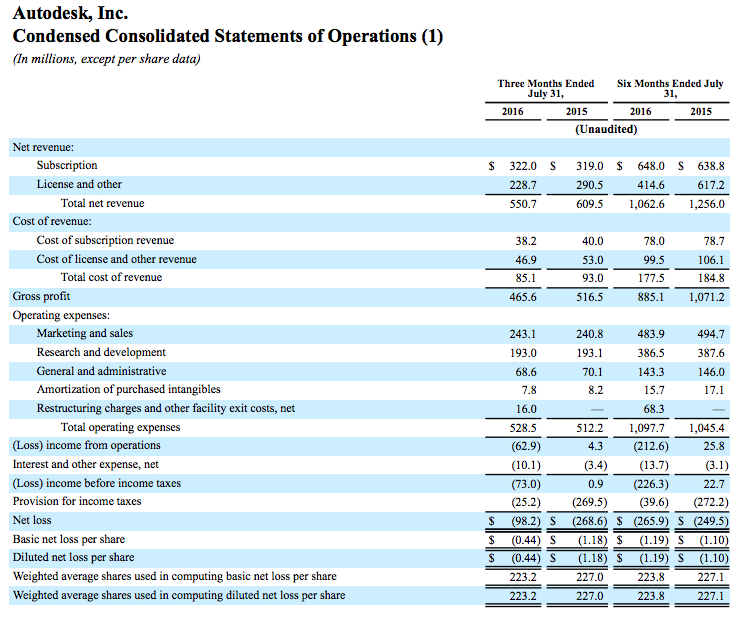

These actions appear to be paying dividends. Total subscriptions reached 2.82 million in this most recent quarter and generated $1.47 billion in revenue on an annualized basis. For the 3 months under consideration Autodesk reported $551 million in revenue. This was a decrease of 10% year on year or 6% when adjusted for FX movements.

After market trading saw the company’s share price make gains and early trading on Friday is expected to reflect the markets positive sentiment.

“We saw record volume of product subscription for suites while also experiencing greater than expected volume of perpetual licenses,” said Scott Herren the company’s Chief Financial Officer.

Autodesk issued revenue guidance of between $470 million at the low end up to $485 million for the third quarter of the period. When the company report Q3 figures for October an EPS of ($0.81) to ($0.74) is anticipated.

Full year guidance was also issued. Autodesk believe $2 billion is a feasible figure. This is even during what Bass described as the “midst of a business model and pricing transition.”

Artists Required: Apply Within

Under the stewardship of Bass, the company has taken a refreshingly long-term perspective on growth and invested substantially in projects with broad horizons.

These projects include Pier 9 in San Francisco, a creative hub that mixes artists, engineers and designers. The Pier 9 artist in residence (AiR) program is a 4 month opportunity for Makers to benefit from the amply stocked Autodesk workshop. The company fund AiR’s with $2000 each month to cover living expenses.

The deadline for applications for the 2017 Spring cohort expires on Sunday.

Fostering the 3D printing community is also evident in Autodesk’s approach to software licensing. Students can make use of a free version of Fusion 360 and several of the company’s other products.

The Californian corporation saw a boost from new customers, as Bass acknowledged that,

“It’s likely that a portion of these people were previously pirating software and now have a much more affordable option with our subscription.”

Transition Period

Gross profit moved south for the quarter. The total figure of $465 million is down on the comparative figure of $516 million for same period in 2015.

Bass explained the factors causing this slowdown,

“There are two things that are inhibiting that growth. The first is FX, which is causing about a 4 point headwind. The second is the accounting treatment of product subscription and EBA revenue.”

R&D expenditure remained constant at $193 million while general and administration expenses saw a marginal decrease from $70.1 million to $68.6 million.

After provisions and other accounting adjustments Autodesk reported a $98.2 million loss for the quarter. This is a resounding improvement on the $268.6 figure recorded for the comparative period.

Turning to the balance sheet, a clean bill of health was evident. Cash and equivalents were elevated and now stand at $115 million above the comparative at $1.5 billion. Accounts receivable and marketable securities have both declined,

Liabilities show no cause for concern and remain relatively static.

Autodesk’s cash flow statement highlights the $68.3 million incurred due to restructuring costs and the movement in accounts receivable. Investing actives also show a material shift with $200.6 million provided versus a $666.6 million used comparative.

Brexit panic, temporary

Bass said the company had, “increased our stock buyback in Q2 to $170 million in light of the dip in the stock caused by the temporary panic around the Brexit vote.”

For the past decade, Bass has guided the company and observed,

“If you’ve been around the tech industry as long as I have, you’ve no doubt seen the carnage of once great technology companies that ultimately failed to innovate and keep their competitive advantage. Autodesk has been the leader in the world of design and engineering software for over 30 years and what we’re doing with this transition is positioning Autodesk to lead the next generation of this kind of software.”

To accomplish this Autodesk will adopt a 3-point strategy to increase the lifetime value of each customer, change cost structure and finally build out the cloud platform.

Accounting has an issue with clouds and the Financial Accounting Standards Board (FASB) have proposed a new accounting standard that could potentially change the way Autodesk report numbers. Scott Herren commented, “it applies to everyone. It’s not just Autodesk,” suggesting that FASB’s inverse rising tide would equally change marine vessel mooring across the economic wharf.

Sticking with the maritime theme, by reducing piracy via free to use software and fostering long-term customer relationships Autodesk have positioned themselves ahead of the competition. And as 3D printing continues to evolve and mature those users who have positive early experiences with Autodesk software may be loath to switch. Instead rewarding the company with lifetime loyalty.

Carl Bass is not someone who is afraid to speak “a little out of school” and conservative analysts have questioned Autodesk’s outlay on projects with an intangible ROI. But for a company intrinsically invested in the transmutation of the digital to physical this is precisely that is needed, and the financial markets seem to agree.