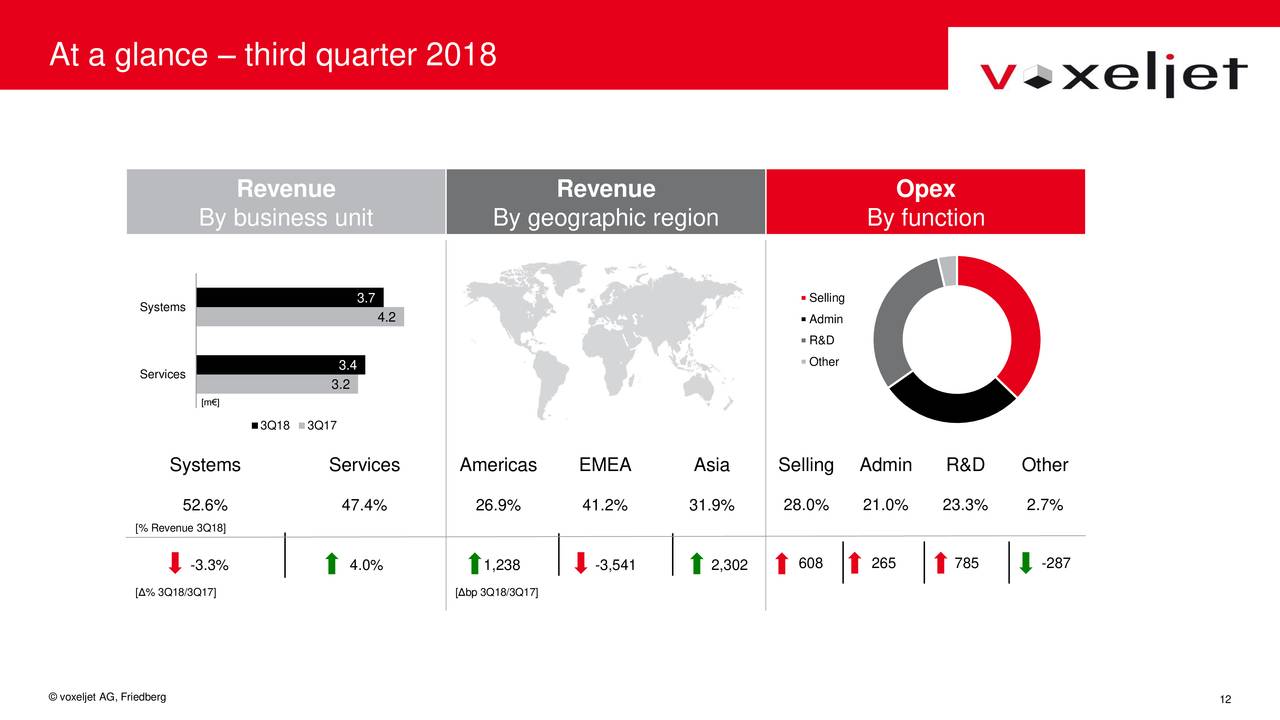

Voxeljet, a German 3D printer manufacturer, has announced financial results for Q3 2018. According to the report, total revenues decreased from €7.12m in Q3 2017 to €7.39m for the current reporting period, a fall of 3.6%.

It further shows a general decline in the Systems segment of voxeljet, whereas the Service segment has shown an increase in sales aggregated from voxeljet’s different subsidiaries.

On a call with investors, Ingo Ederer, Chief Executive Office of voxeljet said, “Revenues from our system segment which includes revenues from selling 3D printers, consumables and spare parts as well as maintenance decreased 10% to €3.7 million in third quarter of 2018 from €4.2 million in last year’s third quarter.”

Decline in systems sales of voxeljet

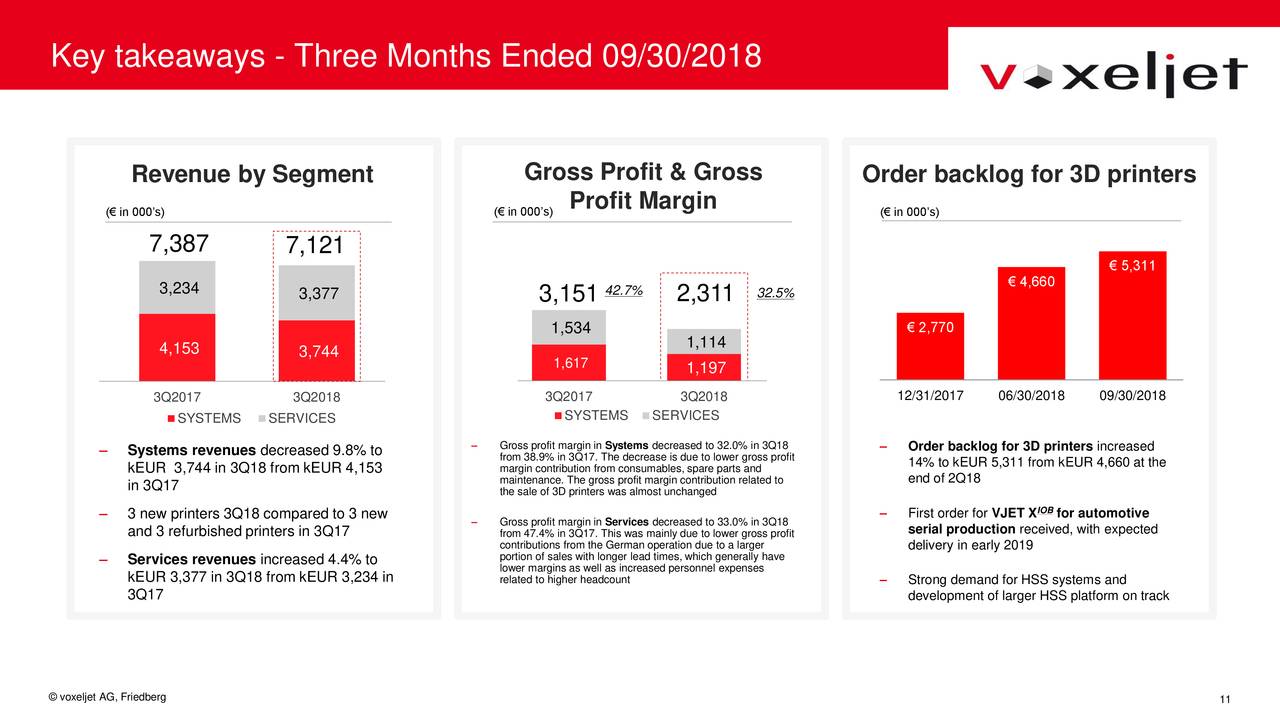

Voxeljet revenue from the sales of 3D printers dropped by 9.8%. This brought the total sales figure to €3.7m compared to the third quarter of 2017 which was €4.2m.

In Q3 2018, voxeljet sold three systems compared to six in Q3 of 2017, which included three new and three refurbished systems.

Breakdown of numbers

However, the Service segment of voxeljet, which includes on-demand 3D printed parts showed an increase of 4.4%, from €3.2m Q3 2017 to €3.4m this year.

A significant portion of these revenues came from voxeljet’s American subsidiary, and minor increases from voxeljet UK, and voxeljet Germany.

But these gains were counterbalanced by losses from the Chinese subsidiary.

Ederer said, “we feel great about the momentum of our global subsidiaries and the U.S. was again performing exceptionally well. In Asia, we sold one of our largest systems to our clients in Indonesia.”

However, voxeljet also reported slightly higher shipping expenses in Q3 2018 compared to the same time frame last year. This was partly due to shipment of a 3D printer to Indonesia which incurred a high shipping cost.

Furthermore, selling and R&D expenses were higher this year due to the hiring of more personnel in both departments.

What’s in store for 2019

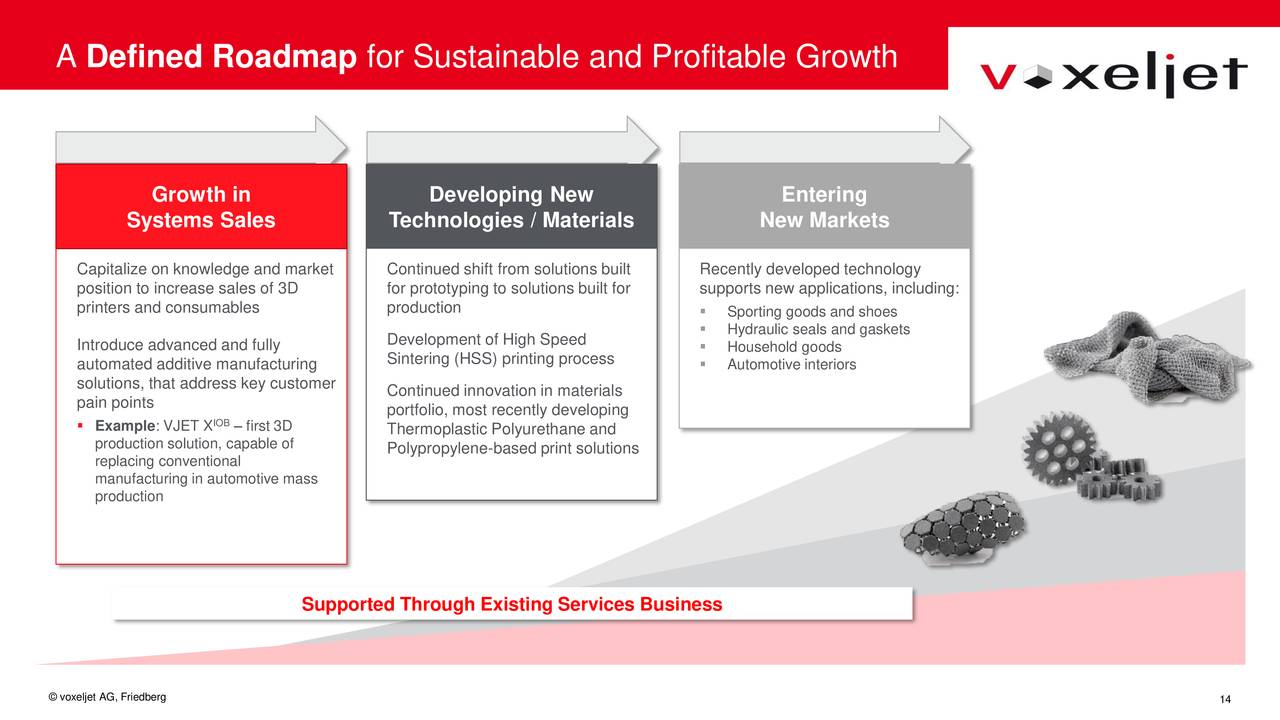

Despite the declining sales reported, voxeljet is hopeful about the fourth quarter of the year and 2019.

“We are very excited about our growing backlog for 3D printers, which is up 14% from the end of the second quarter. Based on our backlog, the fourth quarter has the potential to become the best quarter in the company’s history base and revenue,” said Ederer.

Furthermore, voxeljet has launched the VJET X-IOB, an automation solution due to be delivered to an automotive client in Germany. Ederer commented, “We are collecting orders for this new type of printer for delivery mid-2019. This is very exciting and we are looking forward to the feedback from our customers.”

Ederer also mentioned that part of voxeljet’s growth strategy for 2019 is entering new markets “such as sporting goods like shoes, household goods, and automotive interiors.”

For more financial news on 3D printing subscribe to our 3D printing newsletter. Also follow us on Facebook and Twitter.

If you are looking for a job in the industry, visit our 3D Printing Jobs.

Featured image shows a line of voxeljet VX1000 3D printers. Image via voxeljet